The debate around stablecoins keeps on going with some recent talks coming from US regulators that might have some positive tones about them. The main stablecoins that are being used in crypto usually are the ones with pegged value to the USD. If those assets are backed by a 100% USD kept in a bank, as they grow so does the demand for USD, making the dollar even stronger.

Now the question is are these companies that are issuing tokens that claim to be backed by 100% USD, actually have that USD in banks. This is something that might be a central point of regulators in the future and the process of issuing crypto tokens backed by dollars.

Apart from the fiat backed stablecoins (USDT, USDC, BUSD….) that are keeping USD in banks there are tokens like DAI, UST, HBD that are backed by other crypto as collateral, and/or using conversion on chain operations to maintain the peg.

Here we will be looking at:

- Tether [USDT]

- USD Coin [USDC]

- Binance USD [BUSD]

- Dai [DAI]

- Terra-UST

There is a few more out there like TrueUSD [TUSD], PAX, Huobi USD [HUSD], etc, but we will focus on the above as the biggest ones in market cap.

The period that we will be looking at is from Jan 2020 till Feb 2022. In this period most of the stablecoins market cap was generated.

Tether [USDT]

Tether is the oldest stablecoin in crypto. It has been around since 2015. Allegedly its founded by the Bitfinex exchange. A lot of controversy around this coin in the past, including court cases. The main issue that has been raised has been is each coin backed by one dollar in the bank.

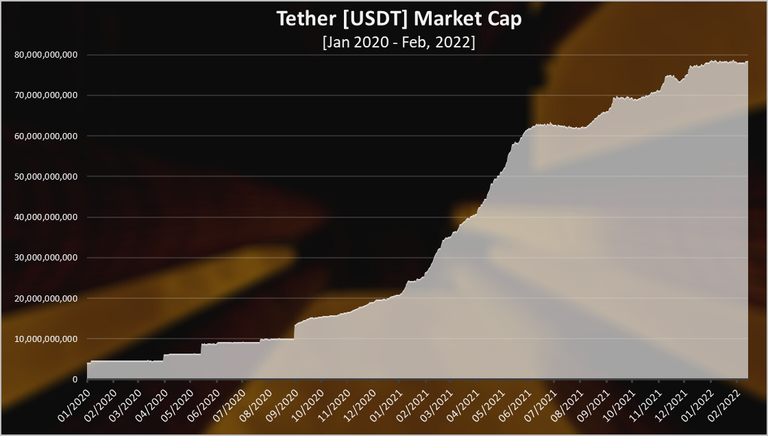

Here is the historical market cap for Tether

Tether has seen a massive growth in 2021, starting from a 20B market cap and now at 78B! But in 2022 we can see slowdown in the growth with the market cap staying stagnant at the 78B. Furthermore, most of the growth happened in the first half of 2021, while in the second half the growth has been smaller.

Overall, a slowdown in the growth for the Tether market cap in the last months.

USD Coin [USDC]

USDC is a common project between Coinbase and Circle. Its supply should be more legit.

