The Next Blue Chip, The "Ethereum-Killer" or simply Solana,

...is a very promising L1 EVM-compatible blockchain. However, it seems like it might be against the ropes now. I will tell you why.

A big Top 10 cryptocurrency with more than $11.5B market cap, Solana is often seen as an NFT safe haven, and a probable next big player ahead of the next cycle (that is, the next bullish cycle.)

It has a very active community supporting it, with an Ambassador program named "The Collective," a Weekly Podcast, a very active YouTube channel with more than 30k subscribers, and more than 1.8M followers in Twitter. It regularly organizes many IRL events such as: Hacker House (made worldwide) and the upcoming Breakpoint 2022, Lisbon, Portugal.

What is Solana?

"Solana is an open source project implementing a new, high-performance, permissionless blockchain. The Solana Foundation is based in Geneva, Switzerland and maintains the open source project." - Source: Solana Docs.

Solana is a scalable, permissionless, Open Source blockchain based in Geneva, Switzerland, supposedly able to process up to 700k transactions per second, EVM compatible, DPoS blockchain (sounds familiar?) with $SOL as its native token, and it even surpassed Ethereum once in NFT trading volume in Open Sea Marketplace (Apr 28th.)

- If everything was so awesome within this blockchain, why we say it is supposedly able to process up to N transactions per second?

The Fall

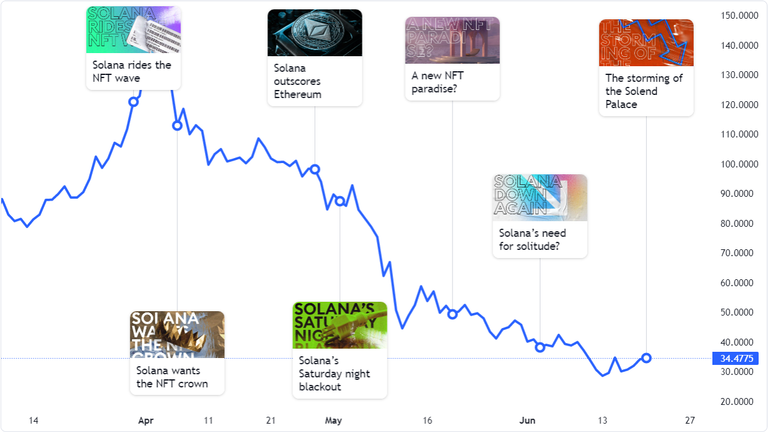

Despite the project being really great, Open Source, with a great community, many IRL events, Solana has suffered a lot of shortages and blackouts ever since last year, being the September 2021 the most serious of all (17 hours down!) and the first one of this year in January (18 hours and then again for a few hours,) then again in May (7 hours shortage,) and the last time being this past June 1st.

Obviously these inconsistencies are very bad for investors, but also provide a very bad image for the whole ecosystem. Also, a Solana stablecoin named $CASH is one of the first depegs of this year:

Ever since the last year the price of the $SOL has been declining (despite the bearish market) yet the daily volume is always increasing.

The first big dump occured after the May blackout. $SOL price never recovered after that.

The Present Day

We all know about BTC (crypto) cycles. If not know for sure, at least have heard about a phenom that occurs every 4 years called "Halving" and that it someway affects prices and that it is the responsible for the mega bullish cycles all the cryptos have lived before.

Well, now the effect of the last halving is gone. The market has retraced to 2017 levels. But is fine. It is the way it should be. Having a limited supply, the future for BTC and many cryptos is one, and one only.

The main issue is the bull cycle. Alongside "experts" and "investors" and all mainstream noise. Just like they were shouting "BTC to $100k by the end of 2021!" they now shout "BTC is going 0."

So what is the situation here? Why do we talk about a horror story?

Without further ado, I will tell you now.

During bull runs, lot of people make tons of money. This creates such a sense of greed in most people that they do not planify, nor manage their assets (and profits) properly.

Like a bull run could last forever.

There are others "investors" even more reckless. They provide volatile assets such as crypto to get lends in stablecoins. But please, always remind: THIS IS A MISTAKE.

Stable assets should be used to get volatile assets, and not the contraire.

There is this huge Solana DeFi platform named SOLEND. This platform acts as a crypto lender. Just like in many other DeFi, you can deposit whatever assets in their smart contract, and receive any other cryptocurrency.

This case is the true story of a wallet (a user) which is consider a major $SOL whale: it has provided more than 95% of the entire $SOL pool in Solend to receive... yes, you guessed it! USDC!!

Institutional Investors vs. Retail Investors

What happened?

Exactly what you may think: $SOL shrinked almost 80% from its ATH (from around $239 to more or less $34 per $SOL at the moment of writing,) causing his position to be dangerously close to the Margin Call or liquidation price.

At the moment, the Liquidation will occur if $SOL reaches $22.30.

This would cause a massive selling of around $20M worth of $SOL, which would be really fatal for its price, and its investors confidence in the project. Additionally, Solend issued a proposal to activate an "emergency clause" that would allow the platform to "temporary gain control over the whale's wallet."

This proposal was very well received when it was first submitted to the community vote (it was at first approved) but then of course it aroused growing doubts related the lack of decentralization within the platform, and maybe in the entire of Solana blockchain.

These feelings are a direct consequence of the community being ignorant of the said emergency clause. We got to say that in a second voting round, the proposal was 99.8% downvoted.

What do you think is going to be the future of Solana, now that they decided not to save the whale's wallet?

Is it destined to a major sellout and bankruptcy? Or maybe the gigantic volume of daily NFT sales/buys will help to preserve the underlying value of $SOL?

Interested in getting involved?

Here are some of the main projects I am into.

- Create a FREE Hive account

- Join my LISTNERDS team

- Check out NoiseCash a decentralized Twitter, where you earn $BCH from Likes

- RisingStar a #P2E music game, where you'll earn $STARBITS in your path from performing in streets, to conquering scenarios worldwide!

- Binance: The Largest C-Exchange by volume in the world. Start trading today. Earn an additional 10% using this link.

- Join me at Bybit and get a $20 bonus in USDT! Plus, up to $600 worth of rewards await at Rewards Hub. Get started with my referral code: MJPE03

Posted Using LeoFinance Beta