The EVMOS airdrop had a troubled start, with a chain halt not long after launch, and a lengthy delay before its eventual relaunch. Claiming was an interesting process, but all those teething problems are in the past - although I am still not sure if Ledger users are properly supported yet.

As all that stuff has settled down, the benefits of staking EVMOS have been exceptional - with a price that has held up over the last few months and a continuing insanely high staking return.

In the early days of the Cosmos IBC era, ATOM was the "gift that keeps on giving" with numerous airdrops (like OSMO, JUNO and more) being the focus of attention. Next OSMO took over the mantle, with high APR's and yield farming on their user friendly Dex - which became the de-facto DeFi hub for the Cosmos. JUNO claimed a position in this regard, with high yield and its own airdrop mania (plus, who could forget the Fortis Oeconomia fun). Currently, it feels like it is EVMOS's turn to be the Cosmos's big drawcard.

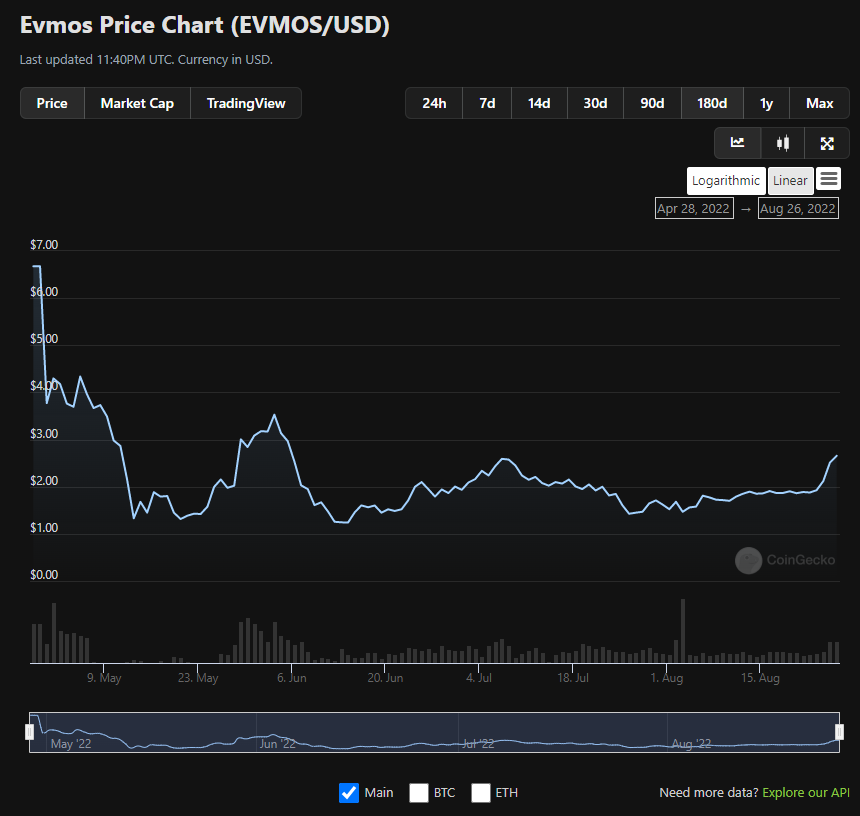

EVMOS Price:

The EVMOS token has performed very nicely over the last few months, as the market has been choppy after the bear market drop. Trending in the $1.70 - $2.00 range for a while, recently it has broken this pattern to the upside, pushing beyond $2.50 in recent days.

As can be seen, in the opening days, hype was real and positioning for the huge APR (in the thousands of % at the time) saw early prices around the $4.00 mark. In the more recent July/August period, it has has ranged between a brief high around $2.50 to lows around $1.50. However, given the high token emission rate, a steady performance is really a big win as I see it. In the last few days, we have seen a rally up to the $2.70 range, breaking that channel.

I have seen speculation on twitter that the buying may be from a centralized exchange, positioning to build liquidity prior to a listing. Alternatively, it could just be a whale, building their position. In any regard, the pump seems to be holding, and if this > $2.50 price holds, that would be real nice.

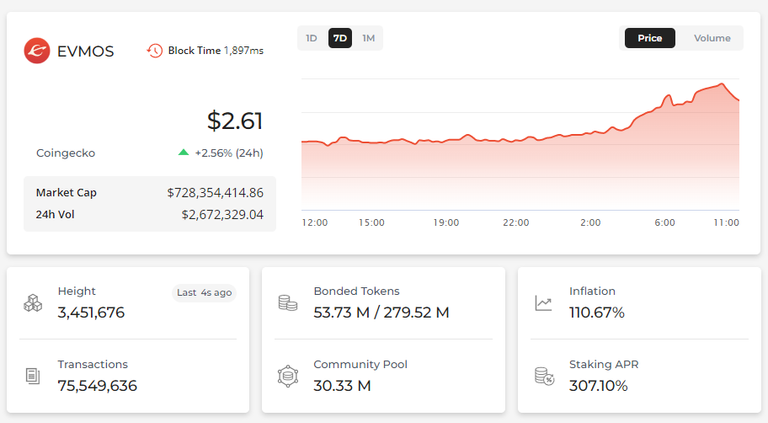

Fundamentals:

For those that are unaware, EVMOS is an EVM layer 1 chain, built on the Cosmos SDK with bridges to other eco-systems, and the Cosmos's IBC protocol also implemented. It is a hybrid really of the Cosmos style, fast and low fee TX, Proof of stake setup with IBC connections blended with full EVM capabilities.

A little while ago, the Nomad bridge, which was a primary bridge for Ethereum assets (notably the $USDC stablecoin) was exploited and drained of funds. Recovery efforts are ongoing, but this exploit was damaging for EVMOS, as it was one of the main funnels of funds from the Ethereum eco-system into EVMOS DeFi protocols like Diffusion.

However, EVMOS itself seems to have shrugged this setback off, and continued on its merry way.

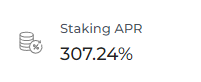

APR:

One of the big appeals of holding and staking the EVMOS token is its still incredible APR. Sitting currently just over 300%. The actual inflation rate is a touch over 100% currently, however, with not a big staked supply, and many tokens still not claimed from the airdrop, APR is much higher.

Closing thoughts:

- EVMOS APR is huge.

- Price has held well despite the new token issuance.

- Upgrade coming soonish (being delayed slightly) implements a fee split model. Gas will be split between validators (and thus ultimately stakers) and the developers of dApps launched on EVMOS - bullish for TX volume and network growth.

My main question is: How long can it last?

I'd love to hear your thoughts in the comments below.

- Do you hold EVMOS?

- Have you heard about it?

- Did you get the airdrop?

- How long can the price hold up in the face of high yield?

Thanks for reading, remember to like and share this post if you have enjoyed it, and follow me for more updates from around the Cosmos, and Hive eco-systems.

Have a great day,

JK.

Here are some more original posts from me that you may enjoy:

- Hitchhikers guide to the Cosmos

- Comdex drama - Marketing, Wash Trading and more

- Good news for the Cosmos - bad look for Ethereum - dYdX on the move

Posted Using LeoFinance Beta