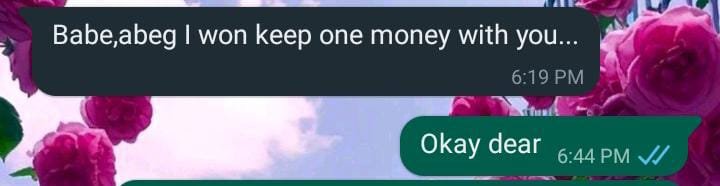

I often find myself receiving messages from friends, earnestly seeking my assistance in managing their finances and saving money. Although I can’t help but find their requests somewhat amusing, it does make me wonder why some grown-ups struggle with the concept of saving. Perhaps these individuals are reminiscent of those who would happily break their piggy banks just days after purchasing one or, for nostalgic purposes, use scissors to extract coins from a wooden or steel piggy bank during their childhood.

Image Design using Canva

As for me, saving money has never been a daunting task. It all boils down to determination and having well-defined objectives for the funds at hand. I believe that having a clear plan in place for utilizing one’s savings provides the motivation needed to accumulate wealth. However, the frequency of such requests from friends is steadily increasing, leading me to humorously refer to myself as a “living bank.”

In this kind of situation, it’s no wonder that platforms like daily, monthly thrift, piggyvest, and similar initiatives have come to the fore. These platforms not only provide convenient mechanisms for saving money but also offer a sense of accountability. By entrusting their funds to such platforms, people can be assured that their money is secure, and there is little risk of someone absconding with it.

While the notion of being the go-to person for financial assistance may seem flattering at first, it does come with its fair share of challenges. For instance, there are situations that may deter one from actively engaging in such practices. Losing a phone or an ATM card could potentially lead to complications in managing the finances of others. It is important to be cautious and mindful of these circumstances to maintain the trust and reliability that friends have placed in you.

image is mine

IMAGE IS MINE

Ultimately, the existence of these savings platforms reflects society’s recognition of the need to instill discipline in our spending habits. The ability to save money is not just about setting aside a portion of our income but also about developing the self-discipline to resist impulsive purchases and focus on long-term financial goals. By inculcating the value of discipline in our financial behavior, we can pave the way for more substantial saving.

In conclusion, while I may occasionally think i am a “living bank,” the essence of helping friends manage their finances goes beyond humor. It highlights the importance of financial literacy and responsible spending, empowering individuals to create a better and more secure future for themselves. By embracing these principles and leveraging the convenience of modern savings platforms, we can all take charge of our financial destinies and make our hard-earned money work for us in the best possible way.