HBD is performing great in the last period, especially having in mind we are in a bear market for the whole 2022. In the last month there were even a few spikes in the HBD price that were short lived and arbitraged from the community and the mechanics that are in place.

The 20% APR on HBD set in April this year keeps on going and has a minimum effect on additional inflation, with estimated 0.28% per year. In fact, if we take a look at from a high level it has probably a net positive effect.

One of the issues HBD has, is the low liquidity. It is hard to buy and sell large amounts in a short period of time without moving the price a lot.

Has the situation improved in the last months. Let’s take a look!

HBD is known for the low liquidity. It is listed only on two exchanges Upbit and Bittrex. Bittrex has been down in the last period and Upbit is for Korean KYC users only. This leaves most of the Hive user base with almost zero options for buying HBD on a CEXs. At the moment the most reliable option is the internal Hive DEX, where users can buy HBD with HIVE, Hive Engine and since recently the pools that the LEO team is building Polycub and CUB on BSC.

Here we will be looking at the historical data for liquidity and the trading volume for HBD on the different platforms as:

- Upbit and Bittrex

- Hive DEX

- Hive Engine Pools

- Polycub

- CUB

For Upbit and Bittrex we will be using the data for Coingecko. More then 95% of the trading volume for this data is from Upbit. For the trading volume on the internal DEX we will be using the records from the transactions recorded on the blockchain, same as for the Hive Engine pools.

The period that we will be looking at is Jan to Aug 2022.

Liquidity

First let’s take a look at the liquidity, or the available supply on the different platforms.

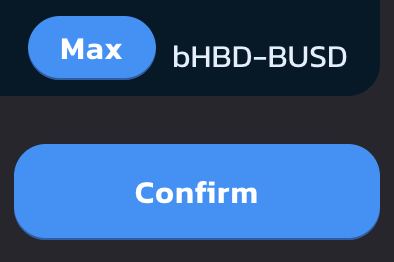

HBD Liquidity On Upbit

First the chart for Upbit.

This is quite the ride for the HBD supply on Upbit in 2022. At the beginning of the year there was 7M HBD on Upbit, and it kept going down up to the end of July 2022. An increase in the price of HBD on Upbit at that time caused for more HBD to be deposited there. Another spike in the price in August and more HBD transferred to Upbit. The supply for HBD has increased from 1.2M at the end of July to 4M and now is back to around 2.6M.

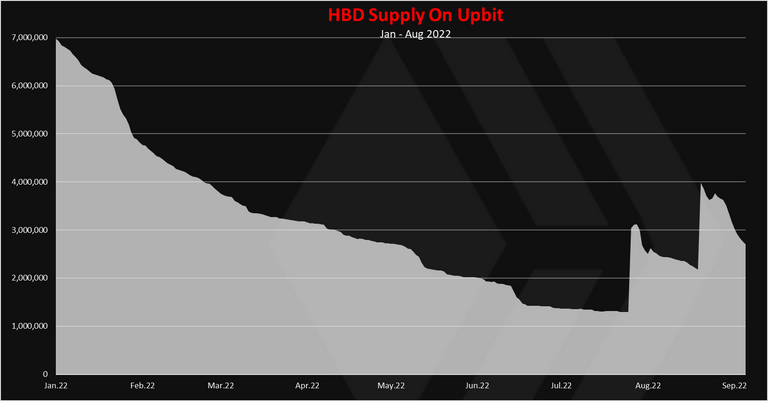

HBD Liquidity On Bittrex

Next let’s take a look at the second CEX where HBD is listed, Bittrex.

Bittrex is not a reliable option for trading HBD as it has closed deposits and withdrawals for a while now. The HBD supply kept decreasing there from almost 700k to 260k. Its almost symbolic number now.

