The markets are absolutely crazy now with FUD out of control. The overall situation in the economy seems to be the major thing to blame, and then we add some crypto specific things on top of it like LUNA and UST to make things even worse.

Meanwhile the Hive witnesses have made a bold move to increase HBD APR to 20% a month ago. The Leofinance team has embraced this and made a bridge to Polygon and the Polycub app.

HBD has been know as a notoriously hard to get with a low liquidity on the both sides. This has made it easy to move in the both direction with just a small amount of capital.

Has the situation improved in the last months. Lets take a look!

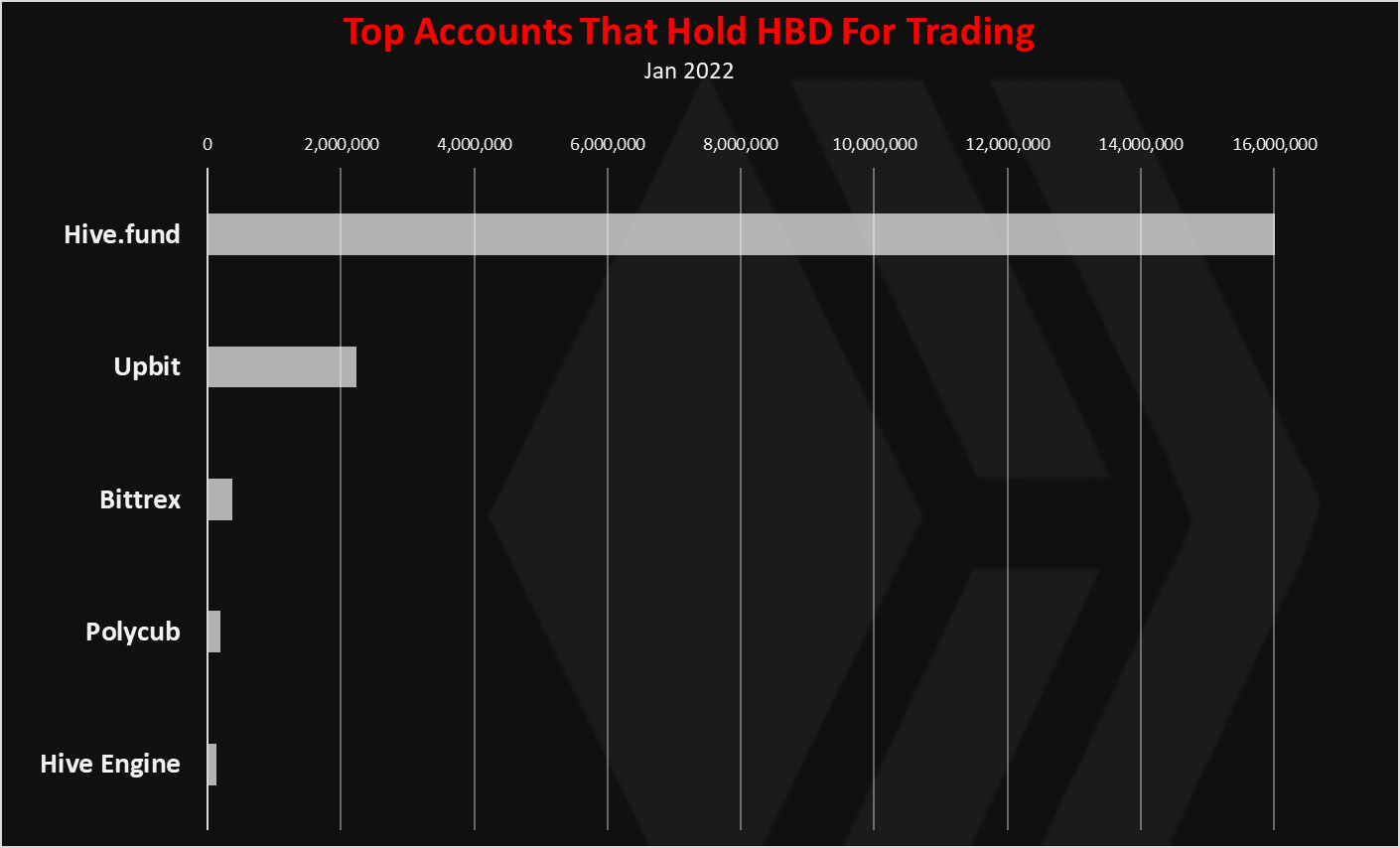

HBD is known for the extremely low liquidity. It is listed only on two exchanges Upbit and Bittrex. Bittrex has been down in the last period, and on Upbit is only for Korean KYC users. This leaves most of the Hive user base with almost zero options for buying HBD on a CEXs. At the moment it is mostly available on the internal Hive DEX, where users can buy HBD with HIVE, Hive Engine and since recently Polycub.

