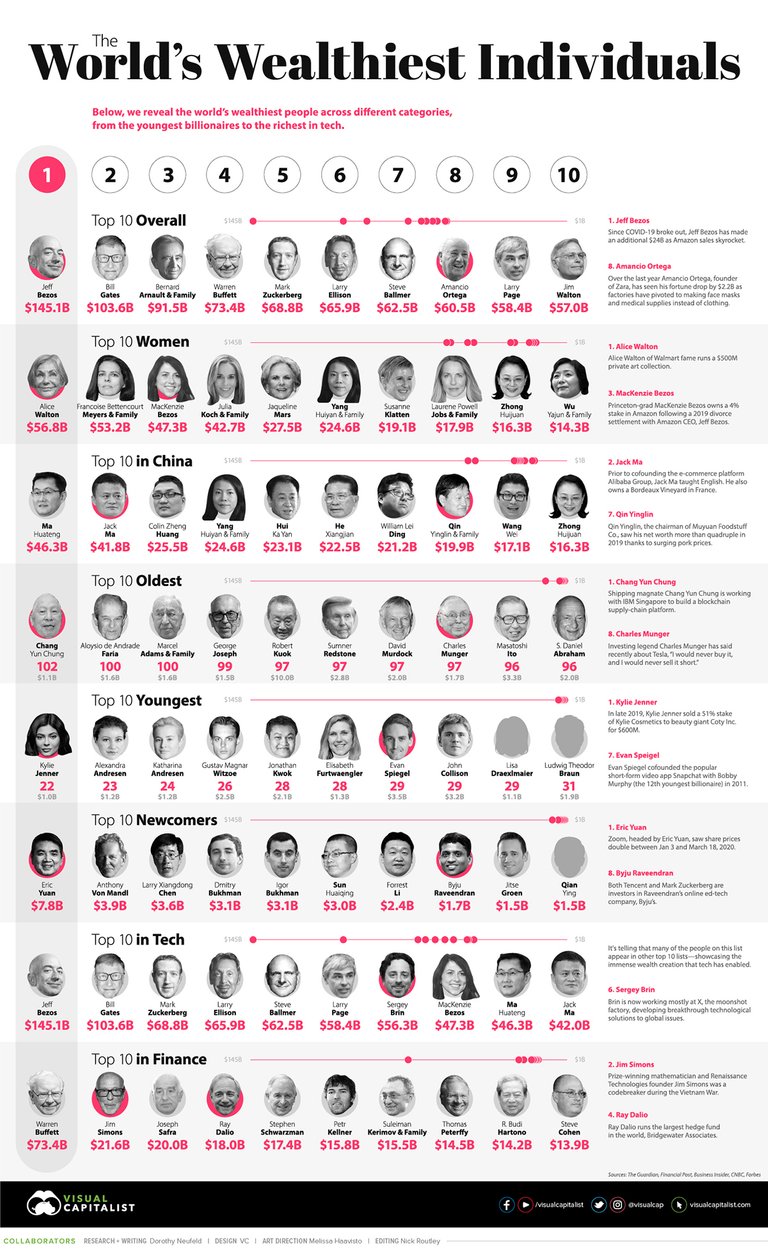

From April 2020

Also Charlie Munger is 98 years young. Can he just die already? Thanks in advance, universe.

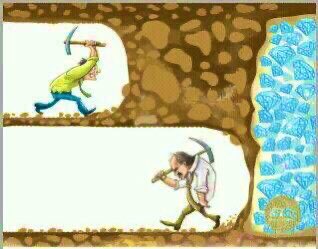

You ever notice how the richest people are never the ones who actually control the money? Never see a central banker on these lists. Weird right? I wouldn't think too heavily on that fact. Don't worry about it.

It's also very interesting that we measure the worth of these "billionaires" in dollars, even though they don't actually have that many dollars. Here on Hive we all know how liquidity works. If you own the majority of shares in a huge company you can't liquidate all your shares for USD, but these assessments of wealth automatically assume that this is possible. We assume that market cap is a measure of total wealth, and this is a very big mistake.

Imagine thinking that central bankers aren't the richest people in the world even when the world literally measures the value of everything in terms of their own product (fiat). Let that sink in for a bit.

When Elon Musk holds 175 million shares of Tesla stock, that is the 'currency' he is holding. But in our minds we can not measure wealth in this way. We require a unit of account. So everyone looks at the price of Tesla shares in USD and then pretends like it's possible for him to liquidate all his shares into USD without any slippage, which is obviously 100% ridiculous when we actually understand how markets work. By holding those shares and not dumping them on the market, Musk props up the value of his own business by shear force of will.

If you had asked me five years ago if Billionaires should exist, I probably would have said 'no'. How are these billionaires getting that much money in the first place? By doing shady things and stomping on the backs of the poor, that's how! If you had asked me back then, I'd of said we should increase taxes on the rich so that we could distribute that value back out to the people who actually need it. Unfortunately, the world is a little more complicated than my idealistic/simplistic view of how the world should work.

