BUSD is a stablecoin that is 100% owned and managed by Paxos. They hodl the reserves for BUSD - handling deposits and withdrawals to and from the stablecoin into USD.

For example, if you want to mint 1 BUSD then you send 1 USD to Paxos and they mint you 1 BUSD. If you want to turn 1 BUSD back into 1 USD, you send 1 BUSD to Paxos, they burn it and then send you 1 USD.

Stablecoin Wars: Paxos Ordered to Stop Minting BUSD

As of today, Paxos was ordered to stop minting BUSD by the New York Department of Financial Services (NYDFS). Obviously, Paxos is regulated by the NYDFS and has major operations in the United States.

This Thread by CZ outlines some limited information about it - basically, the same information that everyone else has. CZ claims he only knows what is publicly known and doesn't have any insider knowledge of the case at this time.

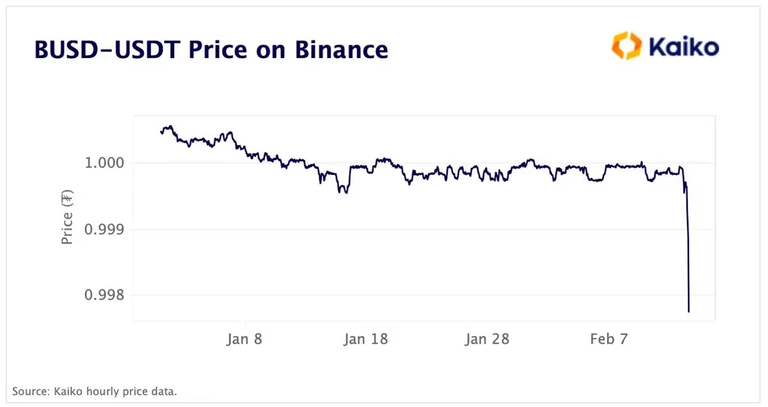

Since this news broke, BUSD has been struggling to maintain its peg. We all know this is a massive FUD play - as long as Paxos is solvent, then there is nothing to worry about long-term in terms of BUSD remaining at $1.

Is BUSD Going to Die?

I think it's important to understand how things like this tend to work. BUSD is a stablecoin and does not meet the qualifications of the Howey Test. It seems to me that this is more so a FUD campaign rather than a real litigation. I have a feeling that this whole thing might just blow over without any real damage done to BUSD (outside of sentiment).

CZ's words sounded pretty negative regarding BUSD though. In his short Thread, he talks about Binance phasing down some products that revolve heavily around BUSD and also taking a look at non-USD stablecoins.

Ultimately, I hope this is a non-event for BUSD but I think that the impact could be felt in a few different ways. There will definitely be less traction and less positive sentiment for BUSD going forward.

What About Stablecoins and Crypto

We're living in a moment in crypto right now where Governments and Corporations are trying to stand up to Crypto in a big way. They've always been anti-crypto - obviously, they have to be... Crypto is anti-corporation and government in a lot of ways. It is anti-establishment and centralized power structures which is the entire business model driving these gov's and corp's.

I think one of the major wars in crypto for the next few years will be fought over stablecoins and trying to deem certain cryptos as securities. The thing is, look at the XRP lawsuit... Look at other times that Gov's have tried to "ban crypto". It never really works out well for them.

CZ is right about one thing though - if BUSD is deemed a security - although, that is a big IF... then we will see resounding negative impacts across the crypto industry. We are under attack and BUSD is simply one point of contact.

What's the Solution?

So... what's the solution here? How do we keep building out this industry but remain resilient against coordinated efforts like these?

- More stablecoin options

- More decentralized stablecoin options

In my opinion, centralized stablecoins absolutely have a role in this crypto ecosystem. With that being said, decentralized options also have a major role to play.

The key to building a resilient economy is to have both and to have more of both. We need to diversify our risk in terms of usage, capital and leverage on all these stablecoins.

Imagine if FTX was the only crypto exchange in the world.. When it blew up, we all would have been completely screwed.

But it wasn't the only one... There are dozens of other CEXes and hundreds of other DEXes out there. Yes, damage was done by losing one of the biggest CEXes, but killing the entire crypto industry was completely out of the question. The risks were diversified and one man couldn't pull down the whole industry with him.

In my opinion, we need to see a similar setup with stablecoins.

Enter DAI

Enter HBD

Enter USDT

Enter USDC

The more options, the better. Obviously, I am a huge fan of both HBD and DAI. I think the Hive-Backed Dollar has a major role that it could fill in the broader crypto ecosystem. Seeing it get more widely adopted is a huge focus of mine.

As a heavy user of MakerDAO, I also firmly believe in DAI and what it offers. I think we'll see continued usage and adoption of DAI. The Spark protocol was recently announced/soft-launched and I think this is another step in the right direction.

As Hivers, let's keep pushing forward with HBD. Some really great changes have been made to the debt system, 20% APR for saving HBD, etc. and all of these changes could position the Hive economy to become a top dog in the crypto ecosystem's future.

About LeoFinance

LeoFinance is a blockchain-based Web3 community that builds innovative applications on the Hive, BSC, ETH and Polygon blockchains. Our flagship application: LeoFinance.io allows users and creators to engage & share micro and long-form content on the blockchain while earning cryptocurrency rewards.

Our mission is to democratize financial knowledge and access with Web3.

Twitter: https://twitter.com/FinanceLeo

Discord: https://discord.gg/E4jePHe

Whitepaper: https://whitepaper.leofinance.io

Our Hive Applications

Join Web3: https://leofinance.io/

Microblog on Hive: https://leofinance.io/threads

LeoMobile (IOS): https://testflight.apple.com/join/cskYPK1a

LeoMobile (Android): https://play.google.com/store/apps/details?id=io.leofi.mobile

Delegate HIVE POWER: Earn 16% APR, Paid Daily. Currently @ 2.8M HP

Hivestats: https://hivestats.io

LeoDex: https://leodex.io

LeoFi: https://leofi.io

BSC HBD (bHBD): https://wleo.io/hbd-bsc/

BSC HIVE (bHIVE): https://wleo.io/hive-bsc/

Earn 50%+ APR on HIVE/HBD: https://cubdefi.com/farms

Web3 & DeFi

Web3 is about more than social media. It encompasses a personal revolution in financial awareness and data ownership. We've merged the two with our Social Apps and our DeFi Apps:

CubFinance (BSC): https://cubdefi.com

PolyCUB (Polygon): https://polycub.com

Multi-Token Bridge (Bridge HIVE, HBD, LEO): https://wleo.io

Posted Using [LeoFinance Alpha]https://alpha.leofinance.io/@khaleelkazi/stablecoin-wars-paxos-ordered-to-stop-minting-busd