Here we will be looking at the historical data for liquidity and the trading volume for HBD on the different platforms as:

- Upbit and Bittrex

- Hive DEX

- Polycub

- Hive Engine Pools

For Upbit and Bittrex we will be using the data for Coingecko. More then 95% of the trading volume for this data is from Upbit. For the trading volume on the internal DEX we will be using the records from the transactions recorded on the blockchain, same as for the Hive Engine pools.

The period that we will be looking at is Jan 2021 till May 2022.

Liquidity

First let’s take a look at the liquidity, or the available supply on the different platforms.

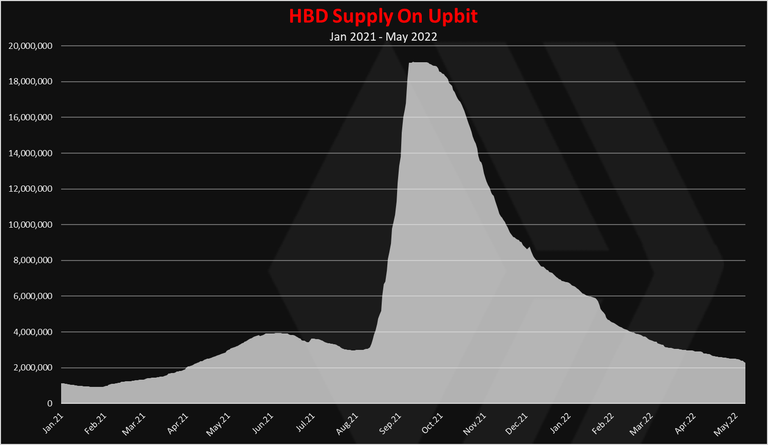

HBD Liquidity On Upbit

First the chart for Upbit.

This is quite the ride for the HBD supply on Upbit. At the end of August 2021 there was an increase in the price of HBD on Upbit that caused a lot of HBD to be transferred there. More than 15M was transferred to Upbit in a period of few weeks reaching 18M HB supply on Upbit. Since then, the HBD supply on Upbit is in downtrend and the current supply is just 2.2M HBD.

