First, I'll start with a challenge, then get into the meaty matters...

Tell me what is the best financial advice you've ever received.

Either put it in the comments below or make a post and mention me in the post so that I can come read it there.

(unsplash pic)

The Meat

There are so many tidbits of advice I have gleaned over the years but some stick out more than others. One of the best bits I did not understand until I went through it was to stay out of debt. I'm now debt free, but I wasn't always and didn't always think debt was bad. I've also learned about leveraging your time/money. It's a great lesson that I'm still always trying to incorporate. It takes analysis, trust, and dedication sometimes...and I don't always have all 3.

One of the Best financial nuggets:

It's too hard to settle on the best. Every time I think of what I think is the best, I think of 3 or 4 others bits of advice I've received that have blown my mind over the years. Here's the one I'm going to focus on: Compound Interest

A lot of people speak of compound interest, but I'm not always sure it's understood. Here's one of my most favorite principles I learned from my father...the rule of 72. It illustrates compound interest beautifully. The concept is this: Take any 2 numbers whose product is 72 (that means they're multiplied together, just in case). Whatever those numbers are, the two numbers represent time and interest needed to double your investment (compounding interest).

Examples:

8 x 9 = 72

6 x 12 = 72

2 x 36 = 72

4 x 18 = 72

5 x 14.4 = 72

Simply put, if I were to invest $100 at 8% interest for 9 years, my $100 would be worth $200 at the end of the 9 years. If I invested $100 at 18% interest, after 4 years, it would be worth $200. This is the power of compounding, but doesn't explain how it works, it just shows how to easily calculate how fast your money can double...

How it works:

Every interval that you receive an interest payment, the idea of compounding interest is to take the interest earned and to roll it into the investment vehicle, adding it to the previous principal balance. Then, the interest just turned principal is now also earning interest...thus interest earning interest.

Here's an example: $100 invested makes 1% per month (12% annual interest, like HBD). The first month, you earned $1. You immediately invest it into the same investment vehicle. Your $100 is now $101 one month later. At the end of month 2, you now have $1.01 as your interest payment. You immediately add that to the $101 balance. You now have $102.01. The next month, you get $1.02. You add that to the balance, so now you have $103.03 at the end of month 3.

After 12 months, you will have earned $12.68 rounded down from your $100 investment. If you had only received the 12% return, you would have earned $12; however, because you were compounding your investment, you got $0.68 more, which is 0.68%. After 24 months, you would have $126.97. After 36 months, 143.08 rounded up. After 48 months, $161.22. After 60 months, $181.67. After 72 months (6 years of 12% interest compounded), you would have $204.71, or more than double your original $100 investment. 6 x 12 = 72, therefore 6 years at 12% interest = doubling your investment.

Now consider if you had not reinvested your interest. 12% return on $100 is $12. $12 x 6 years= $72. Therefore, without compounding, you lose out on a 38% increase over the same time frame.

Now, consider beeswap pools...

Because of information I learned from @bitcoinflood at https://ecency.com/hive-167922/@bitcoinflood/creating-passive-wealth-with-beeswap#@haveyaheard/re-bitcoinflood-20211223t183912547z ,

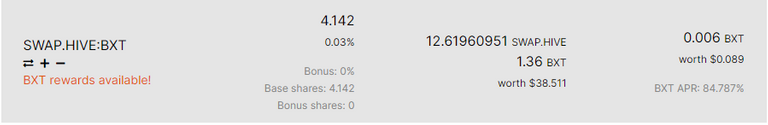

I am able to invest in tokens like BXT and earn an 84.787% ROI, annualized. If all I do is put my money into the pool and wait a year, I'll supposedly earn 84.787% interest; however, if I reinvest my daily earnings, there is potential for me to double my money in less than a year. There are many coins that have payouts that provide great APR's.

The next thing is the caveat: Never invest more than you are willing to lose, past results do not indicate future results. No one knows anything and you'll probably lose all your money if you follow my advice...see there? That wasn't so bad! 🤣

While I think the Rule of 72 and Compound Interest make up the best financial lesson I've ever learned, there are certainly other areas of advice that are equally important. I hope to give you more of these in coming blog posts. Follow me and show how much you appreciate my information by upvoting for this newbie. It's greatly appreciated. I accept all lolz, luv, pgm, and tips, too LOL!

What's the greatest financial nugget of wisdom you've ever received?