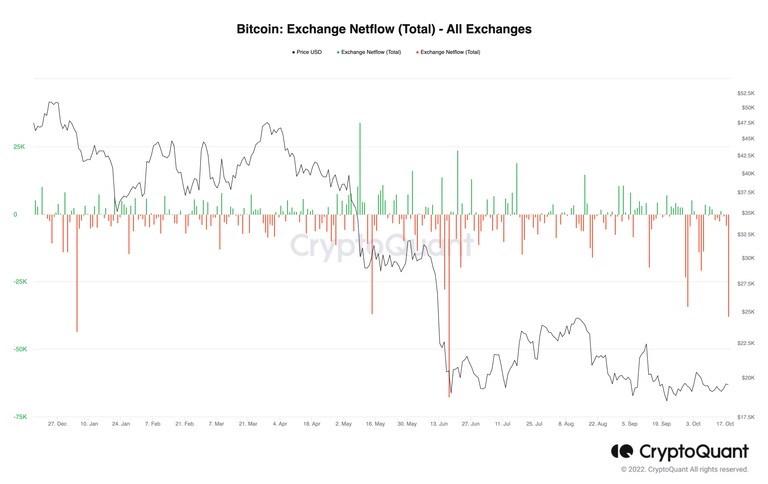

More than 37,800 BTC left cryptocurrency exchanges on Oct. 18, according to data tracked by CryptoQuant. This marks the largest daily Bitcoin withdrawal since June 17, when traders withdrew nearly 68,000 BTC from exchanges.

Additionally, more than 121,000 BTC, or almost $2.4 billion at current prices, have left exchanges in the last 30 days.

Bitcoin withdrawals from all exchanges. Source: CryptoQuant

The increase in withdrawals from exchanges is often considered a bullish sign because traders withdraw the coins they want to hold. On the other hand, an increase in bitcoin deposits on exchanges could be considered a bearish sign. Since, it increases the immediate offer for sale

For example, Bitcoin bottomed out locally around $18,000 when its exchange withdrawals hit nearly 68,000 BTC on June 17. The price of the cryptocurrency rose to as high as $24,500 in the weeks since