Again, the entire concept of "billionaire" is baffling.

We call them billionaires, but they aren't actually billionaires. It is only their assets that are theoretically worth billions of dollars if you assume you could liquidate all their assets at market value (which they can't). So what are we supposed to do? Force "billionaires" to sell the stock of their own companies and then force them to give that money to the government?

Sounds like a pretty shit idea to me.

Because even if that money didn't bleed out through our ridiculous loop-holed swiss-cheese government, there would still be massive diminishing returns. What happens to all the people who were holding that stock who lost money because we forced the "billionaire" to sell? Oops, they all lost money, and now they are pissed. This is why economic systems can't be manipulated in this way. If you tug on a single string of the economy several more will start to unravel. Everything is connected.

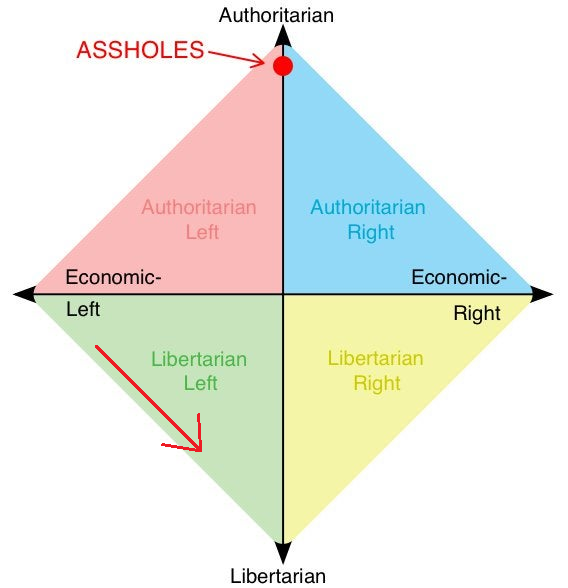

The diamond-oriented Nolan Chart clearly portrays how the political spectrum can be organized as a two dimensional entity. Five years ago I found myself on the far far far left of the spectrum, but after being in crypto for over 4 years I find myself backsliding into extreme Libertarian/Anarchist territory. Crypto has shown me that we now have the tools to build a system of rules that doesn't need to be enforced by rulers like it did before.

Again, the diamond orientation of the Nolan Chart shows that if you want to be more left-wing, then you often have to be more authoritarian to accomplish this goal. How else are you going to fund a social program for the "good of the many" if you don't fund it by 'stealing' the money from those who have it?

Of course, if you're left-wing like me, you don't care much that rich people are being forced by penalty of torture chamber to pony up that dinero and pay for these things that exist for the benefit of society... or so I thought.

Crypto really changes the entire game.

Being in this community for over 4 years has really forced me to study, not only POW and DPOS consensus algorithms, but also the legacy banking sector itself. After all, if the goal is to replace the legacy economy, we have to understand the weak points of it. In fact, crypto could have never taken root if our current system wasn't totally broken. Decentralization is highly inefficient and totally pointless IF you can trust the centralized middlemen in charge. Unfortunately, we can not, so here we are.

How does crypto change the game?

It all comes down to communities taking direct control of their own currency. Whereas five years ago I would have made the argument that billionaires should never exist under any circumstance, now I realize that we should want as many billionaires as we can possibly get. With crypto, we can store that value directly at the heart of the community itself. The value provided by the theoretical "billionaires" then trickles into the pockets of everyone on the network via expanding/contracting liquidity pools.

Take Hive for example.

Imagine if a Hive whale was a billionaire. Now imagine that this Hive whale only owns 1% of the circulating supply of Hive tokens. This explicitly implies that the total market cap of Hive is $100B, which would obviously be insane.

With a current market cap of $432M and a token price of $1.16, our new market cap of $100B would pump up the token price x231 to around $268 per Hive token. These are not absurd numbers. They are totally and utterly reasonable. This will happen it's only a matter of time. Gimmy that $2000 upvote, please and thank you. Soon™.

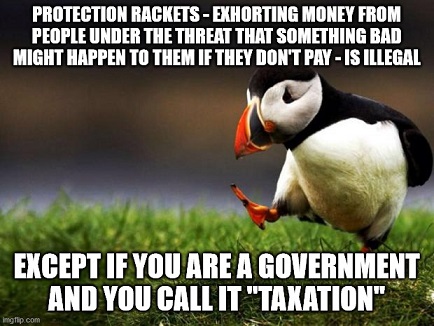

But who's going to pay for roads?

Imagine if Hive itself founded it's very own city-state in the real world. How would we pay for things without taxing people? This is the question that is always posed to libertarians that say taxation is theft. In fact, the entire reason I wrote this post is because I watched a Joe Rogan podcast with a random libertarian rapper I follow on Twitter @zubymusic

So the first half of this (90 minutes) is mostly just about how fucked up COVID is and how we shouldn't be mandating vaccines or taking away alternative treatments and such... whatever... I've already given my opinion on such matters so it's overplayed and off topic...

