It's time. 7 Months of development and hardcore anticipation from all the diamond paws in our LeoFinance Web3 Ecosystem.

Our team has worked incredibly hard on PolyCUB. It is the most complex and exciting platform that we have ever built and it is going to change everything for our Web3 Ecosystem. PolyCUB's backend works on nearly 20 smart contracts. We've pulled designs and inspiration from all of the top DeFi platforms to create what we believe is the grandaddy of all DeFi Yield Optimizers.

There is simply nothing like PolyCUB out there in the DeFi industry.

In this post, we'll announce our launch target and talk about some of the key things to look forward to in the coming days and weeks as we launch and work with our launch partners to make PolyCUB a homerun success for LeoFinance's Web3 Ecosystem. PolyCUB quite literally changes everything for LeoFinance.

- PolyCUB Launch Target Window

- Key Features of PolyCUB, Docs, Tutorials and Massive Content Release

- pLEO Launch

- CertiK Audit Completed

- What About CUB? Inter-Blockchain Expansion of CUB and LEO: Airdrops on Airdrops

- Marketing Partnerships: Our Work With Cointelegraph, Coindesk, Brave Browser and Tik Tok Influencers

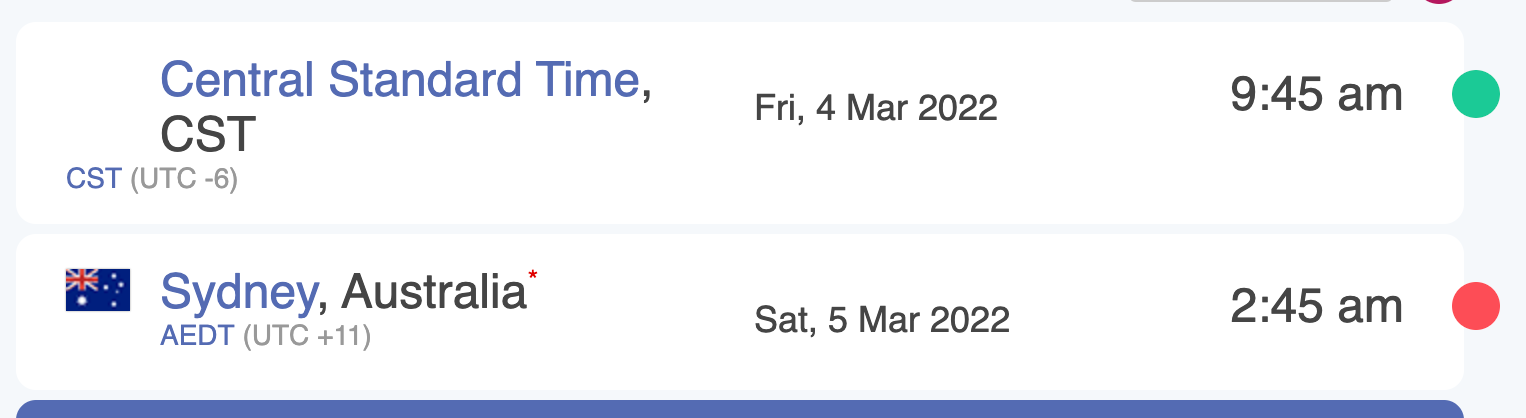

PolyCUB Target Launch Window

See the countdown in real-time

As with anything, this is a target launch window. We've set the block release time and are ready for launch but there can be delays. We want to preface this by saying that we are 90% confident in reaching this targeted release. If there is a delay and we push back the launch window, it will be slight (if at all) by maybe a few hours - 24 hours likely being the longest we would push back the launch for any reason whatsoever.

This is a seminal moment for LeoFinance. We're about to drastically change the way our entire Web3 Ecosystem functions and we're going to create massive awareness for our community (see the last section in this post: marketing partnerships).

