Welcome to this weeks LBI token earnings and holding post

What is LBI?

The LeoBacked Investment (LBI) token is the first of its kind, the 1st token to be valued completely in LEO. Each LBI token represents a percentage ownership in the overall fund including all LEO, HIVE, off-chain and wallets operated by @lbi-token. The goal is to provide a community based and ran investment vehicle focused primarily on the LeoFinance community and LEO token. We provide a weekly LEO dividend payment to all token holders whilst also increasing the value of the LBI token slowly but consistently over the long term by only investing into things that will stand the test of time.

LBI is a long term HODL token based on SPI's model. Because these tokens are backed and valued in their primary assets, the value only increases. Think of it as putting $1000 in the bank and earning interest. In theory, you should never have fewer dollars. The $1000 is the LEO you give us to buy your LBI token and the interest is the earnings we produce with that LEO.

Weekly Recap

Ok folks, not wrote anything under the tables and charts this week because im mentally drained and trying to put a good spin on something that' losing value every week is not easy so i'll do my update in this recap part of the post.

Here's your update

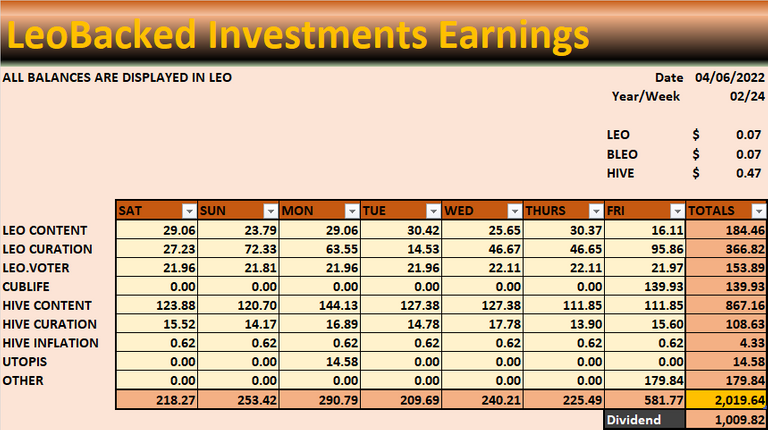

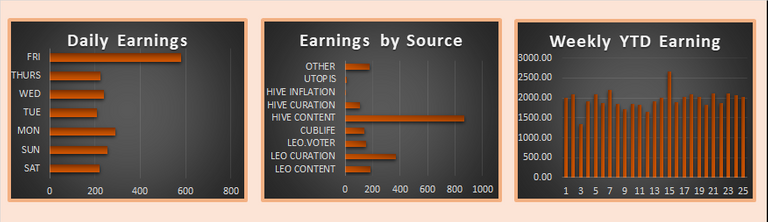

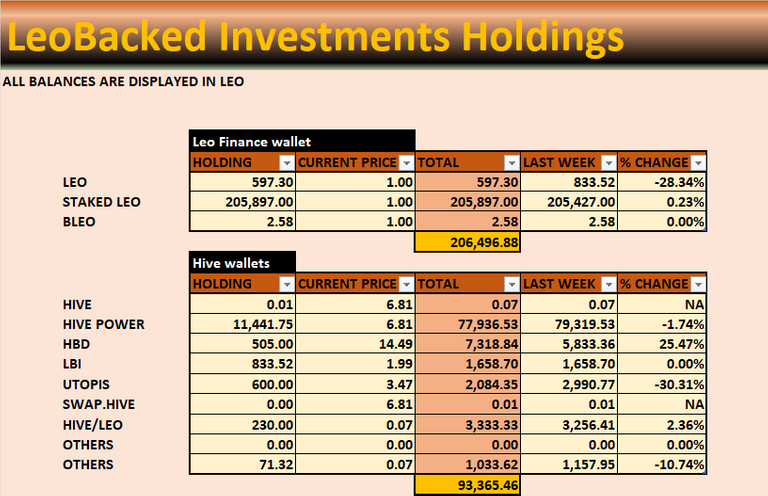

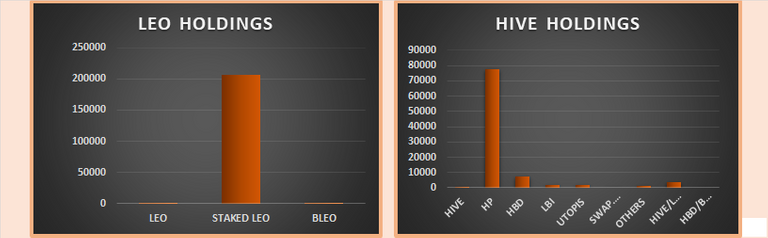

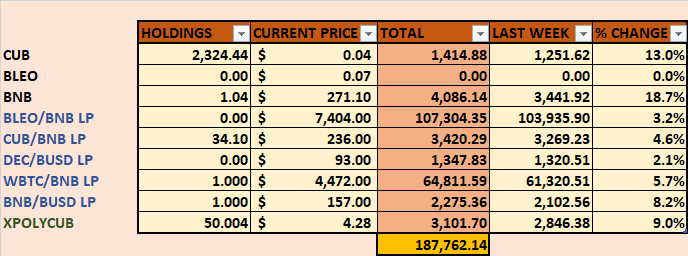

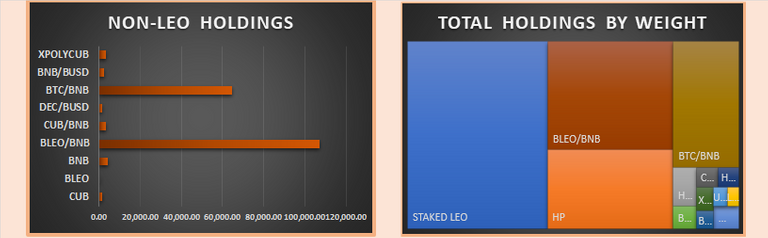

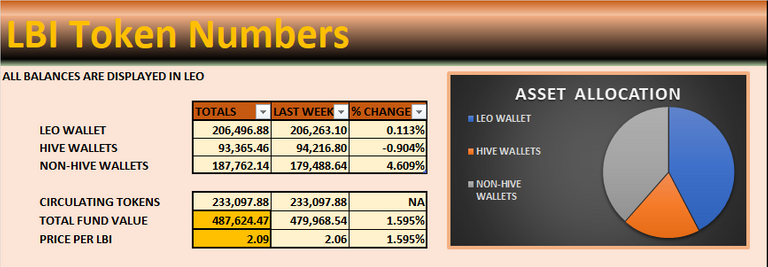

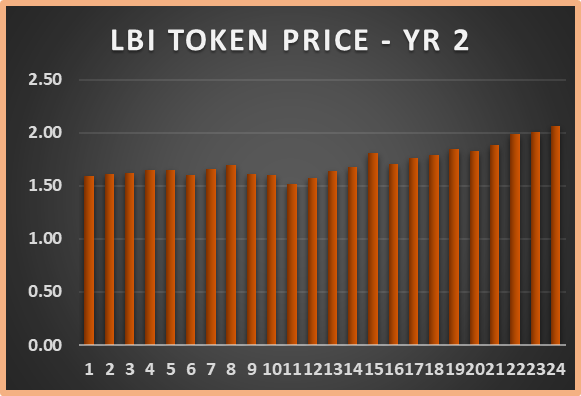

Nothing has happened this week, the price of LEO and CUB dropped so no surprises there. The price of the LBI token has increased to 2.09 LEO each but i dont take any pride in this because all's that has happened is the price of LEO has dropped more than everything else we hold which is pretty standard and im thankful everyday we have holdings that are not LEO. You know we hold over 200k LEO and HIVE content rewards are double that of LEO curation rewards, take that how you will. Curating from over 2% of LEOs total supply is equal to rewards for 3.5 posts could be another way to view it.