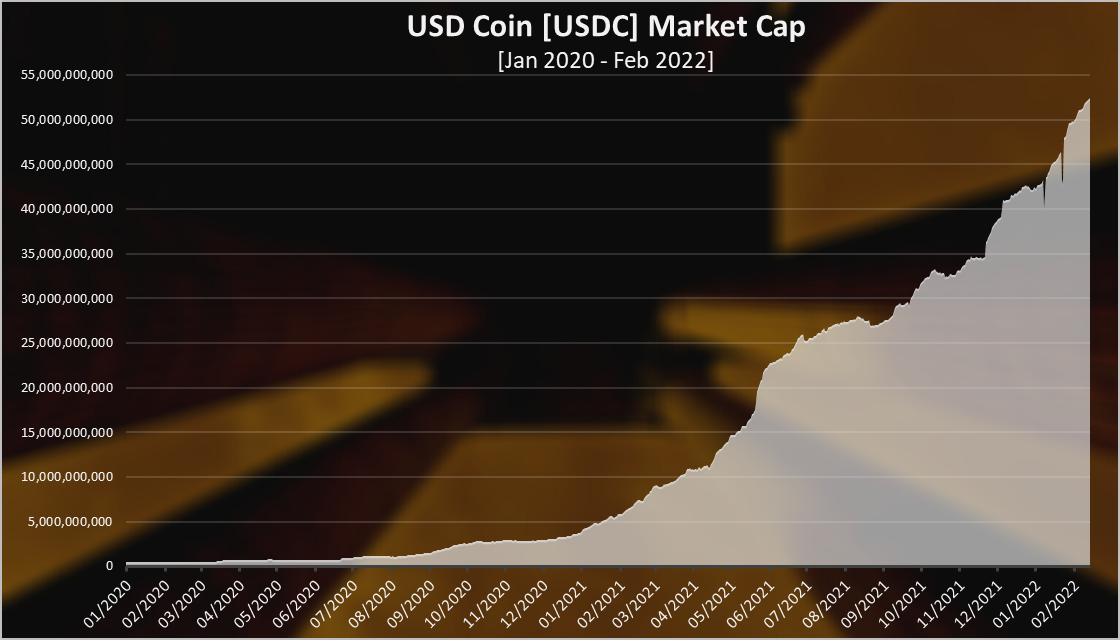

Here is the chart.

USDC has seen a massive growth in 2021 as well, but unlike Tether that has seen slow down in the growth, USDC just keeps on growing. At this pace there is a chance that USDC will flip USDT in 2022. The stablecoins flippening!

At the begging of 2021, the market cap of USDC was around 4B and now it is around 52B. More then 10X in just above a year. USDC the 10X coin 😊.

Binance USD [BUSD]

The Binance exchange stablecoin. It’s mostly used on Binance and BSC as well as a trading pair against other cryptos.

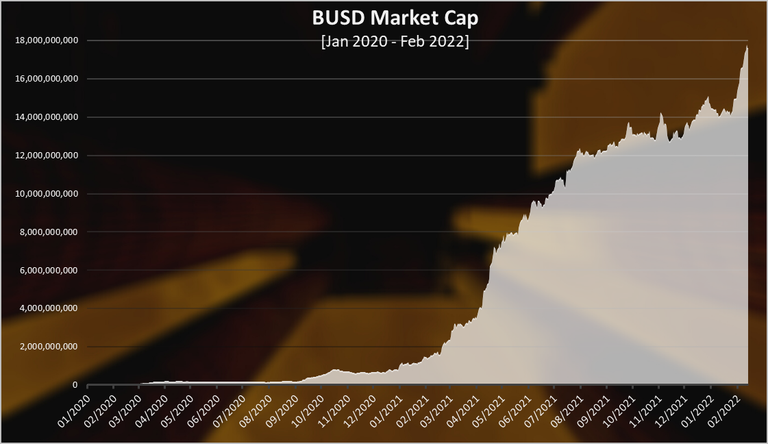

BUSD has been growing very fast in the first half of 2021, then a slower trend in the second half and a big spike in the last month. BUSD gained almost all of its market cap in 2021 and now it is standing at 17B.

Dai [DAI]

DAI is the decentralized version for stablecoin. It runs as a smart contract on Ethereum. Everyone can use the MakerDAO protocol, deposit collateral and generate DAI as a loan.

DAI started later than USDT or USDC. The current version of DAI (multilateral) stared in January 2020. From what we know there was a previous version of DAI, a single collateral one, that started at the end of 2017.

