The Hive stablecoin, or more accurately soft pegged dollar coin, has been around for a long time, more than seven years when we include the previous version. Since the creation of the Hive chain, March 2020, it has been continuously improved and tweaked. Some core features still remain though, like the haircut, meaning there is a cap on the amount of HBD the chain can support and in extremely bad market conditions HBD can lose its dollar peg.

2024 is starting to see some small positive trends, so let’s take a look how is HBD doing under these conditions.

Background generated with Midjurney

HBD is being created and burned in multiple ways. Like many things on Hive, it has its nuances. The main mechanics for expanding and contracting the supply are the conversions, but there are also the author rewards, proposal payouts, interest payouts etc.

For better visibility we will be categorizing the HBD created/burned in the following manner:

- Author rewards

- Conversions

- DHF Payouts

- @hbdstabilizer

- Interest payouts

The HBD in the DHF is treated differently than the rest of the HBD. HBD in the DHF is not considered as freely available HBD on the market, so it is excluded from debt calculations and similar.

The focus here will be on freely circulating HBD, excluding the HBD in the DHF.

We will be looking at the different HBD allocations here as well.

The period that we will be looking at is 2016 – 2024, with a focus on the last year.

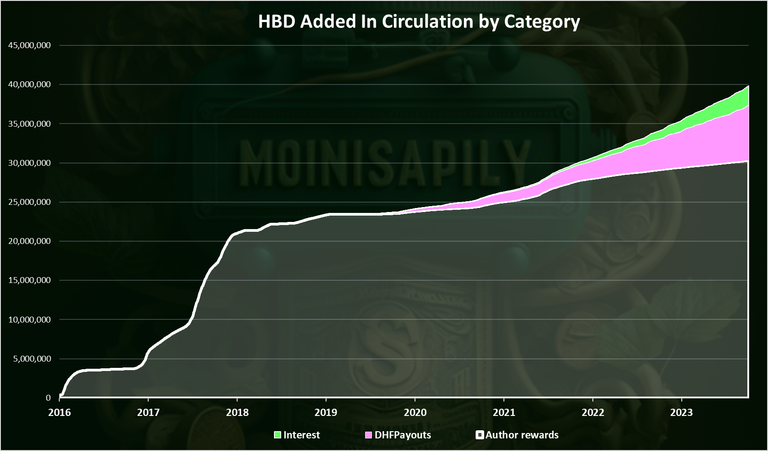

HBD Added in Circulation

HBD enters circulation via multiple ways, like author rewards, DHF payouts and interest to HBD held in savings. HBD is added in the DHF as a share of the inflation, but we will be looking at the HBD that only leaves the Decentralized Hive Fund, the DHF payouts.

Here is the chart.

The chart includes the following:

- Author rewards

- DHF Payouts

- Interest

As we can see the authors’ rewards are the number one source for HBD created.

HBD in theory can be created through conversions as well, but conversions can be both positive and negative depending on market conditions. Here we will be looking at the data for conversions under the HBD removed section.

A 30M HBD was created as author rewards since the very beginning. A 7M as payouts from the DHF, and 2.5M HBD as interest. These are all cumulative numbers for multiple years.

We can notice that in the first years, all of the HBD creation was due to author rewards, but this has changed in the last years and now the DHF is at the first spot, followed by the interest rewards and then the author rewards.

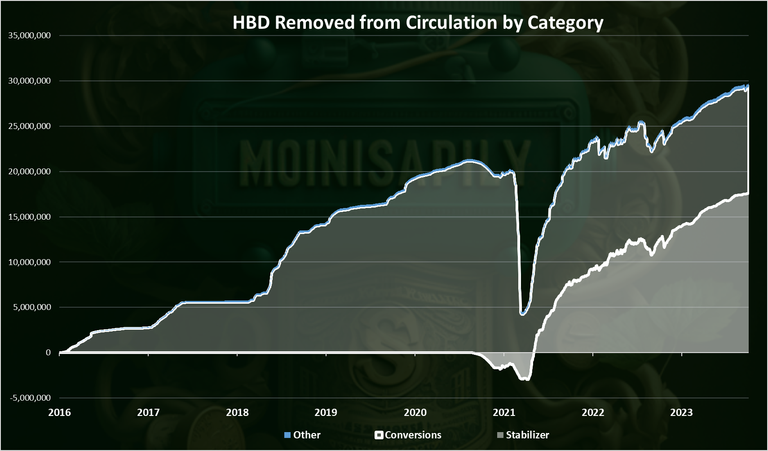

HBD Removed from Circulation

Now let’s take a look at HBD removed. Here is the chart.

