Hm, yeah...

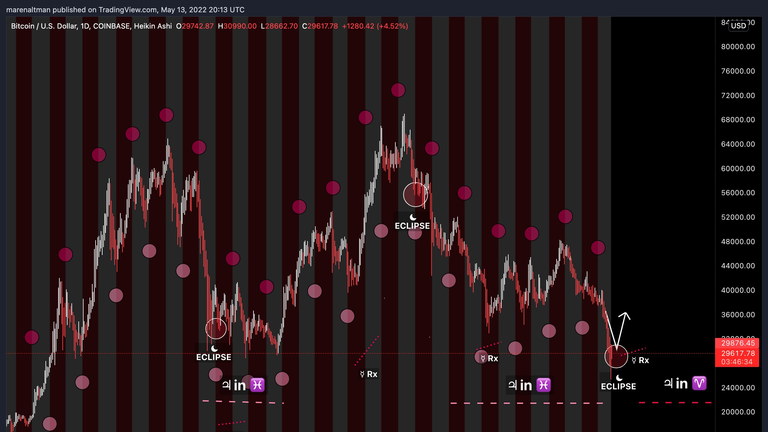

So I look at this chart and what do I see?

- Volume has dropped off a cliff.

- The flash crash is over.

- But we are still stuck under $30k resistance.

- And volume is still dropping.

- This is bad.

But funny thing about my gut feeling...

It's wrong like at least 90% of the time. Therefore, perhaps this is a great sign for us, especially right before a noteworthy lunar eclipse in the middle of a Mercury retrograde.

As hilarious as it is to reference astrological events in combination with crypto speculation. I have to admit, it just never gets old, especially considering the correlation does seem to exist somehow.

Haha seriously...

If I just shorted the market on new moons and longed during full moons... I'd have so much money right now. How weird is that? Astrologers do good analysis it seems.

In any case we got this eclipse coming up tonight. Perhaps I'll even be able to see it although the sky is half-clouded already. The eclipses that I paid attention to in 2020 and 2021 were huge turning points in the market. With November 30, 2020 being a day that BTC was trading at exactly the same level as the peak of 2017 ($19600). Remember those days? Remember how many people on Twitter were like "you'd be an idiot not to sell here and take gains at the previous all time high"... ? Hm yes, that didn't age well. Now a return at $20k at this point in time would signal max-pain.

How quickly the tables turn.

Then in 2021 I even wrote a post called BLOODMOON 666.

Yep, the significant eclipse in 2021 BTC was trading at $66.6k.

Ignored all the bad omens.

Didn't tell anyone to take gains...

And demanded we get a mega-bubble.

Never happened.

Oops!

Now we have another one of these events on midnight my time.

Should be interesting to say the least.

I'm personally betting on the idea that we bounce at least to $35k and hopefully $40k before dipping from there. I made a plan, and I expect to follow through for once. End of the month my long will close no matter what the price is. Sorted. Trading this volatility storm on margin was a silly idea anyway. No reason to drag it out.

Adoption levels have skyrocketed

Look how far we've come since Q4 2020.

- Banks are buying in.

- Corporations are buying in.

- Entire countries are buying in.

All the things we said would happen, are happening.

That's pretty wild.

On a certain fundamental level, the USD price is completely irrelevant (unless you're buying back into the dated legacy system). It's essentially impossible for another round of massive FOMO to be prevented. Can that FOMO come in the middle of a recession? That is yet to be seen. I think crypto would have to invent something pretty spectacular for that to be the case, but you never know.

We also need to take into account that crypto is still essentially a micro-cap within the world stage. The market cap of gold is $11.5T right now. Compare that to crypto's measly $1.3T, and we see that the entire Gold 2.0 narrative has fallen flat on its face. Gold and crypto don't compete, they synergize with each other. That's the exact opposite of competition; cooperation.

It's so silly and obvious to me that this is the case, and yet legit no one seems to agree with me. The constant projected cut-throat competition projected onto this space is pervasive and toxic across multiple false narratives. Don't forget there's profit to me made when millions of people are running around blindly believing bad data. Just ask Big Tech.

In any case, remember all those times everyone was talking about crypto eating the lunch of gold and absorbing the $8T market cap into itself? Well now gold has an $11.5T market cap, and guess what? It's just going to keep going up, and crypto is going to help that happen.

Again, gold is not the investment.

Gold is a robust backup for storing value in an archaic physical manner.

Now that crypto exists, storing gold on a digital ledger is foolish.

The investment is obviously crypto.

You don't buy the gold until after you're a crypto millionaire.

Even in this case, the market cap of gold will skyrocket over ten years.

Just not nearly as much as crypto does.

Because crypto is actually evolving and solving real problems.

Governance and trust are the biggest issues of our time.

These are problems gold can't solve.

But gold can act as a support mechanism for this emergent economy.

Enough about gold already!

I don't even own any!

More of a silver guy myself to be honest.

Gold is cool though.

Conclusion

I think I'm done blabbing on about speculative nonsense for now. We are due for another period of extreme volatility. Remember the last time I warned of this?

Ended the post with:

VOLATILITY IS INCOMING

STEEL YOURSELVES

That was a week ago May 7th when BTC was trading just above the support line at $35k. Four days later we flash-crashed to multi-year all time lows at $25.5k. Epic! Again, I don't know which direction it's going, but it's coming, one way or the other. This volatile market is not going to give us any peace.

Posted Using LeoFinance Beta