PolyCUB is designed to be the ultimate long-term yield platform. Sustainable tokenomics meet intense scarcity and deep utility.

At the core of deep utility is xPOLYCUB Governance. Governance allows anyone holding xPOLYCUB to determine what happens on the platform.

As of 7 days ago, we launched the first-ever weekly Yield Dynamic Governance vote. Every week from here forward, there is an ongoing vote to determine the yields on https://polycub.com.

- The mission of LeoFinance is to democratize financial knowledge and opportunities.

- The mission of PolyCUB is to provide our Web3 community members the opportunity to generate long-term, sustainable cash flow with DeFi.

pHBD, pHIVE, pSPS

We've termed these vaults "V2 Vaults" as they are a radical change from the original vault design. By deploying these wrapped derivatives over the PolyCUB Multi-Token Bridge, we've allowed the PolyCUB Platform an opportunity to earn massive value accrual revenue which leads to vastly more sustainability for PolyCUB as a long-term DeFi app.

Yield Wars

With Yield Governance now in place, there is a constant Yield War over which vaults should earn the most.

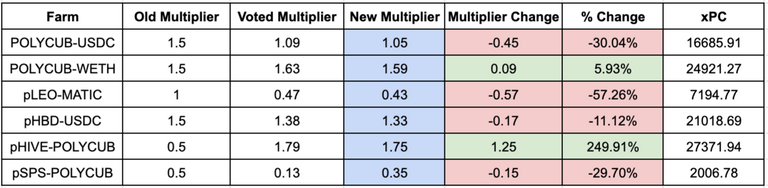

You may REALLY like the results of this first week's Governance vote or you may REALLY hate the results of it.

If you fall into the ladder camp, that may lead you to desire more xPOLYCUB to increase your Vote Strength on the vaults that you are pooling assets.

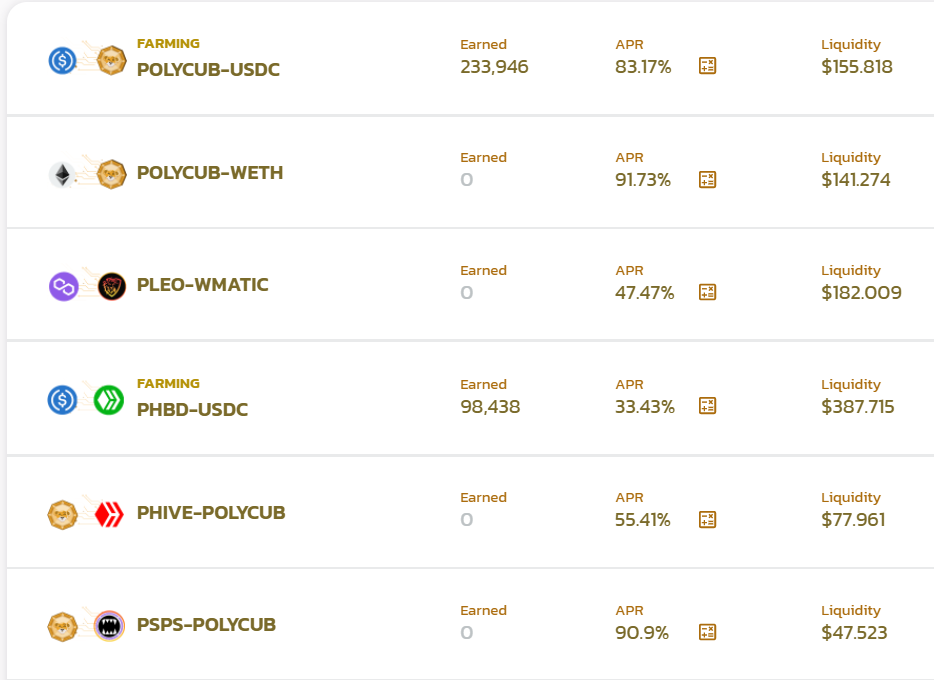

Week 1 Results

A total of 99,199.358 xPOLYCUB was utilized in this week's governance vote. Out of the total 189,679.359 xPOLYCUB that exists, that's ~52% voter turnout.