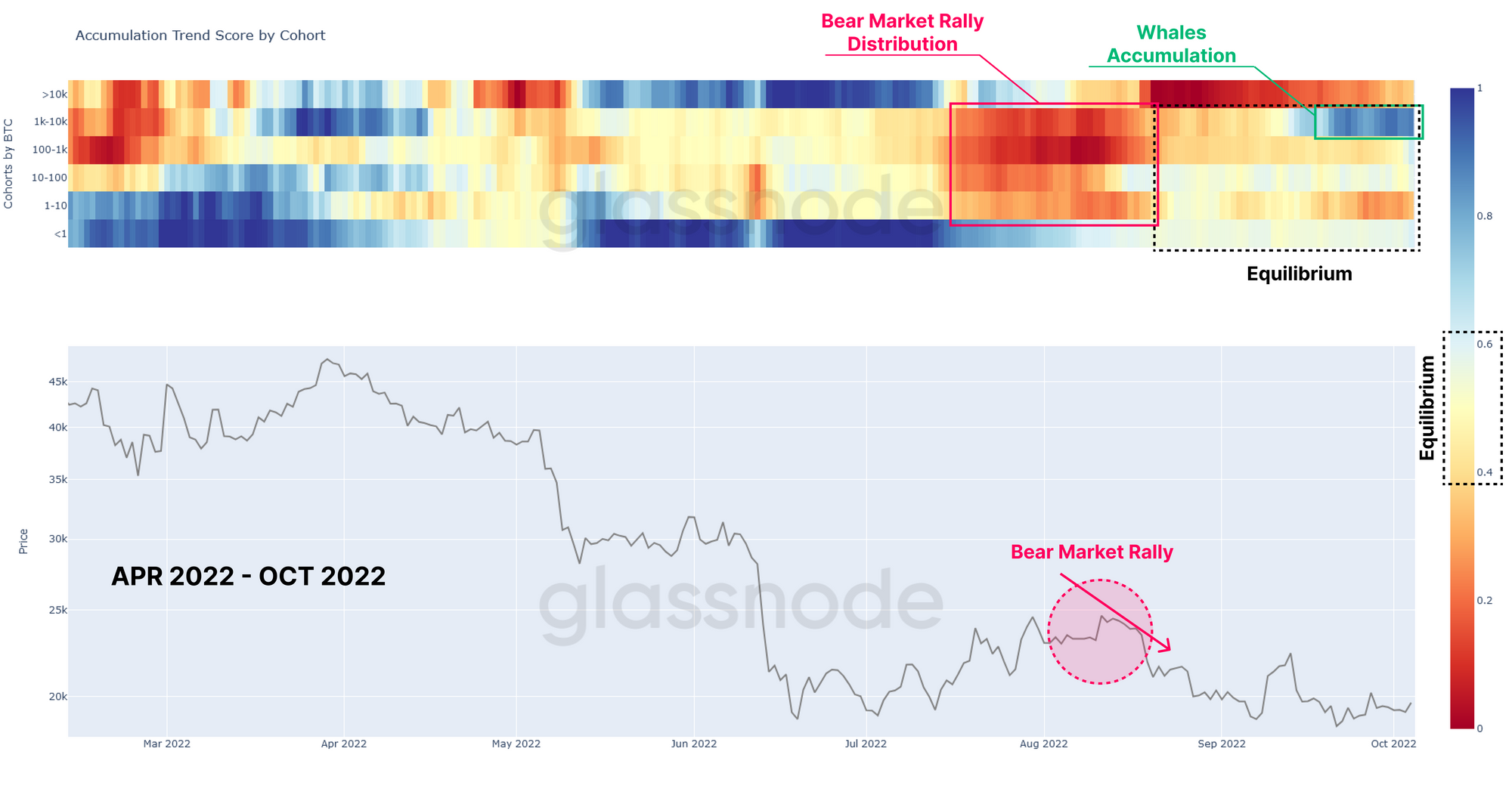

For example, the cohort accumulation trend score notes that wallets holding between 1,000 BTC and 10,000 BTC have been accumulating Bitcoin “aggressively” since the end of September.

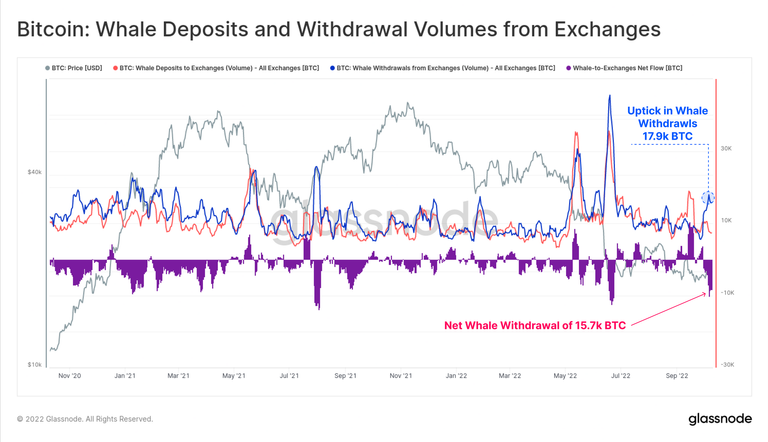

Furthermore, the whales' on-chain behavior shows that they have recently withdrawn 15,700 BTC from exchanges, the highest figure since June 2022.

