Staking has become an increasingly popular way for crypto enthusiasts to earn passive income from their holdings. However, traditional staking often requires users to lock up their assets for a set period of time, which can limit their flexibility and ability to respond to market changes. Liquid staking offers a solution to this issue, providing users with a way to earn rewards while retaining the liquidity of their assets.

In this guide, we'll explore liquid staking in depth, including what it is, how it works, and its benefits.

What is Liquid Staking?

Liquid staking is a new type of staking that allows users to earn rewards while retaining the ability to trade their assets. Unlike traditional staking, liquid staking does not require users to lock up their assets for a set period of time. Instead, it uses smart contracts and decentralized exchanges to provide liquidity while allowing users to participate in staking.

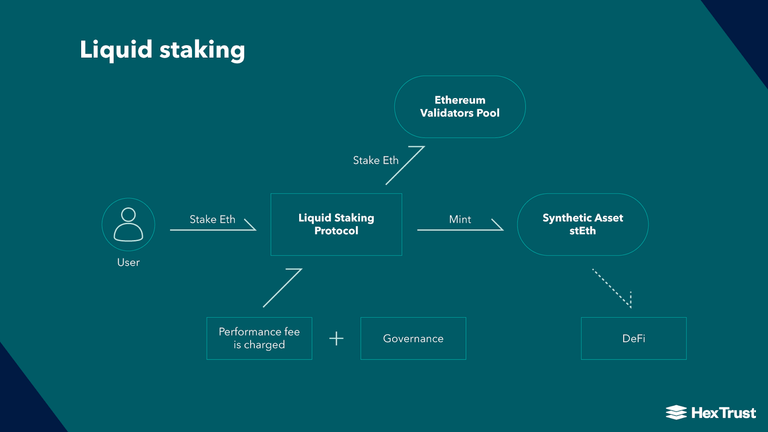

How Liquid Staking Works

The basic concept of liquid staking is straightforward: users deposit their crypto assets into a smart contract on a decentralized exchange (DEX). The smart contract then uses the deposited assets to participate in staking on behalf of the depositor. The rewards earned from staking are then distributed back to the depositor.

One of the key advantages of liquid staking is that users are able to trade their assets at any time, even while they are participating in staking. This is made possible by the decentralized nature of the exchange and the use of smart contracts. The smart contract ensures that the deposited assets remain secure and are used only for staking purposes, while the DEX provides liquidity so that users can trade their assets whenever they wish.

Benefits of Liquid Staking

Liquidity

One of the main benefits of liquid staking is the ability to earn rewards while maintaining the liquidity of one's assets. This is particularly beneficial for traders who want to take advantage of market opportunities as they arise, without being tied down by the restrictions of traditional staking.

Flexibility

Liquid staking provides users with more flexibility compared to traditional staking. With liquid staking, users can choose to stop staking and withdraw their assets at any time, whereas with traditional staking, users are required to lock up their assets for a set period of time.

Ease of Use

Liquid staking is more accessible and easier to use compared to traditional staking. It requires no technical knowledge or setup, making it suitable for both experienced and novice crypto users.

Higher Returns

Liquid staking provides the opportunity for higher returns compared to traditional staking. This is because users can deposit and participate in staking on multiple blockchains, maximizing their rewards. Additionally, since liquid staking is a relatively new concept, there are likely to be fewer participants and thus higher rewards available.

Decentralization

Liquid staking operates on a decentralized exchange, which provides increased security compared to centralized exchanges. The decentralized nature of the exchange means that there is no central point of control, making it less susceptible to hacking and other security issues.

Conclusion

Liquid staking is a new and innovative method of participating in staking that provides users with the benefits of staking while maintaining the liquidity of their assets. With the growing popularity of crypto, it is likely that liquid staking will become a widely used method for earning passive income in the crypto world. Whether you're a seasoned crypto trader or a beginner, liquid staking is an opportunity worth considering as a way to grow your crypto holdings.