The total value locked on DEFI applications has increased 11 times since the beginning of 2021. Favorite categories of investors change frequently in the DEFI industry, but one thing remains the same. Those who make conscious DEFI investments achieve relatively high yields.

In today's article, I would like to briefly touch on what alternatives we have in DEFI and how we can benefit from them.

Lending

Lending applications allow investors to make deposit and loan transactions. Unlike banks, financial transactions are carried out through cryptocurrencies. We earn returns on our crypto deposits through these applications. In addition, we can withdraw loans by assigning deposited cryptos as collateral. We can not argue that these apps provide attractive returns. Still, it's attractive to be able to get a loan in USDC with an annual interest rate of 3% without exchanging our Bitcoin or Ethereum. Especially when we can earn 20% or more on HBD or pHBD. I use AAVE on the Polygon network for this purpose. I have a credit balance of half the value of my Bitcoins.

Blockchain Bridge

Born on the Ethereum network, DEFI has rapidly spread to other blockchains since the beginning of last year. Many blockchains and applications are creating incentive funds to be effective in this area. Being able to move funds securely and economically across blockchains has become essential to catching the most compelling DEFI value propositions. For this purpose, I use Multichain, which supports more than 40 blockchains. I transfer funds mainly using USDC. The fee is 1 dollar and the transfer is completed approx. in 10 minutes.

DEX

Decentrilized exchanges(DEXs), where we can buy and sell crypto without the need for providing KYC, were the most popular DEFI apps of last year. Listing any cryptocurrency on a centralized exchange is a procedural event. Thanks to being permissionless, cryptocurrencies can be easily listed on DEXs. DEXs make use of the infrastructure called an automatic market maker. Investors can obtain high returns by funding liquidity pools created on DEXs. Uniswap, Curve, Sushiswap, and Pankaceswap can be listed as DEX examples.

Yield Farming

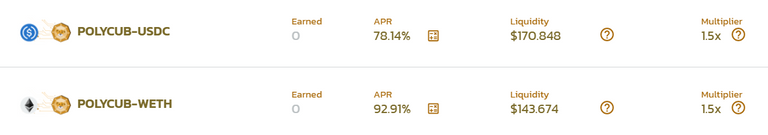

These are the applications that enable easy implementation of strategies that will provide additional returns. The first feature that made yield farming popular was automatic compounding. This feature became more attractive given the high gas fees of the Ethereum network. Leveraging liquidity pool returns by using loans is another yield farming practice. Yield farming applications also provide additional returns to investors through their own tokens. My favorite yield farming application, Polycub, has combined multiple mechanisms that generate commission income with a deflationary token economy. Currently, the USDC-pHBD liquidity pool is delivering 36% annual returns. Farms that include PolyCub are also attractive.

Algorithmic Stable Coin

Algorithmic stable coins are cryptocurrencies that are pegged to one fiat currency and whose value is backed by another coin. Hive community members are familiar with this category through HBD, one of the oldest algorithmic coins. The recent popularity of algorithmic stable coins has been through UST, powered by Terra Luna. A 19% return to UST over the Anchor protocol increased the demand for UST. This led to an increase in Luna's value. I anticipate that the 20% annual interest charged on HBD will have a similar effect on the Hive.

Yield Aggregator

In the DEFI market, hundreds of applications operate on dozens of networks. It is not easy to identify the most attractive investment opportunities, taking into account the security aspect. Yield aggregators allow us to take a quick look at investment options. If we make the investment through these applications, they also undertake the task of compounding the returns. My favorite in this category is BEEFY FINANCE., which offers investment options in 14 different blockchains with security scores.

Liquid Staking

As we are familiar with the Hive blockchain, staking is one of the investment alternatives preferred by crypto investors. This transaction, which takes place on the blockchain, is more secure than DEFI transactions that occur in applications and is easier to understand. However, we cannot withdraw the coins we have staked for a certain period of time. In Ethereum, this period has been determined as the transition date to Ethereum 2.0. Liquid staking applications ensure that the staked coins can be used at any time. Lido, which has Ethereum, Solana, Terra, and Moonriver versions, is the most popular liquid staking application.

DEFI Aggregator

Apps that compare the prices of multiple DEXs and enable us to swap at best rates, provide significant cost savings. DEFI aggregators not only ensure the most affordable swap transaction but also route the transaction to multiple LPs when needed. Thus, we can trade large volumes with low slippage. The main DEFI aggregators are 1inch and Paraswap. I mostly use Paraswap which supports Ethereum, Polygon, BSC, Avalanche, and Fantom networks.

Conclusion

There are many DEFI categories other than the ones I explained above. Services, Options, Payments, Derivatives, and Insurance to name a few. You can find the full list of DEFI categories here.

You may have already used some of the applications I have mentioned above. I suggest trying the others as well. I believe it can have positive effects on the profitability of your crypto portfolio.

Thank you for reading.

Posted Using LeoFinance Beta