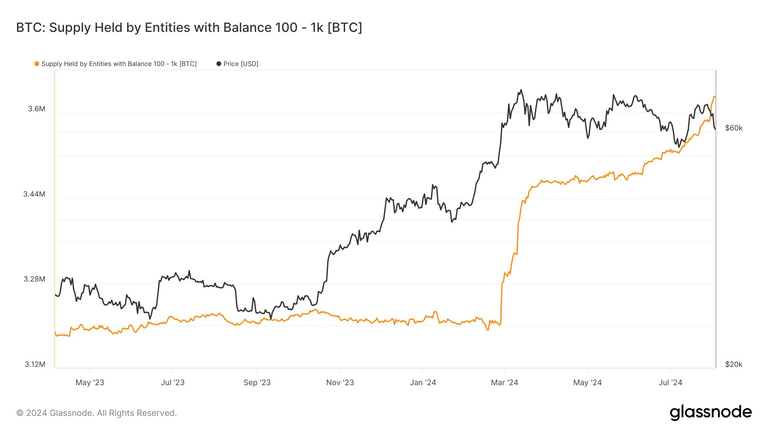

The crypto ecosystem's dynamics have changed drastically since the launch of Bitcoin spot ETFs. Earlier, the new and unknown market was a popular destination for those who are " exploring a new technology " while investing for their future.

However, the young crypto is no longer an independent small market. Now, it is a part of the global market and serves market makers, fund managers, and big investors. Even if someone does not want to deal with the cold / hot wallets, CEXs / DEXs, chains, bridges, and all other complexities of crypto, they can indirectly buy Bitcoin and Ethereum.

Of course, the new service has both advantages and disadvantages. First of all, the market became open to everyone and crypto adoption has been accelerated. On the other hand, the market has become so dependent upon the liquidity of the ETFs that the volume on the weekends cannot cover the sellers' or buyers' orders.

Today, Jump Trading market maker company is said to liquidate their holdings. However, a market maker, by nature, has lots of coins to be dumped. Inevitably, the selling pressure hit the market hard and very strong support levels have been lost for many cryptocurrencies.

Since the market was frightened of the risk of recession and the increasing global tension is making the situation harder, crypto investors are not eager to take more risk by holding altcoins. Thus, while Bitcoin loses 1%, the altcoins lose 5% - 7% within a couple of hours.

Obviously, the global economic risks are targeting crypto and developing countries' markets first. The safe harbor, cash equivalents, debt instruments, government bonds and, possibly gold, will be the center of liquidity in the midst of global turbulence.

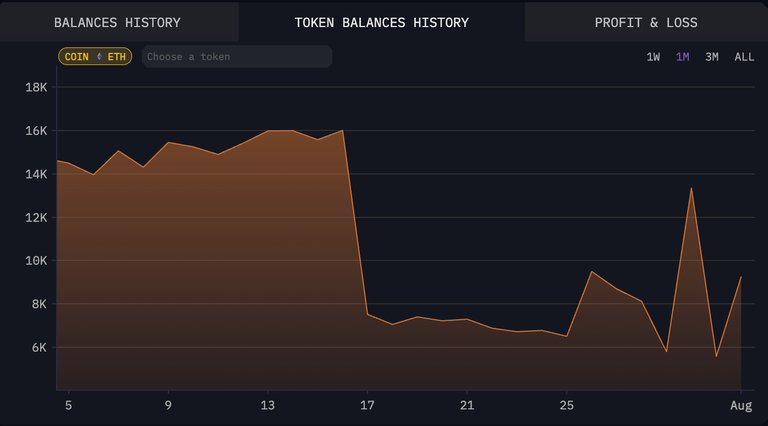

As the long term, I choose to see the recent drop as an opportunity to buy my favorite cryptocurrencies cheaper. Especially in altcoins, the prices have dropped to the all time low levels, already!

Every negative story that has impact on the market will not be available in 6 - 9 months. Besides, the interest rates and the monetary policy will be totally different. Watching the shift in the paradigm, I choose to believe in the future of my investments and Dollar Cost Averaging will continue on my side.

What do you think about the crypto's liquidity and Jump Trading's dump?

Share your thoughts below 👇

Hive On ✌️

Posted Using InLeo Alpha