Polygon (Previously Matic), has been one of the more successful L2, scaling solution for Ethereum. It has successfully survived the bear and is now a top 10 coin. It is competing with other projects that offer low fees as an option for Ethereum, but at the same time it has remained close to Ethereum, pining the chain for security.

A lot of the Ethereum top apps have their versions on Polygon.

Some other major developments like the zero-knowledge proof (ZKP) rollups and other things.

Let’s take a look at the data on the Polygon network and see what has been happening in the last period.

The data presented here is mainly from polygonscan charts.

We will be looking at:

- Number of Addresses

- Active Addresses

- Daily Transactions

- Fees

- Contracts

The period that we are looking into is 2021 - 2023.

Number Of Addresses

One of the key metrics for crypto projects is the number of wallets.

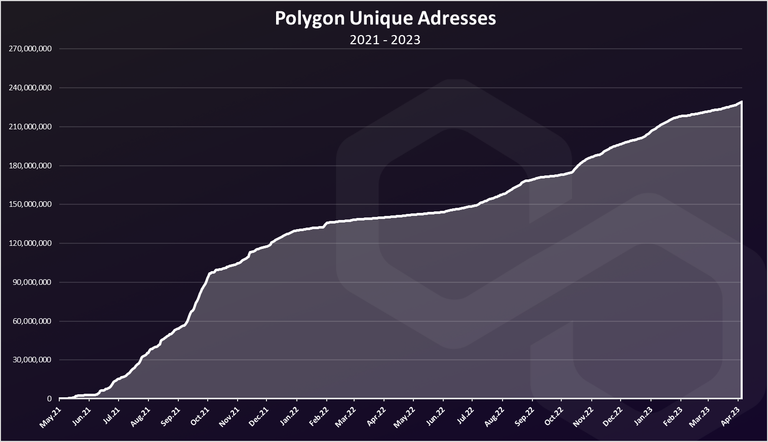

First the overall number of wallets.

Quite a steady uptrend for the number of wallets on Polygon even during the bear market. We can see the initial growth that happened back in 2021, then a slower grind in 2022, and some bigger uptrend in 2023.

The Polygon chain now has a total of 230M wallets!

This is just around the same number as Ethereum wallets.

Around 25M wallets were created in 2023.