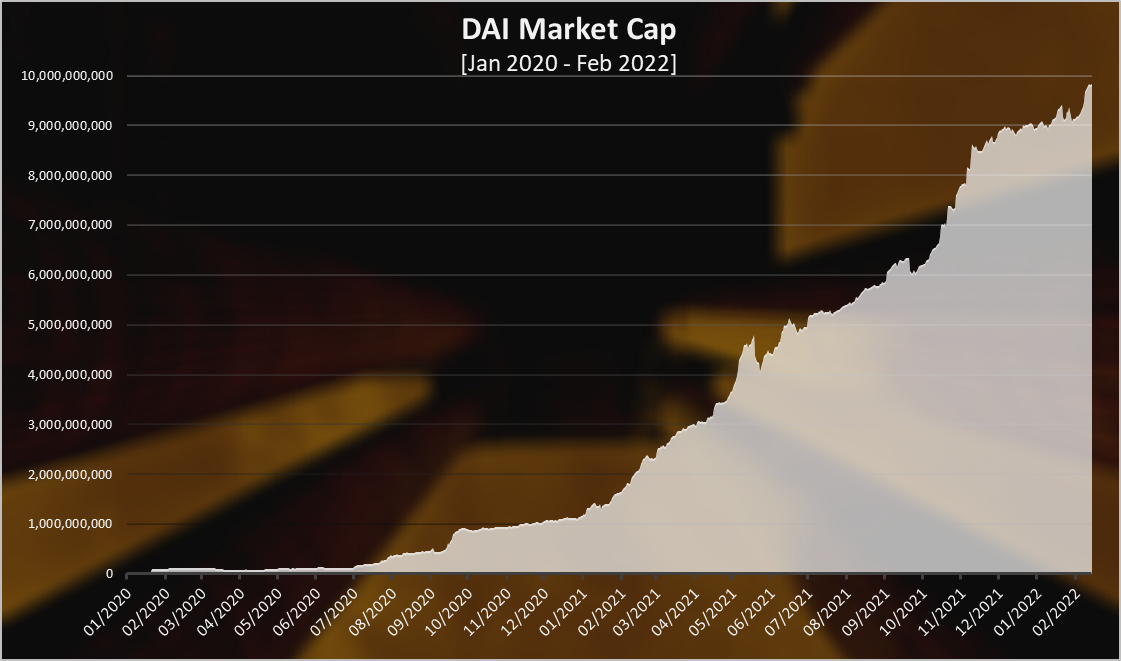

DAI has seen a continues growth during the whole 2021, with some down trend at the end of the year.

Unlike the previous dollar collateralized stable coins. DAI started 2021 with around 1B and now is at 10B in market cap.

Unlike the USDT, USDC, BUSD, all DAI is generated in a decentralized manner with collateral locked in a smart contract. The average ratio of the collateral is somewhere 3:1. So for 1B DAI there is an approximate 3B collateral. No fractional reserve policy here 😊.

The holders of the governance token Maker, are deciding on the cap of the DAI issued.

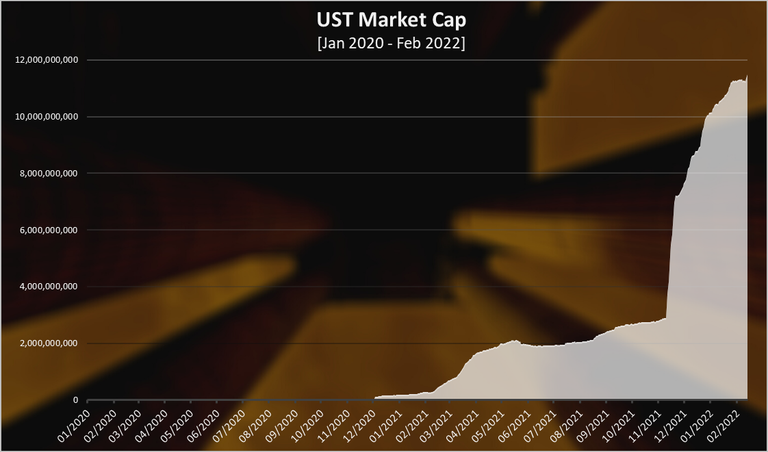

TerraUSD (UST)

The Terra stablecoin UST has seen some interesting development in the last year. It is another crypto backed stablecoin, the closest competitor to DAI. Unlike DAI it works in a different manner, without collateral, but with UST convertible to LUNA, the main token of the platform. Similar to HIVE and HBD. This method for stablecoins in theory is much more capital efficient then the overcollateralization that DAI uses.

2021 was year in which UST established itself as a reliable stablecoin. It is the new boy in the stablecoins arena. The year started with a few hundred in market cap and now it is more than 11 billion.

There was a massive spike in the UST supply in November 2021, as some of the LUNA treasury was converted to UST.

