The SPS token was launched at the end of July 2021 in the midst of the bull market. Initially it did extremely well, but as the time progressed the token price continued to depreciate and facing more and more challenges.

In the first year, there was an airdrop for SL players, that ended in July 2022. The total supply for SPS is 3B and they will be issued in a period of 5.5 years after the launch. The airdrop is no more but new ways to issue the token are activated like the play to earn pool, the rewards for nodes operators, the rewards for liquidity providers etc.

More utility was added as well, and the latest one that is launching just today is the requirement to have staked SPS as a weigh factor for earning rewards when playing the game.

Here we will be looking at:

- SPS Supply

- Staked SPS

- Top accounts that staked SPS

- Overall supply, liquid vs staked

- SPS transferred out of the game

- Top accounts that transferred out SPS

- SPS Price and Market cap

The period that we will be looking at is July 2021 till Oct 2023.

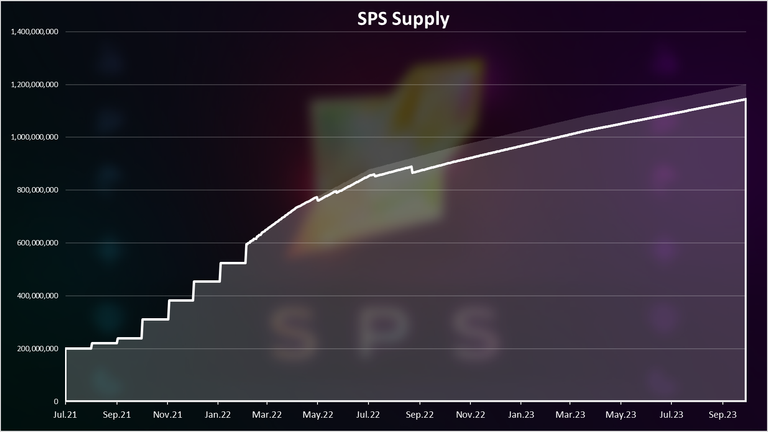

Supply

How is the supply going? Here is the chart.

We can notice the sharp steps first. This is when tokens were unlocked on a monthly basis. Since February 2022, there is a daily issuance of the token happening on the BSC chain.

Overall, we can see that the number of new tokens entering the supply has decreased and there have been some burnings. The light color on the chart.

The current supply is near the 1.15B SPS, or more than one third of the planned distribution has been issued. The max cap for the token supply is 3B. Another important thing to note here is that the DAO now holds almost 124M tokens.

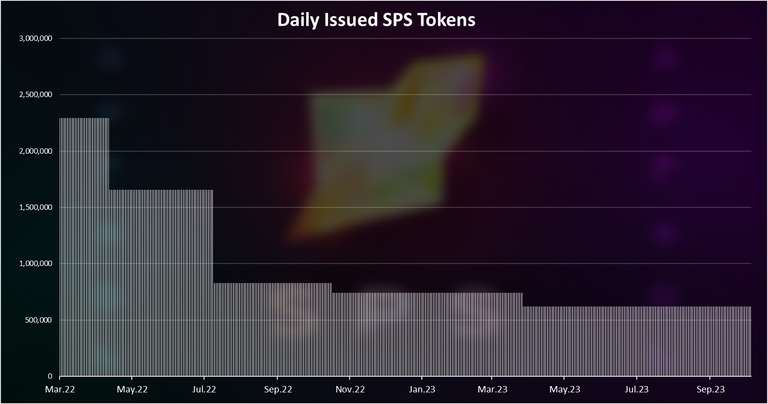

Daily Issued SPS Tokens

Here is the chart for the issued tokens per day.

As we can see at first there was around 2.3M tokens issued daily, then it dropped, most significantly back in July 2022, when the airdrop ended to around 830k, and it has dropped again to 620k where we are now. At this rate of printing the SPS token is in the range of 20% inflation that is reasonable bearing in mind the initial inflation was in the multiple hundreds.

