What a fun week for AMC shareholders! At first there was a terrifying after-hours dump from $5 levels to below $3.70 in the days following. This was after the news broke of a potential APE share conversion.

Just three days later the court case took a surprise U-turn where APE dumped and AMC pumped due to the ruling. AMC was able to claw back $5 levels briefly before settling for $4.81 going into the close.

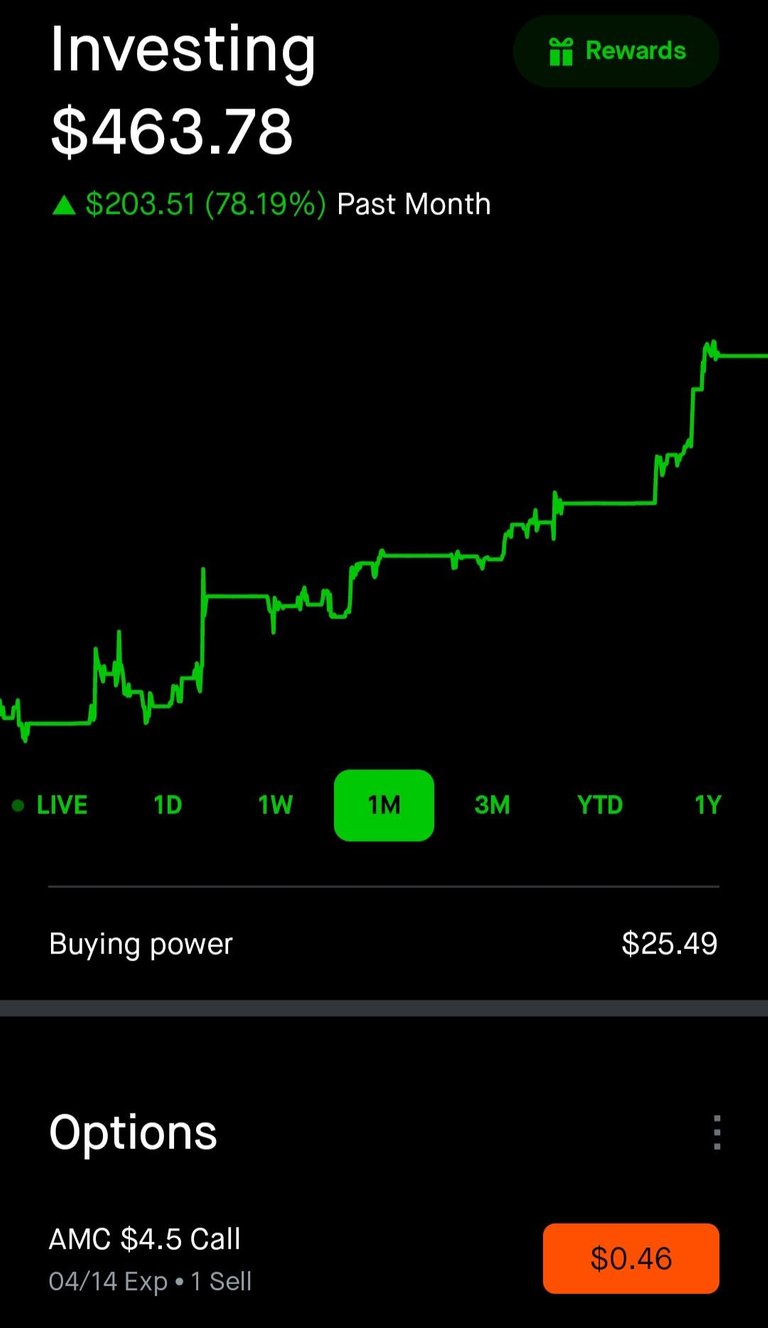

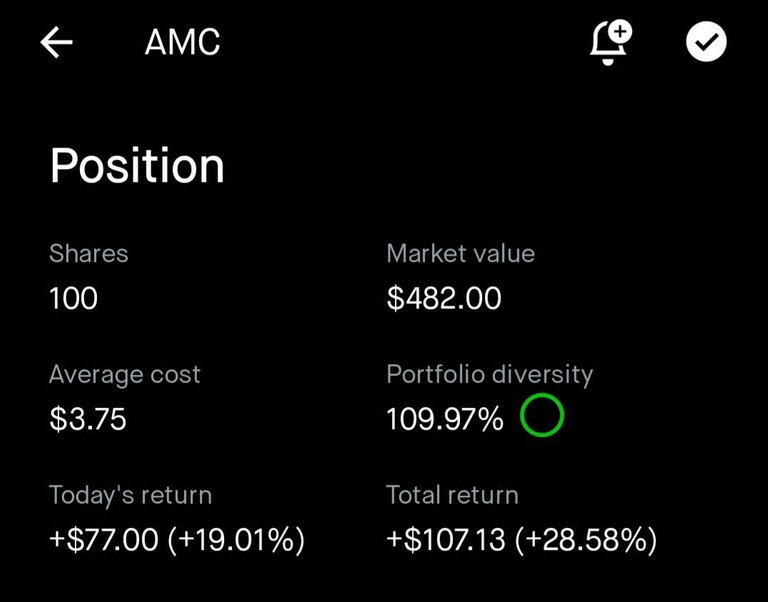

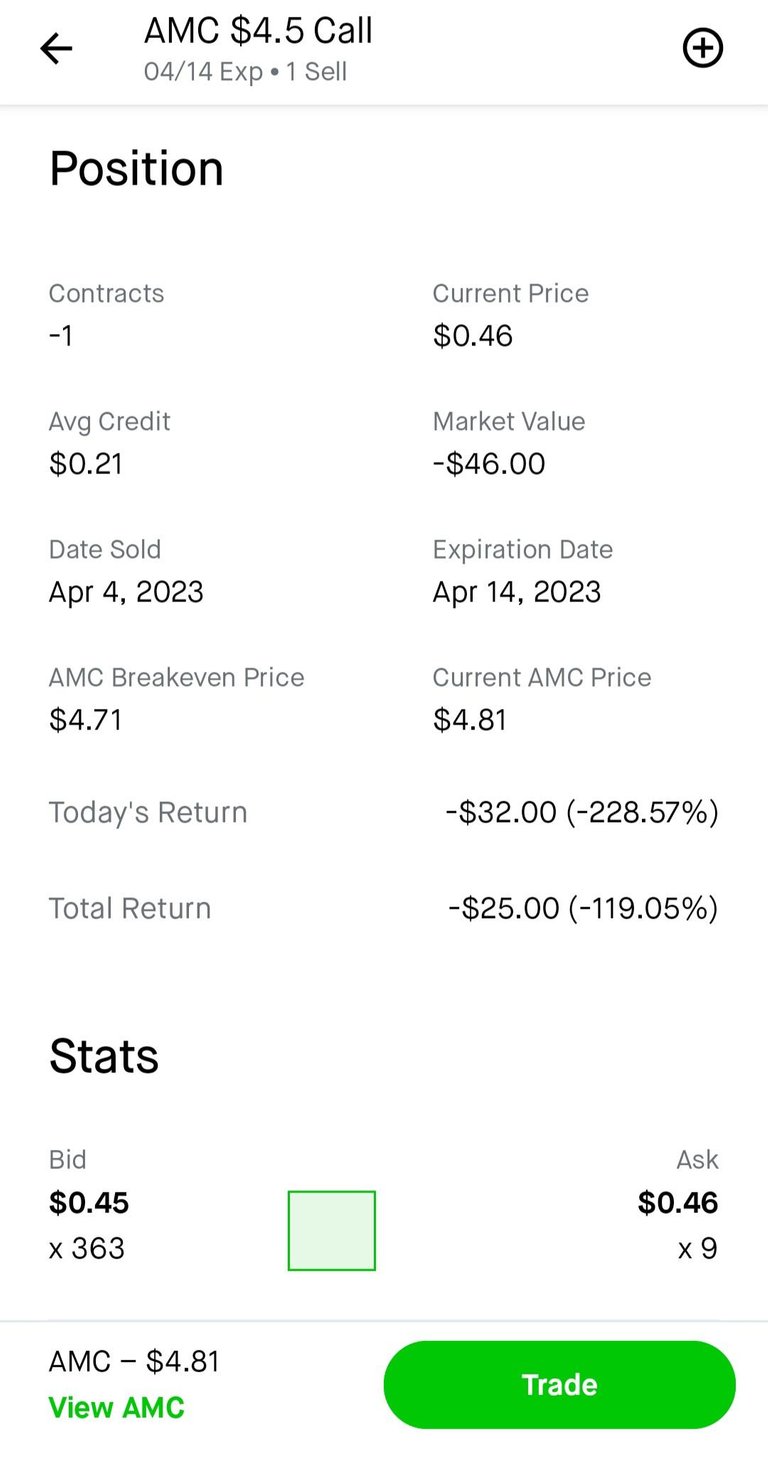

I had been watching AMC closely for quite some time waiting for the perfect opportunity to appear and this was it! I took the chance and bought 100 shares at market price with a cost average of $3.75. Then these shares were used to write a covered call at the $4.50 strike price, expiring next week.

