Bitcoin has frequently been criticized for its high energy consumption, which some argue contributes to climate change. However, new data suggests that Bitcoin may actually function as a “net-negative emissions” network—meaning it removes more carbon from the atmosphere than it emits. This shift implies potential environmental benefits.

Scientists identify greenhouse gases like carbon dioxide (CO₂) and methane (CH₄) as major contributors to climate change, with most emissions resulting from human activities that rely heavily on fossil fuels. Notably, climate tech investor Daniel Batten argues that Bitcoin now ranks as one of the most sustainable industries worldwide, with around 57% of its mining energy derived from renewable sources such as solar and wind. This percentage represents a substantial increase from 33% in 2020-2021.

Batten, also an environmentalist, highlights that hydropower is the leading energy source for Bitcoin mining. He likens Bitcoin’s impact to electric vehicles (EVs), noting that Bitcoin can reduce net emissions by substituting high-emission sectors like gold storage and banking. Bitcoin’s energy-efficient "Layer 2" protocol, the Lightning Network, also scales transactions with far lower carbon footprints than conventional systems like Visa.

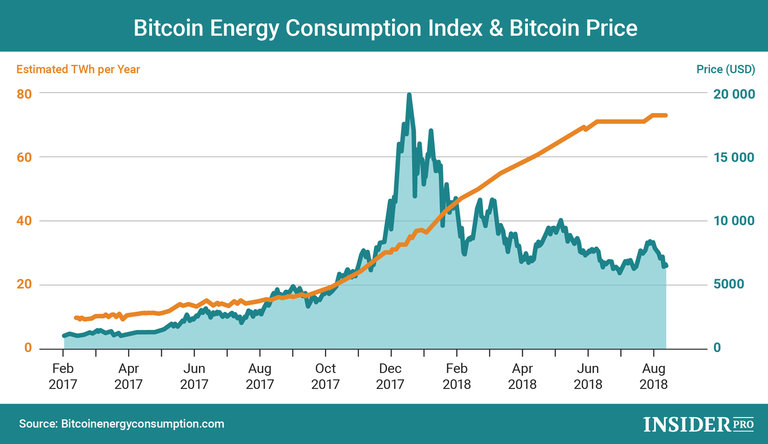

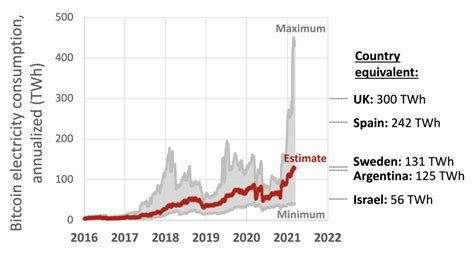

While Bitcoin mining does consume a significant amount of energy—reportedly over 121 TWh in 2023, sufficient to power the Netherlands—these metrics are often based on outdated data that critics leverage to portray Bitcoin as environmentally unsustainable. For instance, studies from institutions like the University of Hawaii and the United Nations have cited fossil fuel reliance in Bitcoin mining and suggested that it could increase global temperatures. However, according to Batten, these arguments ignore Bitcoin’s evolving energy profile.

A key metric often debated is Bitcoin’s energy use “per transaction,” with some suggesting that energy consumption rises with transaction volumes. Batten refutes this, clarifying that Bitcoin’s energy use is driven by mining rather than transaction volume; thus, scaling up transactions doesn’t inherently increase energy use or emissions.

Bitcoin’s net environmental impact, however, goes beyond its energy sources. Mason Jappa, CEO of Blockware Solutions, argues that Bitcoin’s energy use should be assessed by the value it secures rather than by transaction count. He points out that Bitcoin’s energy-intensive mining operations secure a store of value with a market cap of around $1.4 trillion. Comparatively, Bitcoin's energy use is smaller than other high-security sectors, like the global banking system and gold industry. Studies reveal, for instance, that traditional banking consumes about 4,981 TWh annually—roughly 40 times more than Bitcoin.

In terms of efficiency, Bitcoin mining has seen significant advancements. The Bitcoin Mining Council reports a 50% reduction in emissions intensity over the past four years. Furthermore, modern mining hardware has achieved energy efficiency improvements between 200 to 1,000 times over the past decade, with most mining setups now being nearly 100% recyclable. This progress highlights the potential for Bitcoin to balance high energy use with sustainability.

Batten and other advocates underscore that Bitcoin mining’s future impact depends on transitioning fully to renewable and alternative energy sources. At the recent Proof-of-Work Summit in Germany, Batten described Bitcoin’s progress toward becoming a “negative emissions network,” with both environmental and humanitarian benefits. As mining operations increasingly incorporate renewable energy, they could even stabilize power grids by participating in demand response programs.

One promising avenue for Bitcoin is harnessing landfill methane, a potent greenhouse gas that has 84 times the warming potential of CO₂ over 20 years. Landfill methane can power mining operations, transforming an environmental liability into a clean energy source. Batten notes that just this year, landfill-based energy sources helped offset roughly 7.5% of Bitcoin’s total emissions, and that additional methane-capturing facilities could further reduce Bitcoin’s carbon footprint, while generating profitable carbon credits.

Batten argues that capitalizing on landfill methane may be more economical for miners than solar investments, as it reduces emissions per dollar by a factor of 45. Companies like Grid Share in New Zealand exemplify this approach, with plans to mine Bitcoin using landfill gas from a South American site. Once operational, the facility is projected to offset 114,000 metric tons of CO₂-equivalent emissions annually—a figure that surpasses Iceland’s massive “Mammoth” carbon capture project.

According to Batten, Bitcoin is uniquely positioned to address some of the world's most urgent environmental challenges, with the potential to draw billions in sustainable capital. By shifting the narrative, Bitcoin advocates hope to attract institutional investments focused on long-term sustainability.