Bitcoin collateralized lending has always been a fascinating part of DeFi to me. I think my first time using a BTC Lending Vault was about 4 years ago in the early stages of MakerDAO.

This was one of the first major DeFi breakthroughs that we were actually able to utilize. Most of DeFi in its infant stages was completely unusable.

In the beginning, there was really only one option - to collateralize WBTC at a fixed rate. Ethereum blockchain gas fees were extremely high so moving funds around in your vault could cost anywhere from $50 to $500 depending on when you did it.

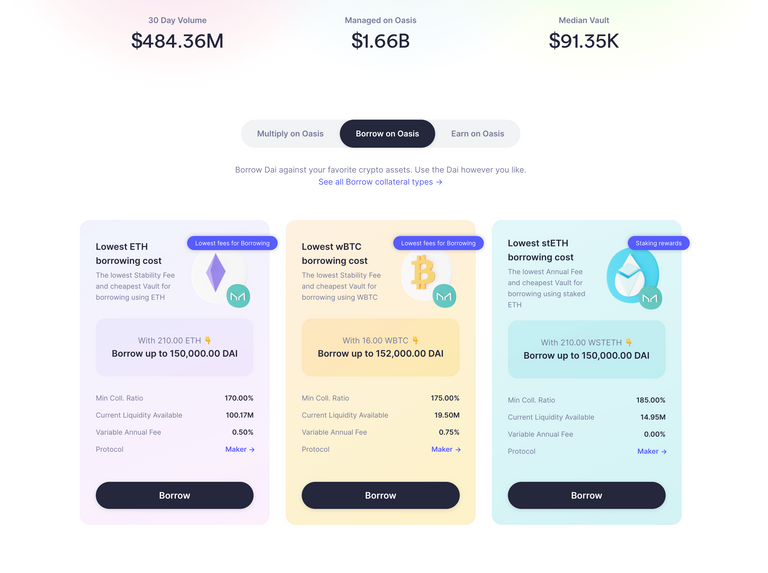

Today, there are 100+ options for collateralized lending. Ranging from centralized to decentralized. Ranging from WBTC to fringe alt coins. ETH gas fees are a lot lower now, so you can move funds around for as little as $10 or as much as $100 depending on when you do it.

Step 1 - Get Collateral

This step is probably already done if you're reading this article. If you're reading this, you probably already own Bitcoin or some form of collateral that you're looking to collateralize.

If you don't, then find a collateral type that you're comfortable with. IMO Bitcoin has always been a pristine collateral. It's the gold standard in Crypto and has the least volatility amongst anything that has crypto exposure.

Step 2 - Find a Platform

Like I said, nowadays there are over 100 options for collateralized lending. Some centralized, some decentralized.

I've used at least 6 different platforms in both arenas. Through my trials with all of them, I still believe that MakerDAO - the OG platform I started with - offers the best vaults with flexibility, trust and ease of use.

Step 3 - Deposit Collateral, Take a Loan

This part is where you need to make some decisions. I have a few different vaults that I use in various ways. Some vaults are to pay personal expenses, some vaults are to simply use collateral as margin to get more collateral (i.e. deposit 2 bitcoin, use a loan to buy 1 bitcoin and then deposit it for a leveraged position of 3 total bitcoin).

There are countless ways to use these vaults. What you're doing is locking up collateral to get access to liquidity. What you choose to do with that liquidity is completely up to you.