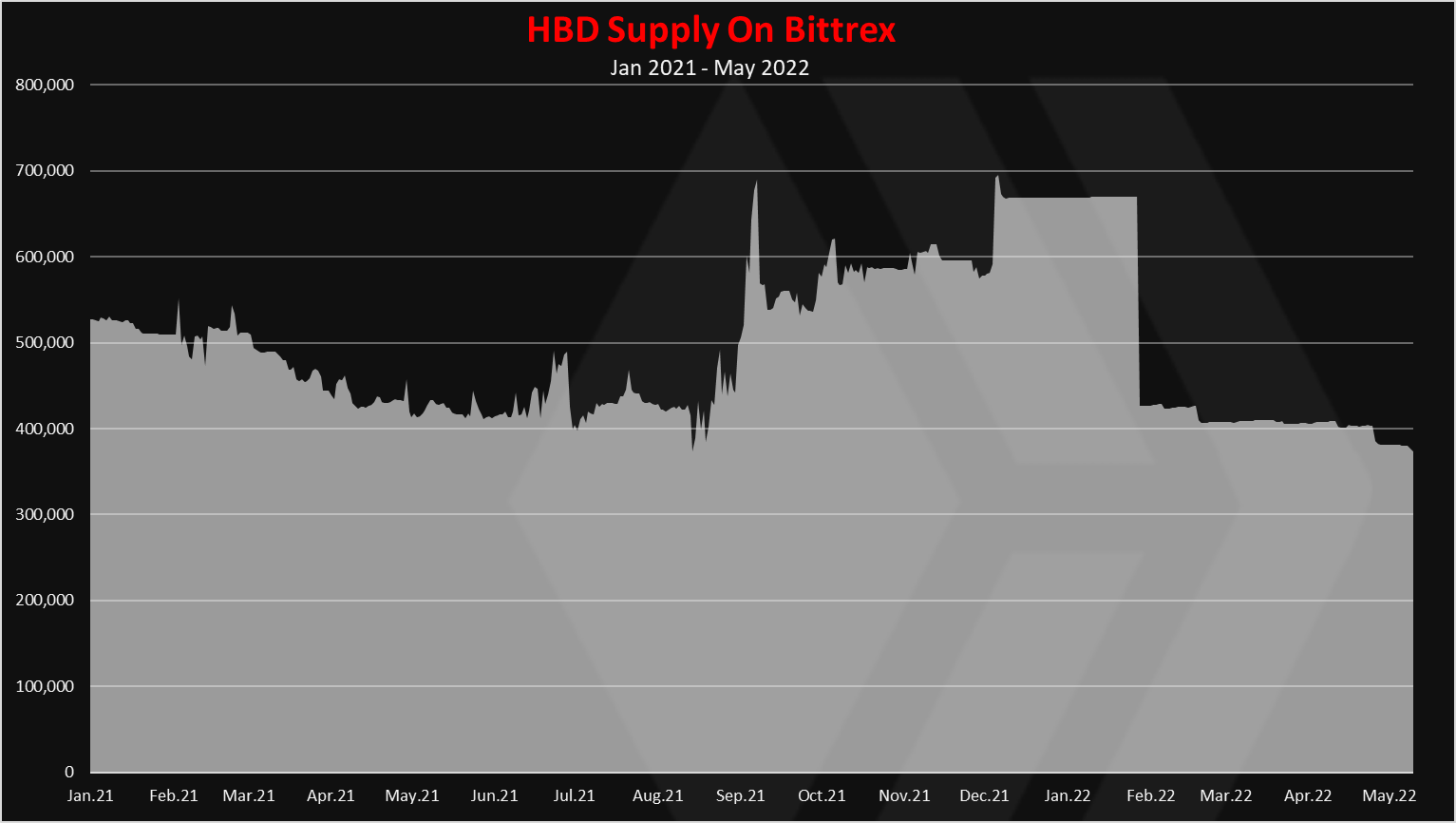

HBD Liquidity On Bittrex

Next let’s take a look at the second CEX where HBD is listed, Bittrex.

A steadier numbers here with the supply in a range of 400k to 700k HBD. Just bellow 400k now.

Starting from December the withdrawals and deposits for HBD on Bittrex has been on pause and there is almost no activity there now.