The launch of CubFinance marked a change in the LeoFinance Web3 Ecosystem that will forever be remembered:

- LEO hit $1 for the first time ever

- CUB launched, brought $20m+ in TVL in the first few weeks and reached a high of $14

We did all of this with nearly 0 external paid marketing efforts. We had little in the way of marketing partnerships. In fact, the team knew that CUB was an exciting app for us to release but we simply had no idea how big it would get and how many people would come into our community. If you want to learn more about this time, then read the 2021 recap post we released on @leofinance at the beginning of 2022.

PolyCUB is everything we wished CUB would've been when it launched. CUB launched as a simple yield farming app like everything else in DeFi back in February 2021. We evolved CUB over time with intense development and a migration to sustainable tokenomics. That took a long time and a lot of effort, but we made it a reality.

With PolyCUB, we took everything we learned from the launch of CUB and then looked to other platforms. We conducted months of research on other DeFi apps like OHM, Sushiswap, Curve, Pancakeswap and others. All of this research yielded incredibly valuable data that we used to build PolyCUB into what it is today.

PolyCUB is built to be a self-sustaining base of operations for CubFinance on the Polygon Network. The token is built with Protocol Owned Liquidity, Cross-Platform Autocompounding Vaults, xPOLYCUB Staking Features and Deflationary Tokenomics.

It's a game-changer on every level and we believe that it is just the beginning of our inter-blockchain expansion of CUB (learn more about this expansion plan in the second-to-last section of this post).

Key Features of PolyCUB, Docs, Tutorials and Massive Content Release

Many of you have already seen the massive amount of POLYCUB-related content being published on the LeoFinance YouTube Channel and through podcast clips from the AMA on @khaleelkazi. There is going to be a continual stream of massive amounts of content for the next 7 days on all of our official accounts.

All of this content is intended to teach our community and the outside world about PolyCUB, CUB and how our platform works. Our Web3 Ecosystem just got an incredible addition that makes it even more complex and rewarding to be a part of.

The PolyCUB Docs will be released shortly after this post. The docs will discuss all of the inner-workings of PolyCUB and will also include a massive quantity of tutorials for all experience levels of DeFi users. Whether you're new to DeFi or have been in it since the beginning, PolyCUB will be accessible to you and we want you to dive deep on the tokenomics of the platform.

Self-Sustaining

PolyCUB is not only built to have sustainable tokenomics, it's actually deflationary. The platform achieves this through over a dozen mechanics that make it the best Yield Optimization app on the planet. We're calling this a DeFi 2.0 Yield Optimizer.

It bridges the core features of all the top DeFi platforms to create sustainability, deflationary tokenomics and a POLYCUB token that is expected to INCREASE in value as the platform matures. In this post, we'll just briefly touch on the core ideas driving POLYCUB's model of DeFi but again - start reading and listening up to all of the content we've been releasing and are going to release in the coming days and weeks.

PolyCUB is a complex platform with many mechanics that will create something radically different than what exists today. Take your time, dive deep and ultimately seek to understand how it works and how to make it work for you:

- xPOLYCUB

- Protocol Owned Liquidity

- Kingdoms

- Management Fees

- Risk-Free Value

- POLYCUB Bonding

xPOLYCUB

xPOLYCUB is a mechanism we designed using inspiration from (actually a modified version of) the xSUSHI staking contract. Taking this + the Curve/Ellipsis style of redistributing early harvesting penalties back to 💎🐾 user is the idea behind xPOLYCUB.

On PolyCUB, there is a single-stake vault that is exactly like the CUB Single-Stake Kingdom on https://cubdefi.com... With 1 key difference:

xPOLYCUB earns rewards in two ways:

- Inflation of POLYCUB (exactly like CUB's Kingdom)

- Early Harvesting Penalties

Early Harvesting Penalties refers to the time it takes for POLYCUB harvests to fully unlock and be available to claim with 0% penalty.

POLYCUB harvests can be claimed at any time - much like CUB harvests.