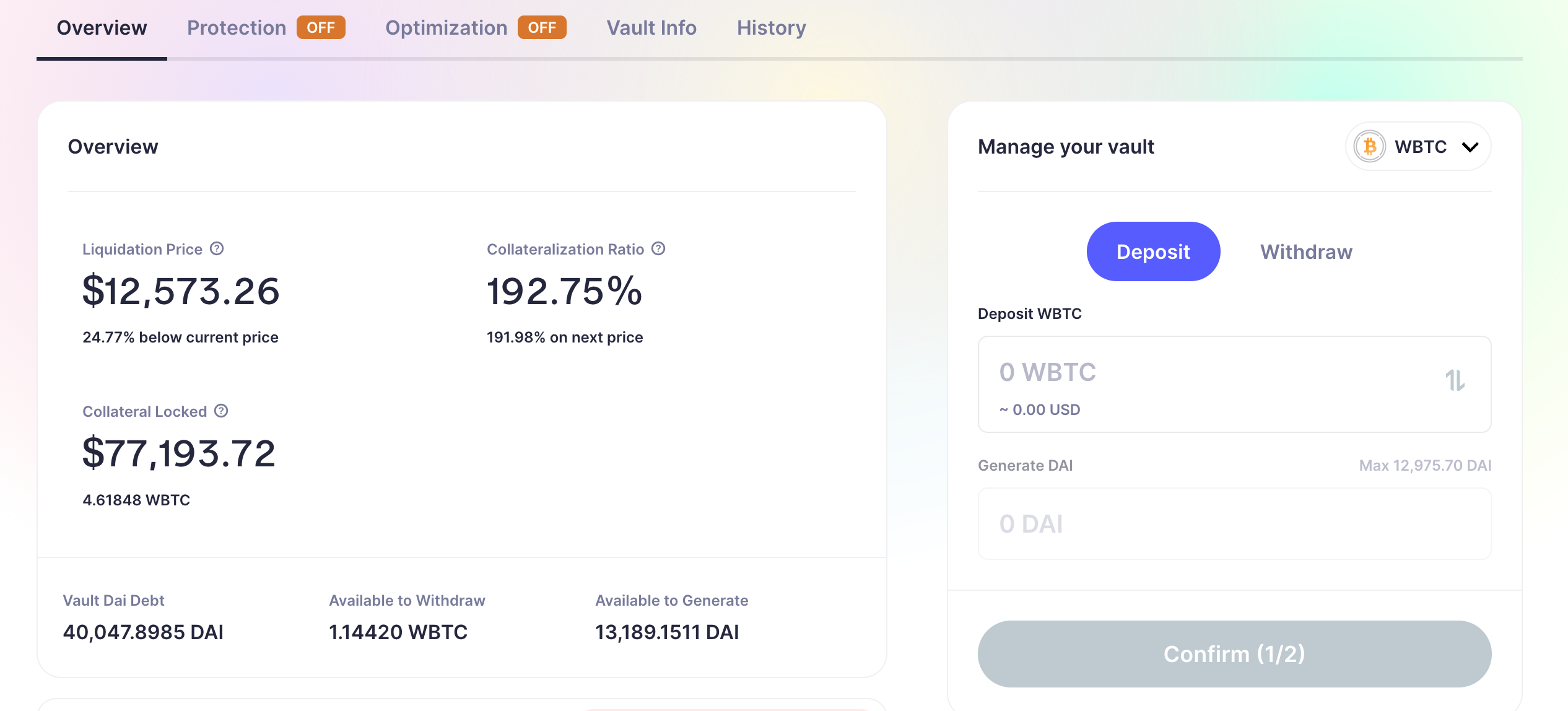

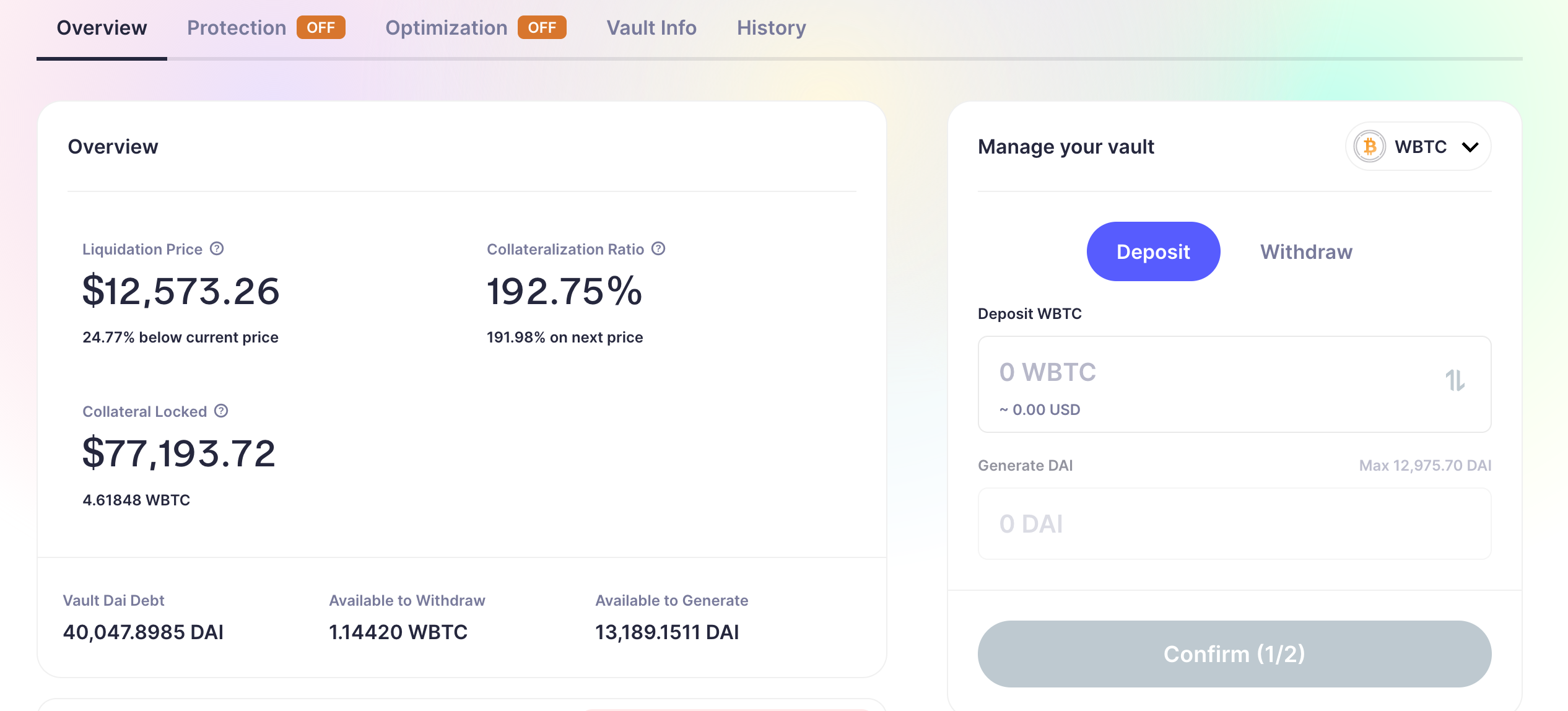

The above image is one of my actual vaults. It's slightly more "risk-on" than most vaults I have. Most of them have a liquidation price well under $8-9k but relative to those, this vault is small and highly active so I'm always moving capital in and out for various things.

How I Use Them

I know a lot of people that use these vaults in a very similar way that I do:

- We're constantly stacking BTC, which means that we are constantly gaining more collateral to push into vaults

- We have life and business expenses, which means we'd have to sacrifice stacking some of that BTC each month in order to pay for things

... unless!

Unless you stack the BTC in step 1 and then stake the BTC in step 2, then take a loan out against it to pay the bills.

Why?

Why would you do this? It sounds like taking on a lot of debt!

Well, yes - you are taking on debt. This is not free money. Any $ that you take out against your collateral must be paid back at some point in the future.

I've been doing this for years which means that I setup some BTC Vaults during the last bear market and held them into the subsequent bull market - when BTC rose by a factor of 20x from the bottom of $3k.

What happened to my vaults? My loan-to-value ratio kept dropping which means that the amount of loan vs. the amount of collateral I held was getting healthier and healthier.

Eventually, the loans were such a minuscule dollar figure compared to the BTC Collateral in the vaults. What did I do? Sell a tiny % of the collateral to pay the loans.

You see, at the time I took those loans, they were nearly 40% of the value of the Bitcoin.

So for example, I had $100k worth of Bitcoin and took a $40k loan against it when Bitcoin was trading at $5k.

Then Bitcoin was $50k. The vault was worth $1M and the loan was still $40k. I sold 4% of the Bitcoin in that vault to pay what was once 40% of the vault's value.

Hindsight is always 20/20 but today's market is feeling a lot like the last bear cycle.

Instead of stacking less Bitcoin and paying bills, I am stacking more bitcoin and still paying my bills through collateralized loans.

The Risks

Everything in life has risks. You need to be vigilant when it comes to collateralized lending.

Never forget that you are your own bank when you do stuff like this. That means you assume all of the risk. Nobody is coming to bail you out when you're in trouble.

