Hello friends!

I don't know if heaven exists, but I do know that there is hell, a tax hell and it is in Spain.

Lately we have heard this expression more and more around here because everything is more and more bloody, in its almost more literal expression.

We are almost talking about an activity that goes beyond merely collecting money, as usually happens, to become almost plunder and a nightmare for many. Because it seems that there have always been classes and especially as long as you are an entrepreneur, someone who tries to generate wealth for himself and for the country (creating activity and even jobs) or simply a humble self-employed worker with a small business or economic activity, the main victims.

Trying to live and generate prosperity is almost punished and they will put all possible and almost impossible obstacles and obstacles.

If you decide to look for the easy and comfortable way, there is no doubt, a large percentage of young people in the country who have been asked comment that their "dream" is to be a civil servant, that is, to study and obtain a public position and then do little, have a good job schedule and a guaranteed pay, nothing more.

It is sad, there is no other aspiration (maybe some football players and few Youtubers/gamers) than to get a job for life even though the level of public workers in Spain is already unfeasible. In other words, there are too many, compared to the private workers who must ultimately support the entire economic structure of the country, without the latter there are no salaries for the former, but they don't think so, until the unsustainable bubble bursts one day. Or do they plan to continue squeezing others?

Self-employment & entrepreneurship. The price to pay.

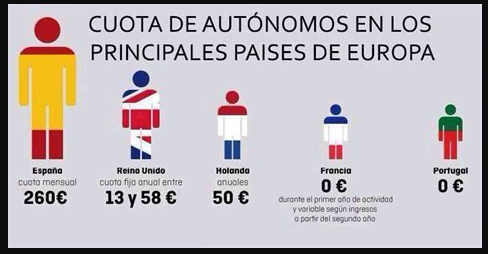

That is happening, and it is an exaggeration. If we compare, for example, what is the monthly fee (named "cuota de autónomos") that is paid in Spain to be allowed to work as self-employed or to start your own activity, it is insane.

Is it possible that, if you earn up to €1000, for example €670, you pay only a minimum fee of around €230 per month and PLUS a 20 % of the total amount of benefits in quarters? How much you have left? And if you earn more, don't worry, the quota/fee increases... Now compare with the rest of Europe:

(Sorry images are written in Spanish but if you see flags and money it's quite clear. The first image is per month, the second image is per year)

Source: Twitter (@NoAlExpolio tweet)

Source: www.easyoffer.es (blog)

There is also another important factor: Bureaucracy

You have to pay the monthly fee, quarterly declarations, VAT declarations, the annual income declaration and another summary declaration of the previous year... Always models and forms, invoices and numbers, percentages and boxes to fill in. And be very careful that, if you don't know, if you make a mistake, the Treasury (Ministry of Finance or Ministerio de Hacienda) will be lurking there to inspect and fine you.

Celebrities VS the Spanish Treasury

Have you heard what happened to Shakira, the singer, during the years that she has lived in Spain? Persecution by the Treasury reaching the courts, because curiously the Treasury inspectors can open investigations with impunity because they earn a succulent bonus.

And if they are wrong? Nothing happens, they have already the bonus in their pockets and if the courts condemn the Treasury, as it happened in that case, we all will already pay (with our "public" money) the compensation for that together.

That has happened to Shakira who fortunately has left the country with that unpleasant memory among others... But also soccer players like Messi and his father lived that experience although maybe not innocents in all the cases but Xavi Alonso fought in courts and he won. And Cristiano Ronaldo left one of the best team and fled to Italy where the tax legislation for players is better. And there are more cases.

And it keeps happening, even famous Spanish YouTubers began to complain in their videos about the money they had to pay in taxes (exorbitant), and how many of them decided to leave, to establish their tax residence in Andorra (a small country between Spain and France) and to develop their activity without that heavy infernal yoke.

Many anonymous working people also choose to change their system and life to be able to breathe, some with businesses or investments prefer to cross the border to Portugal, curiously the closest country has totally different tax legislation and makes much more sense for everyone. They are not as infamous as the ones who run everything here.

Big companies VS the Spanish Government

And finally the icing on the cake arrives, large companies begin to abandon ship, as they say "due to lack of stability and legal and fiscal security", as if we were already a third world country.

Giant construction companies with contracts all over the world such as Ferrovial, leave Spain now to go to the Netherlands, the Spanish government for wanting to get more and more insatiably has managed to lose more in taxes and thousands of jobs.

I am sure that other companies will follow the same path. Especially now that the Minister of Labor says that all companies should be prohibited from leaving the country. Is this Cuba or North Korea?

Source: Spanish digital newspaper "La Vanguardia" (28/02/23)

Spanish politicians have criticized many of them, some speak of a lack of "patriotism", while they have their fortunes in "fiscal paradises" and some ex-Presidents applied for another nationality to avoid taxes and who knows what else to... Funny, well, not really.

But I do not understand that being a patriot means giving up 7 months of your life a year to pay taxes, they steal your time that cannot be returned. There is no proportionality and less and less, recently crazy... Is a rise in 51 taxes normal?

Politicians are the problem

They talk about solidarity while the usual ones, especially politicians, live like kings or maharajahs at our expense (and their families and friends always), without commenting on some absurd overspend, throwing away our money and asking for more and more. Its objective is clear: to impoverish the middle class, make it cease to exist and create a new Venezuela.

Because that way they don't generate wealth in the country, quite the contrary, besides, what do they use our taxes for?

For many things that should not, in addition to uncontrollably increasing spending on advisers who do not advise, placing relatives, on trips just because, in "chiringuitos" (useless but expensive structures or organisms to put more of "their people"), buying people in labour unions, advertising campaigns with which they buy the silence of the media and a thousand absurdities further.

More and more scandals

Another scandal among many (we are used to unfortunately) has recently emerged, you have to know that there was already one in which the largest theft of public money in Europe took place (the ERE case).

Now the last one is named the "Mediador" case in which many national deputies of the Spanish Parliament of the party that governs spent it on prostitutes and drugs, many during the pandemic time when we all were closed at home they were "enjoying" outside with "no fear".

In that time also they had big dinners in private areas of "restaurants" those corrupts were negotiating illegal commissions and bribes among companies and more politicians.

All the information is coming out, very very disgustingly explicit images and audios, and I am sure that in other countries you would not believe the vulgar that everything is becoming, and how serious it is. But of course, the prosecution also protects them, because it depends on the Government itself. What kind of country is that?

Spain is different

This is not the same in other countries, I am not referring to tax havens on some distant islands, but almost any other country in Europe seems to be a bit more normal. What's going on?

Here some can steal more and better, directly. Nobody even resigns. But you, if you want to survive without being penalized, you also need to spend more money on an expert adviser, someone to help you, because it is impossible to know all the details of the hellish legislation and all the obligations that must be fulfilled, and this is another extra expense. I am working on it, I have to dedicate not only money but also time to inform and train myself in this "wonderful" world of presenting model forms to pay.

Can you prosper? Here hardly, because everything is obstacles and there is no help. It's a shame, a great country with a wonderful quality of life, turned into a fiscal hell in which to try to survive. Some of us try that with patience and resignation, or perhaps even thinking in better options or some possibility of leaving... although it is not necessary to go very far, sadly any place seems better than this tax hell.

Thanks for reading! Have a beneficial and productive day.