That's just the way it is.

There's a popular saying out there that Taskmaster likes to throw around that goes, "Fixed money pools!" He says this in reference to Bitcoin, and within this context it makes perfect sense and illustrates the point being made quite well. Bitcoin is deflationary. Deflation is not a good strategy in the long term for building a robust economy, and is accompanied by massive diminishing returns, centralized infrastructure, and a huge gap between the rich and the poor.

However, as my title implies, I'd like to point out that ALL MONEY POOLS. All wealth is constantly consolidated and centralized by those clever enough or powerful enough to seize and hold it. This is just basic human psychology. People are greedy. We can never have too much money; it's just a number on a screen that could always be bigger; a scoreboard with no upper limit.

I mean... just look at Hive...

Hive doesn't have fixed money. In fact we are still giving an insane APR on HBD of at least 15% for the foreseeable future. That's on par with stock market investments. Speaking of stocks, that is also not fixed money and it pools just as badly as anything else. USD is not fixed money and it pools. Hive is supposed to be decentralized and the stake is pooled. It's not something we can get away from that easily.

A completely fair economy will still result in pooled money.

Humans have been trained from birth to have zero savings, live paycheck to paycheck, and demand instant gratification. I can't speak to every culture and country, but I can speak to USA and a few other developed nations. Even in the land of the free and the home of the brave, where it is possible to save up, it is discouraged by those who would profit the most from it. Seeing as those who would profit the most from this type of behavior tend to be the richest and most powerful members of society: this creates a big problem and major conflict of interest within the economy.

Does this problem actually matter?

Money pooling is not an issue so much as citizens living under the poverty line. If everyone on Earth could afford housing, food, water, electricity, healthcare, etc, and still have plenty leftover to spare, it wouldn't matter if there were trillionaires or even quadrillionaires running around. However, because there is a poverty problem, it's easy to pin the source of this problem on the richest among us. After all, they are plundering the world and paying employees by the hour rather than how much value is actually generated from their labor. How could it not be their fault?

Unfortunately this is not completely sound logic. There are plenty of people out there making six figure salaries who don't save a dime of their income and even carry credit card debt, car payments, and house mortgages. Again, the culture we live in dictates these chosen behaviors, not the ultra wealthy. We can't just fix this problem by paying people more. That's absurd and already known to be a failed path.

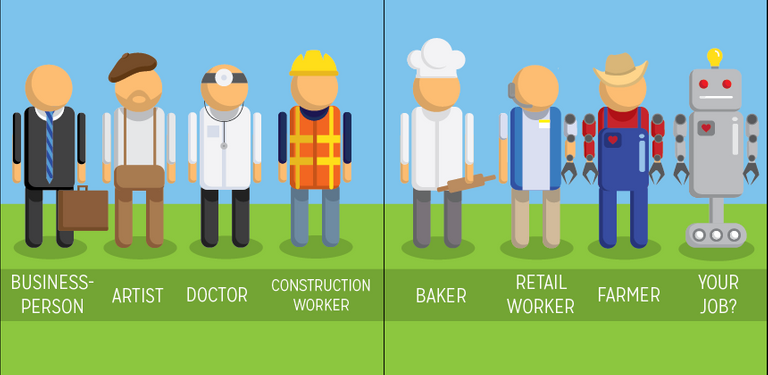

It's also not the fault of the wealthy and powerful that the average person is losing value within society. Computers, the Internet, and automation have outsourced a lot of wealth from the middle class to big business owners. Capitalism dictates that if a company can pay $20/h for a robot to do a job perfectly then they aren't going to pay a human $30/h for imperfect work. That's quite simply just not how the world or even basic logic works. Demanding increases to the minimum wage creates a huge threat that can trend toward eliminating those jobs entirely in favor of automation, but that's another subject entirely.

Spread the Wealth?

The entire point of crypto, decentralization, and disintermediation is to spread out power and wealth in a more fair way that will create a healthy circular economy. It's been known for centuries that a strong middle class is the key to a strong economy, and yet the middle class dwindles every year as liquidity gets sucked up like a straw to the top 1%.

A strong middle class is required because on a very real level the economy itself is born of decentralization and peer to peer transactions. For example: a very wealthy person might be able to afford getting a haircut every day, but nobody would actually ever do that because it's a waste of time and money. The only way the barber shop can stay in business is if a lot of unique individuals require that service every once and a while.

The same goes for most businesses. Netflix could not survive if only the wealthy could afford their services. Restaurants can't turn a profit unless they can serve a certain level of volume. If the vast majority of the local population is poor and can only afford the bare necessities, then a lot of these businesses will go bankrupt within a very short period of time.

Velocity of money

A strong middle class creates exponential levels of velocity. In terms of currency, velocity is when money exchanges hands often, and is a metric that helps money to not be horded and pooled. This is one big advantage fiat has as a medium of exchange.

Because the value of fiat is fated to go down over time this incentivizes market participants to trade this type of debt around quickly in a game of economic Hot Potato. Fiat is the motor oil of the economy. It also helps that in many cases spending fiat does not incur a tax event for the spender (or a relatively small sales tax), further reducing economic friction and incentivizing velocity.

Producer vs Consumer

In a perfect capitalistic society every citizen is both a producer and a consumer. Back in olden days you might have been a blacksmith, a cobbler, or a farmer. The farmer trades his chickens for money. The blacksmith trades his steel for money, the cobbler trades his shoes for money. Then that money gets recycled back into the economy for whatever that person needs to the other professions.

This was also during a time in which income tax did not exist, further reducing economic friction. In fact many would be surprised to learn that federal income tax did not exist until 1909 in America, and back then it was only a few percent and people were still pissed about it.

The point being that this day in age we have a warped and completely messed up form of capitalism in which almost nobody is a producer, and instead we are all consumers who agree to trade our time for money to the time vampires, aka employers who own the means of production. The reason for this is that creating end-products that consumers actually want these days has become way too complicated for a single person to create.

No one person can create a ball-point pen, let alone a car or cell phone. Thus the paradigm shifted to a centralized model where only wealthy investors have the capital to take risks in exchange for ultimate ownership of the finished product line. Everyone else takes zero risk and just trades their time for money on a fixed schedule.

Hive would ironically pool less if it was worth more.

While Bitcoin is doing quite well, many other tokens are still in the distressed sellers phase. If someone from Nigeria could come here and earn even $5/h that would be a pretty awesome wage and they could save their stake for the future. Instead what we have is a struggling community just trying to get by in any way possible.

Again, a lot of this has to do with the value of our actual employees; in this case our employees being the users of the network. How much value are we actually creating here? Clearly not enough to sustain the network and maintain a positive feedback loop. The solution to these problems will always lead to the idea that we need better jobs and ways for the users to build value.

But of course actually turning that theory into a reality tends to be a quite difficult task. The vast majority of value in crypto is created by either devs or outside investors, and most people are neither devs nor fabulously wealthy in the first place. In fact the entire point of coming to crypto was to become fabulously wealthy after the fact. What came first, the chicken or the egg?

Conclusion

All money pools, which is bad for any and every economy. The best thing for an economy is a strong middle class, which means good jobs on a large scale for a lot of people all at once. This is the crux of all economic activity: leveraging the power of the individual into maximum value. Technology is the problem, and crypto is trying to be the technology that solves it.