Disclaimer that this data has been pulled from the BSC chain, and I’m not sure does it exactly matches the in-game records for the SPS token. I have also made some small adjustments.

Staking

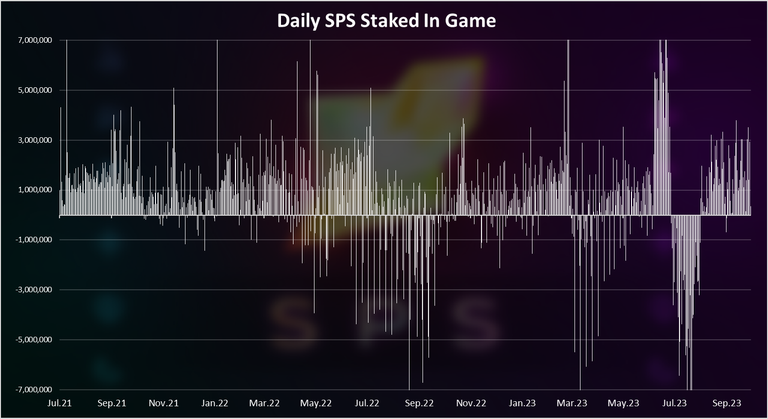

What about staking? Are players staking some SPS? Here is the chart for daily net staked. Positive bar means more staked in the day, negative more unstacked.

This is the overall staked and unstaked daily SPS.

As we can see there has been some unstaking in the period August - September 2022, and again recently.

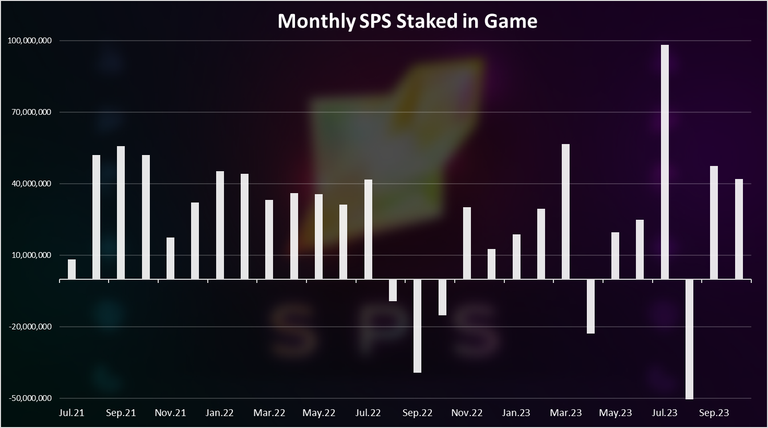

When we plot the chart on a monthly level we get this:

A clearer representation here, where we can notice that most of the months have net positive SPS staked, with only four months in the negative. There was a lot of unstaking happening just recently in August 2023, when there was a net of 50M SPS tokens unstaked. This was in correlation to the previous month of July when there was almost a 100M tokens staked. Some volatility in the recent period.

Note: the above is a net staking, meaning staked and unstaked SPS combined. The data is collected from the blockchain. There is no record of cancel unstake operation and I have made some manual adjustments for it. It’s not a 100% accurate data.

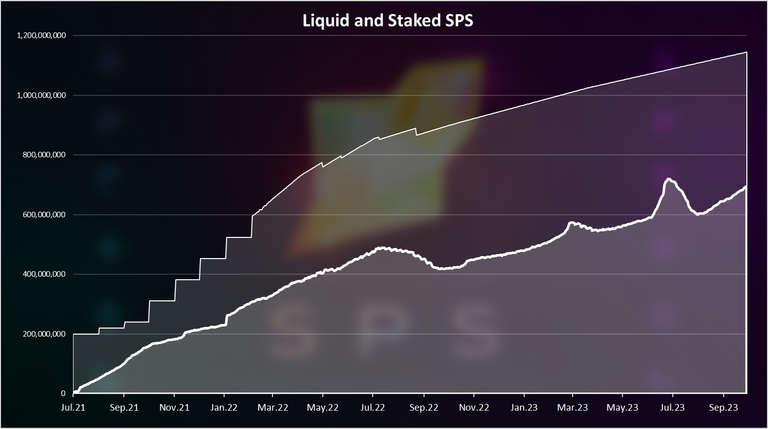

When we plot liquid vs staked tokens we get this.

