Image created with Night Cafe Studio

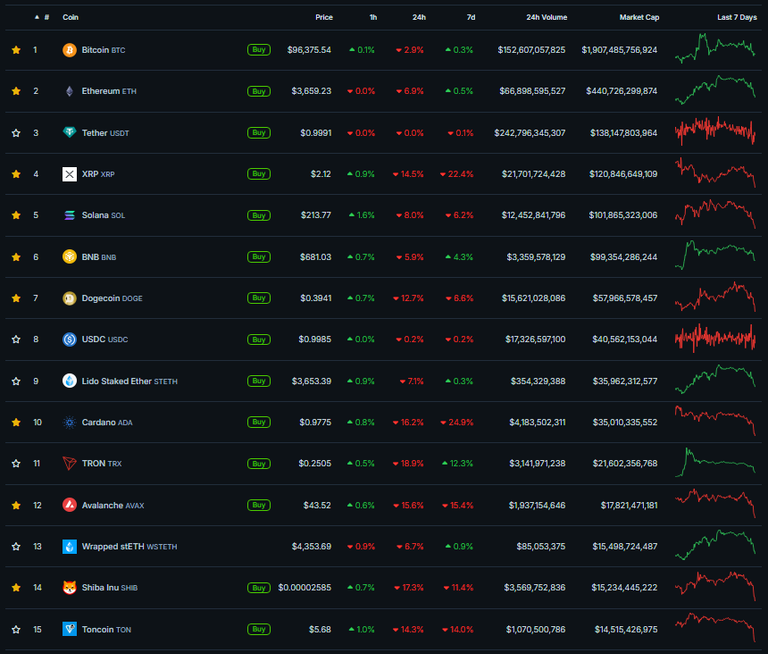

So I woke up rather early and was surprised to see my portfolio in a sea of red. After somewhat recovering from my initial shock, I went online to search for answers why. It seems that the crypto market experienced several liquidations totalling around $1.5b. This after $BTC dropped below $100k another time. While bitcoin lost around 3% in 24 hours, alt coins were harder hit with some losing 20% of their value.

What Should I Do?

In cases of severe market drops, we investors should have a trading plan and stick to it. A trader's greatest enemy are his emotions: fear and greed. We should keep a level head and go back to our trading plan.

Avoid Panic Selling

Market volatility is common in crypto. Selling during a sharp decline can lock in losses. Assess your portfolio’s long-term strategy before taking action.

Focus on Fundamentals

Despite short-term turbulence, blockchain and cryptocurrency adoption remain on an upward trajectory. Instead use this dip to look for projects with strong fundamentals and real-world use cases. I avoid meme coins and don't invest much in them.

Risk Management

Check your position size so that not one asset that loses can burn your whole portfolio. Consider diversifying your holdings to around five to ten cryptos.

Look for Opportunities

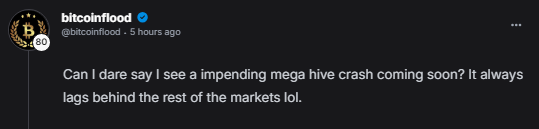

Earlier while I was in threads, I chanced upon the below post by @bitcoinflood and I realized, He's right! No way $HIVE can sustain 40 cents while others are dumping. It was only a matter of time.

So I swapped my liquid Hive to HBD and will wait for an ideal price to buy back.

Conclusion

While today’s selloff shows the inherent volatility of crypto, it's also an opportunity to profit. Periodic corrections often precede renewed rallies as the market finds a healthier footing. Investors or traders with a clear head could view this as an opportunity to capitalize on lower prices.

Thank you for reading!

Posted Using InLeo Alpha