We can see that up to the start of the stabilizer, the main way to destroy HBD was conversions to HIVE. Since the launch of the stabilizer, it has played a major role in the decrease in the HBD supply. In the last years it has been the main method for removing HBD from circulation.

Cumulative, the stabilizer has removed 18M HBD from circulation, while 12M were removed trough conversions.

The stabilizer is providing support for the HBD price on the internal market, buying HBD with HIVE if the HBD price is below the dollar. Since recently the stabilizer has scaled down its operations and lowered the funds that is receiving from the DHF. Will see how things will evolve going forward.

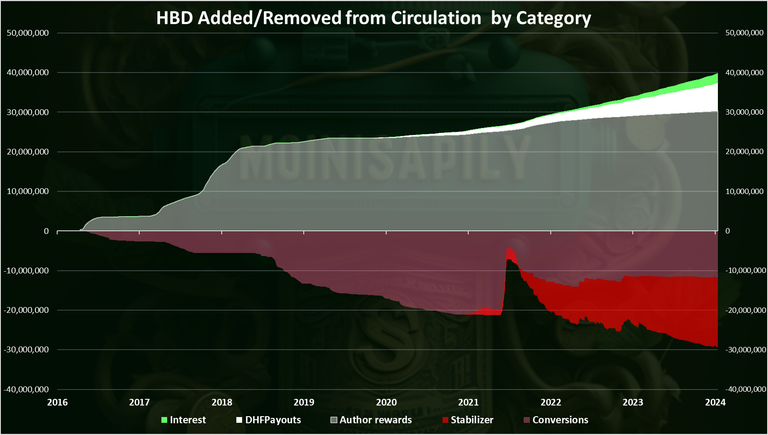

Cumulative HBD Added/Removed from Circulation

When we add the two charts above, we get this.

As mentioned already the author’s rewards are the main category in the positive, and the stabilizer is dominant in the negative.

What’s interesting is that after the introduction of the HIVE to HBD conversions, we are now seeing that the trend for the conversions has switched and now there is more HBD created from conversions than removed.

Also, while the authors’ rewards are still dominant in total, in the last years we can see the DHF is also putting more HBD in circulation, followed by the HBD interest.