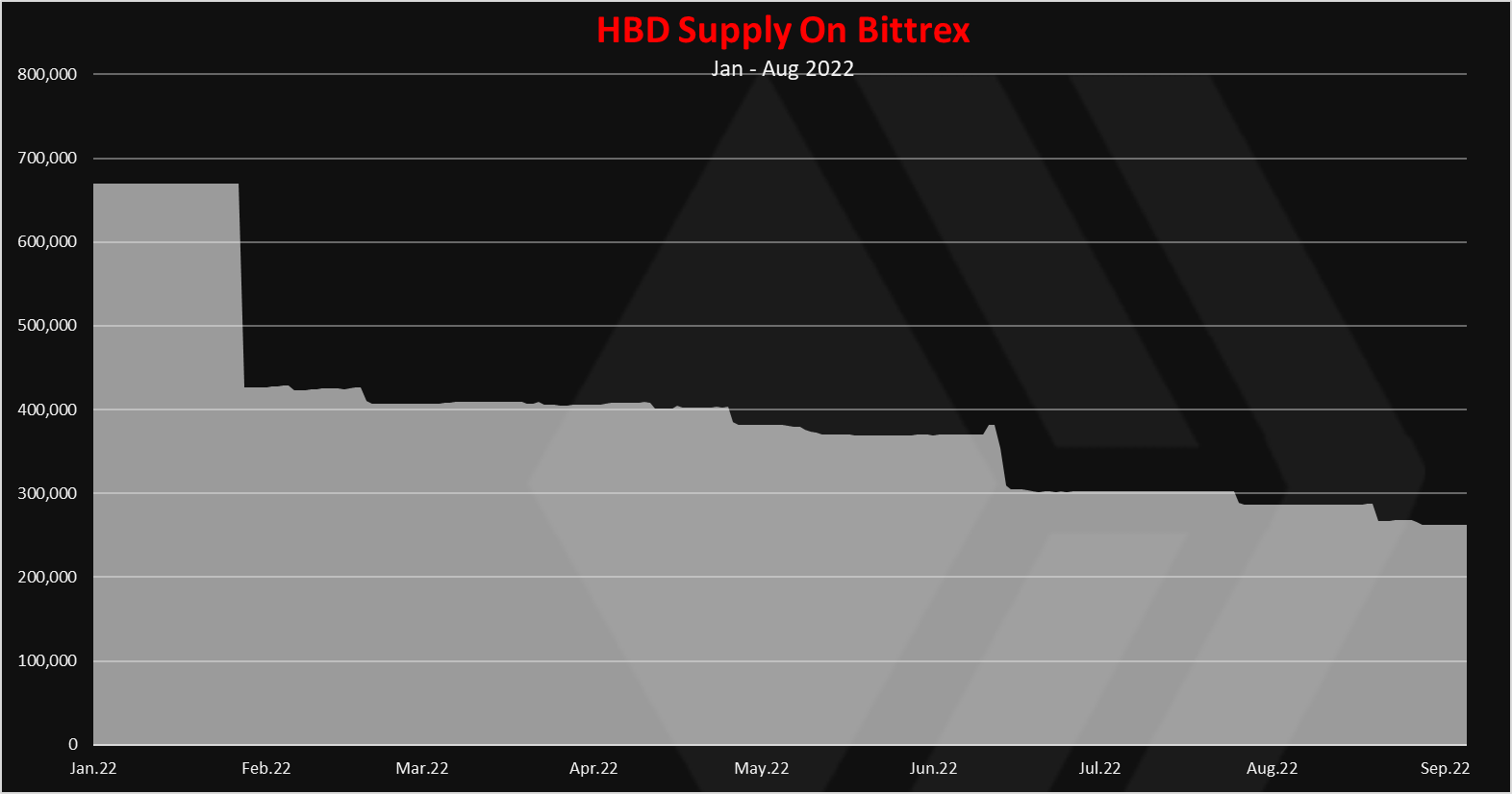

HBD Liquidity On Hive Engine

Now lets take a look at the Hive L2.

The Diesel pools on HE have been active for some time and have increased the overall activity a bit.

The HBD supply on Hive Engine has also been in a downtrend during the 2022. At the beginning of the year it was around 220k and now it is at 120k.