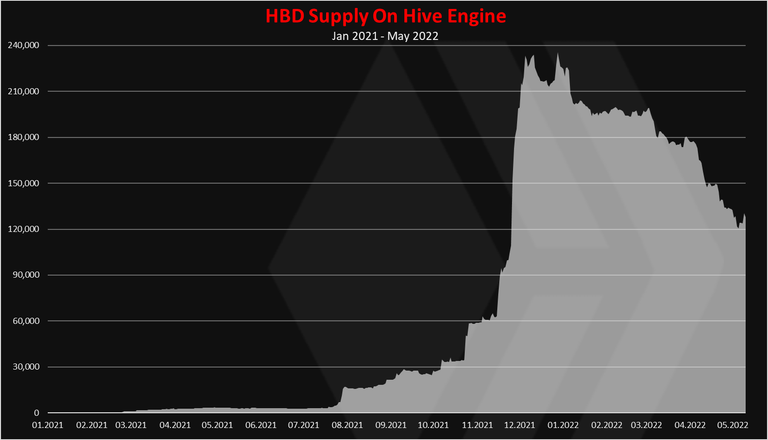

HBD Liquidity On Hive Engine

Now lets take a look at the Hive L2.

The Diesel pools on HE have been active for some time and have increased the overall activity a bit.

As we can see the HBD supply on HBD started increasing in August 2021 and has especially increased in November. This seems to be connected with the launch of Splinterlands SPS token, and then later with the launch of the BeeSwap BXT token that incentives the HBD pools on Hive Engine.

The BXT token has especially improved the HBD liquidity on Hive Engine. While the liquidity has improved it is still low with around 120k HBD in all the pools with the HIVE:HBD and HBD:BUSD. In the last period there is a downtrend for HBD on Hive Engine, most likely because of better APR on savings and Polycub.