The key difference is that if you claim POLYCUB that hasn't unlocked yet (unlocking continuously in a drip contract over 90 days), then you are hit with a 50% penalty on any POLYCUB that hasn't been unlocked yet.

This 50% penalty is paid out to the xPOLYCUB staking contract. All users who stake POLYCUB into xPOLYCUB earn an even share in all of these penalties.

It's a pretty incredible mechanism and when you look at how it has performed on the few platforms that have actually put it into practice, the results are astonishing.

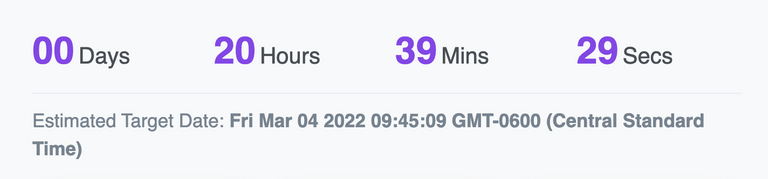

This wasn't enough though. Our goal is a fully self-sustaining and actually deflationary inter-blockchain base on Polygon, remember? As I said to Edicted in discord - did you expect LeoTeam to deliver anything less?

Protocol-Owned Liquidity

OHM popularized the idea of Protocol Owned Liquidity or Protocol Controlled Value. This mechanism uses fees and POLYCUB bonding to create a smart contract treasury for the PolyCub Protocol.

This treasury pools assets in the Kingdoms vaults and continuously compounds on itself until all POLYCUB is minted.

As you can read in @edicted's latest post: https://leofinance.io/@edicted/pcub-launch-imminent - the POLYCUB token does not have much inflation at all. It has early days of inflation and has an accelerated version of Bitcoin's halvening cycle. The POLYCUB emmissions rate drops every week for the first 4 weeks and then after that it drops in half every single month.

With the launch of CUB, we learned something extremely valuable. If you were around for the launch of CUB then you remember the price going straight up for the first few weeks... reaching a high of $14.

That's incredible but what happened after? We didn't capitalize on that opportunity because we didn't know what was going to happen.

With the launch of POLYCUB, we know what's going to happen. We know the price is going to moon and we know that there will be SIGNIFICANT volatility in the early weeks of the platform's launch.

Our response? Capture the volatility in a bottle and call it Protocol Owned Liquidity (PoL).

The PoL is built in 2 primary ways:

- Management Fees on Kingdoms TVL

- POLYCUB Bonding Contract

The management fees on Kingdoms TVL is the one to watch out for in the early days of the platform.

TVL sloshes around quickly on the launch of new platforms. Tens of millions of dollars flowed in and out of CUB in the first few weeks of it going live. We could've captured millions of dollars in Protocol Owned Liquidity in those days but we didn't because the idea of PoL didn't exist and the LeoTeam only had 8 members on it.

We are smarter, more organized, more informed and have more smart contracts. Everything is about to change.

