Welcome to the weekly edition of the LeoFinance stats report.

This is a weekly report covering February 28 through March 3, 2022.

If you want to learn a bit more about the LeoFinance ecosystem and dig into the numbers, this is the place to be.

The following topics will be covered:

- Issued LEO Tokens

- Top LEO Earners

- Rewards to HP delegators trough the leo.bounties program

- Daily stats on tokens staking

- Share of tokens staked

- Top Users that staked

- Unique number of LeoFInance users

- Posts/comments activities on the platform

- Posting from LeoFinance.io interface

- Price Chart

Issued LEO Tokens

Let’s take a look into token issuance and how it is distributed over time.

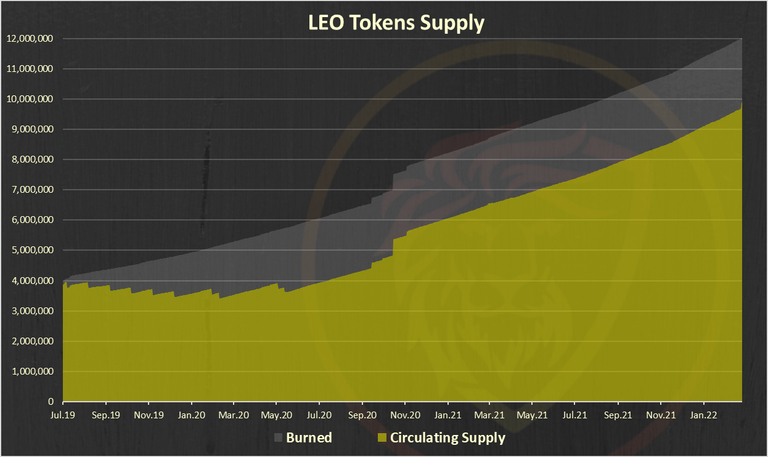

Below is a chart that represents the cumulative issued LEO tokens.

This chart is representing the total LEO supply, circulating supply and burned tokens.

A total of 12.2M issued LEO tokens, 2.3M burned, 9.9M circulating supply.

