When I read about the Hive blockchain on non-Hive sites, I often read that its just an inward looking blogging site. There is however a lot more to the Hive blockchain than just blogging. In this post I'm going to cover some of the other areas where I invest and earn crypto on the Hive blockchain.

Earning from the native currencies - HIVE and HBD

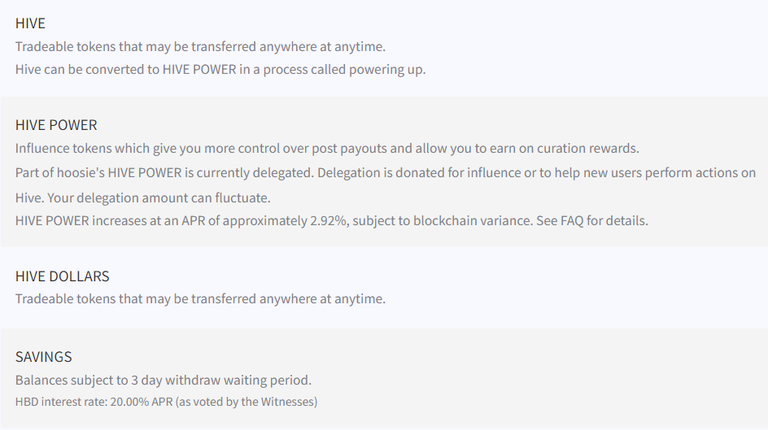

The two native currencies on the Hive Blockchain are HIVE and HBD. HIVE is awarded from blog post payouts but can also be used to earn in two ways, when you power-up HIVE so that it becomes HIVE POWER:

- HIVE POWER (HP) is what gives you influence on the Hive Blockchain. The more you have, the bigger your up-vote power, when you are voting on blog posts - called curation. When you up-vote/curate a post, you get 50% of that up-vote value back when the post pays out its reward (one week after posting). If you actively curate with your HP then you can earn 8% APR. You can also delegate and auto-manage that curation so that its not so time consuming.

- HP also increases by an APR of around 3%. You dont have to do anything to get that - just have HP.

The other native currency HIVE BACKED DOLLARS (HBD) is a stable coin pegged to the value of the US dollar. You can move your HBD into savings where it will earn a cool 20% APR, paid monthly !

The screen shot above is from hive-wallet provides some of the relevant information. You can control how you what you want to do with your HIVE and HBD from within hive-wallet.

Delegating tokens

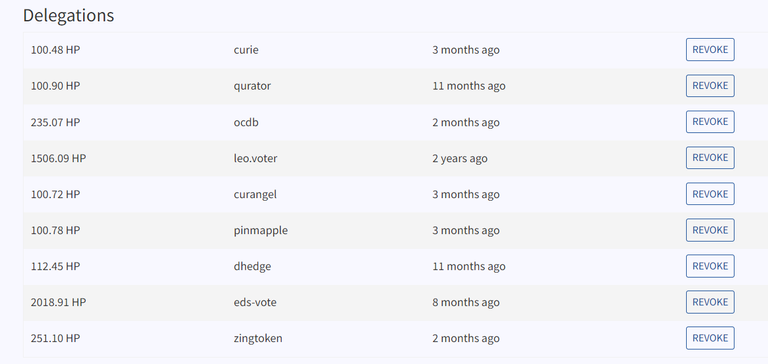

You can delegate tokens on Hive. That is - you can delegate your HP (but not HBD), and also some layer 2 tokens.

Layer 2 tokens can be created on the hive blockchain for all kinds of applications and projects. Some of those tokens can be staked, and delegated.

When you delegate tokens, you are basically giving the influence/power of that token to someone else to use. You keep the token, but they get the influence/power to use. There are numerous opportunities to delegate tokens on the blockchain, and get paid in return from the person/project you delegate those tokens to.

I particularly like delegating tokens, because I can focus on accumulating tokens and then putting them to work via delegation to earn more.

The screen shot above is also from hive-wallet, from which you can delegate HP, and shows my current HP delegations.