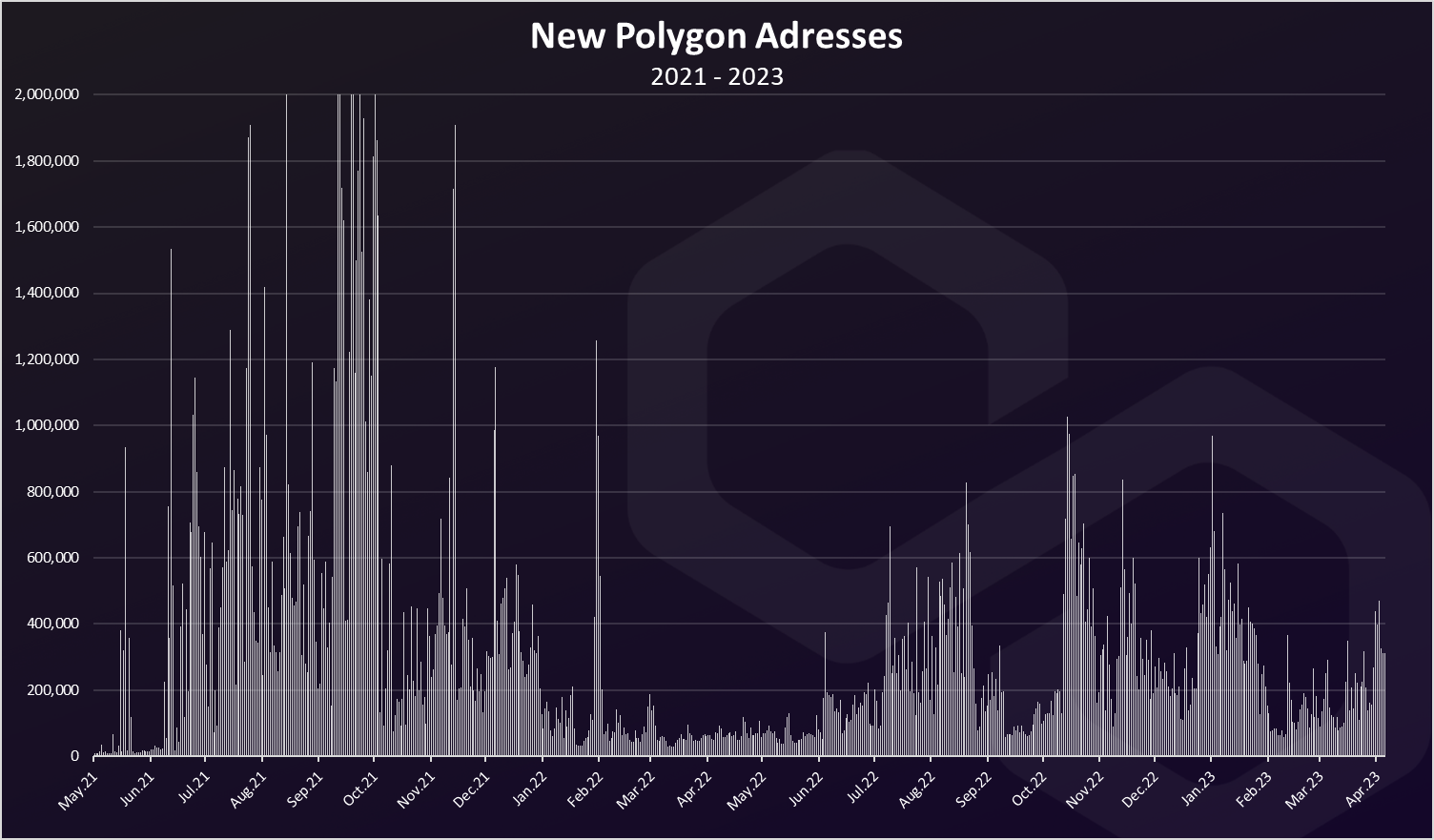

If we take a look at the new daily wallets we get this.

We can notice the spikes in daily created wallets since the summer of 2021 and the record reached in September 2021. A slow down since then and a few spikes again in the recent days.

At the peak there was more then 2M wallets created per day.

Recently there is between 200k to 400k wallets created daily.

Active Addresses

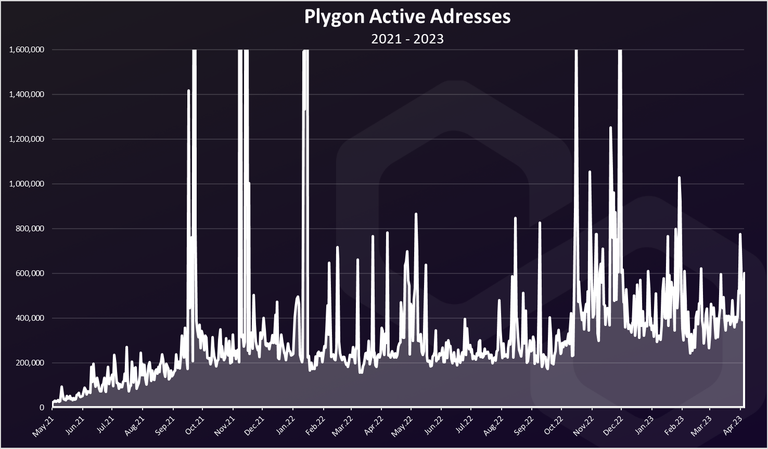

What’s more interesting in times like this is how many wallets are transacting. Volatility should increase the numbers of active wallets. How many of those 230M addresses are actually active?

It’s interesting to see that with a few spikes in between, the number of active wallets on Polygon has kept on growing even during a bear market.

In the last period there is on average 430k active daily wallets. This is a higher number even from the bull market of 2021, when if we exclude the spikes the numbers were around 300k active wallets per day. For reference the number of active wallets on ETH is around 500k to 600k.