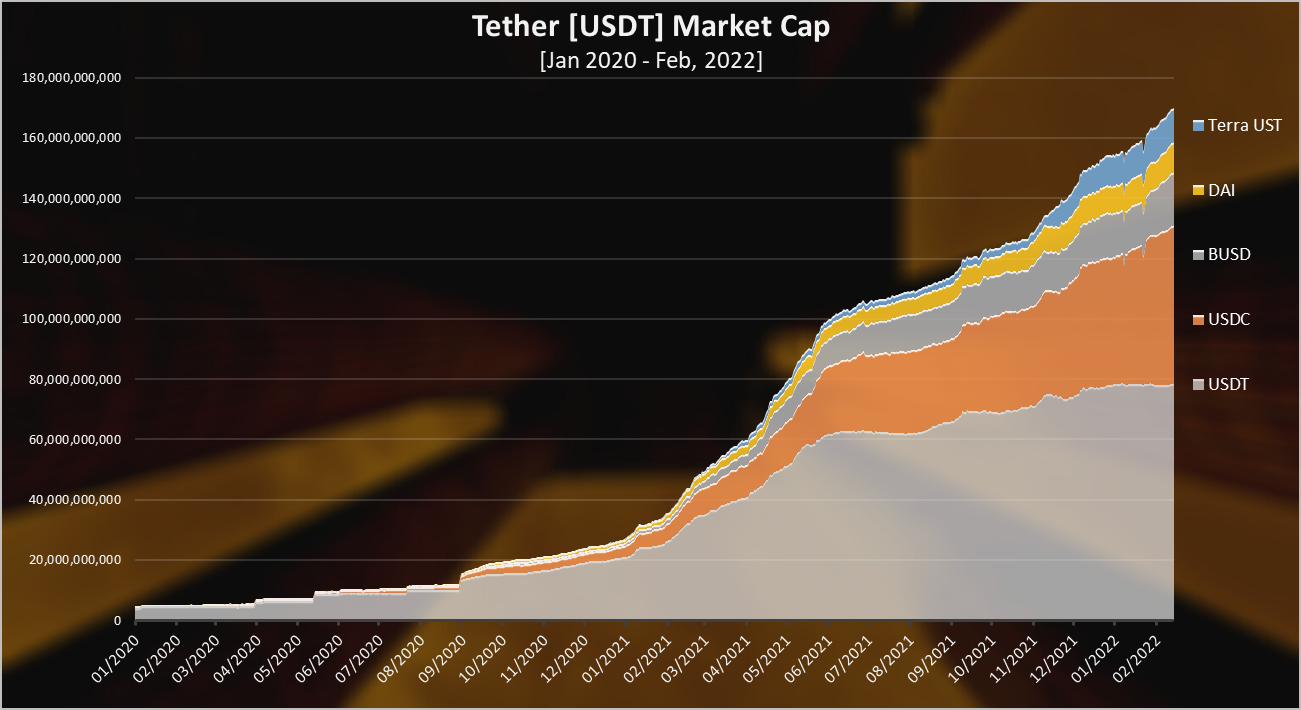

Cumulative Stablecoins Market Cap

Here is the chart for the total stablecoins market cap.

The chat above includes the stablecoins from the previous list. There are some others, but these consist 99% of the market cap.

The overall market cap for stablecoins has gowned from 27 billions at the begging of 2021 to 170 billions at the moment. More than 140 billion added in a just above one year. Some nice demand for USD there 😊.

We can see how USDC is growing faster then USDT and it is now take a big share of the stablecoins arena. The other three have grown a lot as well, especially UST.

No wonder stablecoins are no.1 on the regulatory list. The issuance of a stablecoin can cause a lot of regulatory problems, especially if it is not 100% backed. Also, in the long run corporation can overdue it, if left unchecked.

Top Stablecoins Rank

Here is the chart for the latest market cap of the top stablecoins.

Tether is still on the top, but USDC is closing in now. A 78B to 52B in market cap, or 67% of Tether market cap. A year ago, this percent was around 20%. BUSD is on the third position.

UST has flipped DAI now and is leading in the decentralized stablecoin arena.

The stablecoins growth remains with USDC pushing for the biggest share of it in the last months. The fiat backed centralized options remain in the lead with USDT, USDC and BUSD on the top. The decentralized stablecoins DAI and UST are in the top five and UST is now in front of DAI.

Just for context the market cap of HBD at the moment is around 24 million, out of which 13M in the DHF. If we compare this to the billions for the top stablecoins, we can see the potential. UST works amazingly similar to HBD.

What stablecoin are you using?

All the best

@dalz

Posted Using LeoFinance Beta