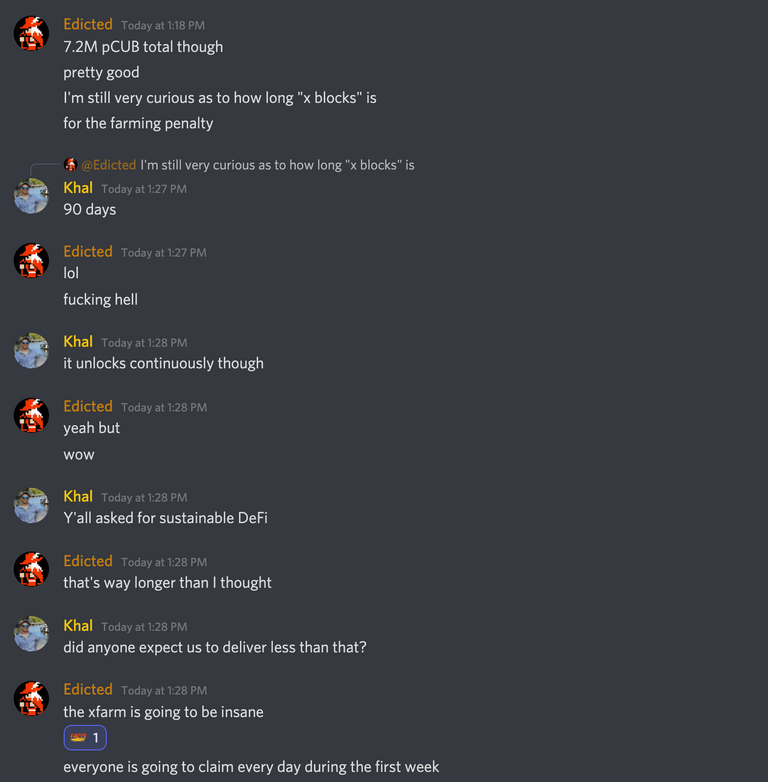

Risk-Free Value

Risk-Free Value or RFV refers to the floor price of POLYCUB. You can determine this by simply calculating the value of the PoL against the current supply of POLYCUB tokens.

RFV is a telling indicator of the value of POLYCUB. We consider this to be inspired by both OHM and Thorchain.

Thorchain (RUNE) Community Members often describe the Deterministic Value of RUNE as being 3x the value of all non-RUNE assets pooled in Thorchain's Liquidity Pools.

Then they will tell you the speculative multiplier of RUNE - the value of RUNE above the current floor price (deterministic value of RUNE).

You can do the very same calculations for POLYCUB. This creates some interesting figures and gives people a concrete way to value the POLYCUB token. In the POLYCUB Docs, you'll find a section called "How to Value POLYCUB" which will describe all of these mechanics in great detail.

PolyCUB Bonding

PolyCUB Bonding will act as a way to further bolster PoL by driving massive amounts of liquidity to the PoL smart contract.

Factor this in with all of the information above and what do you get? A massive, exponentially growing Protocol Owned Liquidity which brings with it a massive, exponentially growing floor price (RFV) for the POLYCUB token.

Bonding simply allows users to trade tokens with the PoL. It trades POLYCUB tokens for LP positions and sometimes offers a discount on those POLYCUB tokens below market price. It then takes those LP positions and adds it to the PoL. Increasing PoL total value and with it, RFV.

Polygon LEO (pLEO)

The goal of our inter-blockchain expansion is to seed the ground for LeoBridge and the LEO Token Economy. LEO is an incredibly versatile utility token. You can blog with it, curate with it, earn liquidity rewards with it, wrap it onto multiple blockchains.

What we've built with the LEO Token Economy is truly incredible and what's even more incredible is what is about to happen.

LeoBridge V3 is ready for production. This means that you'll be able to permissionlessly trade any BSC asset for any Polygon asset and all of the trading volume will happen through the LEO Token Economy.

With the launch of PolyCUB, we're releasing the pLEO token and including a pLEO-MATIC Farm on PolyCUB.

This means you'll be able to stake LEO and earn a 1,000%+ APY in the early days of the platform with the APY remaining high for the forseeable future afterwards.

It's going to drastically change the entire landscape of LEO's multi-blockchain token economy and further expand the reach of LeoFinance's Web3 Ecosystem.

pLEO will be accessible through PolyCUB's UI and the https://wleo.io wrapping UI we have for wLEO, bLEO and (soon) pLEO.

We are more bullish than ever on the LEO token. This fulfills our mission of continuously expanding the width and depth of the LeoFinance Ecosystem.

CertiK Audit Completed

About 1 week ago, our CertiK Audit was fully completed. We had some back and forth with them - as discussed in the last LeoFinance AMA - about the PolyCUB platform and their audit is now fully stamped as completed.

This audit will go live on CertiK's platform in the next 24 hours, right in time for the PolyCUB launch.