A few examples from that list are:

- The delegation to @leo.voter - it returns an APR of 16% which is paid out daily in the layer-2 token LEO,

- The delegation to @zingtoken in currently earning an APR of 28.89% in a token called ZING, which is the token for an up and coming HIVE game called Holozing (which is looking to be pretty cool by the way),

- The delegation to @eds-vote provides a return of around 8% APR. Half (4%) in an investment token called EDS (see more about investment tokens below), with the other 4% going into the EDS fund to provide future payments to those investing in EDS (see more details below),

- The delegation to @ocdb is to an active curation account that upvotes good content on the blockchain. In return it pays back its curation rewards to those that delegate HP to it, at around 8% APR. I particularly like this delegation as its also good for the community.

You can also delegate various layer 2 tokens to get similar varying returns. With delegations you can basically decide on what you are trying to achieve (ie, growth in a particular token), and often find a delegation method that allows that to happen.

Layer 2 token delegations can be made from within Hive-Engine.

Trading Tokens

One of the other methods I use to earn on the Hive blockchain is token trading, via flipping/scalping. One of the beauties of doing this on Hive is that generally your trading fees are zero. So you can even trade small amounts at small gains without having to worry about your trading fees hitting your profit margins.

I mostly focus on trading between HIVE and HBD using hive-wallet. I really like the close relationship between the two. I dont try to the time the market, but instead make set trades based on fixed percentages sort of using a spot-grid type approach. I set up all my trades in advance so that I dont have to be online when the market dumps or pumps.

The reason I mainly focus on HIVE and HBD is that it also gives me options if the market moves in a direction out of my trading range - so it gives me exit options. I sell HBD for HIVE when the price of HIVE is low, and HIVE for HBD when the price of HIVE is high. Bearing that in mind, if the price really drops, I can instead just power up my HIVE to HP and earn from the APR and curation. If the price really pumps, I can convert all HIVE to HBD, and then move the HBD into savings to earn the 20% APR -so there is always a good option.

I have also traded between layer 2 tokens using Hive-Engine from time to time for very small profits. The prices can be less predictable between layer-2 tokens to I dont tend to do it so much, but its clear that there are many others that do it profitably, so its clearly also an option.

Layer-2 Mining Tokens

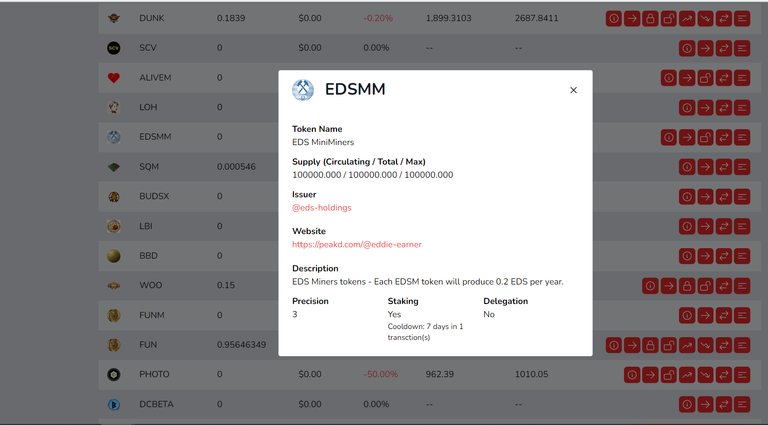

Another popular option for earning on Hive is to use mining tokens.

The screenshot above from Hive-Engine shows an example of a mining token - the EDS MiniMiners (EDSMM).

The EDSMM token produces EDS tokens when it is staked. It does this via a mining lottery - whereby you have a chance of winning some EDS, per EDSMM held every period (from memory its every hour for EDSMM) - and as the description above shows, in the case of EDSMM you should earn around 0.2 EDS per year. EDSMMs were sold at 1 HIVE each (and are now sold out, but they can still be bought in the market). EDS are currently listed on the market at 1.4998 (sell orders) and 1.2501 (buy orders) - so you basically can get your money back within 4 years = 25% APR (or a little better, if you bought your EDSMMs at 1 HIVE each).