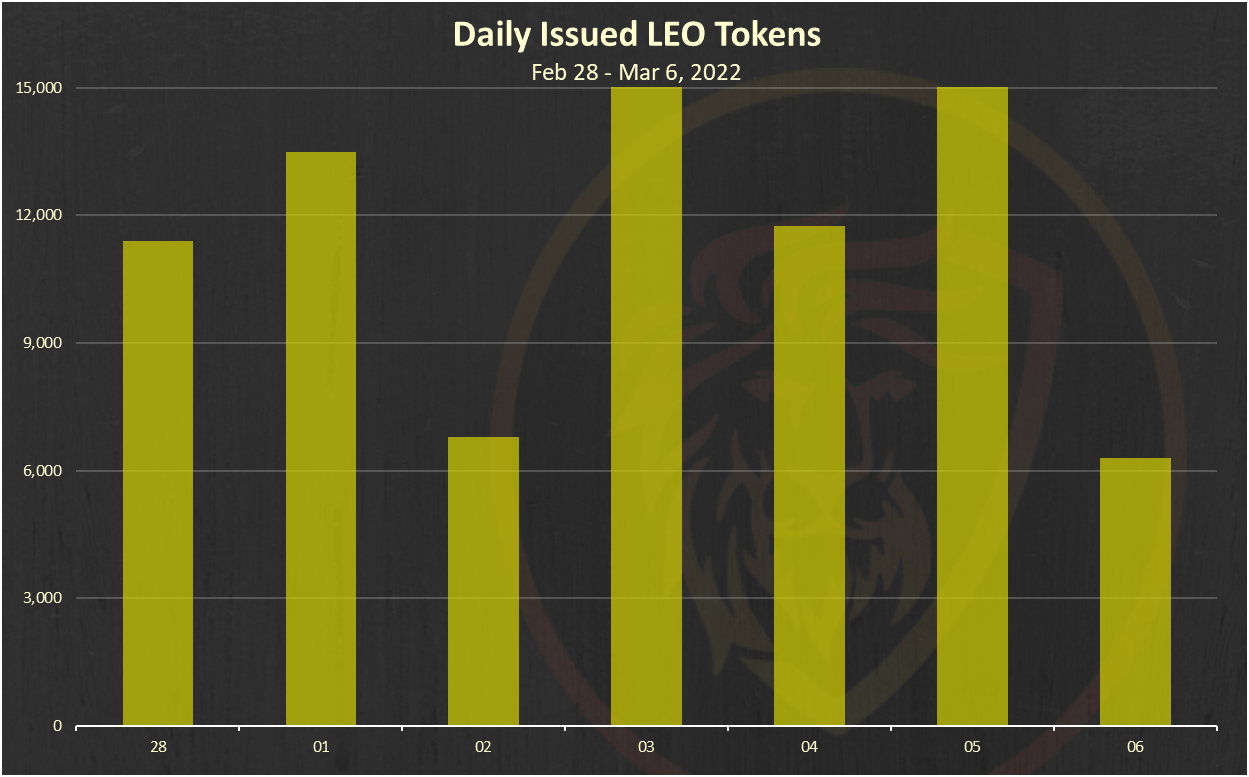

Next is the issued LEO tokens from last week. Here is the chart:

A total of 257k LEO were issued in the last week.

Note that this is more then usual, because of a 181k tokens issued to the team account for seeding the pLEO-MATIC pool. If we exclude those tokens there is a 76k tokens issued in the week.

Let’s see how these tokens were distributed.

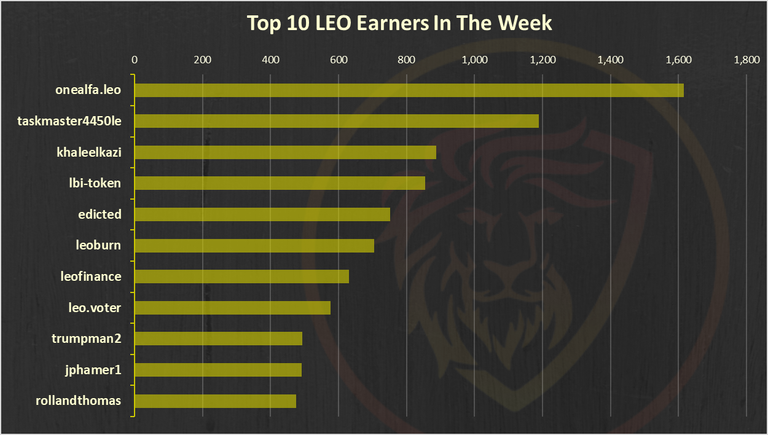

Below is the chart of the top 10 LEO earners this week.

@onealfa is on the top followed by @taskmaster4450le. Note again here about the team tokens issued for seeding the new pool.

