BlackRock has surpassed Grayscale to become the largest collective holder of on-chain assets through its exchange-traded funds (ETFs). This milestone underscores a growing trust in digital assets like Bitcoin and Ethereum among institutional investors, driven by the increasing approval of crypto ETFs.

According to a report by Arkham Intelligence, as of Friday, August 16, 2024, BlackRock's holdings in its IBIT and ETHA ETFs reached an impressive $21.22 billion. This figure surpasses Grayscale's combined holdings of $21.20 billion across its GBTC, BTC Mini, ETHE, and ETH Mini funds.

Grayscale Maintains Larger Overall Holdings

Despite BlackRock's new leading position, Grayscale still holds a larger overall balance, primarily due to its GDLC fund, which manages around $460 million in assets. Unlike BlackRock's ETFs, the GDLC fund is not an ETF, allowing Grayscale to maintain a broader market share. However, BlackRock's rapid rise, particularly following the launch of its Bitcoin ETFs in January, positions the company as a formidable competitor in the cryptocurrency sector.

Bloomberg's ETF analyst, Eric Balchunas, has predicted that if the current growth trend continues, BlackRock's IBIT ETF could surpass Satoshi Nakamoto's Bitcoin holdings by 2025. Balchunas remarked, "U.S. ETFs are on track to overtake Satoshi in Bitcoin holdings by October. BlackRock alone is already in third place and could become number one by the end of next year."

Recent market data reflects this growing interest in BlackRock's crypto products. Last week, digital asset investment products saw inflows of $176 million, with BlackRock's ETFs alone attracting $408 million. In contrast, Grayscale's ETFs experienced significant outflows, totaling up to $552 million, highlighting a shift in investor preferences.

Institutional Preference for BlackRock’s ETFs

The appeal of BlackRock's ETFs is further demonstrated by large financial institutions like Capula Management, Goldman Sachs, and DRW Capital increasing their stakes in IBIT. This stands in stark contrast to Grayscale, which is facing client redemptions due to the growing competition from spot Bitcoin and Ethereum ETFs. A key factor contributing to Grayscale's struggles is its high fee structure, with charges of 2.5% compared to an industry average of 0.25%.

In response, Grayscale has launched its new Mini ETH ETF with lower fees in an attempt to stem the outflows from its flagship ETHE fund. This move reflects a broader trend, as Grayscale's Bitcoin Trust also faced significant outflows following its conversion earlier this year.

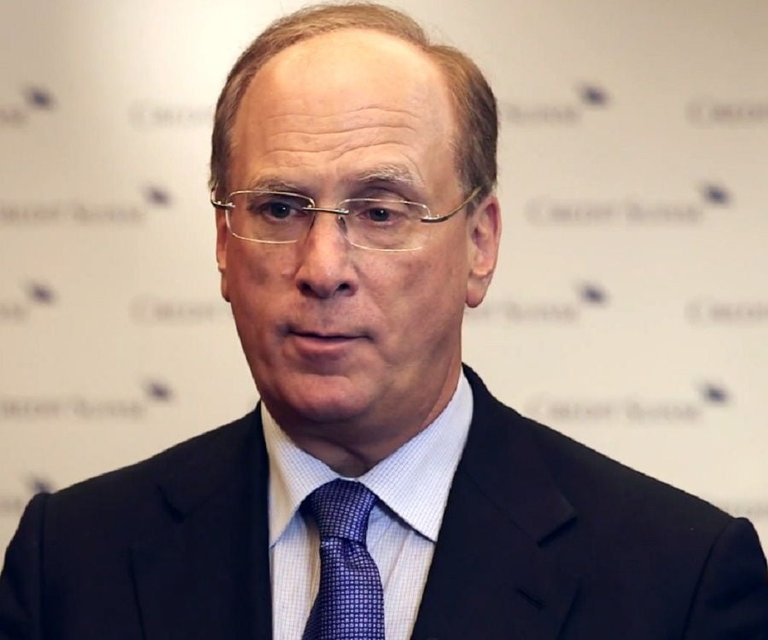

BlackRock CEO Larry Fink Recognizes Bitcoin as “Digital Gold”

Further deepening this narrative, BlackRock CEO Larry Fink recently made a significant statement regarding his change of perspective on Bitcoin, marking a turning point in institutional attitudes towards cryptocurrencies. Previously skeptical, Fink, like many traditional financial leaders, had dismissed Bitcoin as a passing fad or too volatile to be taken seriously. However, the growing adoption of BTC and other cryptocurrencies by institutional investors has led Fink to reconsider.

In a recent interview, Fink described Bitcoin as "digital gold," a comparison that highlights its increasing role as a store of value in an era of global economic uncertainty and rising inflation. Calling Bitcoin "digital gold" is not just a powerful metaphor but also a recognition of the asset's role in investor portfolios as a safe haven during financial turbulence.

Fink also stated that Bitcoin represents "a legitimate financial instrument," a significant departure from his past criticisms that could positively influence the institutional perception of the cryptocurrency. He emphasized Bitcoin's potential to offer uncorrelated returns, which is particularly attractive to investors seeking diversification and protection against systemic risks.

Finally, Fink suggested that Bitcoin might be viewed as a particularly suitable investment tool during periods of fear and uncertainty, reflecting the growing awareness of the global financial system's instability and the search for alternative assets that can provide security in difficult times. This shift in stance by such a prominent financial figure could not only influence BlackRock's investment strategies but also pave the way for broader adoption of Bitcoin and cryptocurrencies by other large financial institutions.