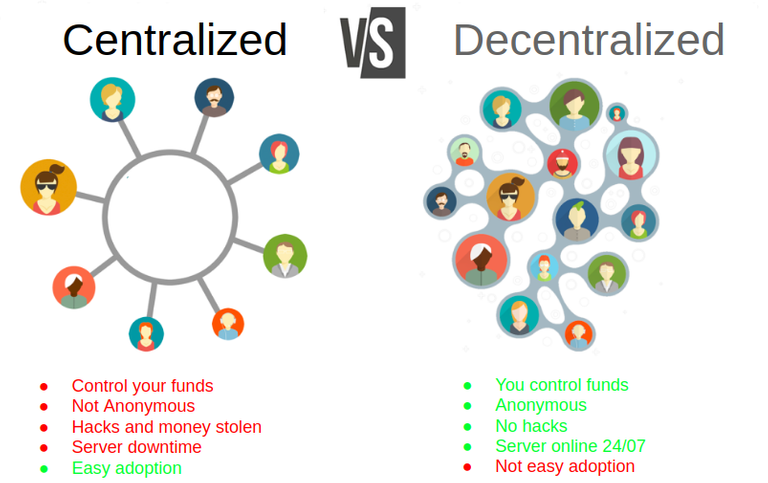

A decentralized cryptocurrency exchange is not a centralized network. Both exchanges monitor the activity of users. Centralized exchanges require users to verify their corporate or personal information before being allowed to purchase or sell cryptocurrencies. However, it is not without risks. Listed below are some of the advantages of a decentralized exchange.

Investing on decentralized exchanges is safer

There are several benefits to investing on decentralized cryptocurrency exchanges. First of all, they offer greater protection. Most centralized exchanges are vulnerable to hacking. However, previous experiences have led to numerous security upgrades. Also, decentralized exchanges offer no risk of losing funds. So, if you're looking to invest in cryptocurrencies, a decentralized exchange is the better choice. Listed below are the three main reasons why investing on decentralized cryptocurrency exchanges is safer.

When investing on a centralized cryptocurrency exchange, your personal details are protected. A centralized exchange monitors every transaction and holds your account's personal data. Moreover, they collect and verify your personal information, which makes them less safe for privacy. So, it's always best to invest in decentralized exchanges. But which cryptocurrency exchange is the safer option? The answer depends on your personal needs and your preferences.

They are more transparent

Both centralized and decentralized cryptocurrency exchanges operate in a similar manner. They allow users to trade cryptocurrencies and other assets, but a centralized exchange has a middleman, who is responsible for managing the trades and handling the assets. In the decentralized world, trades are executed between users. Both types of exchanges offer a range of benefits, but decentralized exchanges are generally more transparent and easier to use.

Firstly, decentralized exchanges offer a wider range of currency options. A centralized exchange offers a list of approximately one thousand coins, whereas a decentralized exchange offers a list of only fifty. A decentralized exchange is the best choice for investors who wish to invest in less popular cryptocurrencies. However, decentralized exchanges are also less accessible for non-technical users and have limited functionality.

They are safer

There are several differences between centralized and decentralized cryptocurrency exchanges. Those with centralized exchanges have better infrastructure, whereas those with decentralized exchanges have fewer advantages. The main differences between the two types of exchanges are liquidity, security, and regulatory oversight. Centralized exchanges were the first to enter the market, but they have a competitive advantage over decentralized exchanges. Furthermore, centralized exchanges offer more services such as spot trading, margin trading, and portfolio management tools. Moreover, DEXs are limited in terms of order types.

A decentralized exchange is less vulnerable to hacking because there is no'middle man'. Unlike centralized exchanges, they work as peer-to-peer exchanges, and they are safer because of smart contracts and atomic swaps. The use of smart contracts, which are based on blockchain technology, ensures no single point of failure. While centralized exchanges are more secure, there is still a potential for them to be hacked.

They are less vulnerable to hacking

A significant difference between centralized and decentralized cryptocurrency exchanges is their security. A centralized exchange has a single point of entry into the network, making it vulnerable to hacking. On the other hand, a decentralized exchange has no such single point of entry. This means that any hacker would have to access more than half of the chain to gain control of it. This is much harder to do with a decentralized exchange.

In recent years, centralized cryptocurrency exchanges have been the target of hackers. These sites store user assets in "hot wallets," which are connected to the Internet. Since these are more accessible to hackers, they are more likely to be attacked. Some of the largest heists in crypto history took place on centralized exchanges. The Coincheck hack, which resulted in a theft of $530 million, is one example of this.

Posted Using LeoFinance Beta