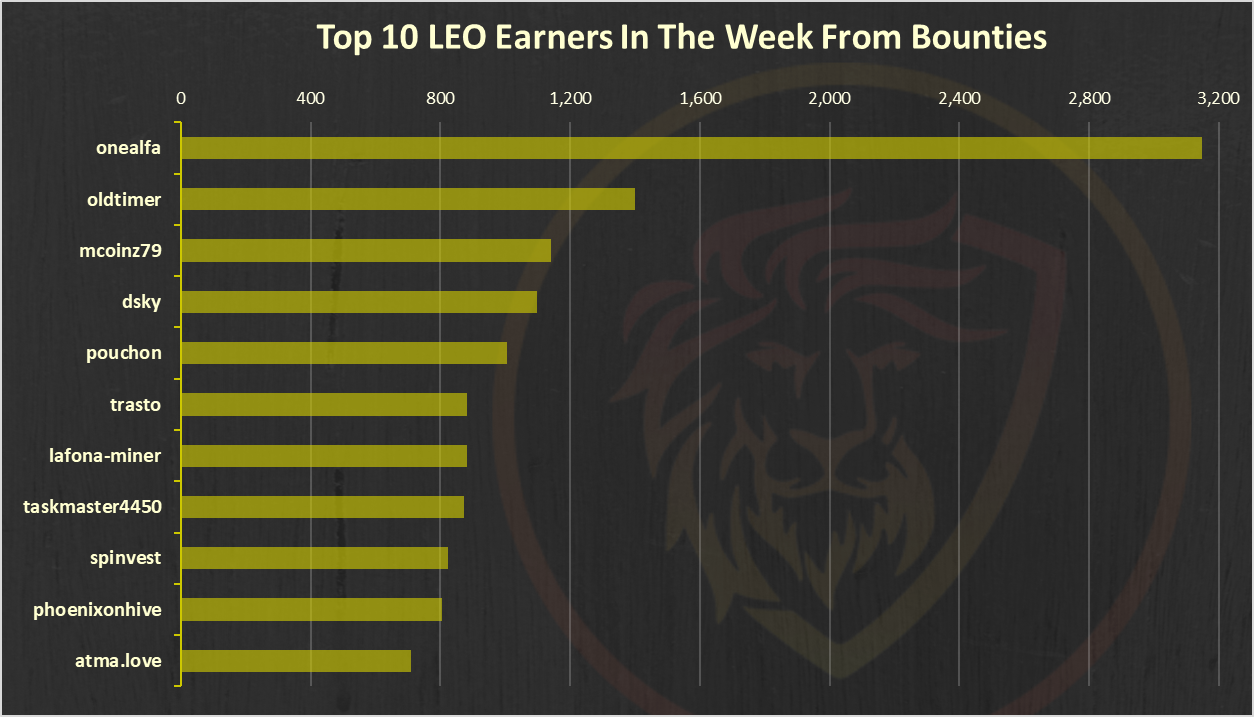

Rewards from Bounties

Users who delegate their HP to the @leo.voter receive daily payouts in the form of LEO tokens at a rate of ~16% APR. Also, at time some other bounties are in place.

@onealfa is on the top here.

Staking LEO

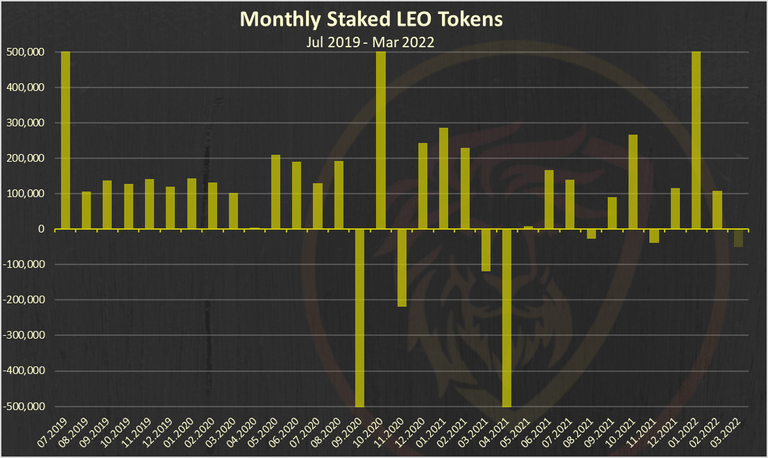

Below is a chart that represents the monthly flow of staked and unstaked LEO tokens. A positive bar going up shows a day where more LEO was staked than unstaked.

In the last period there is some unstaking happening in the last period due to the launch of the polycub platform. March just started will see how it end.