As yields change, we expect a lot of nascent voters to dive into governance as well as other LP's to buy POLYCUB, stake xPOLYCUB and increase their vote weight on the pools that they want to see rise to the top.

Stack Your HIVE and Provide Liquidity:

Admittedly, it was unexpected that pHIVE would get so much support. Looks like its time to stack up your HIVE and provide liquidity, that vault is getting nearly a 3x increase in the yield allocated to it.

Typically with the weekly snapshot on votes, the yields will update almost exactly 24 hours after - 24 hours is the Timelock Governance Contract we use to delay any operations on our Masterchef for security purposes.

With this first Yield Governance Vote, please allow up to 48-72 hours for the yields to update (though we're aiming to stay on pace with 24 hours, this gives us some extra time since this is the first time we're operating under the new Yield Governance contract).

Votes Carry Over Week to Week

A key component of the weekly Yield Governance is that your previous votes carry over. If you've already voted, then the only time you need to re-cast your vote is if you want to change your votes to a different vault.

Keep in mind: every xPOLYCUB holder has two votes and their xPOLYCUB Voting Power is essentially split in 2 to represent their vote strength on the two chosen vaults.

If a 3rd vote is cast, then it replaces their 1st choice. If a 4th vote is cast, then it replaces their 2nd choice. So on and so forth.

How Quickly Will Yield Dynamics Change?

The first yield vote was anticipated to have a large-scale change on the yield dynamics on PolyCUB.

From here forward, the big changes will likely be due to stakeholder shifts. For example, if someone unstakes a lot of xPOLYCUB or someone else stakes a lot of xPOLYCUB to try and change the vote.

Since LeoFinance's Web3 Ecosystem is cohesive, we also expect a lot of posts to come out where people aim to band together support to overthrow the #1 vault and try to raise their favorite vault to the highest yield status.

The Long-Term Vision of Governance on PolyCUB

PolyCUB's long-term mission is and has always been to create the opportunity to generate long-term, sustainable cash flow with DeFi. Right now, there is a massive discussion in the DeFi space about long-term "Cash Flow Life". We believe that PolyCUB will be one of the few platforms that can sustainably, reliably and securely deliver long-term yields.

Most people are focused on the next 5 minutes, PolyCUB is focused on the next 5 years.

Next on the roadmap for Governance...

Governance UI

Now that we've got our governance contracts deployed and we're tweaking it as we go, we're gearing up to release the Governance UI. There's a process to these things and getting the backend in order before releasing a frontend for it has been vital. Thank you for your patience as we get this together, we know it's a bit of a hassle to manually vote with your Metamask/Web3 wallet.

vexPOLYCUB

vexPOLYCUB stands for Voting Escrow xPOLYCUB. As complicated as it sounds, it's actually quite simple.

It's an amplifier for xPOLYCUB Voting Strength. It will allow anyone to lock their xPOLYCUB stake for 2.5 years and amplify the strength of their governance vote.

One of the major impacts that this will have on xPOLYCUB Governance is actually seeking to redistribute voting power to those who have the longest-term vested interest in the success of the platform. It allows non-whales to amplify their voting weight and compete with whales.

This is something that we straight up copy/pasta'd from Curve and it works extremely well.

There is a whole community out there of CRV holders that stake their CRV as veCRV to create what they call "Cash Flow Life".

Our goal is that POLYCUB is viewed as an asset that you buy and stake to get long-term yields. You may stake it in POLYCUB-WETH or pHIVE-POLYCUB to earn yield and keep it liquid or you may stake it as xPOLYCUB or vexPOLYCUB to earn amplified, single-staking yields + have a heavy impact on Governance.

Most of us dream of a "Cash Flow Life" setup. PolyCUB aims to deliver it and we're just getting started.

LeoFinance is a blockchain-based Web3 community that builds innovative applications on the Hive, BSC, ETH and Polygon blockchains. Our flagship application: LeoFinance.io allows users and creators to engage and share content on the blockchain while earning cryptocurrency rewards.

Posted Using LeoFinance Beta