The brazilian stock exchange index (iBov - Índice Bovespa) has been reaching new all time highs on a daily basis for the past weeks, as it can be seen by the chart:

Where each candle is a day, and for the past week every day has had both a higher high and a higher close. Throughout the whole year the index has been trending up, but near the year end the bullrun seems unstoppable, the chart shows no sign of relief for bears, even though the RSI shows it is overbought.

Risky to buy, riskier to sell in my opinion.

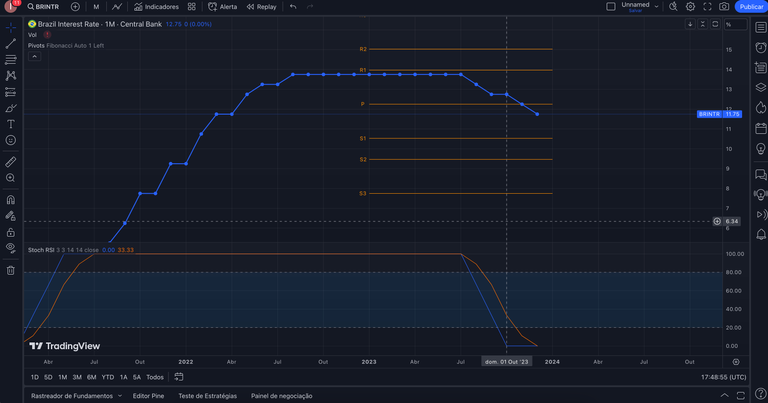

Possibly non coincidentally the interest rates have been going down consistently in 2023:

It is intuitive that high interest rates causes downward pressure on risky investments, while low interest rates put upwards pressure on them.

That is because at such high rates, currently at 11.75% a year, it is not worth it to risk more for possibly double the annualized gains on an excellent outperforming portfolio.

The stockmarket in Brazil was hit heavily when the interest rates start going up, but the stocks started better when the rates stopped increasing and reached a plateau. Now with the yields going down the index is reaching all time highs day after day.

How sustainable is it? I don't know and I wouldn't put my money on either side. But this case sseems to be a book example of how interest rates are closely correlated to stocks performance.