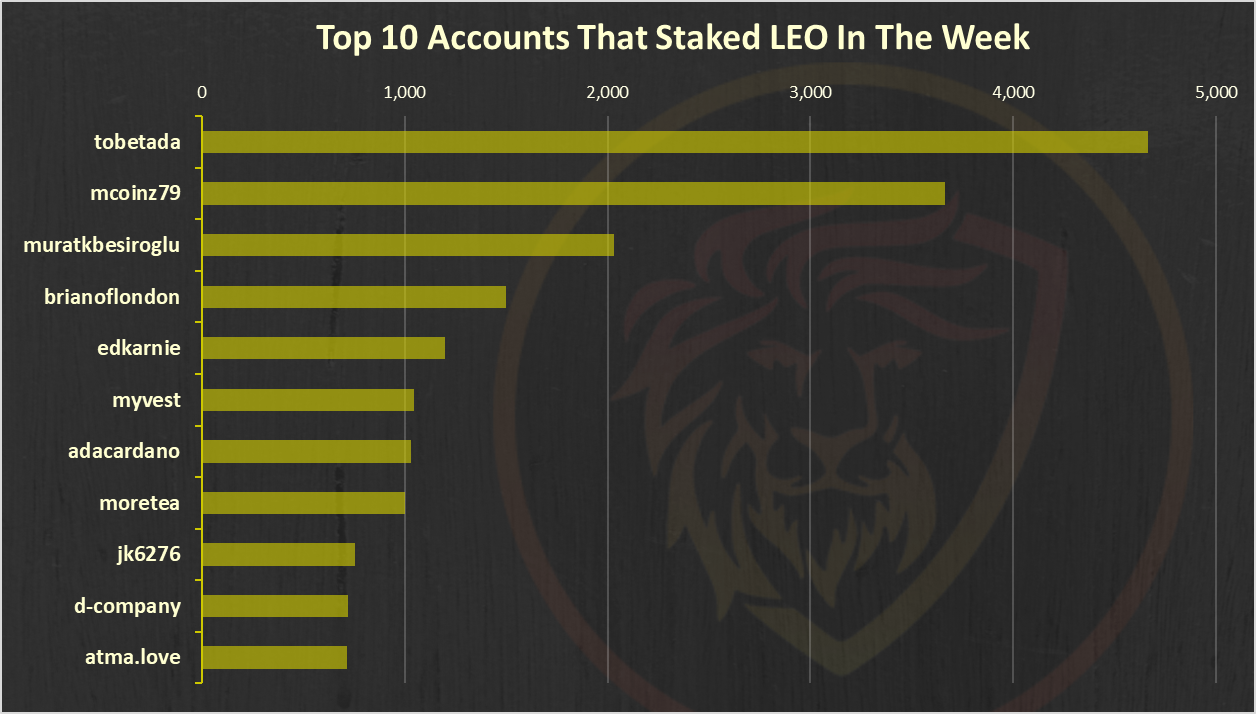

Below is the chart of the top 10 users that staked LEO last week:

@tobetada on the top here with more than 4k LEO staked.

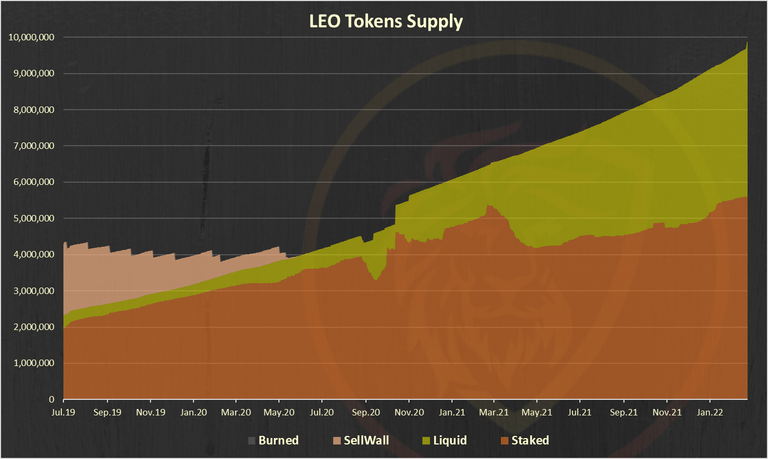

The Overall Flow of the LEO Token Supply:

Note on the yellow, liquid category above. It includes the LEO in the liquidity pools on ETH and BSC as well. If we remove that, the liquidity will be much lower.

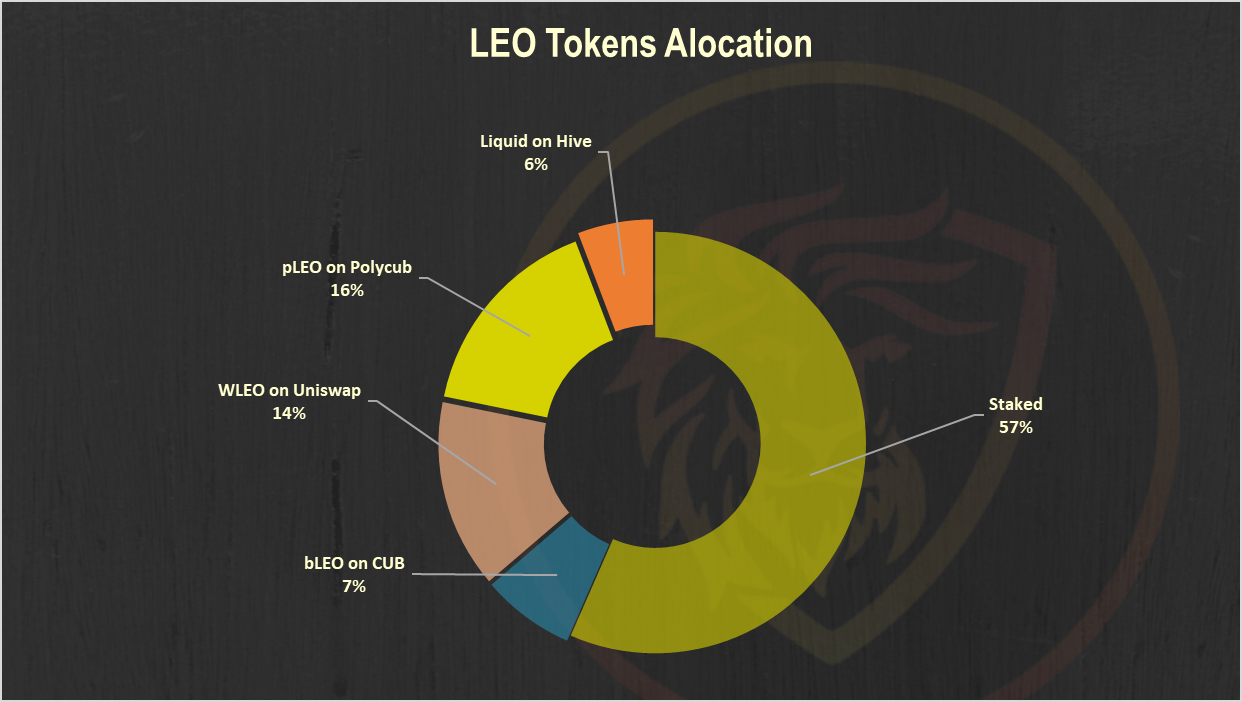

Below is a chart of the LEO tokens allocation.