Daily Transactions

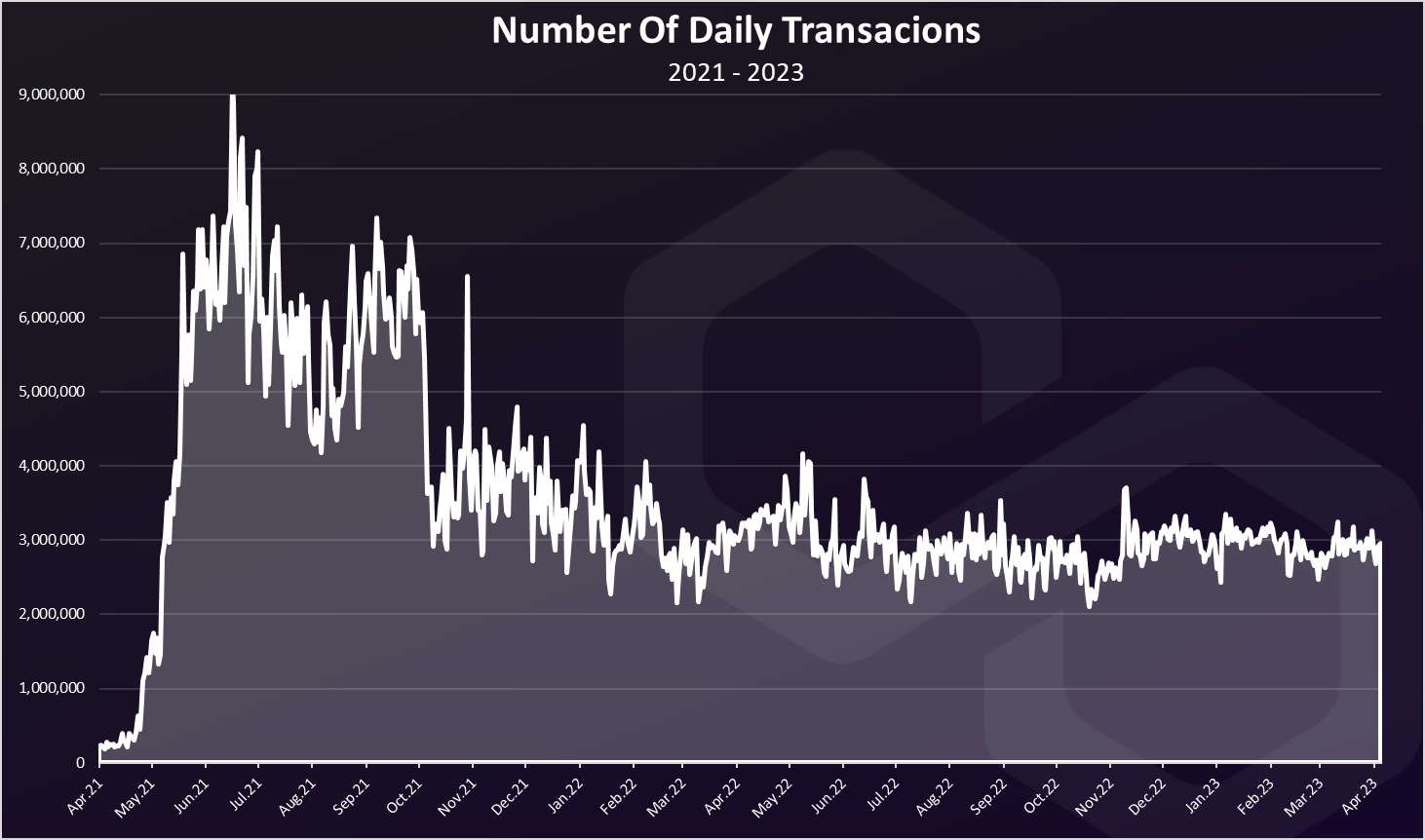

The activity on the network is mostly represented by the number of daily transactions.

An explosive growth back in May 2021, and a downtrend afterwards.

A stabilization period in 2022 when the numbers of transactions per day settled around 3M tx per day. On Ethereum the number of transactions per day is around the 1M mark.

Fees

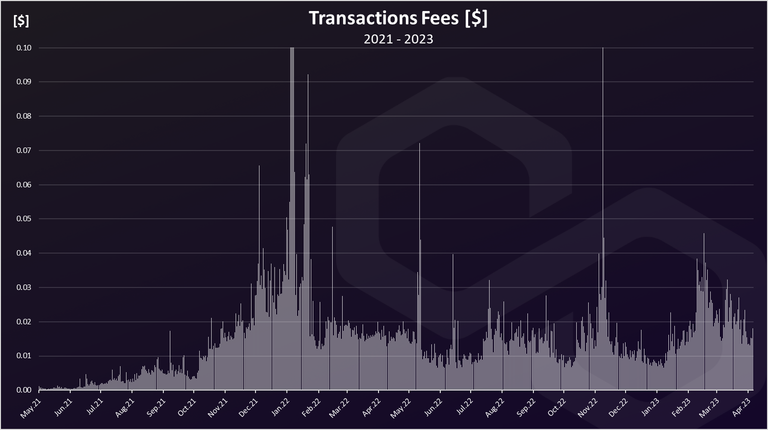

Polygon is known for its very low fees, that has been the lowest in the industry to under one cent, lower then BSC. Here is the chart.

The above are the fees per transactions in $.