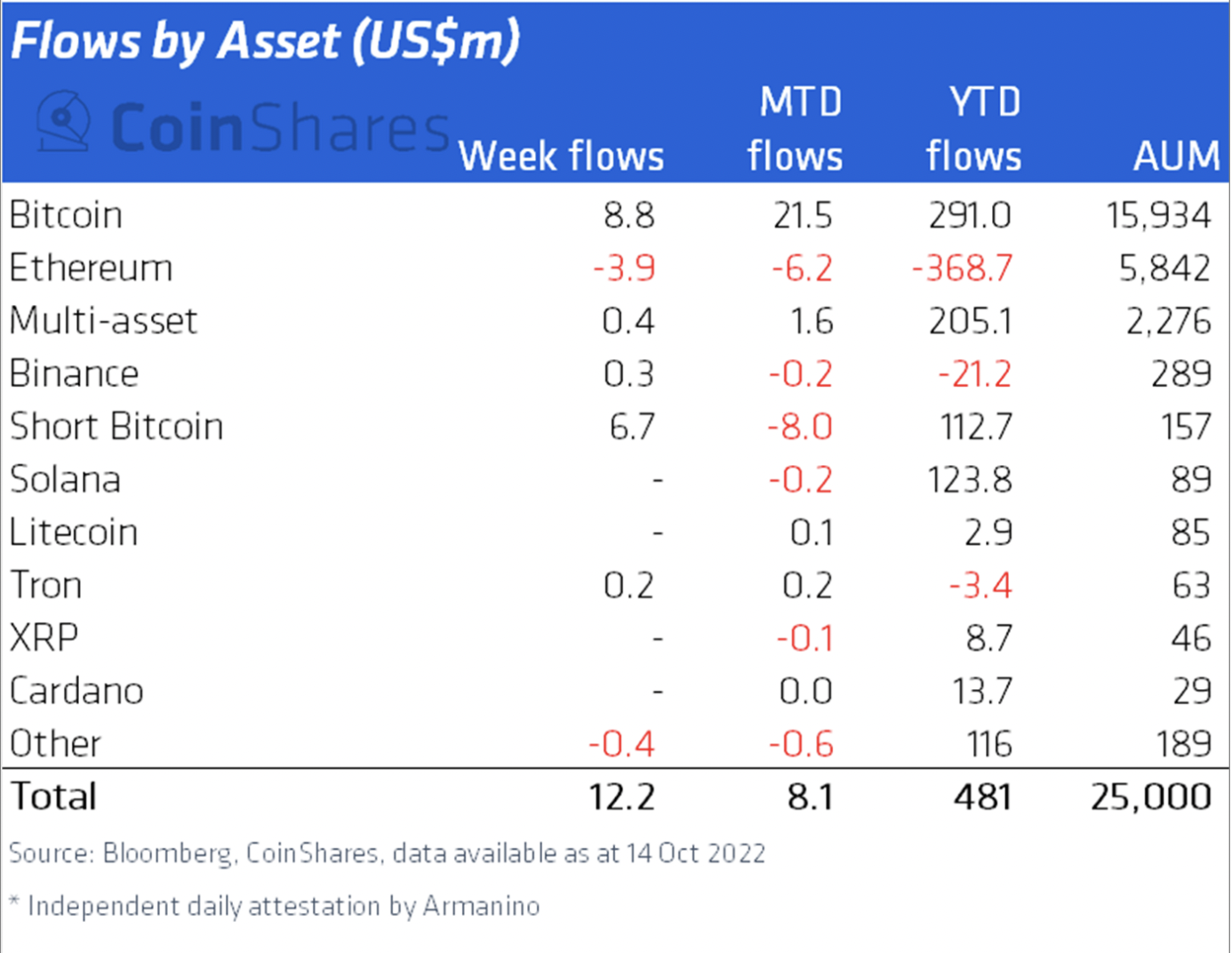

Green numbers for BTC deposits in institutional funds

Some $8.8 million went into Bitcoin funds in the week ending Oct. 14, bringing the net capital received by these funds to $291 million year-to-date. CoinShares head of research James Butterfill said that the deposits imply a “neutral net sentiment among investors” towards Bitcoin.

Posted Using LeoFinance Beta