A 57% share staked. I have added the new pLEO pool, and as we can see there is a significant amount there already. A total of 1.5M, or 16% of the supply. Already more then LEO on Uniswap or Cubfinance. The BSC pool especially went down, from 16% last week to 7% this one.

LeoFinance Users

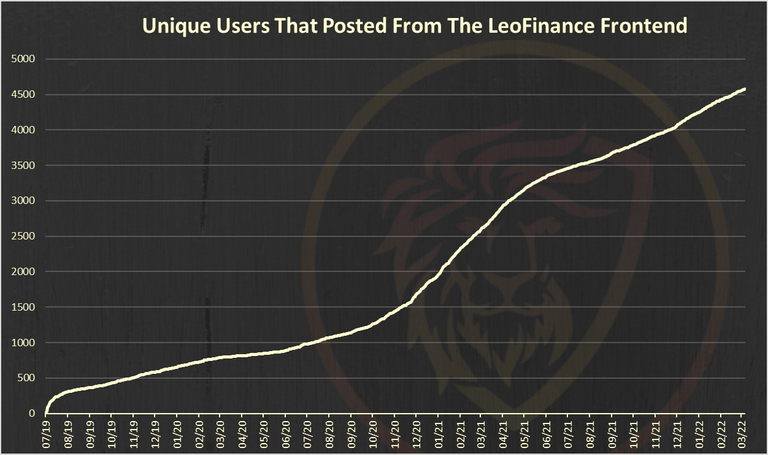

Below is a chart with the number of unique users that posted from the LeoFinance frontend.

A 4.55k unique accounts have posted from the LeoFinance interface.

