BNB is the native coin of the BNB Chain ecosystem, created by the already well-known cryptocurrency exchange Binance, which makes it one of the most well-known utility tokens in the cryptocurrency world, not to mention that it ranks number four in Coinmarketcap's cryptocurrency ranking.

Possible bullish signals on BNB. Source: @emiliomoron,BNB logo was taken from Wikipedia.org..

And at the end of April it had an interesting momentum that made it grow close to 5% in one day, approaching $340, a level that seems to be acting as an important barrier, however on May 1st the price quickly retreated, losing almost 7% in the last seven days, trading at the time of writing this publication at $311 approximately. However, some On Chain indicators are showing some signs that would allow bulls to keep an eye on the market.

Screenshot taken from Tradingview.com.

But, although BNB failed to break the $340 resistance, it seems that the cryptocurrency is gaining attention among traders looking for alternatives amid the market turmoil, and an increase in trading activity and the big whales have stopped selling could suggest that there is a new bullish move.

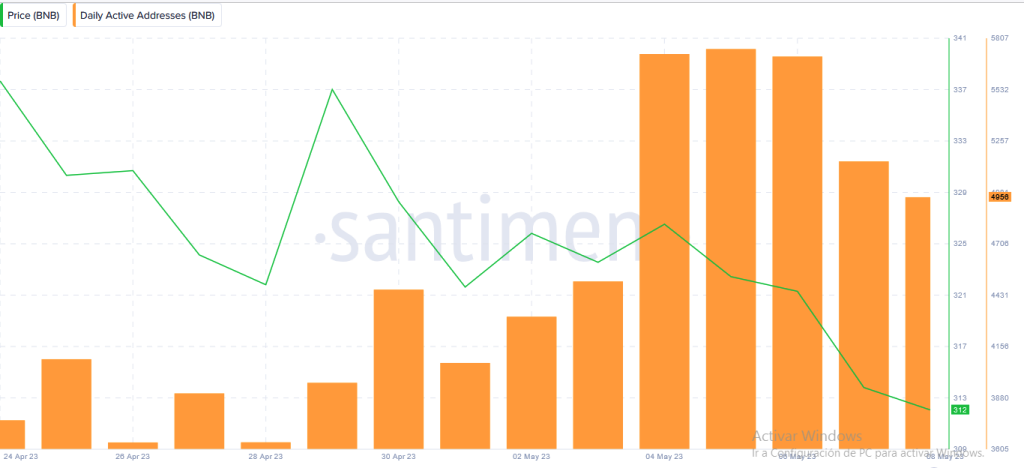

If we look at the following chart we can see that the BNB Chain network has seen an increase in the number of active users in the last seven days, as we can see, even though prices have been declining since the beginning of May, the number of daily active BNB addresses went from almost 4000 to almost 5000 today, even surpassing that value days before.

Screenshot taken fron Santiment.com.

This divergence between the price curve and the number of active addresses can be seen as a bullish signal, as it suggests that a project is gaining market share, and if investors continue to choose to use BNB for their transactions, it could have a positive effect on token prices.

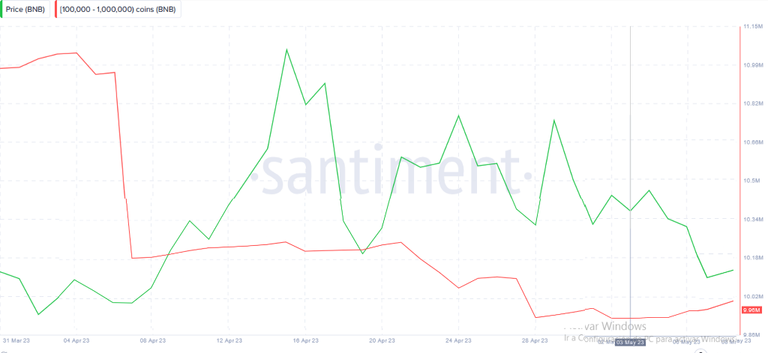

Another aspect that could portend an increase in BNB prices is a new trend of accumulation among the big whales. In the following graph we can see how a number of users who own between 100000 and 1000000 BNB reduced the balance in their wallets during the month of April, which means that they took advantage of the price increase to take profits. Now, we can see that since May 3rd this group of users have stopped selling, and rather started adding balance to their wallets.

Screenshot taken fron Santiment.com.

The onset of this accumulating trend in BNB could be indicative that the whales are confident about the future prospects of the market, and considering that this group of whales already managed to capitalize on the previous bullish rally, their recent accumulating trend could precede a positive price move.

So, despite the current price decline, we can see signs that a bullish reversal in BNB prices is possible, we can only wait and see if these assumptions hold true.

Well friends, I hope you liked the information, see you next time!