A clickbait title one might think. I on the other hand would say it may be both at the same time - the ugly truth and a clickbait. However you need to decide for yourself if we are facing insolvency or mala fides (bad will).

What being bankrupt or insolvent really means? Let's omit any particular legal definition or system and find the common understanding of the terms.

The wiki reads

In accounting, insolvency is the state of being unable to pay the debts, by a person or company (debtor), at maturity; those in a state of insolvency are said to be insolvent. There are two forms: cash-flow insolvency and balance-sheet insolvency.

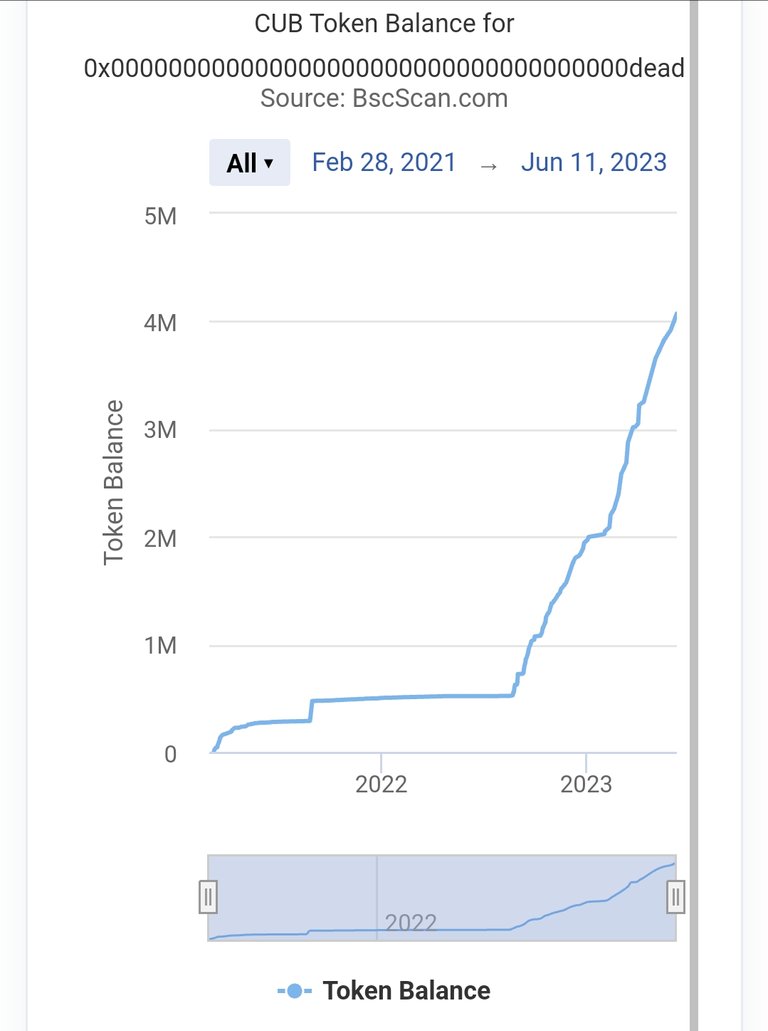

I have complained in many posts about how Leofinance has dropped it's Cubdefi project and left it out to rot. There was a bit of hope when they reorganised the MTB (Multi Token Bridge) to generate swap fees and provided arbitrage between different pools to generate income that was supposed to be used for cub buybacks and burns.

Here you can see the moment when it kicked in. It really looked promising.

This graph however is incomplete because it doesn't include the time between the date since the last burn and today and it's really a big deal because the last burn was 254 days ago (or even more at the moment).

The official reason: security issues that require building the bridge from scratch.

Sounds noble and responsible, doesn't it?