HBD Liquidity On Polycub and CUB

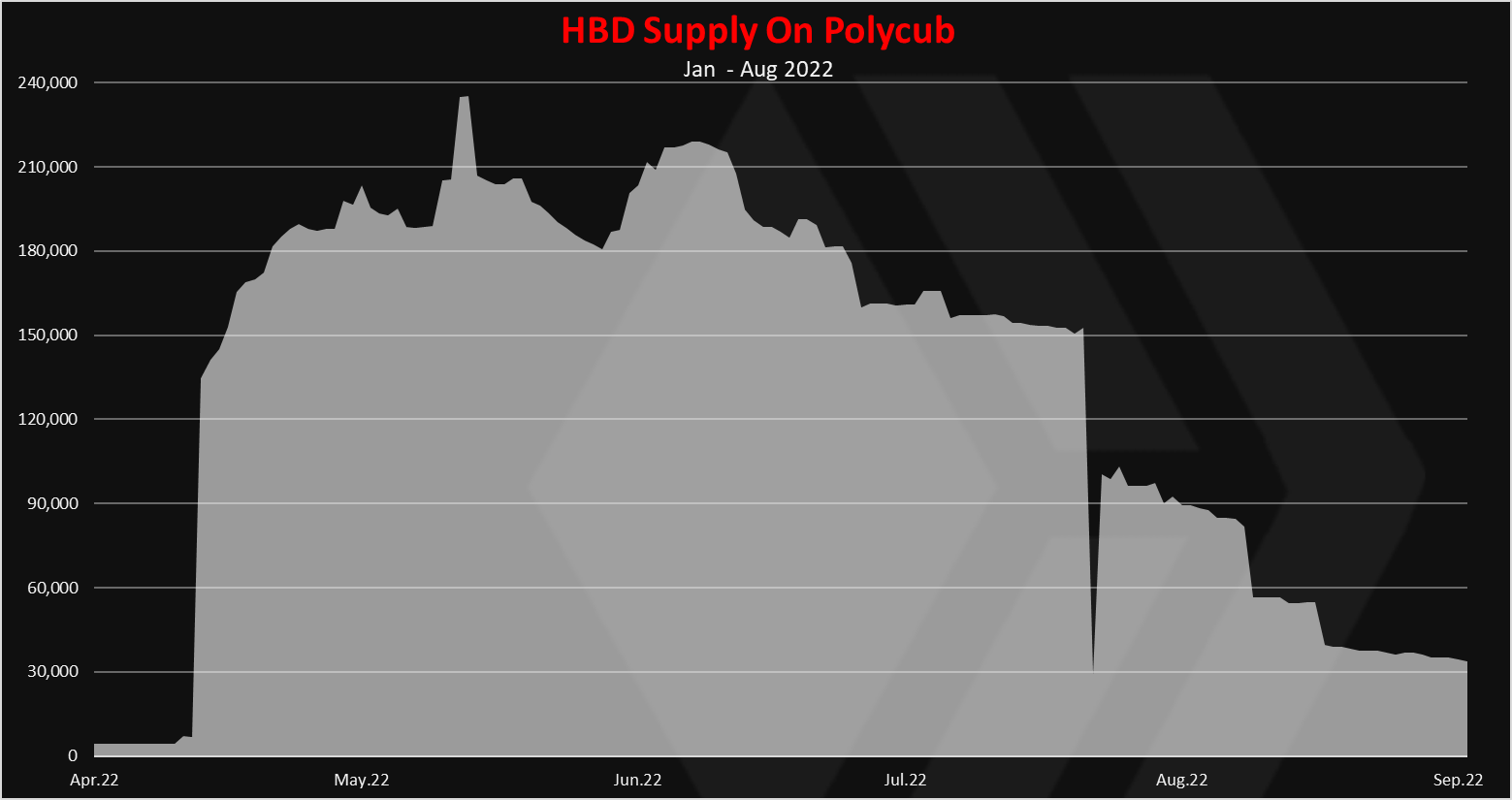

The pHBD:USDC was created in April 2022. Here is the chart since then.

We can see that the amount of HBD converted to pHBD grew fast at first, but then slowed down and went down. At the moment there is around 30k HBD on Polycub.