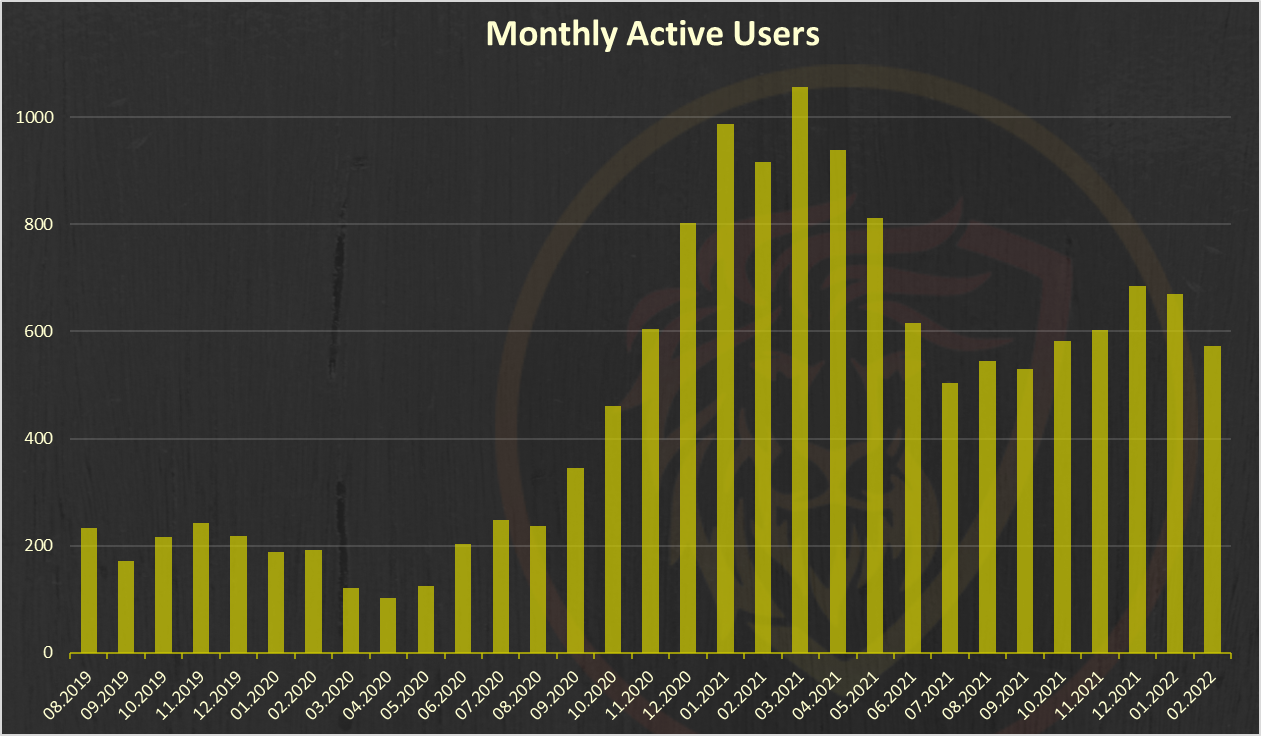

Monthly Active Users Posting from LeoFInance [MAU]

Here is the chart for the monthly active users that posted from the leofinance.io interface.

After a nice uptrend at the end of 2021, January and February have seen a small drop in the MAUs. This is aligned with the overall crypto market prices.

Activities on LeoFInance

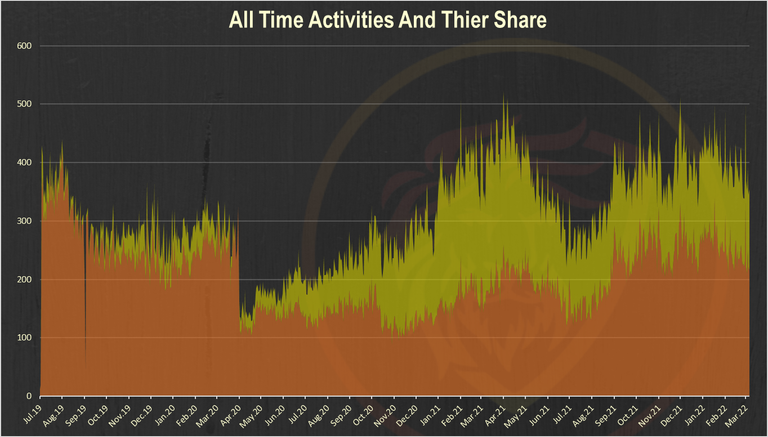

Below is a chart of the LeoFinance activities with the numbers of posts from the LeoFinance interface and posts with the #leofinance tag.

The yellow are posts from the leofinance interface and the orange posts from other hive frontends with the leofinance tag.

