With the launch of pHBD, we set out on an important mission to grow the Hive Ecosystem. HBD's fixed interest rate being raised to 20% is one of the best moves that Hive has ever made as a blockchain, community and crypto project.

The problem that remains is getting your hands on HBD you can see this as a resounding effect ever since the HBD savings rate was raised from 12% to 20%. People are trying to acquire as much HBD as they can but it is incredibly difficult to buy it on the open market. Exchanges like Bittrex have no liquidity, listings like Binance are non-existent and the internal market is only wortwhile to buy a few hundred dollars worth at a time.

Enter pHBD.

How pHBD Solves the Liquidity Problem for HBD

pHBD is a wrapped version of HBD that the LeoFinance team deployed on the Polygon network. Along with this launch, we listed pHBD-USDC as a liquidity pool on the Sushiswap decentralized exchange.

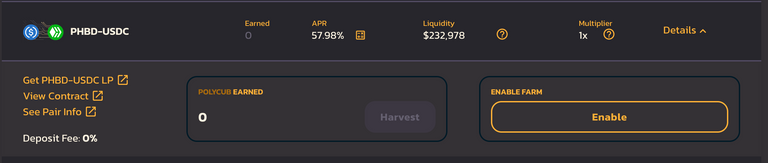

Yesterday, we released the pHBD-USDC Farm on PolyCUB. The Farm is currently paying a 57.98% APR or 78.49% compounded APY.

Compared to the base fixed-interest rate for saving HBD on the Hive blockchain, this is nearly 3x higher.

The reason for this high APY is to incentivize HBD liquidity to enter this pool. Building deep HBD liquidity is incredibly important for the future adoption of the Hive ecosystem.

We're working as hard as we can to develop more incentives for staking HBD into the pHBD-USDC pool. We want HIVE to succeed... badly. It directly impacts LeoFinance and all of our applications. More on this later.

Liquidity

Right now, there is $232k in liquidity on the pHBD-USDC pair. It's been less than 24 hours so this is a great start. Our goal is to develop this into a $5M liquidity pool. $5m gives a great deal of flexibility for pHBD to continually grow and ultimately allow DeFi whales to onramp and offramp into the Hive ecosystem through HBD savings.

DeFi Whales

I've spoken with - likely - approaching over a hundred DeFi whales. We talk about LeoFinance, CUB and POLYCUB but lately I've also mentioned HBD. HBD is the longest-standing stablecoin in the entire crypto industry.

This being said, most people have never heard about it or how it works. I explain the ecosystem of Hive to them and how HBD maintains its peg and they are fascinated by it. It seems like HIVE and HBD have the potential to gain even a fraction of the market share that LUNA and UST have.

Imagine that... Billions of dollars flowing into the Hive ecosystem. That could radically change the lives of all of us here on Hive. All of the apps on Hive would benefit and all HIVE hodlers would get far wealthier. All of this is great for Hive and great for LeoFinance.

So why don't they throw their money into HBD? I've told a few to buy up even $20k or $100k of HBD which is peanuts for people of this caliber who stake stablecoins in other platforms like Anchor.

Their issue? Entrance and Exit Liquidity.

See, DeFi whales - and really any investor, for that matter - need to have the ability to enter a position with low slippage and exit their position at any time with low slippage.

Without this characteristic, you could get yourself in an extremely bad situation very quickly. First of all, you'll lose several % on your entrance into the position.

Earning 20% on a stablecoin is great, but not when you lose 5% of your stake off the bat just for buying a position.

Earning 20% on a stablecoin is great, but not when you lost 5% of your stake off the bat AND lose 5% on the way out. That's 6 months of earnings gone just to enter and exit.

pHBD-USDC has the potential to change that. Imagine being able to buy tens of thousands, hundreds of thousands and eventually millions of dollars worth of HBD without paying high slippage costs.

pHBD can achieve this through a number of ways. It all starts with deep liquidity:

- Having deep liquidity allows trades of $10k to go through. Many DeFi whales would be happy legging in $10k at a time

- Immediately after these sizable trades, the internal arbitrage bot buys HBD from other sources (exchanges, internal markets, etc.) and wraps it to pHBD and sells it to re-balance the price and bring pHBD back down to its $1 peg

- Buyers buy up again - rinse and repeat

This allows people to enter an HBD position with low slippage. Under 1% slippage in many cases which is exactly what they want. Then they know that they can do the same thing on the way out. It gives them the peace of mind that they need to hodl a large stake in HBD.

What We Need From Hive - Tell a Friend

What we need from the Hive Community and Ecosystem now is liquidity for pHBD. We need as much HBD as possible to flow into the pHBD-USDC pair. That's why the APR is currently 58%. We're trying to make it as beneficial as possible for the LPs, Hive Ecosystem and the PolyCUB Ecosystem as well.

If you're reading this as a Hive user, make sure you tell every other Hive user you can about the value proposition of pHBD. It's foundational to the success of Hive in the long-run in our opinion: once we seed deep liquidity to the tune of $1M+, we'll be able to start onboarding DeFi whales into stablecoin positions who will hodl HBD in the LP or on-chain for 20%.

- There is no deposit fee for depositing liquidity in pHBD-USDC (for the time being, to incentivize early liquidity providers)

- The pool is currently $238k which allows some smaller TXs around $500-$1000 to be pushed through with minimal slippage. More liquidity will allow a lot more DeFi users to leg-into an HBD position

Writing Contest:

"Why Every Hive User Should Stake pHBD-USDC If They Want HIVE and HBD to Gain Mass Adoption"

- Tag your post with #phbd

- Winner will get 100 HBD (chosen by the curators)

- All posts tagged with #phbd will get curated by @leo.voter

Posted Using LeoFinance Beta