Tokenization has always caught my eye as one of the most exciting aspects of the crypto industry. Going all the way back to the days when we were obsessed with SMTs and the prospect of creating tokens on this blockchain.

Today, we have tokenization on Hive through awesome second-layers like Hive-Engine. We also see other blockchains riding the Tokenization wave. Whether you're on Ethereum, BSC, Avalanche, Hive or really any blockchain, there is some aspect of tokenization happening.

Tokenization is happening in all sorts of formats and for all sorts of assets. We saw a major crazy for Non-Fungible Tokens (NFTs) by the general public and this trend of "normies" coming into the space for various token use cases will continue.

The Tokenization of Everything: Trillions to Flow Onto Blockchains

Investment Bank Citi just published a massive report. In it, they outline their vision for the future of DLT (Distributed Ledger Technology) and the tokenization of real-world assets.

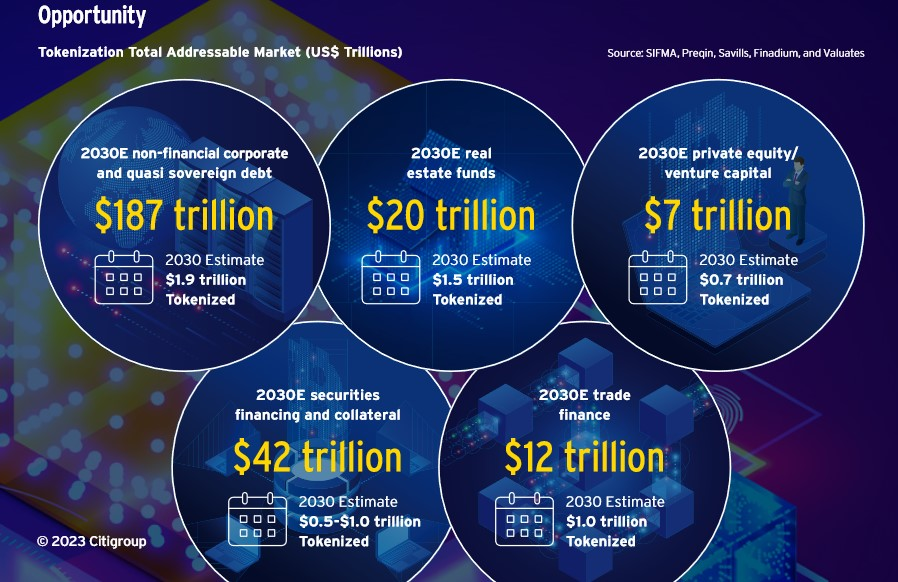

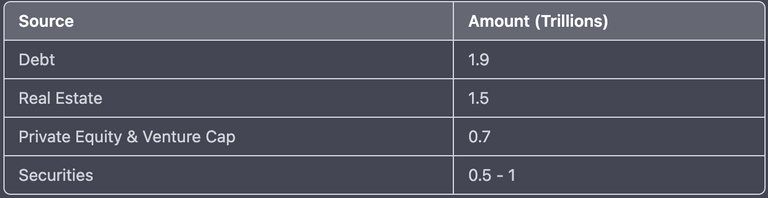

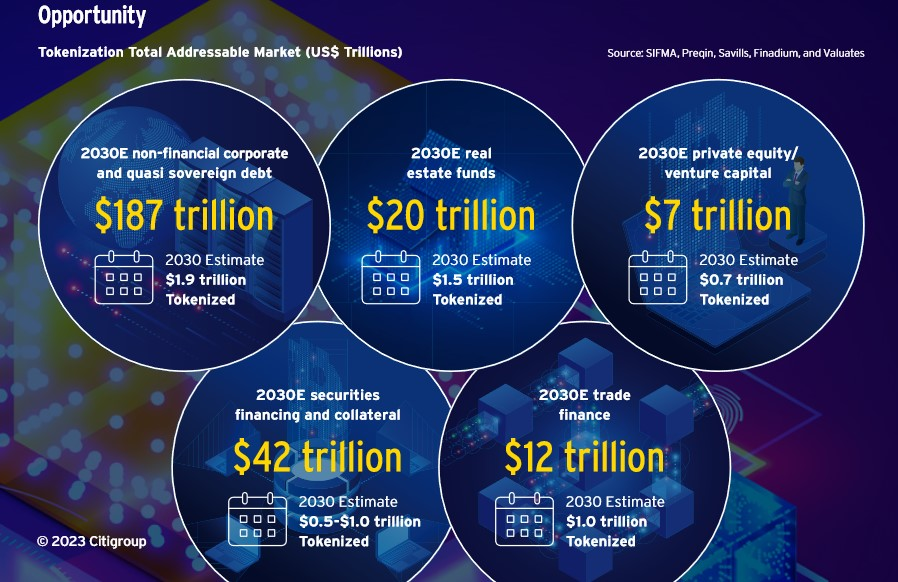

They believe that by 2030, $4-$5 Trillion in real-world assets will be tokenized on the blockchain. That's an 80 fold increase.

The above 4 categories are where they believe these trillions of dollars will flow. While it might seem like a large amount of capital, it's actually somewhat small when you evaluate the total value of these categories:

(source: citi)

Why tokenize? Here's what Citi says:

"“Traditional financial assets are not broken, but sub-optimal as they are limited by traditional systems and processes,” it said. “Certain financial assets — such as fixed income, private equity, and other alternatives — have been relatively constrained while other markets — such as public equities — are more efficient.”"

Why Tokenize?

From my point of view, tokenizing has always been the logical next step for assets.

A great example is looking at businesses and the yellow pages. It used to be important for a business to be listed in the yellow pages. That's how people could find you.

Then the internet came along. Businesses both small and large rejected the idea that it "mattered" to have a website on the internet.

They couldn't see the next logical step of evolution for listing their business. They adopted yellow pages, why is the internet any different?

Technology tends to do this to us. It keeps us in the dark. We don't know right away that something is going to be a big thing that you need to use. From the perspective of the moment, we're limited in our breadth of seeing what's next.