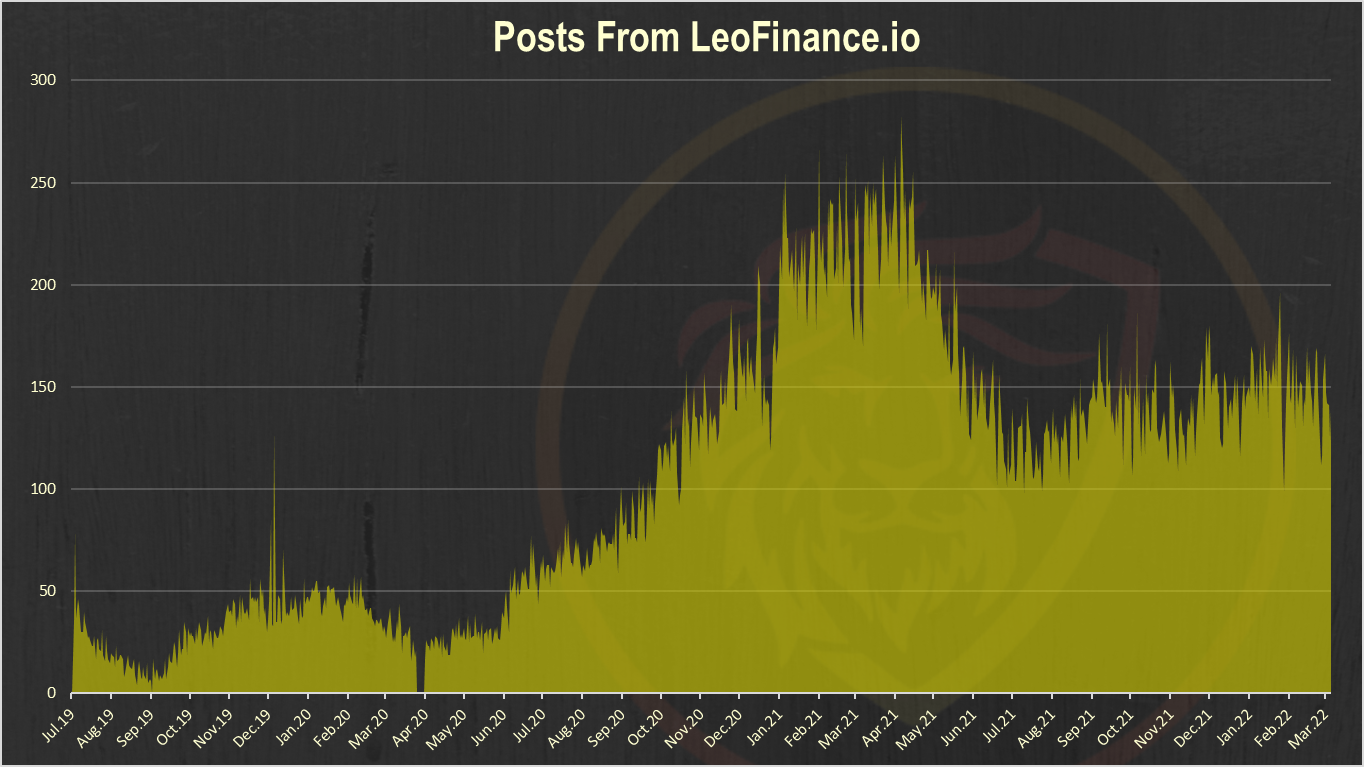

Here is the chart showing only posts made from the LeoFinance.io interface.

The number of daily posts has been around 150 in the last period.

LeoFinance has a 20% incentive for posting trough the native frontend. When users post from other frontends and just with the leofinance tag they have 20% less rewards.

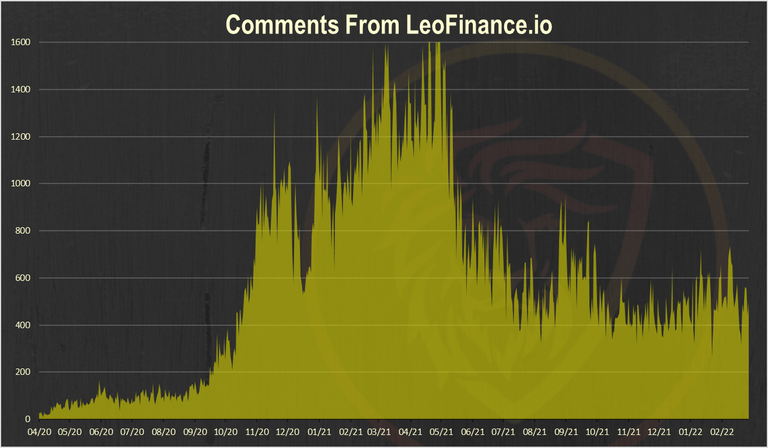

Number of comments from LeoFinance.io

Here is the chart for the numbers of comments starting from April 2020.

A total of 3.5k comments in the previous week.