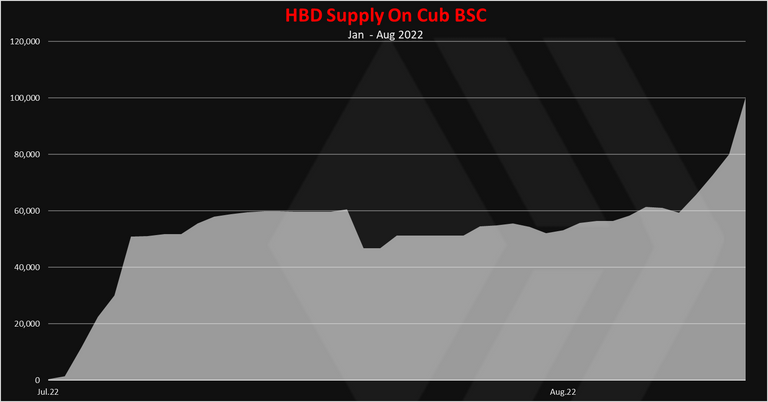

For CUB on the Binance Smart Chain the chart looks like this.

HBD was listed here from recently and it seems that this pool is holding better than Polycub. For a while it was around 60k and now it is at 100k HBD.

HBD Liquidity In The DHF (@hive.fund)

In theory this HBD is not for sale, but if the price of HBD goes above $1 on the internal DEX, the @hbdstabilizer will start selling some of it on the DEX.