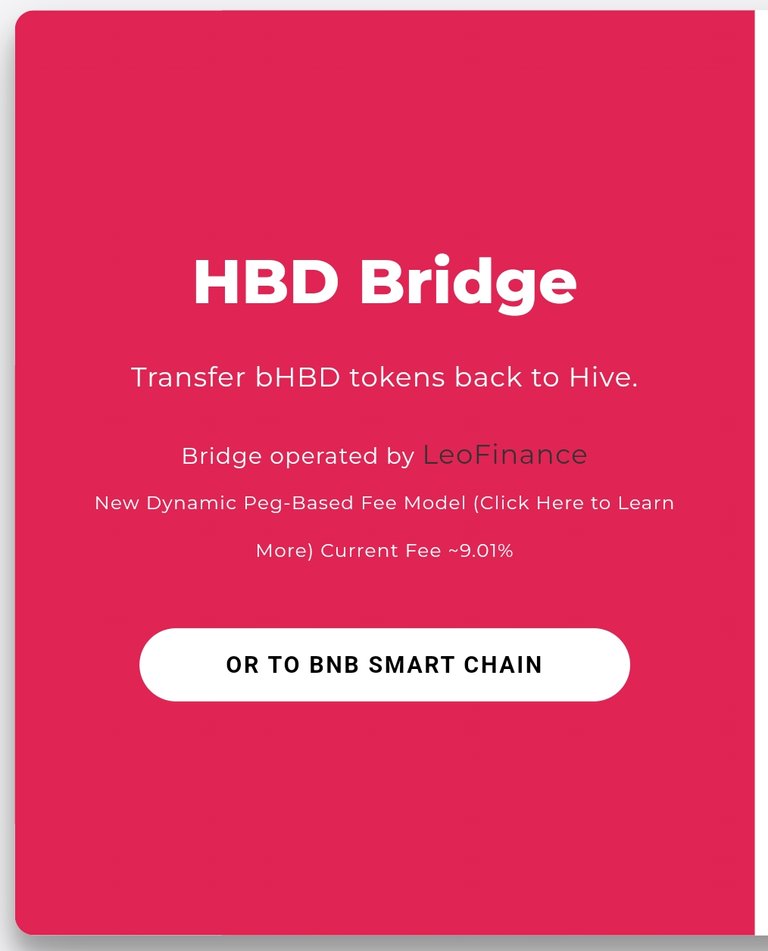

It would if only it was true. Funny thing is that the bridge works fully one way - you can send as much HBD, Hive or Leo as you want. The other way round it doesn't, but let's not get ahead of ourselves, just yet.

There are no indications any work takes place, on the contrary, there are clues it's against their best interest, short term at least.

- HBD has been depegged from bHBD. Not a single HBD stands behind bHBD.

- HBD that used to secure bHBD has been put into savings.