In my opinion, Tokenization is like that internet moment. A lot of businesses and corporations don't yet see the need to tokenize. We haven't hit that critical mass of adoption yet where the tipping point causes people to be forced to tokenize or become irrelevant.

The points made by Citi are valuable: TradFi is not broken (although I don't fully agree with that) but they are sub-optimal.

They're sub-optimal in relative nature to tokenized assets. If you've used crypto for even one day to move BTC from one exchange or one wallet to another, then you know the power of tokenization.

If you dive deeper and use tokens like HIVE or LEO, then you see a whole other world open up in front of you. Mini-economies form and you start to see a much different version of the future. Start layering in more complex version of tokens like NFTs or Soublound NFTs... Now you're starting to see the true power of tokenization: the ability to layer in contracted rules for tokens.

You can imagine a whole new global landscape for assets. Instead of being landlocked by TradFi, you can be globally accessible as a token.

About LeoFinance

LeoFinance is a blockchain-based Web3 community that builds innovative applications on the Hive, BSC, ETH and Polygon blockchains. Our flagship application: LeoFinance.io allows users and creators to engage & share micro and long-form content on the blockchain while earning cryptocurrency rewards.

Our mission is to democratize financial knowledge and access with Web3.

Twitter: https://twitter.com/FinanceLeo

Discord: https://discord.gg/E4jePHe

Whitepaper: https://whitepaper.leofinance.io

Our Hive Applications

Join Web3: https://leofinance.io/

Microblog on Hive: https://leofinance.io/threads

LeoMobile (IOS): https://testflight.apple.com/join/cskYPK1a

LeoMobile (Android): https://play.google.com/store/apps/details?id=io.leofi.mobile

Delegate HIVE POWER: Earn 16% APR, Paid Daily. Currently @ 2.8M HP

Hivestats: https://hivestats.io

LeoDex: https://leodex.io

LeoFi: https://leofi.io

BSC HBD (bHBD): https://wleo.io/hbd-bsc/

BSC HIVE (bHIVE): https://wleo.io/hive-bsc/

Earn 50%+ APR on HIVE/HBD: https://cubdefi.com/farms

Web3 & DeFi

Web3 is about more than social media. It encompasses a personal revolution in financial awareness and data ownership. We've merged the two with our Social Apps and our DeFi Apps:

CubFinance (BSC): https://cubdefi.com

PolyCUB (Polygon): https://polycub.com

Multi-Token Bridge (Bridge HIVE, HBD, LEO): https://wleo.io

Posted Using LeoFinance Beta