We can see the spike in December 2021 and January 2022.

In the last period the average fees are between one and two cents. Much lower than the ETH fees that are few dollars or more.

Contracts

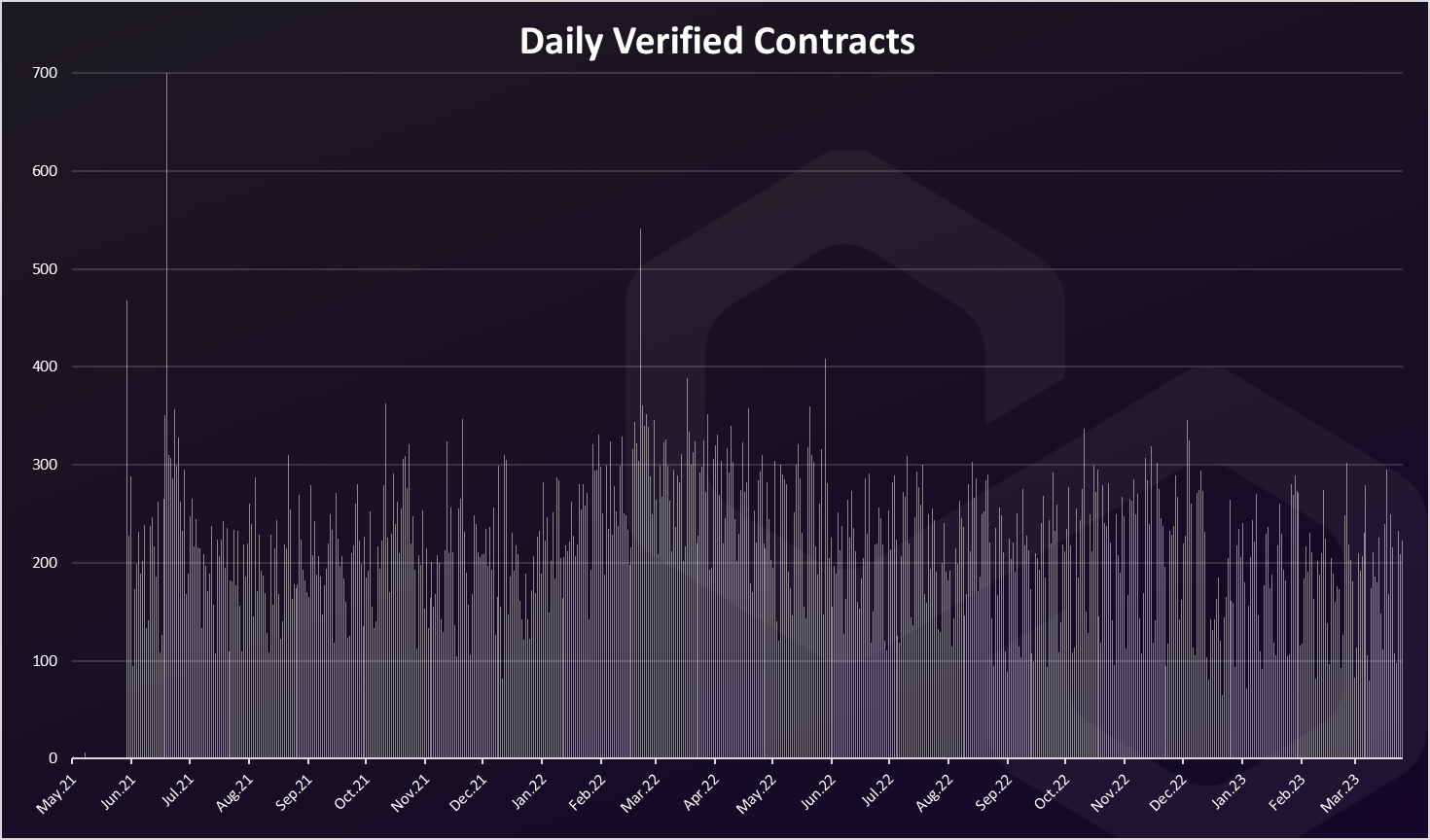

Polygon as Ethereum is a smart contract platform so here is the chart for verified contracts per day.

The number of daily contracts has been steady around 200 per day.

The major takeaway here is the number of wallets and active wallets that have kept growing in the period. Polygon now has more active wallets per day compared to the 2021 period. This means that the usability and adoption of the chain has increased over time. The number of transactions remains quite constant with around 3M per day, and the fees are few cents.

All the best

@dalz

Posted Using LeoFinance Beta