Just imagine if you could take loans that would repay themselves on their own? That is the magic of DeFi 2.0! What if the borrower does not have to pay the Loan interest without putting a single dollar from his own pocket. Generally, a person takes a loan and is faced with high-interest rates on repayments. Also, there is a risk of liquidation. DeFi 2.0 offers a great solution to these problems - Self Repaying Loans. Here your only debt is the time!

How Does Self Paying Loan Work?

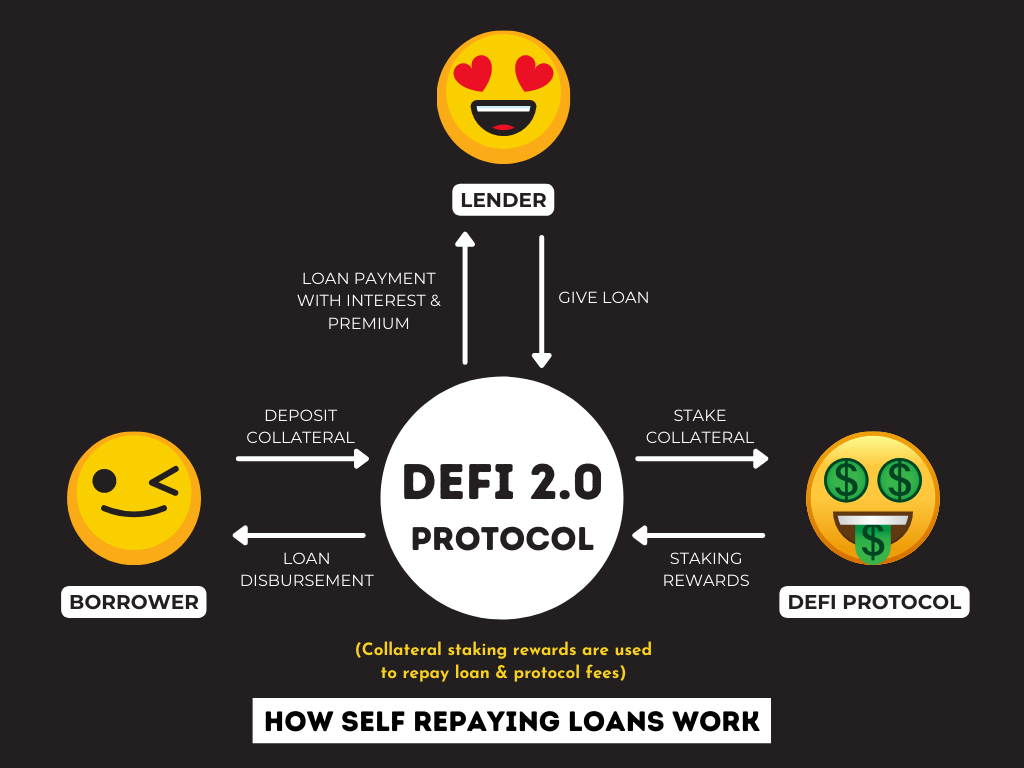

- Let's say, a borrower deposits $6000 worth of crypto as collateral in order to get a $3000 worth crypto loan at a fixed percentage.

- Crypto collateral ($6000) is staked to another protocol to earn further yields.

- Yields from the collateral are used to pay off the $3000 loan with interest and protocol fees.

- As soon as the lender gets their $3000 back with interest, $6000 collateral will be sent back to the borrower.

- Everyone makes money!

^ This section is edited with corrections. Thanks @thinkermind

In this process borrower never did any payment from their pocket. They didn't have to do anything apart from taking the loan and depositing collateral as crypto. After loan repayment, they will have $3000 and their collateral $6000. The lender makes a handsome premium by giving out loans. This avoids liquidation problems and the money lost in so many exchange operations. Even if the value of the collateralized asset depreciates with time, the loan will repay itself by taking some extra time to repay the interest. This is a great way to put your crypto to use and earn extra value for all the parties involved in the transaction.

I have created this Infographic to understand how these loans work in DeFi 2.0 applications:

Future of Lending

DeFi 2.0 protocols are shaping up the future of lending where Lenders, Borrowers, and LP providers, all of them are getting the benefits of participating. By removing the third party and automating all the processes, it gets easier for anyone to get a Crypto loan and use that money to compound further. Alcehmix Fi is one of the most famous lending protocols which provides Self Paying Loans services. Users can deposit DAI as collateral to get alUSD as a loan for up to 50% LTV (loan-to-value). alUSD can be exchanged on Sushiswap for other Digital Assets.

It's an interesting way to provide a great user experience. I am keen on seeing this develop in the future. Would you like to take such a loan? Or would you give out such a loan? Please let me know your thoughts in the comment section below.

Posted Using LeoFinance Beta