The Coinbase chain, Base has gained traction in the last year, emerging as one of the top L2 on Ethereum. I’m not even sure should it be called L2, as from my perception it’s more of an L3 than L2. Coinbase wants to give its users more toys to play and onboard the users of the exchange to the Base chain. Instead of users using Coinbase to buy crypto and then transfer it to another chain where they do all the defi, nft and other stuff, keep them in the ecosystem by offering them this company chain.

The chain itself is opensource, built with the Optimism technology. However, from my understanding Coinbase is running the chain by themselves, meaning one validator/block producer. I’m not totally sure how exactly this works and if there more validators, or options for other to support the chain, but in both cases it’s a single entity show. What this means is that basically if they want, they can censor transactions, freeze funds etc. without any consent from other parties. They can be subject to regulation and government control as a US based company.

However, for now the show continues and the chain has gained traction. It is global and international, and everyone can use it. Just a week ago they even introduced zero fees for USDC transactions on Base, making payments with USDC on Base attractive.

Let’s take a look at the data on the Base network and see what has been happening in the last period.

The data presented here is mainly from base scan, DeFi Lama and Dune Analytics.

We will be looking at:

- Total Value Locked TVL

- Number of Addresses

- Active Addresses

- Daily Transactions

- Fees

- Contracts

Total Value Locked

This represents how much of value has been bridged to the Base chain where it seat and is being used in DeFi and other use cases. Here is the chart:

As we can see for the first time funds started being bridged on Base back In August 2023, when the TVL reached 400M USD. Then a period of stagnation up to February 2024, when the TVL started growing aggressively and it reached 1.5B in a short period. Since then, the TVL has slightly increased and is now around 1.8B.

Number of Addresses

One of the key metrics for crypto projects is the number of wallets.

First the overall number of wallets.

A massive growth back in August 2023, basically from zero to more than 50M in a period of one month. I believe at this time the Friendtech application was gaining traction on the Base chain. A steadier growth since then and Base is now at 80M wallets.

For comparison Ethereum has around 270M wallets.

If we take a look at the new daily wallets we get this.

Here as well we can see the growth back in August and September 2023 when there was close to 1M wallets created daily. This lasted up to October 2023 and then dropped to less than 100k new wallets daily. Some spikes in the last months, but overall, in the range of 100k to 200k new wallets per day.

Active Addresses

How many of the wallets created are active? Here is the chart.

At first the number of active wallets increased to around 100k DAUs, where it stayed for a while, and then a new growth in March 2024 up to 700k for a short period of time. In the last period the number of active wallets is around 400k daily.

For reference the number of active wallets on ETH is around 500k.

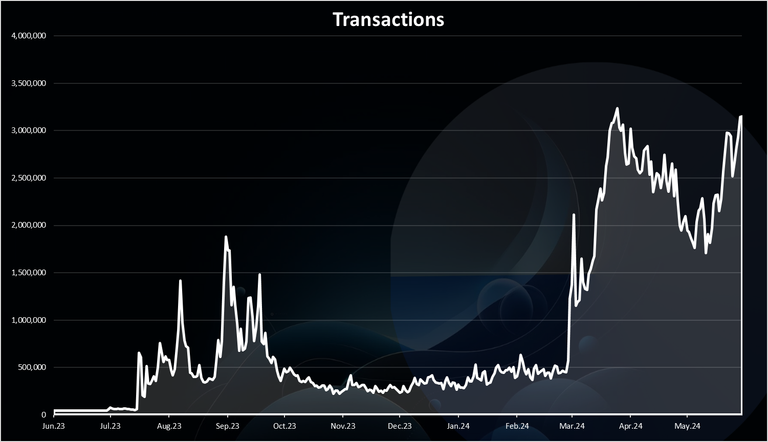

Daily Transactions

The activity on the network is mostly represented by the number of daily transactions.

On the transactions side we can see an initial growth back in the summer of 2023 reaching almost 2M transactions per day, then a drop to around 400k. A steady period around that number and a new increase in March 2024 up to new ATH of 3M transactions per day and a small pull back to 2M.

Recently there has been another increase to 3M transactions daily.

On Ethereum the number of transactions per day is around the 1.2M mark.

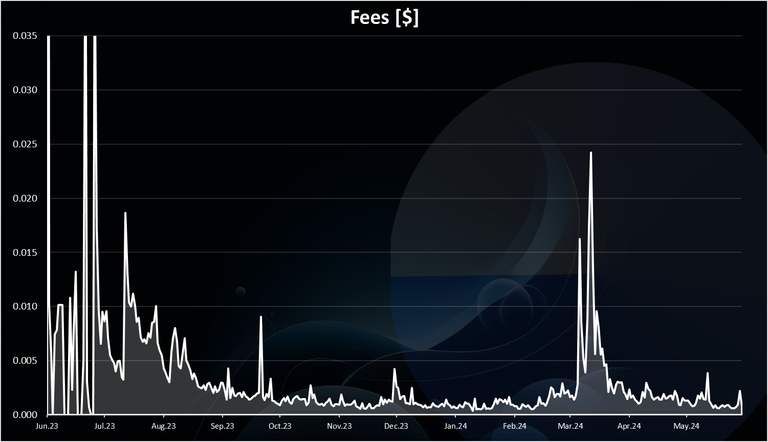

Fees

Base is basically promoting itself as a low cost option to Ethereum, but also an easy gateway from the Coinbase exchange. Recently they have even made USDC transactions feeless.

Here is the chart.

The above are the fees per transactions in $.

As we can see, at first there was a lot of volatility with the fees going up and down but staying relatively low. In the recent period the fees are basically below one cent or in the range of 0.001 to 0.005 USD. This is no doubt a very small fees. But even with this small fees the Base chain generate daily revenues somewhere between 100k to 700k USD.

Contracts

Base as Ethereum is a smart contract platform so here is the chart for verified contracts per day.

A spike at first up to 2k daily contracts, then a drop to few per days, and an increase again in March 2024 to 2k. A small pull back to around 1k daily contracts where it is now.

From the overall data we can see that there was an initial spike in the use of the Base chain and then a drop. But since March this year the chain relay took off and now has 3M daily transactions, almost half a million active daily accounts and close to 2B in TVL. At the same time providing very small fees competing with the fees on the Solana chain.

All the best

@dalz

Posted Using InLeo Alpha