There are quite a few different mining tokens available, so you could build up a nice little stack of miners which will produce a passive stream of tokens on a regular basis (and clearly there are many investors on Hive who have done exactly that).

Layer-2 Investment Tokens

Another option on Hive is to buy into investment tokens/projects. These are tokens/projects designed to provide a return over a specified period. Again there are a number of options around investment tokens, with EDS, BRO, SPI, DAB, PWR and LGN just a few of those available.

EDS and SPI both come from the same team (@spinvest). EDS provide a weekly payment each monday in HIVE depending on how many you hold, and SPI does the same, but on a Sunday. EDS is currently reporting a 28% APR (see here).

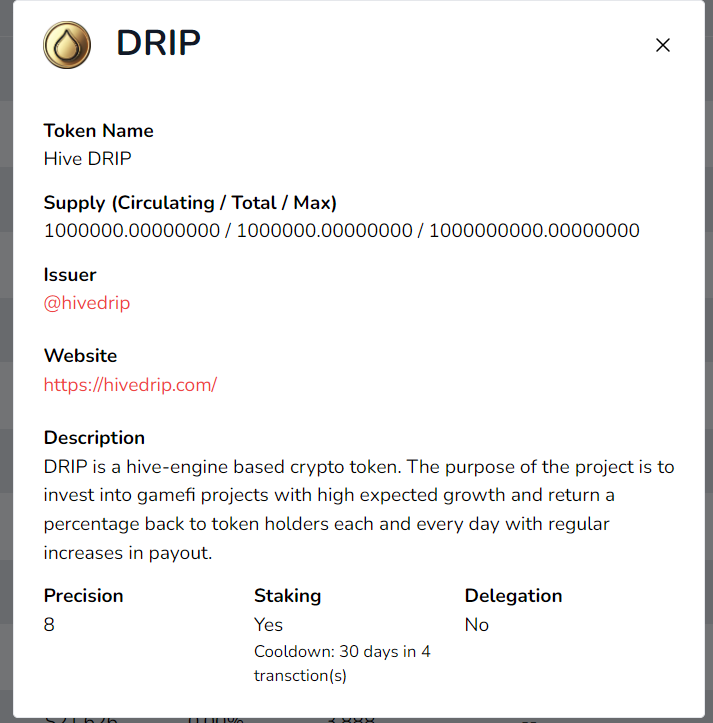

DRIP is another particular favourite of mine at the moment. I've been buying more of this token each week with what spare funds I have. It pays out daily in DRIP and also in swap.HIVE, with a combined APR of 149% which is quite amazing. It sounds rather unreal, but they have an investment strategy behind it to provide that return.

A notable aspect of investment tokens is that many of them also grow in value over time. So you could buy a chunk of them, hold them for a while to get a passive gain from their regular payout, and then sell at some point later at a profit - a nice win-win.

So again, depending on what you are looking to do there are a number of options available for investing through investment tokens to grow your earnings.

Liquidity Pools

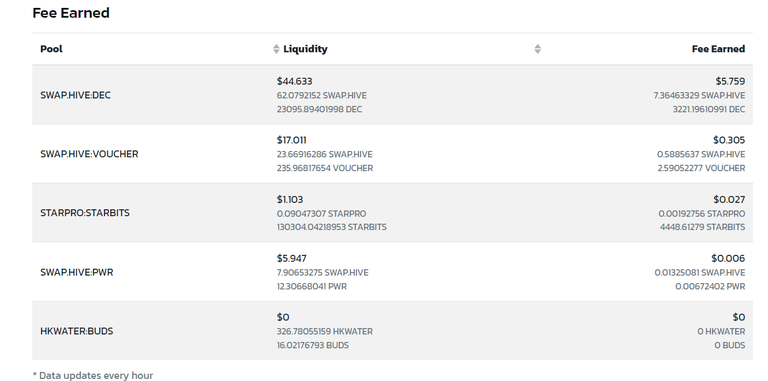

Liquidity pools are another option. I do have some tokens in liquidity pools. I use Tribaldex for that. I'm not an expert on this, but have a few long term positions that payout out nice regular rewards.