This will put PolyCUB in the upper tier of all DeFi platforms. Having the CertiK audit in place before we even launch PolyCUB was a must for us. This is an incredibly complex and wildly important platform. The mechanics needed to be battle-tested before we would take it live.

What About CUB? Inter-Blockchain Expansion of CUB and LEO: Airdrops on Airdrops

So many people are curious about CUB now that we're launching PolyCUB. They think CUB will be left by the wayside.

On the contrary, this expansion with POLYCUB and all of the upcoming expansions with AvalancheCUB, TerraCUB, FantomCUB, etc. are going to show you exactly where we're headed. The future for CUB has never been more bright and this is quite evident in the current price CUB: which has risen more than 75% in the past 2 weeks since we announced the completion of the CertiK audit.

You can watch this video for more details on this idea about inter-blockchain expansions.

The key things to note:

- POLYCUB is designed first-and-foremost to be a self-sustaining base on the Polygon network for CubFinance

- If POLYCUB plays out as designed, it will be used as the framework for us to expand to every EVM blockchain

- With every EVM Blockchain expansion, we will release a new version of POLYCUB and each version will feature a multi-million dollar airdrop to CUB holders

CUB's base mission is to be the base layer of LeoFinance's DeFi stack.

As the base layer, you can think of CUB as the parent platform to all of the POLYCUB Expansion Bases that reach new blockchains.

Each base of expansion pays back to the base layer: CUB diamond paws who stake in CUB-BUSD, CUB-BNB and the CUB Kingdom.

This means that POLYCUB is just the first in a line of many expansions that LeoFinance is undertaking across the entire EVM landscape.

We're building the future for LEO and CUB simultaneously:

- With each expansion, a new version of Wrapped LEO is created (bLEO, pLEO, aLEO, tLEO) and LeoBridge is extended to handle cross-chain trading

- With each expansion, a new version of PolyCUB is released: airdropping its token back to CUB hodlers

Each expansion is self-sustaining and deflationary. That is the core design of PolyCUB and we're about to find out if it works as we designed it.

Marketing Partnerships: Our Work With Cointelegraph, Coindesk, Brave Browser and Tik Tok Influencers

Here we get to one of the most important questions regarding the release of PolyCUB: Marketing.

LeoFinance continues to grow. Our users are upward trending and we have grown so much since the release of CUB last year.

For this reason and many others, we expect the release of POLYCUB to be even more explosive than the release of CUB.

It's obvious to all of us though that we need to capture all of this attention. We need to bring more users to the LeoFinance Web3 Community and there are many ways to achieve this.

One of many ways is through marketing partnerships.

We're excited to announce, for the first time ever, that we are partnering with Coindesk, Cointelegraph and Brave Browser to do a series of Press Releases, AMAs, Newsletters and Advertisements about CUB's upcoming airdrop and the release of our Polygon Yield Optimizing Platform - POLYCUB.

This is an incredibly arduous undertaking. We've got dozens of PRs already lined up to go out and AMAs with all of the biggest Crypto News outlets.

We're going to make waves with PolyCUB and capture all of that attention with LeoFinance's Web3 Ecosystem.

We learned a lot from the launch of CUB and that's why we've spent the last 7 months preparing for the release of POLYCUB.

The PolyCUB Airdrop UI

The airdrop UI will go live tonight in preparation for the launch. On this UI, you'll be able to calculate your pending airdrop and then the Claim button will take you to the page on PolyCUB where you can claim, trade, stake and earn yield.

We are about to change the LeoFinance Web3 Ecosystem forever. Are you ready?

Keep your eyes glued to the @leofinance account and other official channels for dozens of daily pieces of content explaining POLYCUB and our launch. It's going to be MASSIVE on all levels. We can't wait 🦁

LeoFinance is a blockchain-based Web3 community that builds innovative applications on the Hive, BSC, ETH and Polygon blockchains. Our flagship application: LeoFinance.io allows users and creators to engage and share content on the blockchain while earning cryptocurrency rewards.

Posted Using LeoFinance Beta