An overall uptrend in the staking with some bumps on the way. Meanwhile the supply has also increased.

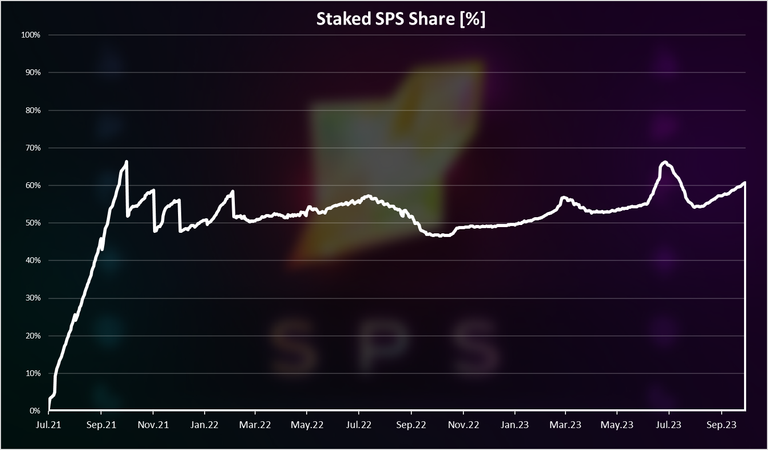

If we plot the staked vs liquid supply as a share we get the following chart:

We can see the sharp increase in the share of staked SPS in the beginning. The APR at the start was high and a lot of users were staking. The maximum share of staked SPS was around 65%. Since then, it has dropped, and has been hovering around the 50%, with a tendency to grow, and we are now at 60% SPS staked.

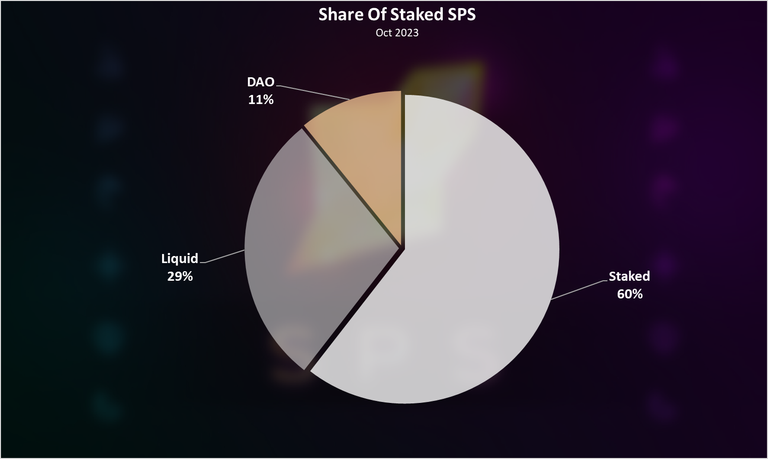

The pie for the staked vs liquid tokens at the moment looks like this:

A 60% staked SPS at the moment! An 8% is now in the DAO. This will probably grow in time, but it might go down as well, if there are large payments, as the proposal for listing SPS on exchanges. Cumulative the staked SPS and the DAO hold 71%, while the liquid supply is at 29%.

Top Accounts That Staked SPS

Who is staking the most?

The @gosplinterland5 account is on the top here with 12M staked. @vugtis on the second spot, followed by @bravetofu.

SPS Price

At the end the price chart.

An overall downtrend for the token from 2022, with a small recovery in the July 2023, and then a downtrend again to a recent lows at 1.3 cents.

There seems to be a small increase in the price just in the last few days Is this the bottom of SPS. Time will tell. Also, will be interesting to follow to overall tokenomics with the requirement for staked SPS.

All the best

@dalz