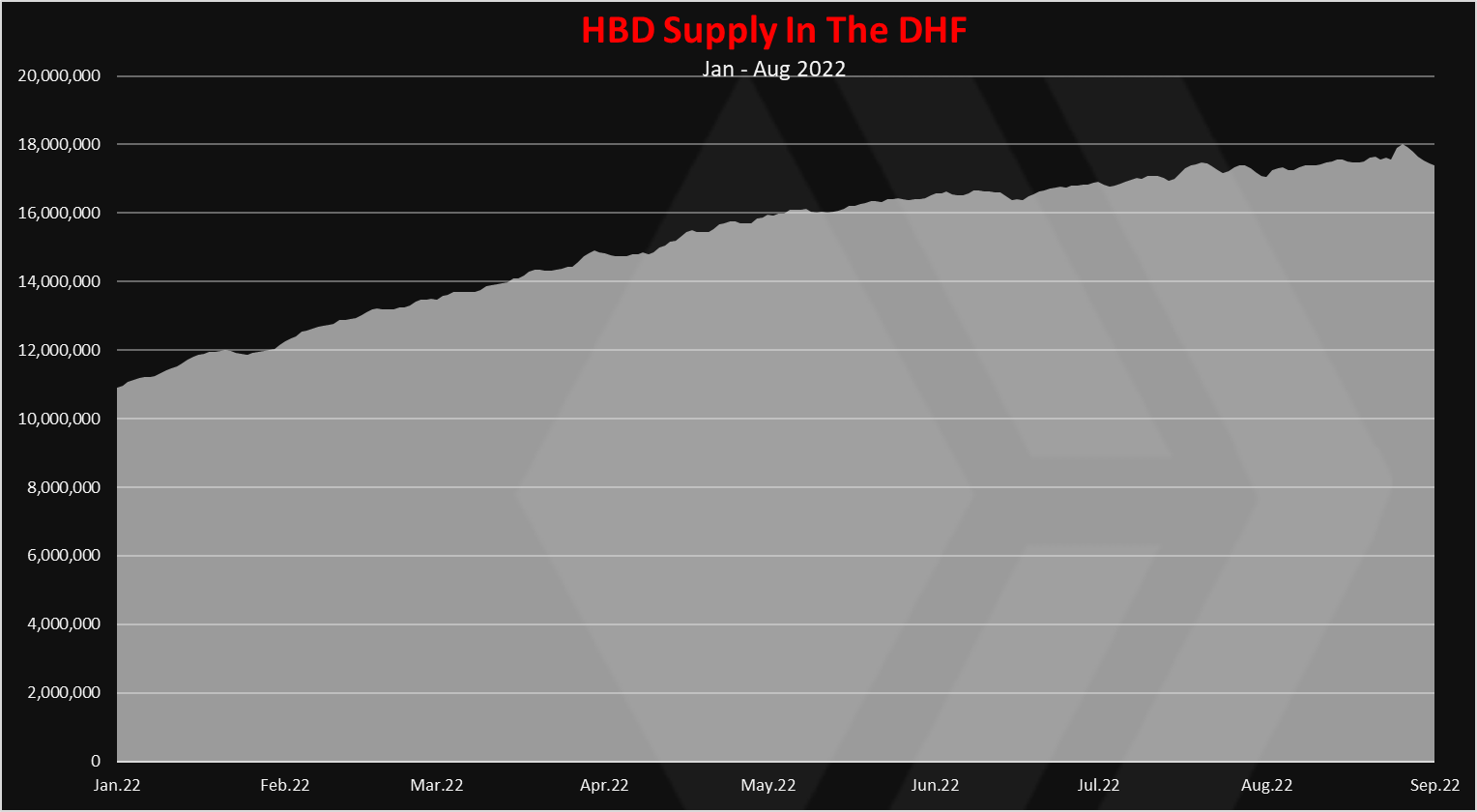

Here is the chart for the HBD in the DHF.

The HBD supply in the DHF keeps growing from 11M at the beginning of the year to almost at 18M HBD. This makes the @hive.fund the biggest holder of HBD. As mentioned not all of it can be used for trading, and in theory the DHF can pay a max of 1% of its holdings per day. The stabilizer asks for 240k HBD daily, and since the budget is around 180k, it receive the maximum minus the sum for the other funded projects.

When we rank the above, we have this.

The @hive.fund is dominant now, followed by Upbit, Bittrex and then Hive Engine. A year ago Upbit was no.1, Hive Engine, Polycub and Cub were non excitinet. While these are small pools it is still a step forward in the liquidity for HBD.

The overall trend for 2022 is that the HBD supply has decreased in all pools except for the DHF fund. Even with the recent Upbit price increase the supply there is still lower from what it was at the beginning of the year. The new Polycub and CUB pools are expanding HBD on Polygon and BSC and while the pools are small they can be convenient for getting some HBD. The 20% APR has also make a lot of users to move their funds to the savings accounts where there is now more than 3.5M HBD.

