Following the Orwellian Newspeak, welcome to Newfinancial. At Newfinancial, the banks prefer not to be paid in them the amount of money they have lent with the relevant interest, (even in the long run), but to liquidate its value for zero euros.

Yes, you read that right.

Of course, you will have heard the vision of the elites for our future! The WEF story that in 2030 we will own nothing, we wil have no privacy and life has never been better.

Have you ever wondered how this will be achieved? For example, how will you become homeless? Today I will try to write, about one of the many aspects of this property removal effort.

We are in Greece, of 2022. The country with one the most expensive fuels in the EU due to taxation and the most expensive electricity bill due to the adoption of green energy. Where after the "financial crisis" of 2009, but also all this economic consequences after the pandemic, many private borrowers are unable to repay their loan obligations!

Fortunately or unfortunately, this has always happened. The most stupid and at the same time scandalous is that the Greek banks were subsidized by the state to help the borrowers with more flexible terms. About 88 billion euros in a few years and guess how the banks repaid the aid which they received. They sold the "red" loans (the loans with an obvious inability to be repayed to them )to investment funds.

All of the above, with the assistance and supervision of both the European Central Bank, the European Commission and the International Monetary Fund. Keep it this.

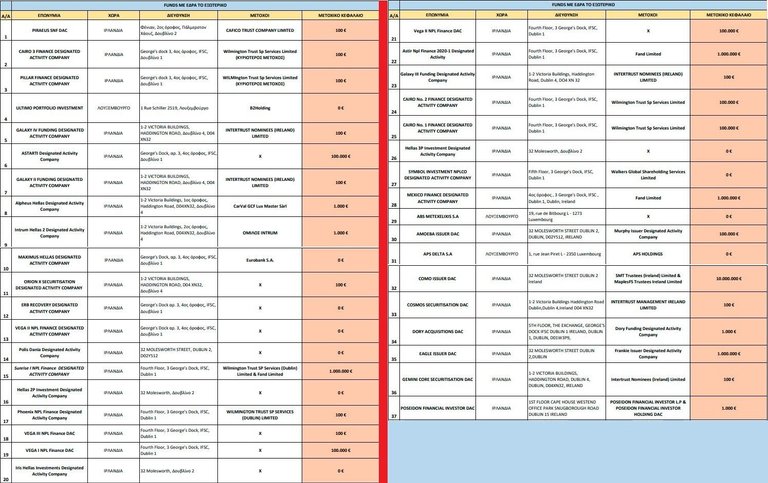

Today, a Greek opposition MP, Pavlos Polakis, announced 37 funds with a capital of 100 to 2,000 euros managed to "buy" 135 billion euros in Greek loans.

That is, with almost zero capital you buy a loan, say hypothetically 1 million euros, you auction the property or business that the loan served and you have immediate net goodwill.

Have you thought of a dirtier wealth transfer?

Below is a part of Mr Polakis announcement and and a table with the details of the relevant investment funds. In the orange box, are reffered their capital stocks

...we publish a list of the 37 FUNDS (out of 41 in total) for which we found data, with addresses, joint stock companies and share capital, which are based mainly in Ireland (where the "game" was set up) and from 2019 onwards bought 135 Greek € loans (photo 3.) In this list one can easily distinguish among others 11 FUNDS with a share capital of 0 € and another 11 with a share capital of 100 €. There is even a FUND with 100 € and 76 shareholders (some "shareholders" contributed with a capital of less than 1 €). In general, the smallest non-capital FUND has received € 2.5 billion in securitizations (eg AMOEBA with real estate values over 1.6 billion) and the largest (SNF) about 35 billion with pre-purchase rights.Many of these FUNDs are based in Ireland at FHENIAN Street, PALMERSTON HOUSE, DUBLIN 2, in a building, that is full of billions of Greek loans

If we look at the bigger picture, tomorrow the same could happen to any borrower, from any country. High inflation,non-stop taxes, in all aspects of our lives on the occasion of climate change, dramatic increase in the cost of living, more and more people will be forced to the need for borrowing, in order to cope with the violent economic situation. But when the European institutions turn a blind eye to organized fraud against ordinary citizens, then we have certainly completely lost the train of democracy!

This is one of the many step for your 2030 happiness. Are you ready to enjoy it?

For my post, i used information from this site, which is owned to a greek newspaper.