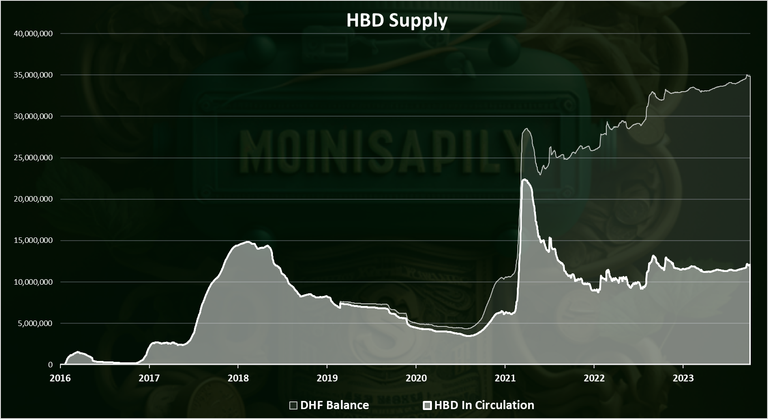

HBD Supply

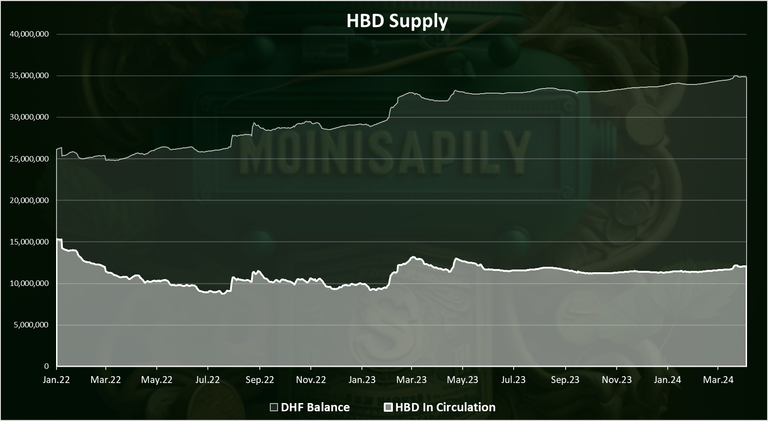

Finally, the HBD supply looks like this.

The HBD in the DHF is represented with light white.

We are now at 12M HBD in circulation, while there is another 22.7M HBD in the DHF, accounting for a total of 34.7M.

In the last year the HBD in circulation has been around the 10M mark, going from 9M to 11M HBD, and just recently increased from 11M to 12M. A very stable period for the amount of HBD in circulation.

When we zoom in 2022-2024 we get this:

Back in 2022, the freely circulating HBD supply started the year with 13.7M and ended the year with 9.2M HBD supply, or a 4.5M reduction in the supply. In 2023 we have an increase in the supply from 9M to 11M. This has slowly continued in 2024 and we are now at 12M.

On the other side the HBD supply in the DHF has increased from 10M at the beginning of 2022, to 19M at the end of 2022. In 2023 it has increased to 22M, and it has been hovering around that number for a while now. The growth of the HBD balance comes from multiple sources, but the biggest one is from the conversions of the HIVE balance in the DHF.

HBD Liquid VS Savings Balance

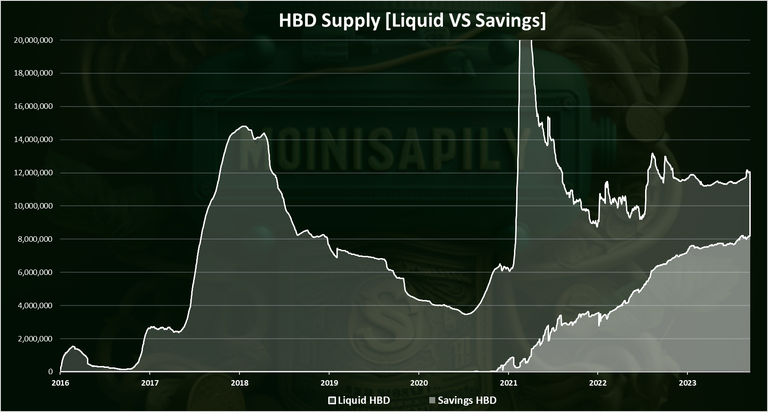

The HBD in the savings give a 20% APR at the moment. When we plot the amount of HBD in the savings against the supply we get this.

We can clearly see that since the introduction of the interest for HBD, back in 2021, there is a constant growth in the amount of HBD in savings, while the liquid HBD supply went down.

We are now at 8.2M HBD in savings from the totally 12M supply, leaving 3.8M liquid HBD.

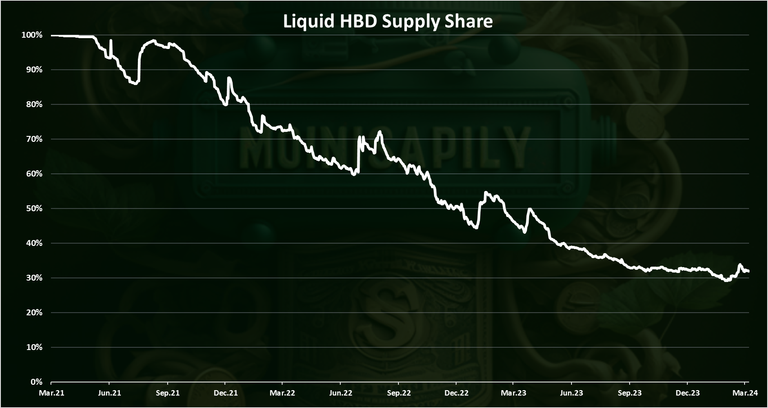

Liquid HBD Share [%]

The chart for the liquid HBD supply share in percent, excluding the HBD in DHF and in the savings looks like this.