AMC is already well above my strike which means I am likely to be called away this week. The best case scenario for me would be if AMC drops back to $4.50 exactly and closes there by Friday, whereby my collateral of 100 shares would simply be returned to the account.

The contract which was sold was for a $21 premium making my breakeven price $4.71. This week I would like to see AMC sellers step back in to drop it below where my strike or breakeven is sitting, which is $4.71-4.50 or below.

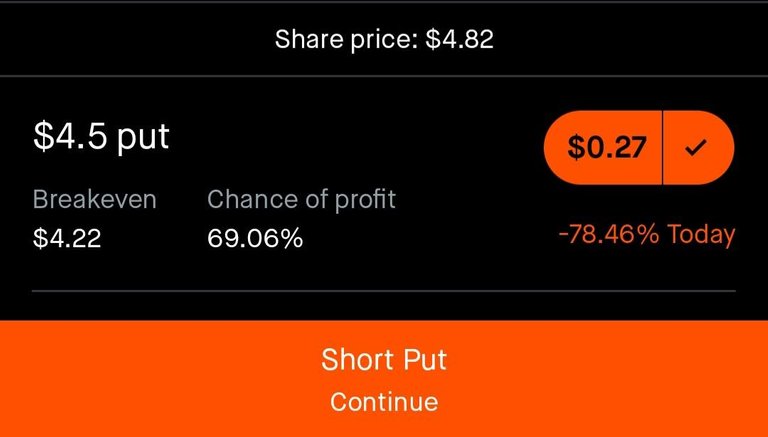

If I do get called away the strategy then would be to use the cash to write a "cash secured put". This guarantees even more premiums into my balance to continue this challenge.

Here is an example of the premiums on a $4.50 put. It would only cost me $4.23 per share if assigned with a $27 premium.