The above screenshot from Tribaldex shows some of the positions I hold, and some of the fee earned for providing that liquidity. The pools for DEC and VOUCHER are of particular note. They are both gaming currencies from the very popular Hive game Splinterlands.

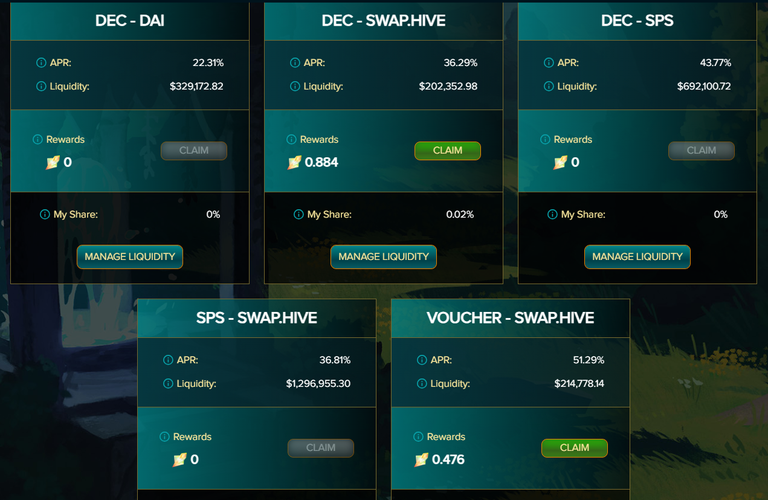

The screenshot above is from splinterlands and shows their corresponding page for their pools, which provide some nice APRs. The two pools I'm in, DEC/Swap.HIVE and VOUCHER/Swap.HIVE provide 36.29% and 51.29% APR respectively, both paying out in SPS - which is another Splinterlands token, which in turn can be staked for a current APR of 13.11%. So each day I go and get my output from those two pools in SPS and then stake it for a further gain within the game (which I also claim daily, and stake again).

Staking

As mentioned above, there are also a number of tokens that can just be staked (without delegation) to provide an income. I gave the example above of SPS, which is currently paying out 13.11%. Another example is ZING, as mentioned above under delegating tokens, which is currently earning 50.84% APR.

These two examples begin to show the beauty of hive, because different methods can be used together to provide further gains:

- In the case of ZING, I delegate HP to earn ZING. I then stake that ZING to earn more ZING - which I keep re-staking.

- In the example of SPS, I earn SPS via the liquidity pools, and also from playing the game, which I then stake via the Splinterlands game to earn further APR gains.

Leasing

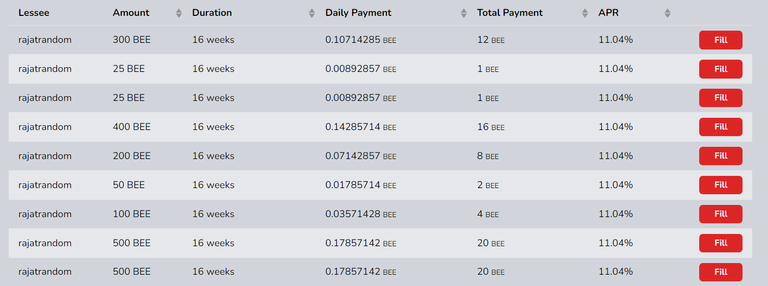

Leasing is another earning option on Hive. You can lease some of your tokens to other people who will provide you with a set repayment amount at a certain APR. They inturn use those tokens for some other purpose during the lease period.

I have used this option for a short period of time when I was trying to increase my holding of swap.hive to buy some layer-2 tokens I was wanting.

The screen shot from Hive-Engine shows some options for leasing with a decent 11.04% APR. Its all automatic, so you just set it up and the payments happen automatically. If you want to back out, you just cancel the lease - its fairly straight forward.

