Tether Holdings Limited is the company behind the #1 and oldest stablecoin in the industry: USDT. Tether has long had controversy pitted against it. It seems like a 50/50 shot when you talk to someone in the crypto industry about whether they believe in Tether or think it will be the downfall of the whole industry.

Created in 2014, USDT is the oldest stablecoin on the market. Tether Limited is the company that issues USDT and that company is owned by iFinex Inc. which is a Hong-Kong-based company that also owns the Bitfinex crypto exchange.

"Tether was founded by a group of Bitcoin enthusiasts and early adopters, passionate about facilitating the use of fiat currencies in a digital manner. In 2014, the company launched Tether.to, a blockchain-enabled platform aimed at disrupting the conventional financial system with a more modern approach to money."

Tether USDT Imminent Explosion That Will Cascade the Crypto Market or Microstrategy 2.0?

This has been one of the biggest doomsday scenarios that has circled the crypto industry for over half a decade.

USDT started small but has since grown into a behemoth. They currently have nearly $80M USDT in circulation.

pssst have you seen @leofinance's proposal to double the userbase of Hive? It's officially live and waiting for you to vote and support it getting funded! The proposal outlines our strategy to grow the Hive blockchain by 9,615+ monthly active users using our LeoInfra Lite Account protocol and bring the masses to Hive. Check it out here -> https://peakd.com/me/proposals/269

The cause for concern has been all sorts of stories about how USDT is not 100% backed by $80M (or whatever prior/current figures have been) by USD or USD equivalents.

Recently, USDT started publishing transparency reports that are audited by a third-party. Even these are not enough for the naysayers. A lot of people still claim that USDT is unbacked and that if a bank run were to occur, the whole crypto industry could coming crashing down because of how deeply entrenched Tether is.

