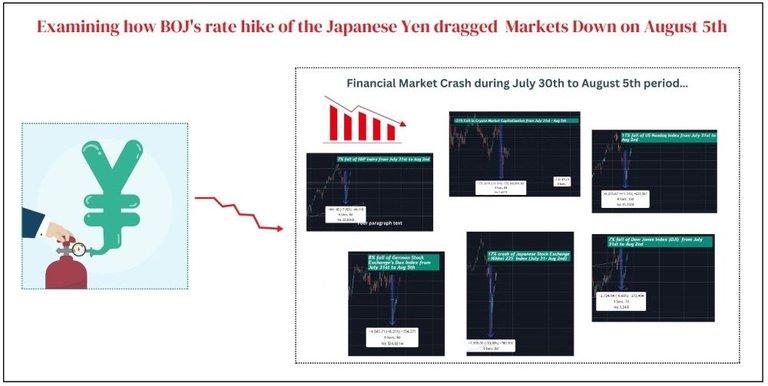

Increase in value and interest rates of JPY causing the August 5th Market crash

One of the interesting factors behind the August 5th Market crash has been the appreciation of JPY in the foreign exchange market.

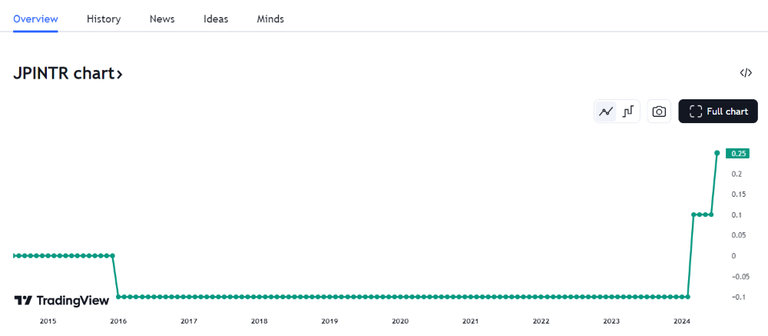

This appreciation of JPY took place after the Bank of Japan (BOJ) began raising interest rates in March of this year. Before March since 2016, borrowing JPY was very cheap as interest rates were below 0% at -0.1%.

Now, suddenly with the BOJ hiking interest rates, the borrowing cost of JPY became expensive. This led to traders who were leverage trading with borrowed JPY, selling off their assets to pay off their borrowed yen, which led to the Market crash of both traditional Finance and crypto Markets.

Market Makers began to fund their trades by borrowing JPY as it was inexpensive

BOJ had first hiked interest rates in March 2024 to 0.1%. After this hike, on July 31st, there was another interest rate hike of 0.25%.

Tradingview chart showing BOJ's interest rate hikes on JPY

As these hikes took place JPY began to appreciate against major currencies like USD.

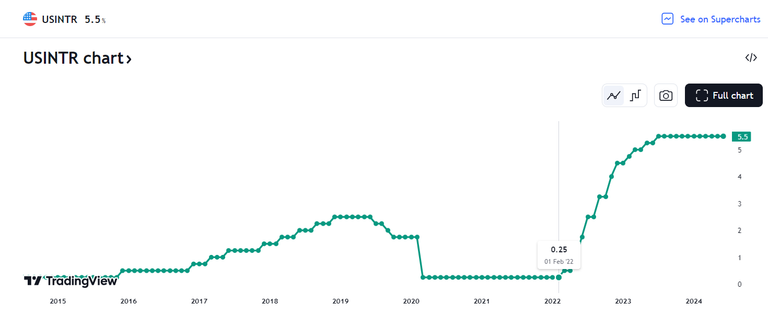

Ever since the US FED began hiking interest rates in March 2022, USD became an expensive currency to borrow. Interest rates on borrowing USD was raised gradually from 0.25% on March 2022 to 5.5% on July 2023 where it now stands.

Tradingview Chart >> US Fed’s systematic interest rate hikes of the USD from 0.25% to 5.5%

As a result, institutional overseas traders began borrowing JPY instead of USD as cost of borrowing JPY was -0.1%, amounting to nothing!

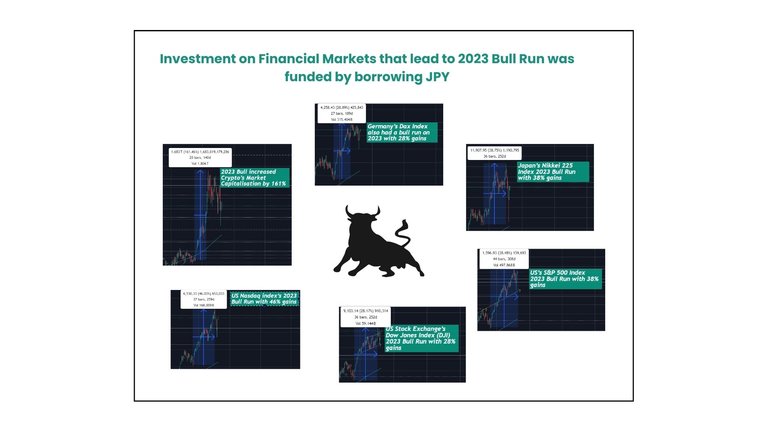

This paid traders off well last year as with borrowed low-cost JPY, investing on both Stock Market and Crypto Market was profitable with both markets experiencing a Bull run.