No matter how much I collateralize and how much DAI debt I accumulate, I still have loads of BTC that is not used as collateral.

This means that if BTC's price suddenly drops, I can quickly deposit more collateral before I get liquidated.

I've been liquidated in the past on 1 vault and let me tell you: it sucks.

You never want to be in a position where that happens. You lose thousands of dollars and you feel like an idiot for not being on top of it.

A mistake I made once, never to make it again.

Another risk is what asset you're using as collateral. There aren't any decentralized native BTC lending vaults yet (Thorchain is working on one and hopefully will have it by the end of 2023), so until then: we're stuck using WBTC.

WBTC has counter-party risk. I'm comfortable with it but you should definitely DYOR and be comfortable with a wrapped token before pushing a bunch of collateral through it.

This is starting to get long, I'll probably do a part 2!

About LeoFinance

LeoFinance is a blockchain-based Web3 community that builds innovative applications on the Hive, BSC, ETH and Polygon blockchains. Our flagship application: LeoFinance.io allows users and creators to engage & share micro and long-form content on the blockchain while earning cryptocurrency rewards.

Our mission is to democratize financial knowledge and access with Web3.

Twitter: https://twitter.com/FinanceLeo

Discord: https://discord.gg/E4jePHe

Whitepaper: https://whitepaper.leofinance.io

Our Hive Applications

Join Web3: https://leofinance.io/

Microblog on Hive: https://leofinance.io/threads

LeoMobile (IOS): https://testflight.apple.com/join/cskYPK1a

LeoMobile (Android): https://play.google.com/store/apps/details?id=io.leofi.mobile

Delegate HIVE POWER: Earn 16% APR, Paid Daily. Currently @ 2.8M HP

Hivestats: https://hivestats.io

LeoDex: https://leodex.io

LeoFi: https://leofi.io

BSC HBD (bHBD): https://wleo.io/hbd-bsc/

BSC HIVE (bHIVE): https://wleo.io/hive-bsc/

Earn 50%+ APR on HIVE/HBD: https://cubdefi.com/farms

Web3 & DeFi

Web3 is about more than social media. It encompasses a personal revolution in financial awareness and data ownership. We've merged the two with our Social Apps and our DeFi Apps:

CubFinance (BSC): https://cubdefi.com

PolyCUB (Polygon): https://polycub.com

Multi-Token Bridge (Bridge HIVE, HBD, LEO): https://wleo.io

Posted Using LeoFinance Beta