Play-2-Earn Gaming

There are a number of play-2-earn games on Hive, with more games coming online all the time. The number in development seems to be increasing, which is great to see.

Splinterlands is the most popular play-2-earn game on Hive. Its a trading card battle game, but also has a whole DeFi side to it as well, with just a few elements of that described above.

Rising Star is another popular game on Hive, and a particular favourite of mine. You can actually start earning straight away on Rising Star without making any investment. Many of the other games, including Splinterlands, do require some upfront investment (typical values being of the order of $10).

EDS and HIVE - multiple method example

I've mentioned the EDS investment token a few times above. In this example, I'm going to work through a number of methods that combine constructively to provide additional growth, and this is a method I'm currently using to provide passive income.

1 - As mentioned above, I have 120 EDSMMs (which at base cost would have cost 120 HIVE). They currently earn 0.2 EDS per year = 24 EDS per year.

2 - I have 2019 HP delegated to @eds-vote, which brings in an APY of around 8% (source). Half of that is issued as EDS, minted at the price of 1 HIVE per EDS = 80.76 EDS each year. The other half is powered up on the EDS account to grow the EDS fund for the project and future payments.

3 - The 2019 HP that is delegated to @eds-vote will also attract the 3% APR growth on HP = 60.57 HP (in this case that means that the delegated amount to @eds-vote will increase by that amount in the year - unless I remove it from that delegation).

4 - The EDS generated, produce a payment in HIVE each monday. The current EDS APY is running at around 27.38% (source). The total EDS gained in a year (from 1 and 2 above) = 84.76 EDS. If they in turn are held for a year, that will generate a payment each week in HIVE, totaling 23.21 HIVE over the year.

5 - I could re-invest the HIVE gain from step 4 above back into either buying EDS or delegating it to @eds-vote, and so provide additional growth.

So you can see how this can begin to add up, and with thanks to compound interest, will could continue to grow week on week, over the years.

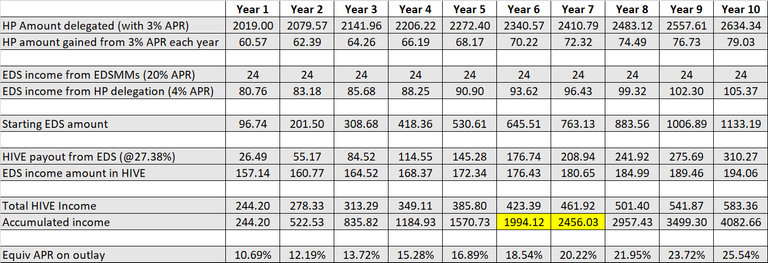

I've attempted to show what that might look like in reality over the coming 10 years in the table above.

The calculation is actually conservative, because I've actually paid less HIVE to gain my current stack of 120 EDSMMs and 96.74 EDS. Also, the table does not take into account the weekly income and the compounding effect that would have.

It also assumes that current APRs and prices stay static (which is very unlikely) - but its illustrative and shows a payback period somewhere between year 6 and 7, with the APR pay back on the initial outlay continuing to increase year on year which is very nice !

Before creating this post I hadnt actually worked out the increasing return over the years from my EDS investment, and now that I've seen it, its actually making me want to delegate even more HP in order to gain even more ! The compounding impact really kicks in quite nicely after a couple of years !!

Thats just one example of how you can combine multiple methods on Hive to make increasing gains, and there are many different ways you can do that.

Summary

The aim of this post was to demonstrate that there is way more to Hive than just blogging, especially if crypto and investment is your thing. I've listed out a number of investment and earning options above, and I'm sure there are even more. Some of the returns are pretty amazing, and you can combine methods constructively to earn even more (with a worked example provided in the case of EDS).

Although I'm posting this on Hive, the main intention is for me to post in some other areas (eg, PublishOx) as it may help a little to dispel some of the myths around on Hive, and hopefully drive another new user or 2 to the blockchain. However, it may also come in as a handy reference for new starts here on Hive.