We can see that the liquid HBD supply share keeps going down. In the last two years. It has dropped to around 70% staked HBD, and it is around that spot for months now.

As the liquid HBD supply drops, the demand for new HBD should trigger conversions from HIVE to HBD, driving demand for HIVE as well.

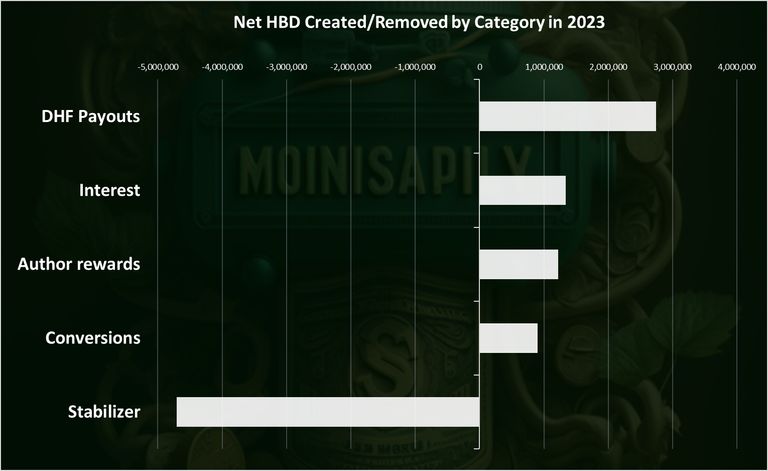

Summary for HBD Added and Removed By Category in 2023

When we sum it up, all the above, and check what has caused the HBD supply to expand or contract we have this.

The DHF payouts are the number one way for HBD entering in circulation in 2023. A 2.8M HBD was put in circulation in this way. Next is the interest payouts and then comes author rewards. Conversions from regular users are also positve, close to 1M for the whole year.

When it comes to removing HBD from circulation the stabilizer is the only one doing this and has removed 4.7M HBD from circulation in 2023. Even conversions that historically have been used to remove HBD from circulation now are in the positive, they have been used to created 1M HBD in 2023.

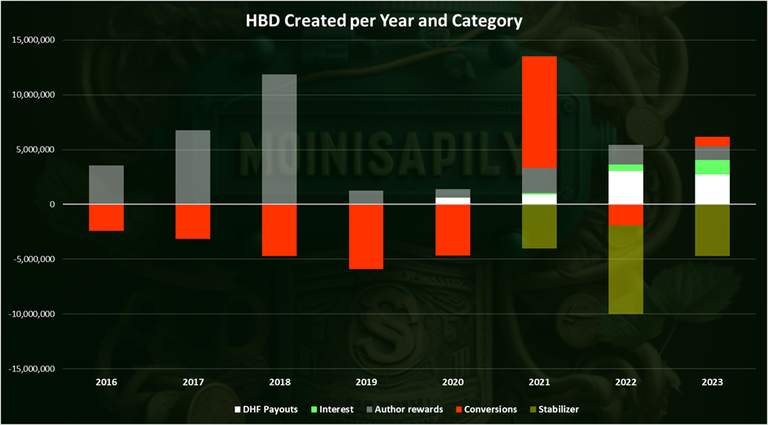

Historicly the creation/removal of HBD per caterory trought the years looks like this.

We are seing that there is now a shift in the way HBD enters circulation. In the past the majority of it was put in circulation from the authors rewards, and cumulative this is still the bigesst position. But in the last years the shift is more towards proposal payouts and interest, that is close to the author rewards. It should be noted that this is just half of the author rewards, the other half is paid in HIVE.

The stabilizer has been the main way to remove HBD from circulation for three years now since its intruduction. Will see how 2024 turn out.

All the best

@dalz