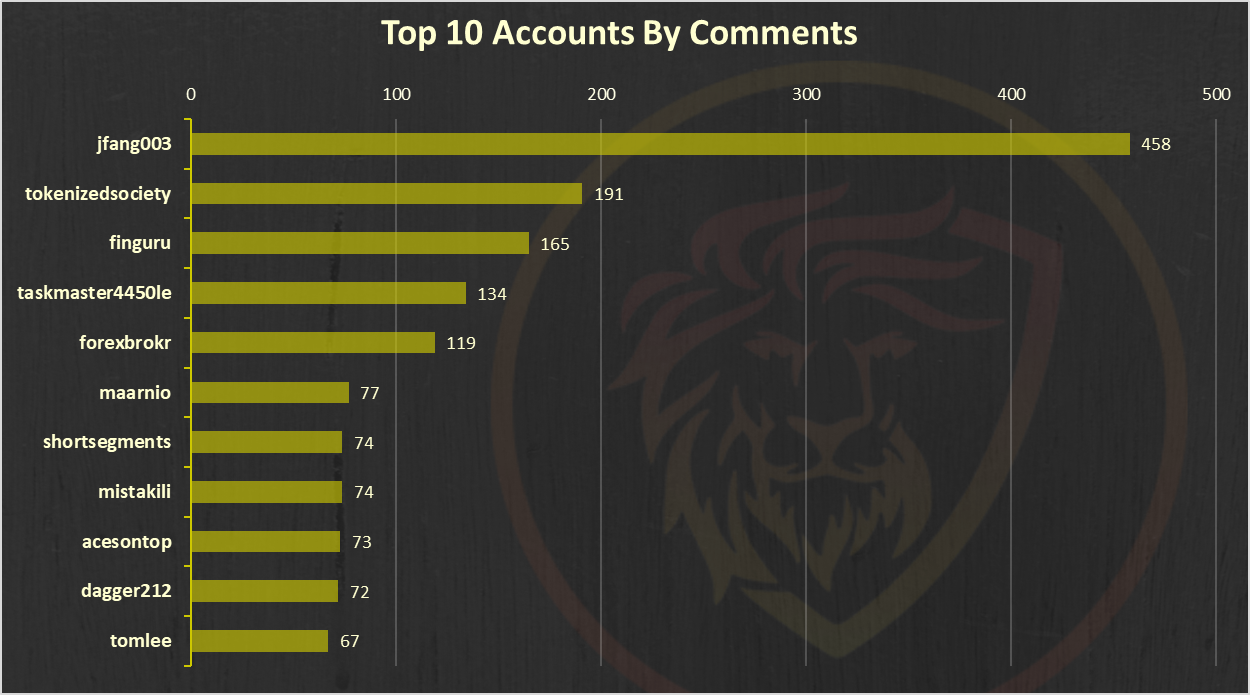

Authors that commented the most

There is an initiative in the last period for engagement on the platform and some of the large stakeholders have been voting comments a lot.

Here are the top authors that commented the most.

@jfang003 is on top followed by @tokenizedsociety.

Price

All time LEO price

It is interesting to look at the LEO token price, keeping in mind the crazy ride that HIVE had in the previous month.

Here is the price chart in dollar value with average price for better visibility.

Have in mind the above is an average daily price.

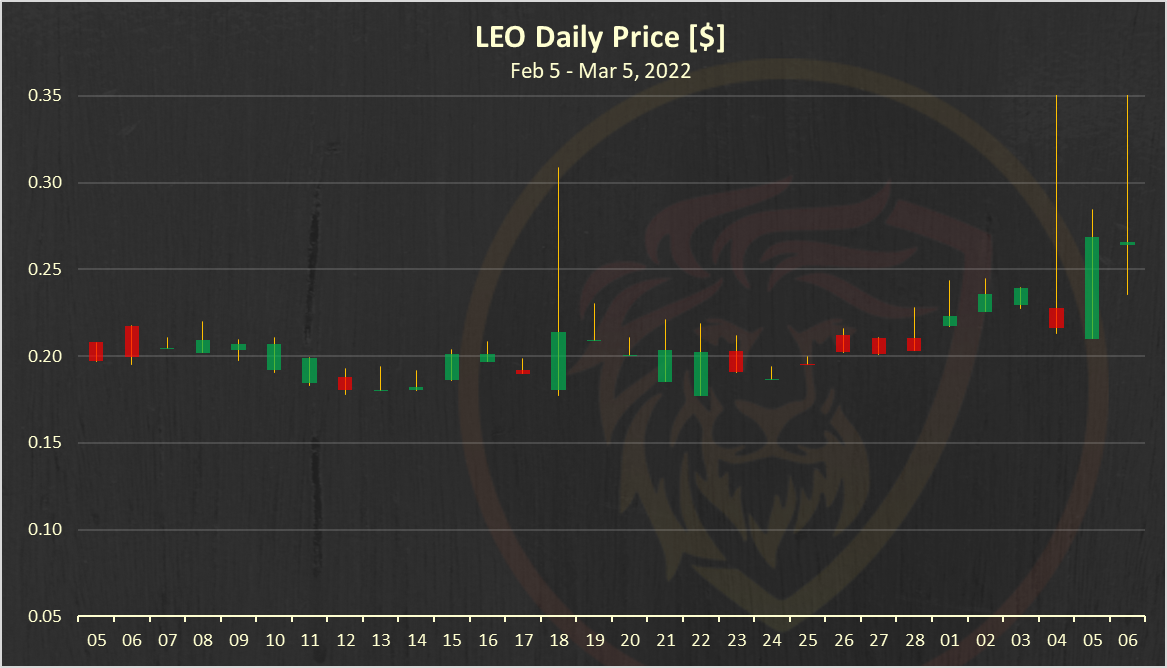

LEO price in the Last 30 days

Here is the price of LEO in the last 30 days also in dollar value:

With the launch of Polycub the LEO token has experienced some volatily on the upside and for a short period of time has reached 0.3$. Now it is around 0.24.

| Track Hive Data | New Interface! | About Us |

|---|---|---|

| Hivestats | LeoFinance Beta | Learn More |

|  |  |

| Trade Hive Tokens | Wrapped LEO | Hive Witness |

|---|---|---|

| LeoDex | Trade on Uniswap | Vote |

|  |  |

Report by @dalz

Posted Using LeoFinance Beta