However, when they switch gears and try to talk about other things, the whole "tax is theft" argument comes up. Rogan asks Zuby how we are supposed to pay for things if we don't tax people, and the answer he gives is TERRIBLE. It was something like, "If the government doesn't build the roads, someone will." What? Yeah, he basically said we should just privatize everything. You know, because privatizing the prison-industrial-complex and turning prisoners in Matrix batteries that farm profit is going SO well. This is not the answer.

Even though that podcast happened in August 2021 I wanted to leap through my goddamn screen and yell at both of them and tell it how it is. It's very obvious that neither of them understand the basic fundamentals of central banking itself or what we are doing over here in crypto land.

So what's the answer?

How do we pay for communal infrastructure?

The answer is simple: just print the money and pay for it. This is what people don't get. The government can't print money. Even the Federal Reserve can't print money. But we can. If Hive needs to build a road, all we have to do is upvote a proposal for building the road, and BOOM: it's funded. End of story. We solved the problem and no one even realizes the gold mine we are sitting on here.

Now, there's a very good reason why the government can't print money, and there's a very good reason why the Federal Reserve is not allowed to print money either. It's called: Checks and Balances. Allowing an all-powerful agent to unilaterally control money is an obvious conflict of interest, so that power is delegated to retail banks.

Government has a little power over the FED, and the FED has a little power over retail banks, and the retail banks have a little power over corporations and the citizens of the world. In theory, this system distributes power fairly enough so that no entity can make printer go brrrr and send us spiraling into rampaging hyperinflation.

Only retail banks can print money.

And that money exists as debt that needs to be paid back with interest, which is how hyperinflation is prevented from happening. We can't print money unless entities taking out the loans accept the given interest rate. If people aren't taking out loans, new money is not entering the economy.

Compare the legacy system with Hive.

We cut out all the middle men. We can print as much Hive as we want. Hive is community owned, and we don't need all these silly centralized checks and balances in place to make sure printer doesn't go brrr. If we need to pay for something, we just print the money and pay for it; simple as that. Taxing citizens is completely antiquated within these new systems because these new systems are self-funding and self-regulated from within the system itself.

Hive isn't just a community.

- Hive is a technology.

- Hive is a business.

- Hive is a corporation.

- Hive is a central bank.

- Hive is a government.

- Hive is social media.

- Hive is gaming.

- Hive will have healthcare and insurance.

- Hive will have food/water/shelter.

- We can do it all; there is no limitation or glass ceiling in play.

See how crazy this is?

When you really actually start parsing what is going on here, it's totally fucking bonker balls bananas. There is no comparison to be made. What is happening now with crypto is a revolutionary transition that is going to completely change the very core fundamentals of economics and government as we know it. There is no question as to if this is happening or not; only wen.

Back to the real topic at hand.

So yes, within the old broken system, perhaps billionaires should not exist and perhaps they should pay more taxes. But that argument is antiquated and totally irrelevant now. We want as many Hive billionaires as we can get because that value is distributed to everyone on the network in the form of massive exit-liquidity.

This is nothing like a corporation (stock/security).

A corporation doesn't need permission from the employees to print more stock. A board of directors votes to print more stock and boom: everyone's value gets diluted just like that. Of course there are tons of security regulations in play so it's not that simple, but on Hive we can see the way this works is totally different.

On Hive, if the "board of directors" voted to print more stock (Hive) and channel that money into their own pockets, we'd see a pretty aggressive fireworks display. Things like that can cause massive divisions and hardforks within the community. That would also be a great way for the chain to get rolled back and new witnesses to instantly be voted in to replace them. Case in point: blockchains have much more robust systems in place that allow them to be self-governed from the inside without any central agent being able to dilute that value and siphon it into their own pocket.

Conclusion

Making the claim that billionaires shouldn't exist, but if they do exist they should pay more taxes, is a very tricky subject. First of all, we call them "billionaires" when they don't even control billions of dollars. They control assets, securities, commodities, property, etc. Calling a billionaire a billionaire is a total misnomer and oversimplification of the issue.

When we realize the tools crypto has created this argument goes right out the window. We want people on Hive building as much value as they possibly can and HODLing all of it. If they sell the Hive they earned, the liquidity pool gets drained and everyone loses money. The more billionaires we have, the better.

When the community controls money itself, when the community IS the central bank, there is no reason to hate the rich, because the rich are pumping that value directly into the communities we care about. At the same time, this dynamic makes taxation pointless because the network can just print more inflation to pay for anything it needs. This is the future of the economy and government itself.

When corporations hold millions of dollars on their balance sheet:

Central Banks win.

When Hive whales HODL:

Everyone on Hive wins.

These two systems are not comparable in any way.

We need to learn the difference and teach others the path forward.

Posted Using LeoFinance Beta