Amplified risks for traders trading with borrowed money in losing their capacity to pay off borrowed JPY

It is common for traders to engage in margin and leverage trading, especially in a bull market scenario, to get amplified gains.

Here, a trader borrows JPY and purchases collateral using this borrowed JPY amount, and then acquires the trading asset.

For ex, a foreign institutional investor borrows JPY, then purchases USD and uses this USD as collateral to acquire the trading asset.

There are the known risks of a trader engaging in trading assets using borrowed funds be it in margin trading, leverage trading, perpetuals futures trading where traders borrow money and go long or short on a trading asset.

So long as the trading asset’s price moves in the direction that gives the trader profits, the trader would have gains and can pay off his deposited collateral.

However, if this trading asset’s price moves in the direction where the trader incurs losses, the trader is in danger of having that collateral that is procured by borrowing JPY liquidated.

Inevitable to have price falls due to asset sell-offs during times of market volatility

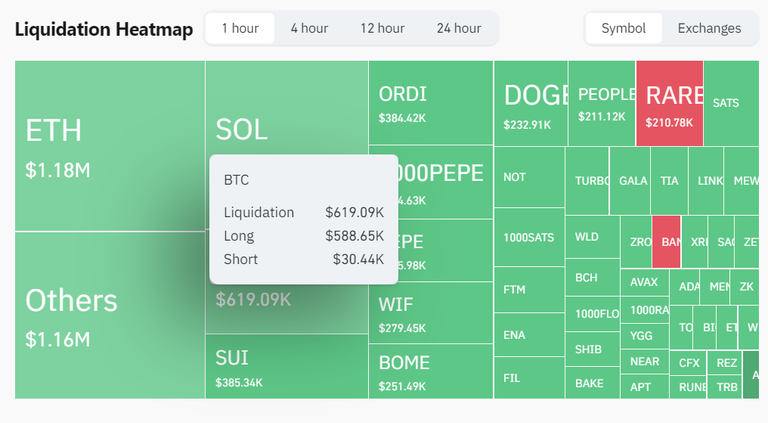

During periods of crypto volatility, these traders that fund their trades with collateral acquired from borrowed money cause further price declines of trading assets be it crypto or stock.

This is because a trader would be forced to sell his trading asset to prevent his collateral from getting automatically liquidated, or his collateral will get liquidated automatically.

The concept here is that when a trading asset’s price is declining, there is the risk of liquidation of deposited collateral.

The trading asset should have the required minimum price value so that it can be sold off to pay off the deposited collateral. When the trading

asset’s price declines beyond that required minimum price value, there will be automatic liquidation.

With today’s modern trader even in crypto trading with leverage, during times of market volatility, there are further pronounced market crashes as their deposited collateral gets liquidated.

These days, traders can deposit their ETH and BTC too as collateral, so when these assets get liquidated, there is a more amplified decline of crypto markets as sell-offs happen.

Huge liquidation also gets triggered during periods of market volatility for leverage traders as a slight price movement leading to loss, can trigger 2x, 5x. 10x level of liquidation.

Markets collapse as foreign investor's JPY loans increase in value!

Now, all this is complicated enough but the scenario gets further complicated when suddenly the JPY loan borrowed by a foreign institutional investor gets costlier because BOJ has hiked interest rates.

As said, before March of this year, interest rates for borrowing JPY was -0.1 and on July 31st it further increased to 0.25%.

For a foreign investor, who has acquired collateral in USD selling borrowed JPY, the loan gets even costlier with JPY appreciating in value against the dollar.

From July 1st - August 5th, USD fell to JPY from 161 to 141 which means less Yen can be procured per dollar. There was a 12% depreciation of value of USD to JPY.

So the trading asset that's borrowed using that USD as collateral which was procured borrowing JPY should be now priced more in value than earlier to pay off this rise in value of the JPY loan.

This JPY loan became costlier for foreign investors not only because of the increased interest rate of 0.25% but also because JPY appreciated against the USD. So, more USD has to be paid per JPY by the borrower than earlier.

[Image Generated by AI software

As can be seen, on July 9th with 0.0006189 USD, 1 JPY could be procured but on August 6th, 0.007061 USD had to be paid for 1 JPY, an increase of 13%.

So, a foreign institutional investor's trading asset should be sold at a price range that's much more in value than before because there is a 13% increase in the value of loan taken in JPY because of JPY's currency appreciation.

Apart from this, loan value has further increased due to increase of interest rates on JPY loans!

All this resulted in either sell-offs of trading assets to pay off loan, or automatic liquidation of collateral.

Thank you for reading! Don’t forget to upvote this article if you enjoyed reading it!

Posted Using InLeo Alpha