This is the one that I've been waiting for.

For about five years at this stage. The original steemit team brought in ad revenue to the site near the end of that cycle to fund development and put a stop to the massive sell off of their ninja mined tokens. It was working out very well with a lot of revenue generated and enough to stop the sell off after a few months.

I still think that it's crazy not to be generating revenue for the chain and it's second layer tokens from ad revenue as our number one activity here is content creation. Money that could be pulled into the system adding value to every tribe, app and account which would strengthen the whole eco-system.

Finally though, one team is going ahead with it. Leo trialed ads previously to great success before focusing on the new front end previously generating thousands of dollars a month in revenue on old site.

Now after many months of waiting we will have The new ad smart contracts.

Everybody should read the full post and all previous posts to get up to date but this has been building steadily for the past three years through trial and error.

Now we will see the updated version.

A version based on a simple concept.

Bring in traffic

Drive up revenue.

The new Leofinance UI launches on the 1st May and the focus is on short form content, user engagement and user experience. All part of the long term plan to build a community with lots of activity and drive up that traffic. A home for the crypto community online.

This combined with a better ads system, better placement and higher payments for these ads should drive up the revenue.

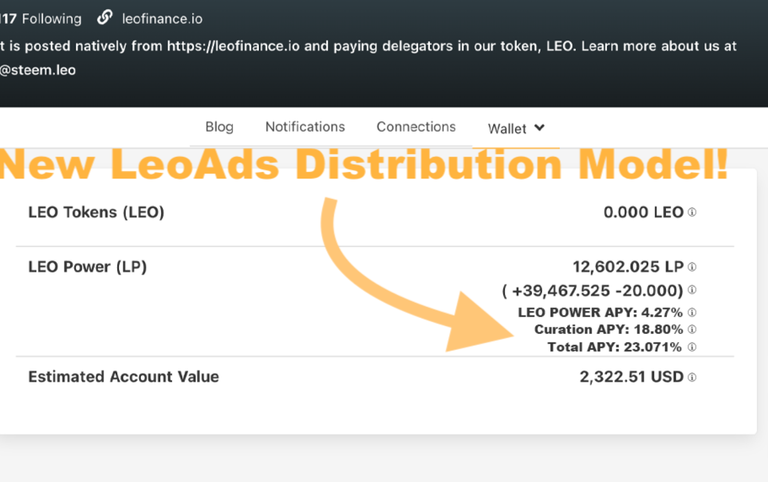

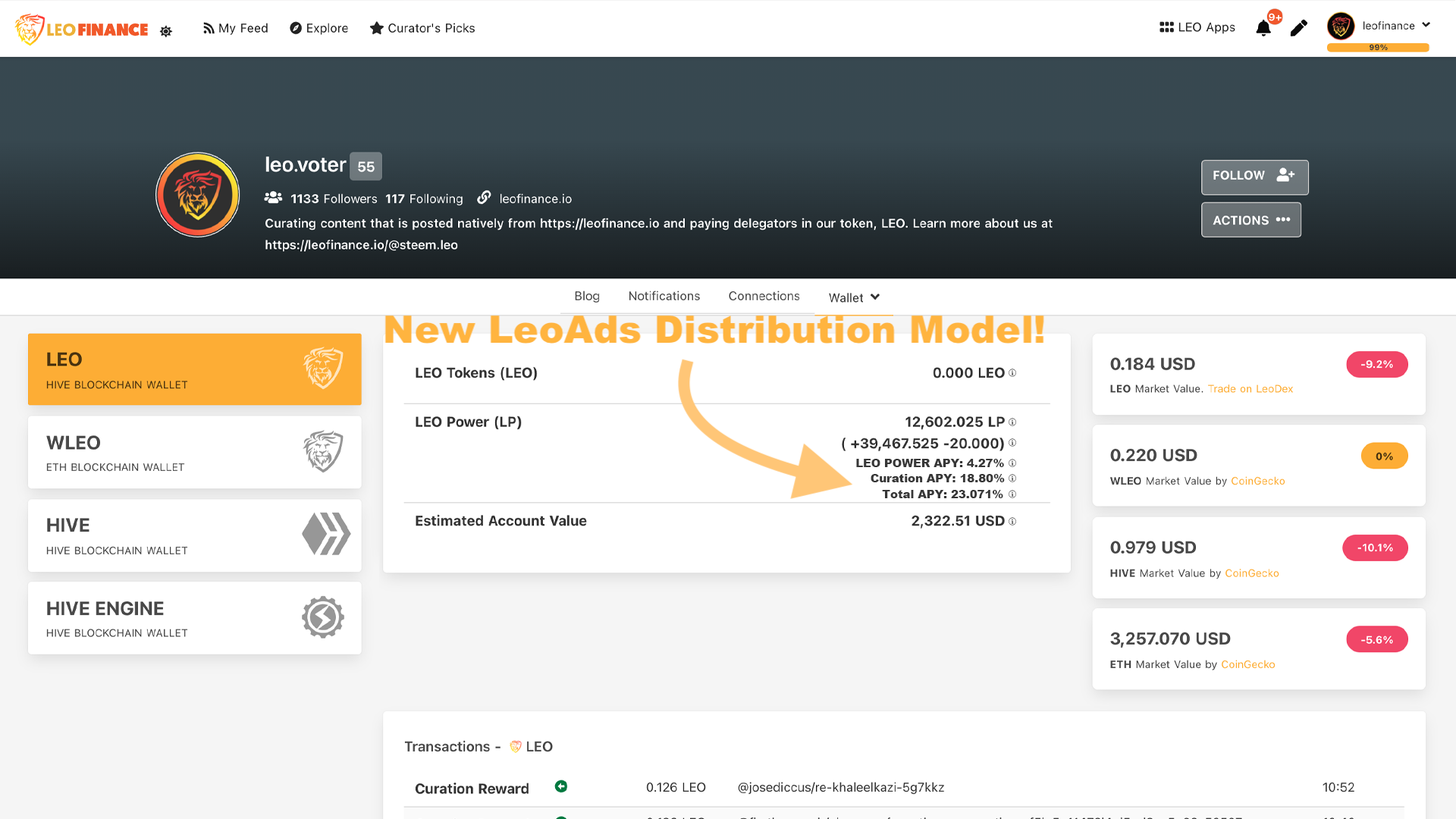

The idea that Jk laid out was a great one: have the automated LeoAds system take the ad revenue each month (it's paid in BTC), buy LEO on one of the 4 exchanges it is listed - whichever has the cheapest arbitrage price (wLEO, bLEO, pLEO or LEO) - then stake it all as LEO POWER into the accounts of everyone already holding LEO POWER.

