Over the past few days, I’ve found myself going down a bit of a rabbit hole, trying to get me head around what happened to CUB Finance. To be fair dinkum, I started this journey knowing bugger all about it. But as I dug into old posts on PeakD, checked liquidity on TribalDEX, and had a squiz at community discussions, I discovered an interesting (and somewhat concerning) story about a once-promising DeFi project.

What is CUB Finance?

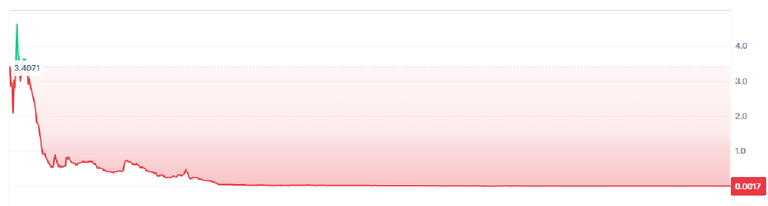

CUB Finance was launched in March 2021 by the LeoFinance community as a yield farming platform on the Binance Smart Chain (BSC). The idea was to create an ecosystem where users could provide liquidity, stake tokens, and earn CUB as a reward. At its peak, CUB reached an all-time high of $4.60 shortly after launch, showing strong early adoption and enthusiasm.

The Rise and Fall

As with many DeFi projects, early momentum eventually slowed down. Here’s a timeline of key events that I was able to piece together:

March 2021: The Big Launch

CUB Finance officially launched, offering yield farming and staking opportunities.

The price shot up to an ATH of $4.60, reflecting strong initial interest.

April 2021 – 2022: Market Adjustments and Decline

The price of CUB started to dwindle over time, mirroring broader market trends and DeFi volatility.

Liquidity and trading volumes dried up a bit, making it harder for users to enter and exit positions.

March 2022: Introduction of PolyCUB

The LeoFinance team launched PolyCUB, a new DeFi platform on the Polygon network.

This move was meant to expand the ecosystem and provide additional earning opportunities.

However, the launch of PolyCUB raised concerns that CUB Finance would lose focus or liquidity, and it seems those concerns weren't unfounded.

2022-2023: Declining Engagement

Discussions within the community continued about ways to bring CUB back to life.

Token burns and staking adjustments were proposed, but they didn’t seem to have a lasting impact.

2023: Price Hits Rock Bottom

By 2023, CUB’s price had dropped to $0.0084, a massive nosedive from its former peak.

Community sentiment took a hit, and discussions became less frequent.

Where Does CUB Stand Today?

From what I can tell, CUB Finance is still technically operational, but it’s not looking too flash, currently 0.001735. A quick check on TribalDEX shows that liquidity for CUB is shockingly low, meaning that even if someone wanted to buy or sell, it would be tough to execute trades without significant price slippage.

I haven’t stumbled across any recent updates from the LeoFinance team regarding plans to breathe new life into CUB, and it seems like most of the community's attention has moved elsewhere. That being said, I’m still learning and would love to hear from others who have been following this project for longer than I have.

Final Thoughts

I went into this research trying to answer a simple question: What happened to CUB Finance? The answer, it seems, is a mix of early hype, shifting priorities, and the harsh realities of DeFi markets. While some projects find ways to reinvent themselves, others fade into obscurity. Right now, CUB seems to be closer to the latter.

If anyone has more insights or corrections on this timeline, I’d love to hear them. What do you reckon—does CUB still have a future, or is it just another DeFi project that’s carked it?