No idea what to do with LBI. It's basically a fancy curation trial where the curation rewards are shit and real earnings come from creating content. When LBI launched, there were 6.5 million LEO in circulation and now there are over 11 million so I guess this would explain why curation rewards are dropping. I have tried many times to suggest idea's on how to increase our holdings by moving funds off HIVE out of the LEO ecosystem but everyone wants to keep everything within the LEO ecosystem. I can understand this POV but I dont I agree with it because it's not the model LBI was set up on and it's a little retarded, to be honest. We've watched LEO drop from over $1 down to almost nothing and still people keep the faith, why?

Look at CUBlife as an example. CUBlife is the side project, all it does is a farm on CUBfinance and split harvests in dividends and reinvestment. CL tokens were issued at 1.60 LEO on release and today they are worth over 4.3 LEO each with 60 minutes work per week. CL token would be worth much more but its 2 biggest holdings (LEO and CUB) have both fallen over 95% in price since CL's release. At this rate for LBI, our 10k HIVE that is delegated to do leo.voter will soon be earning more than 200k LEO will from curation. It's already 50% the way there. It's not good.

As the fund manager, I dont see any requirement for me other than bookkeeping and putting out content. I actually feel bad because I know lots of people had high hopes for LEO and LBI and we've only had disappointment since. I am not saying that the LEO ecosystem has not grown since LBI was launched but all of its growth has been focused on building off HIVE with silly farms and promises of things that will never be.

Sorry, I dont have anything nice to say this week, I had written more but deleted about 300 words.

There's your update, LBI token price is 2.09 LEO..., super stuff

HAVE A GREAT WEEKEND!

(LEOfinance frontend is not working 🙄 so uploading from peakd)

Get LBI on LeoDex - https://leodex.io/market/LBI

Get LBI on Hive-engine - https://hive-engine.com/?p=market&t=LBI