Src: Yahoo Finance

Recent activities by Microstrategy have caused significant developments in both its Bitcoin holdings and its stock performance.

The firm has made its largest Bitcoin purchase to date, obtaining approximately 51,780 Bitcoins between November 11 and November 17 2024 at an average value of about $88,627 per Bitcoin. The transaction had a value of $4.6 billion, bringing Microstrategy's total Bitcoin holdings to 331,200 Bitcoin which are valued at roughly $30 billion at current prices.

MicroStrategy sold around 13.6 billion shares to finance this massive purchase of Bitcoin as part of its aggressive $21 billion ATM stock offering program.

The stock of MicroStrategy experienced a considerable increase following the announcement of the Bitcoin purchase. Shares of the firms soared by approximately 13% to a new record high closing at around $384.79. This spike represents MicroStrategy's stock's year-to-date growth of more than 500%, greatly surpassing both the market as a whole and other major stocks.

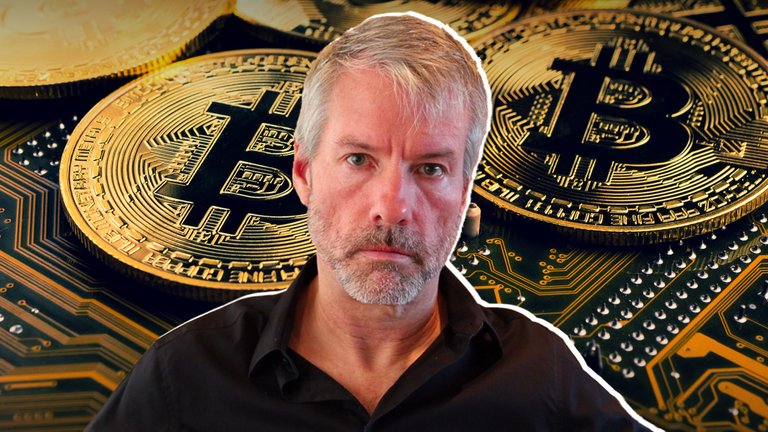

Initiated under the leadership of Michael Saylor, MicroStategy's strategy aims to hedge against inflation and diversify the firm's corporate treasury by accumulating Bitcoin.

MicroStrategy has become the largest institutional hold of Bitcoin and has plans to continue expanding its holdings. The strong correlation between the firm's stock and Bitcoin prices continues with the stock's performance closely tied to the crypto market movements.

Based on past patterns and present momentum, technical analysis indicates that MicroStrategy's stock may aim for higher levels, possibly hitting $525. However, key support levels near $180 and $115 are also identified as important for maintaining the upward trajectory of the stock.

It's me, @justmythoughts, an ordinary Hive user looking to make the most of the platform. I will appreciate your support. Follow me for more. Thanks, Gracias :)

Posted Using InLeo Alpha