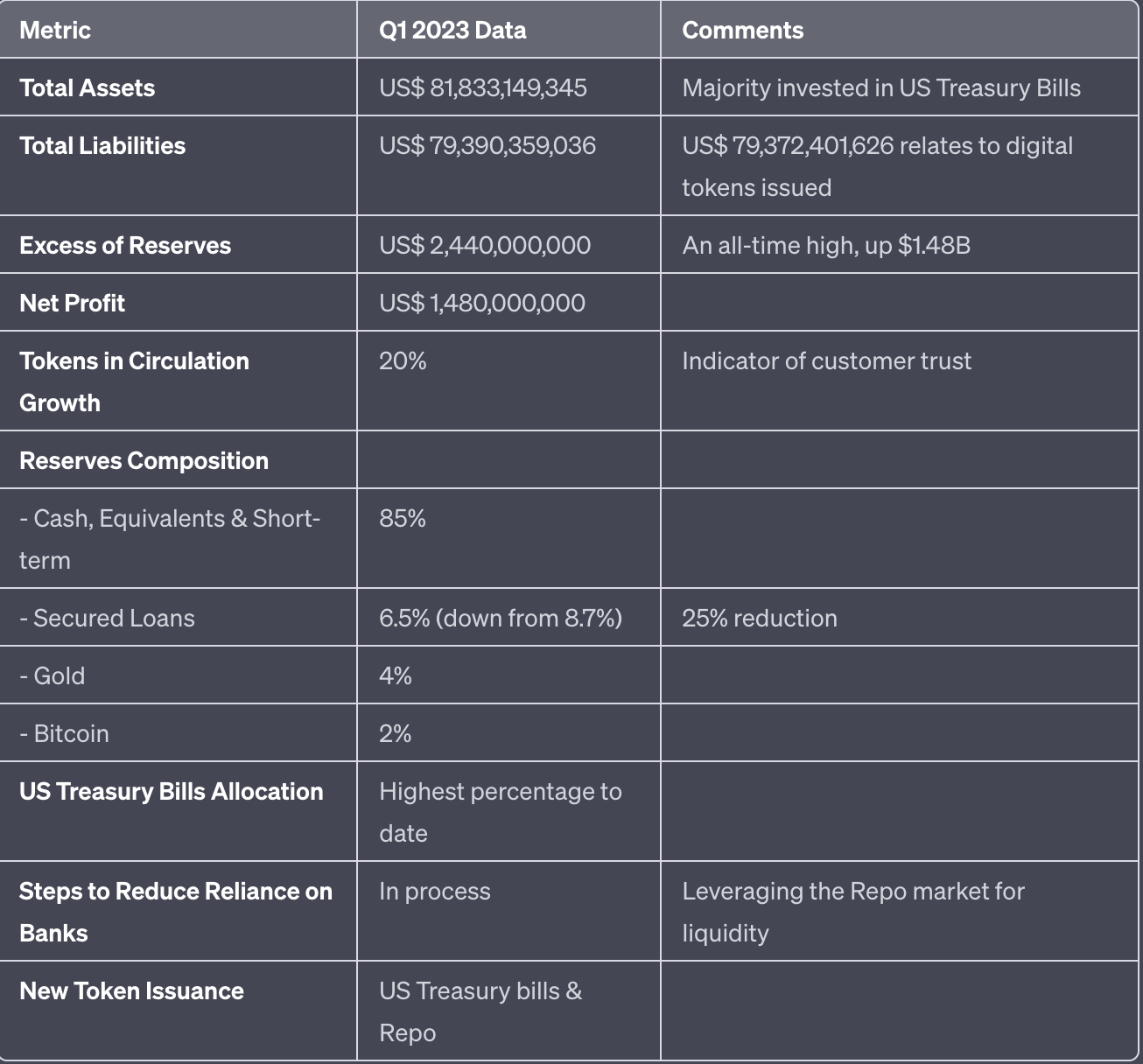

Well, I did a deep dive on Tether's latest report. The following is a table showing the metrics that Tether provided. I'll briefly describe some of the key points that stand out to me.

The Total Assets are $81.833M while the Total Liabilities are $79.390M.

The assets are primarily made up of US Treasury Bills, other cash-equivalent assets and a few % of Gold & BTC reserves.

The $79.390M in liabilities is primarily the USDT that is in circulation (because those USDT can be claimed for their balance sheet of cash / cash-equivalents, these are liabilities).

The excess reserves total $2.44B which is up from $1.48B (an all-time high for Tether's Excess Reserves category).

They show this as a net profit on those assets - which again, largely are gold and BTC.

The breakdown of their reserves composition shows that most of the money (85%) to back Tether is immediately liquid.

The rest are loans (6.5%), Gold (4%) and Bitcoin (2%).

Tether Bought 1,529 #Bitcoin in Q2

According to some reports, Tether bought an additional 1,529 BTC in Q2 for $45.4M USD.

They recently reported that they are going to be using up to 15% of their profits in order to buy BTC and add it to their balance sheet of "Excess Reserves" backing USDT.

With the way this is going, this could become a very large excess reserve to back USDT.

That being said, we saw Do Kwon do something like this to back UST from his LUNA/UST treasury reserves. I am not entirely convinced about an approach like this but as long as its a piece of the puzzle and not the whole puzzle, I am okay with it.

If USDT does in fact have the 85%+ in reserves of cash-equivalent to back USDT, then USDT to me is a safe bet.

I personally hold some USDT and often use it as a stablecoin pair when I trade in and out of other cryptos like BTC, HIVE, etc.

USDT is extremely convenient, ridiculously liquid and so-far, extremely safe.

More Auditing, More Transparency

One thing I would love more of is more transparency on Tether's balance sheet. I think we could get a lot more clarity by having 10+ auditing firms all confirm the balance sheet and constantly monitor the activities of Tether Holdings Limited.

This all being said, I have also long-said that I want to see a rise in the total market cap of DeFi stablecoins. Yes, we've had a shaky past with UST and other "algo stablecoins" but I do think of these blow-ups as learning experiences and I forsee DeFi stablecoins taking over more market cap from CeFi stablecoins like USDT and USDC.

HBD has a lot of potential to gain some market share in this environment. I think the right partnerships, use cases, exchange listings and liquidity could drive massive adoption of HBD and by-effect, HIVE.

I've been pushing for more liquidity for HBD and working hard to get it spread to as many chains and places as possible. I love seeing the growth of DeFi stablecoins but yes, I also love seeing USDT and USDC get more widely adopted by big CeFi players. Get them into the industry and then we can ultimately onboard them into DeFi products.

pssst have you seen @leofinance's proposal to double the userbase of Hive? It's officially live and waiting for you to vote and support it getting funded! The proposal outlines our strategy to grow the Hive blockchain by 9,615+ monthly active users using our LeoInfra Lite Account protocol and bring the masses to Hive.

- Vote the Proposal on PeakD ▶️ https://peakd.com/me/proposals/269

- Vote the Proposal on Ecency ▶️ https://ecency.com/me/proposals/269

- Vote the Proposal on Hivesigner ▶️ https://hivesigner.com/sign/update-proposal-votes?proposal_ids=%5B269%5D&approve=true

Posted Using LeoFinance Alpha