Timing is a big issue for investors as the return on your investment is directly affected by the length of the time or the market condition, such as bear, bull, or consolidation market times. However, these are not the only ones that the investors try to relate their actions and the period.

Many experienced investors / traders know the old saying that "sell in May, move away" and it is a known fact that the summer times are the most boring terms in the markets because the real traders set their robots or close their positions to enjoy the three - month peace of mind away from the stress of the trades.

As the summer is officially over, it is time to earn money!

Summer Out, Money In?

Yet, this is not really as easy as it sounds.

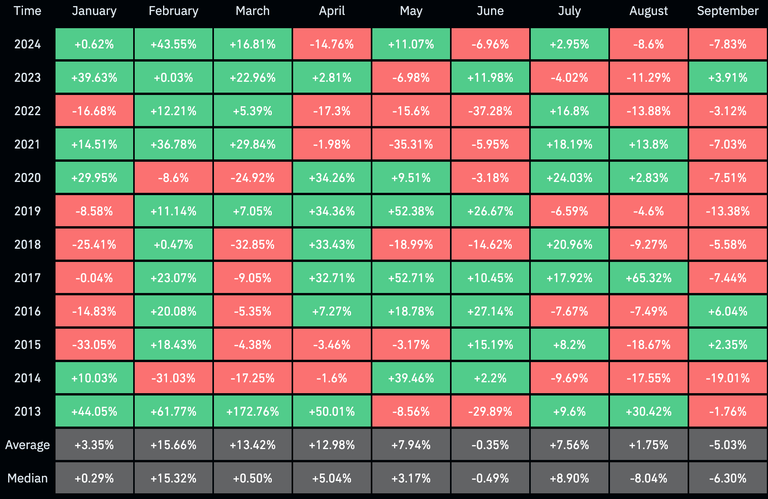

It is a fact that the volume tends to increase, and so does the number of traders. However, this does not mean that the prices of assets will go up. In contrast, Coinglass data shows us the opposite.

The performance of Bitcoin in Septembers has never been the best time for the crypto investors. The average drop is around 5% and we have already tasted around 8% in 9 days of September.

The upcoming elections and the risk of recession are the major factors that affect.

After the drop in September, the rest of the year tends to be more bullish. Lots of people call October as Uptober because we have the first reversal signs in this month.

We cannot expect history to repeat itself the same as before but the historical data might sign something very obvious, the party has not started yet 😉

$100K above in Bitcoin does not sound unrealistic anymore. I think the altcoins will follow the march of Bitcoin, unlike the Q1 when Bitcoin outperformed the rest with the approval of spot ETFs.

Good times ahead. Patience is the key. Time to harvest what we have yielded 👨🏼🌾

What do you think about the performance of Bitcoin in Septembers historically?

Share your thoughts below 👇

Hive On ✌️

Posted Using InLeo Alpha