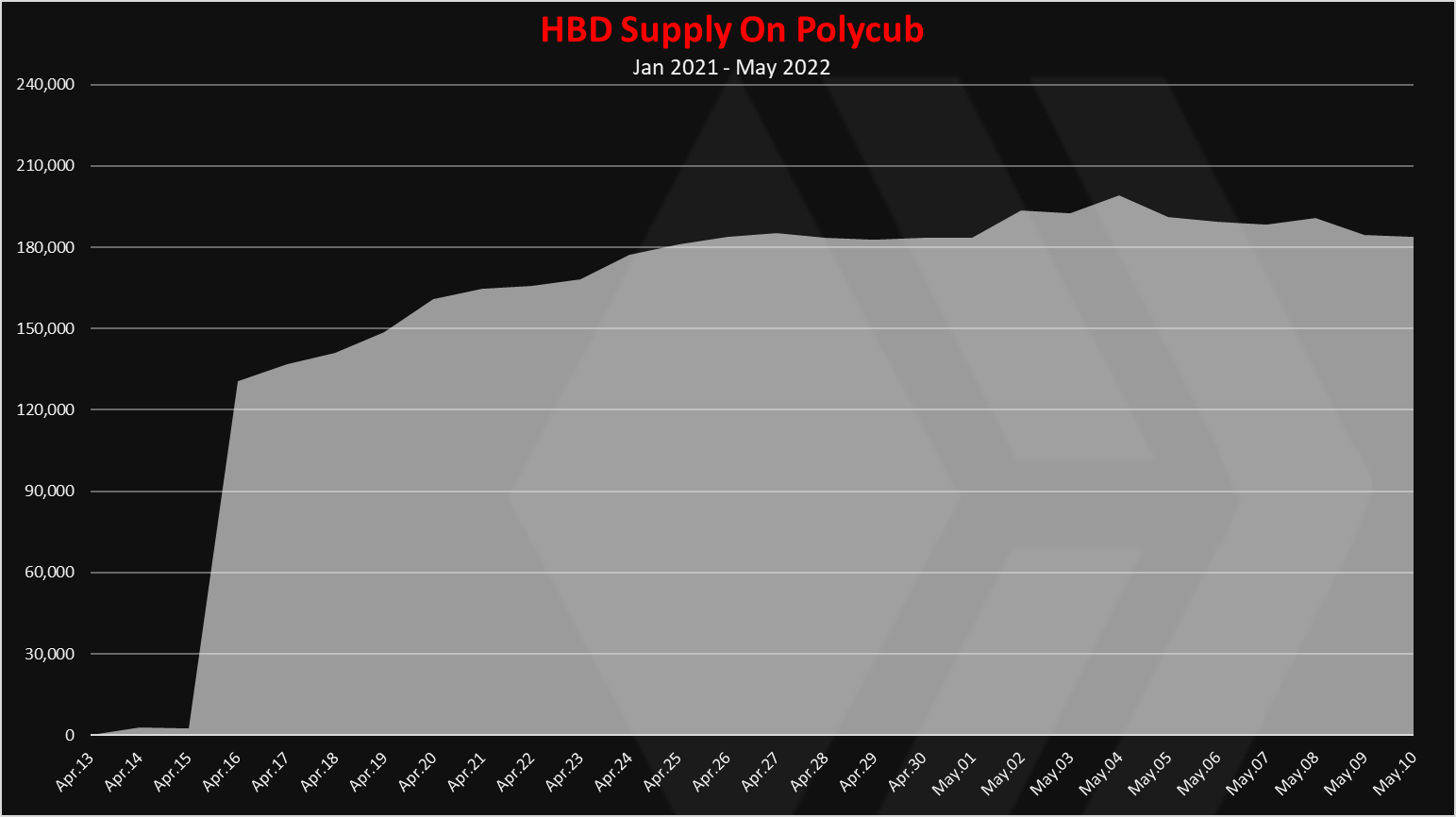

HBD Liquidity On Polycub

The pHBD:USDC was created on April 15th. Here is the chart since then.

We can see that the amount of HBD converted to pHBD grew fast at first, but then slowed down. At tg moment there is 185k HBD on Polycub.

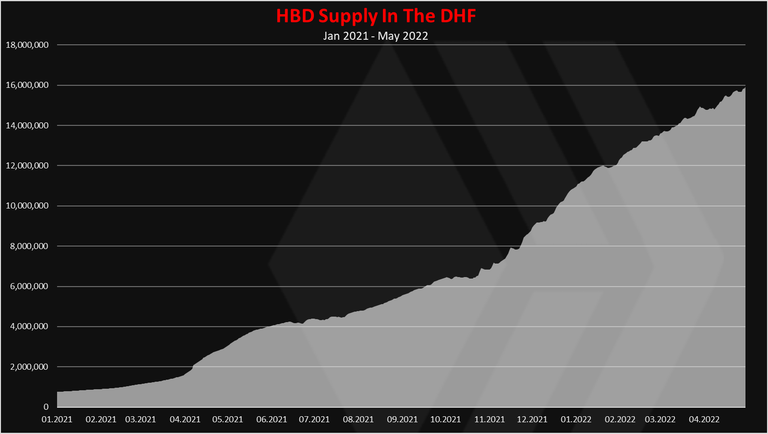

HBD Liquidity In The DHF (@hive.fund)

In theory this HBD is not for sale, but if the price of HBD goes above $1 on the internal DEX, the @hbdstabilizer will start selling some of it on the DEX.

Here is the chart for the HBD in the DHF.

The HBD supply in the DHF keeps growing and now we are now at 16M HBD. This makes the @hive.fund the biggest holder of HBD. As mentioned not all of it can be used for trading, and in theory the DHF can pay a max of 1% of its holdings per day. The stabilizer asks for 240k HBD daily, and since the budget is around 160k, it receive the maximum minus the sum for the other funded projects.

Last year this time the DHF had around 3.5M holdings and 35k daily budget, while the stabilizer budget was less than 10k.

When we rank the above, we have this.

The @hive.fund is dominant now, followed by Upbit, Bittrex and then Hive Engine. A year ago Upbit was no.1, and Hive Engine was non existence. There has been some small improvements in the HBD liquidity.