Trading Volume

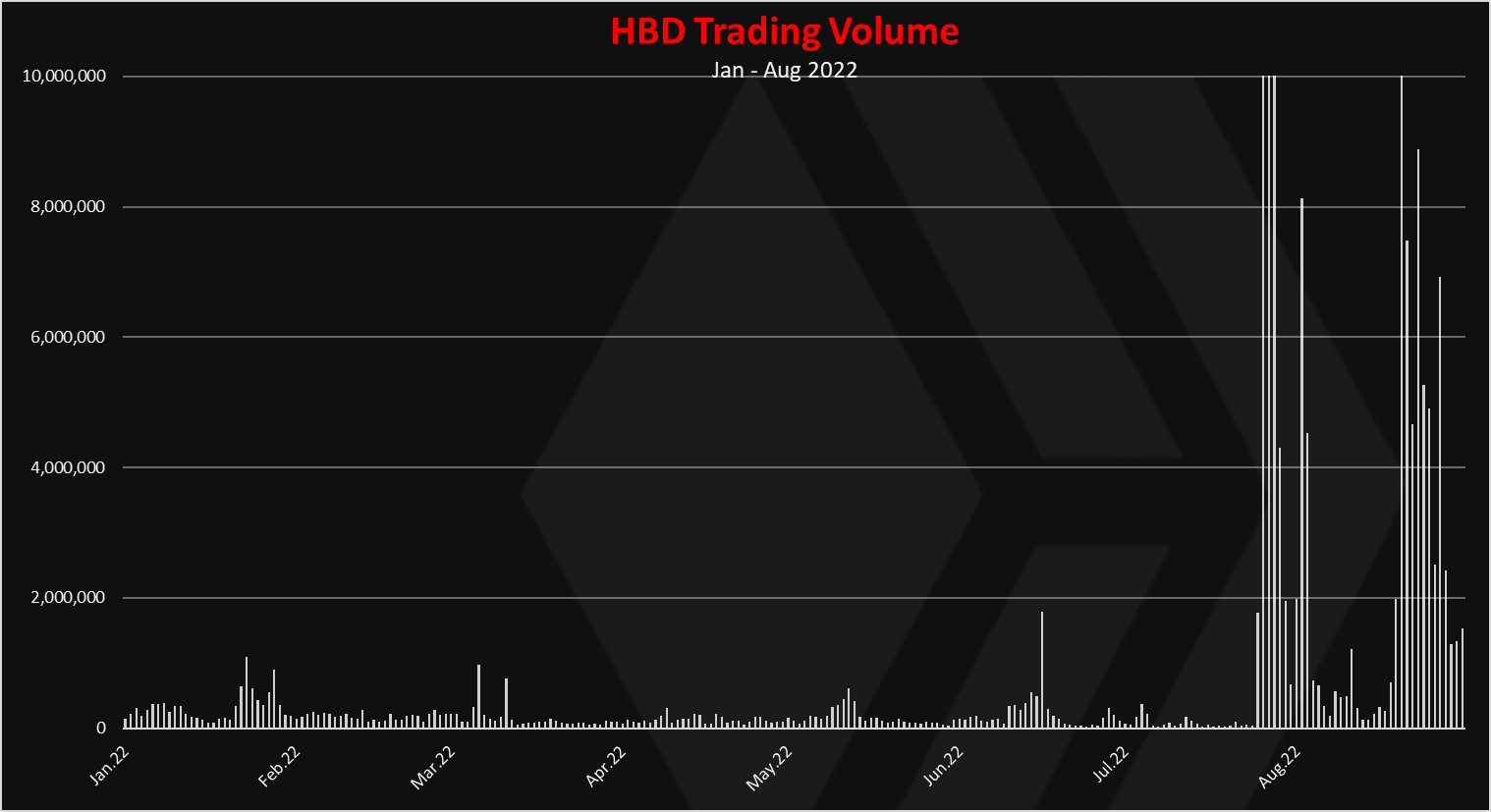

The data above was about the HBD holding on the different platforms where it can be bought. What about the actual trading volume. Here is the chart for the overall daily trading volume for HBD.

We can notice the big spikes at the end of July and in August. Prior to this the daily amounts of HBD trading volume have been in the range from 100k to 500k. But on these days the trading volume has reached a 30M on a few occasions.

Where does the trading volume comes from?

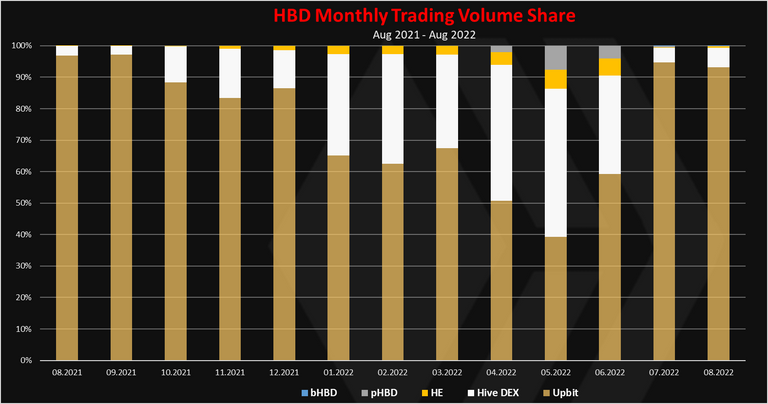

Here is data for the monthly trading volume share.

There are two dominant pools now, the internal DEX and Upbit. Prior to July the Internal DEX kept growing its dominance, but then in July and August there were HBD pumps on Upbit and most of the volume happened there. We can say that under normal conditions for HBD, most of the volume is on the internal DEX and when there is an increase in the price of HBD (or maybe a decrease in the future) the volatility and the trading volume comes from Upbit.

We can notice the other options that appear now like Hive Engine, Polycub and CUB, but the trading volume there is still relatively low comparing with the two main pools.

All the best

@dalz

Posted Using LeoFinance Beta