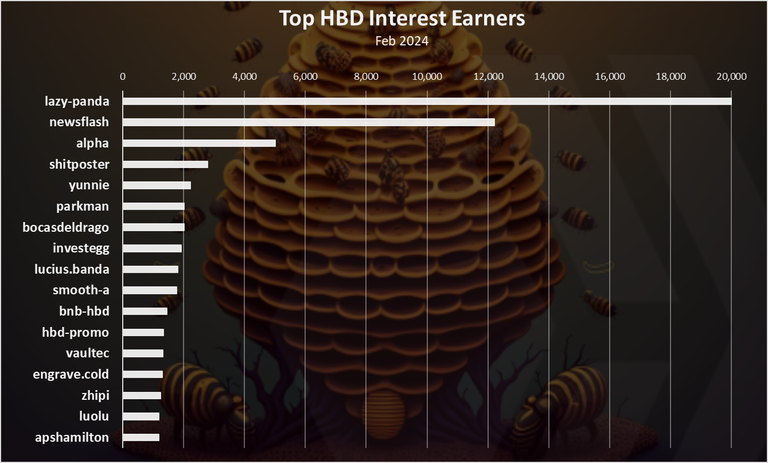

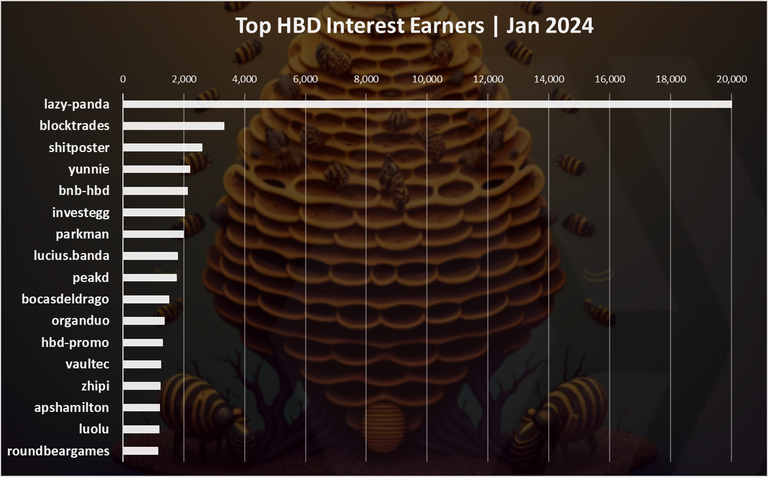

- @bnb-hbd account earns shitloads of HBD out of other people HBD. In just January 2024 alone it was more than 2,000 HBD. @bnb-hbd is the 5th biggest hbd interests benefactor.

- bHBD holders can't even swap their manually paying extra 9% fee. Their transfer is being (or should be to to be precise) sent in 13 weakly installments. I got 2 transfers since the 5th of January 2024.

I hope you grasp the absurdity of the situation when your funds that should be refunded in 3.5 days are locked for more than 13 weeks.

Would it be a lie, if one said that Leofinance has little or no interest in fixing it?

They turned off the service, earn interests on funds that are actually yours and still charge a tiny commission of 9.01% at the moment

Leofinance unable to pay?

At this point you really don't know whether Leofinance doesn't want to pay or is objectively unable to.

Personally, I think it's the former option considering the amount of other development that is taking place. I think they don't fix the bridge and don't pay debts in order not to loose the objective ability to pay.

But let's ask ourselves, should I really care?

In my practice I often have to resort to filing insolvency claims against contractors that aren't willing to pay what they owe. For fear that rhe court would rule a bankruptcy, the opponent needs to prove he or she has the ability to pay what's due (showing cash is the best way to achieve it).

One of the best things a blockchain offers is public ledger, that allows one to browse through the finances. And there's this guy called @dalz that does it really, really good.

Let me jus give you two facts:

- Inleo via @bnb-hbd is the 5th biggest HBD holder

- Inleo via @bnb-hbd is one of the biggest hbd interests earner.

February 2024

Source https://hive.blog/hive-133987/@dalz/top-hive-earners-by-category-or-authors-curators-witnesses-dao-hbd-interest-or-february-2024

January 2024

So what does that mean?

It means that Leofinance/Inleo did not bankrupt, it has enough funds to pay what it owes to bHBD holders it simply does not want to pay.

What's this fuzz all about?

What do I want to achieve? Nobody asked me to be a creditor for anyone, but I understand the need to keep things sound. If it would collapse, we would all be left out empty-handed.

Here out ny demands:

- Fix the bridge or pay out bHBD for HBD on 1:1 rate in max 3.5 days period (you may keep the fee).

- Tell us what's going to happen with interests made out of HBD in savings while they should have been pegged to bHBD.

My ideal statement concerning the second point, would be that all interests made by @bnb-hbd will be used to buy ane burn CUB. I'm afraid the funds were used on current operations and we credited the Leofinance for free.

Is this a lot to ask, to keep your promises?

P.S. If you're about to drop a comment telling me I should cash out and leave them be, I want to reply you beforehand - I'm heavily (as for me) invested in Leosphere (Leo, CUB, LBI) and I want it to change, I want it to deliver on promises.

I know you guys are affected by this as well

@mightpossibly @lbi-token @silverstackeruk @valdiva @brianoflondon @mes @paulag @caladan @bozz @d-company @x30 @toni.point