Trading Volume

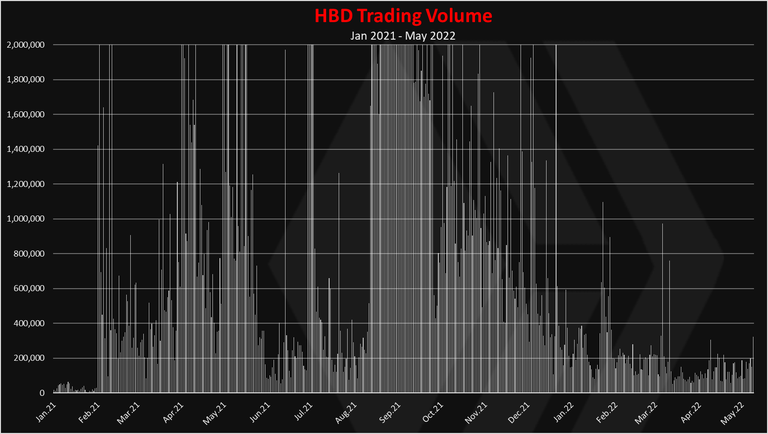

The data above was about the HBD holding on the different platforms where it can be bought. What about the actual trading volume. Here is the chart for the overall daily trading volume for HBD.

A lot of spikes in the chart. We can notice the large daily volume at the end of August 2021. Again, this is the period where there was an up pressure on the price of HBD on Upbit. On some days there is more then 15M daily trading volume. In the last period the trading volume is less then 1M HBD per day, and we can notice a slight increase in the last days.

Where does the trading volume comes from?