Simple but effective. External revenue driving the price of the token and creating sustainability.

It's what I and others have been saying for years about hive.

If the LEO front end can do it successfully then the push should really be on peakd to do the same and any other project that is being funded by the DAO. Bring money back into the system after getting funded to build it.

Imagine Hive Power with 30% APR.... Would this be a more attractive proposal than 15% especially without needing to do anything?

I think so as users are more accustomed to staking for rewards than than curating for them.

That is what I am hoping to see here with LEO. The curation is just icing on the cake.

If we can see $10K per month that's closer to 10% APY and with the new ads system I'm hoping to see closer to those numbers.

The daily volume today for LEO is $400 or around $12000 for the month. If we double this with the majority buying LEO it has to have an effect on the market.

It will put more LEO into the hands of the holders. Anybody who sells their extra tokens is just putting them on the market to be bought and distributed back to the holders taking more supply off the market.

The lower the price, the more that is getting bought and handed to the long term holders.

A higher price will be an important piece of the marketing push to new users as the reality of life is that people will follow the money.

If the monetary rewards go up then more people will follow creating a positive cycle.

Despite most of us getting into the trenches of DeFi and putting SocialFi on a bit of a backburner, we're still growing at a great pace. Evergreen content and a hardcore community that is dedicated will do that. We are now faced with an opportunity to expand this on all fronts.

- Grow the userbase.

- Grow the revenue.

- Grow the rewards.

- Grow the the community further.

- Grow the platform

Keep up the positive cycle and if these kpi's can be hit everything will keep moving in the right direction.

Posted Using LeoFinance Beta