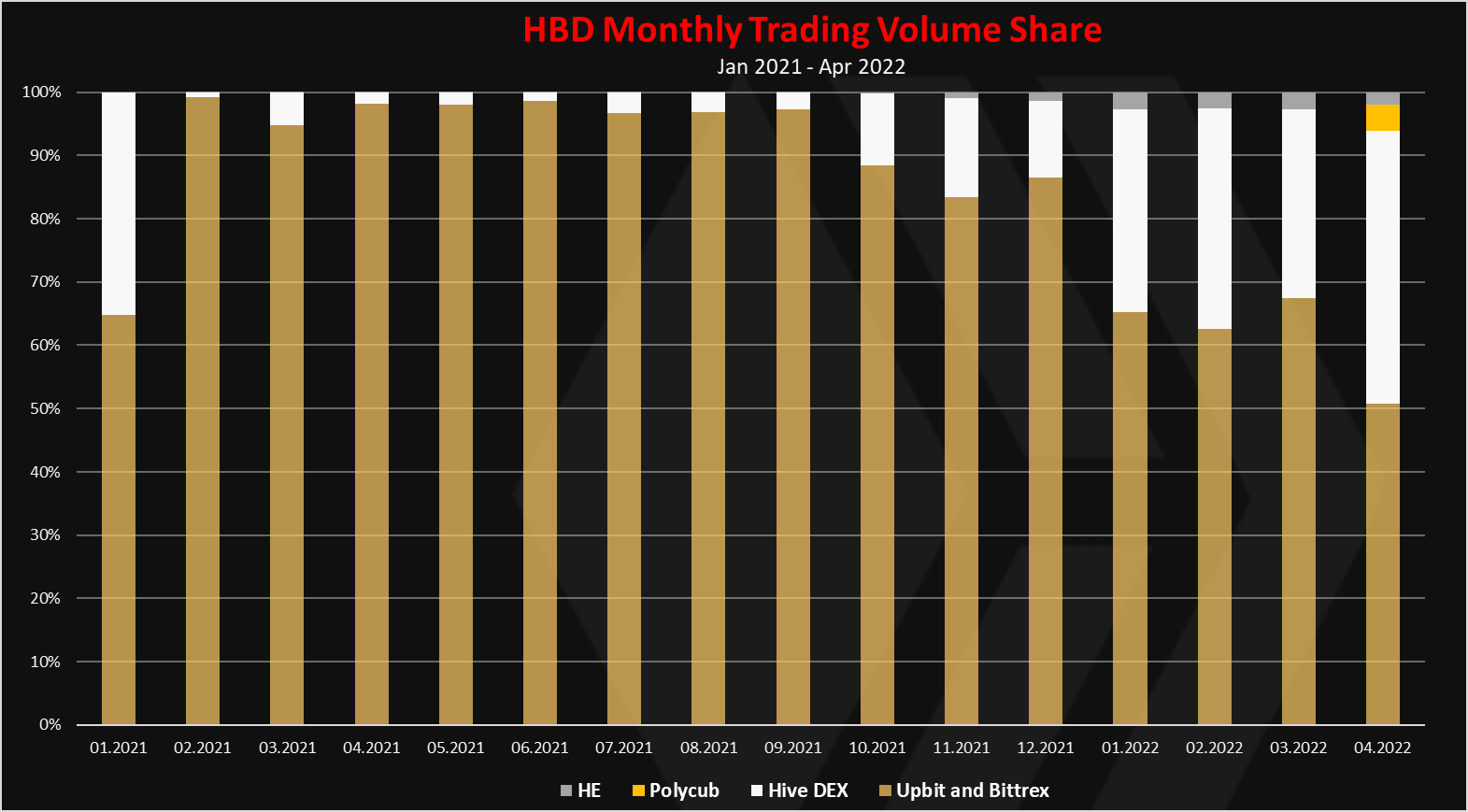

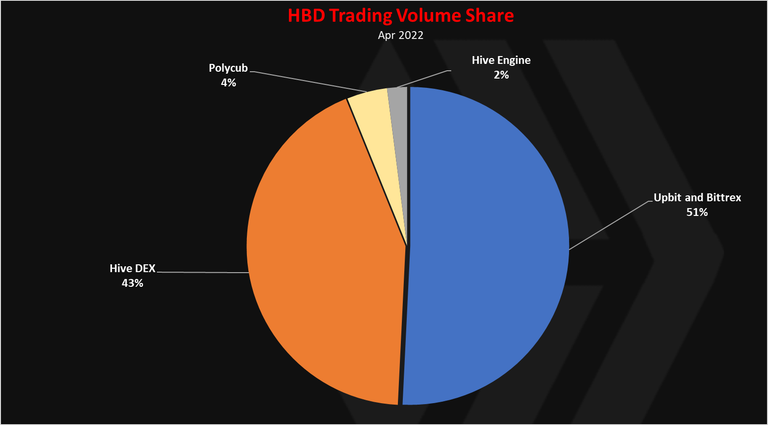

Here is data for the monthly trading volume share.

We can notice here that in the last months, the share for the trading volume for HBD has increased on the internal DEX, that for April 2022 accounts for 43%.

We can notice the Polycub emerging in the last month, but the share is still small. Also HBD on Polycub was live for half the month. Hive Engine also has small volume.

On average in the last 30 days the trading volume on the Hive DEX and Upbit has been around 65k HBD HBD daily, each.

For April 2022 we have this pie.

Upbit is still dominant in April 2022 with 51% share, followed by the internal DEX and then Polycub. However in the first days of May, the internal DEX has more volume then Upbit and it will take the no.1 spot for trading HBD. It is worth noting that Upbit speculators seems to lost interest in HBD in the last months, and the supply and trading volume keeps going down, while the numbers on the internal DEX keep going up, especially with the increased holdings and the budget of the DHF.

The internal DEX now is positioning as the no.1 HBD liquidity provider as the DHF holds dominant position for HBD and the @hbdstabilizer has more than 150k HBD daily budget. Upbit is on a downtrend, but you can never know with that exchanges, as sometimes massive volumes in millions per day seems to come from nowhere. Polycub is the new kid on the block for HBD and it has a decent volume, but still has a room to grow. For a regular user it might be the easiest way to get some HBD and with a 400k liquidity pool, one can make swaps in a few k, without big slippage. Hive Engine pools are on the downsides as competition from the savings account and Polycub is taking HBD in.

All the best

@dalz

Posted Using LeoFinance Beta