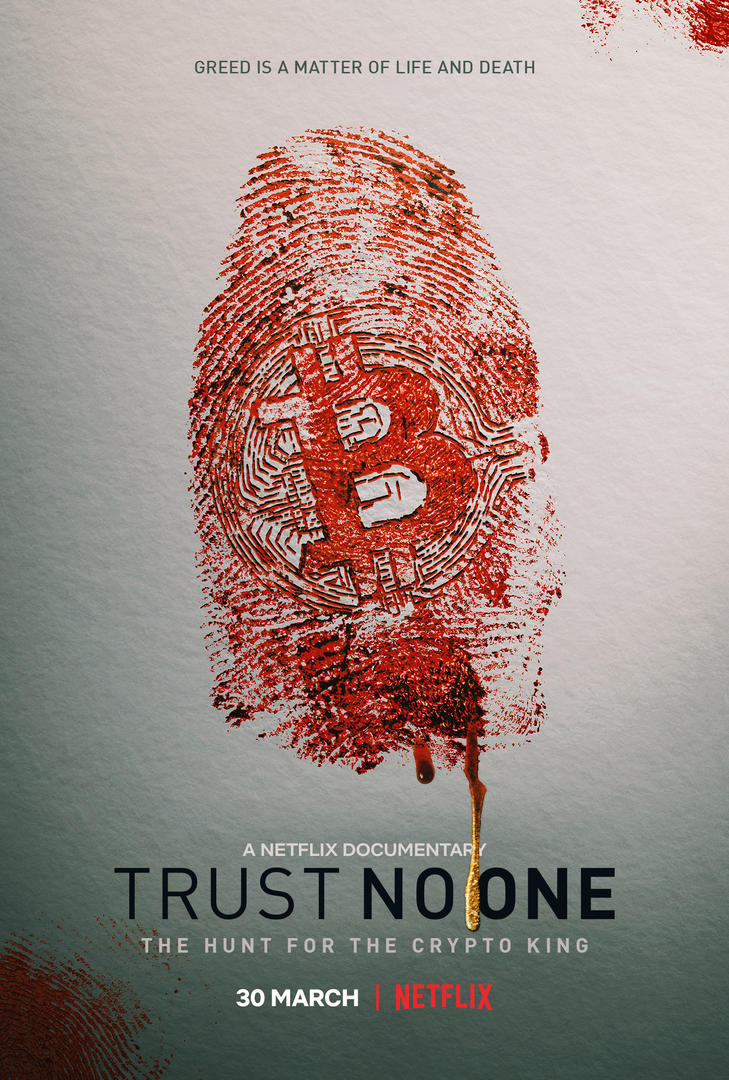

This is a reaction post to the documentary, Trust No One (not a review). In this post, I highlight some of the major talking points in the documentary.

I just finished watching Trust No One on Netflix, and there is a lot to unpack from this story. I spent the last 1hr 30 mins glued to my screen, watching as the story unfolded. Thinking about the story gives me shivers because I have had to question a lot of things about cryptocurrency.

Scams and cryptocurrency are strange bedfellows. This is not to discredit the space. It is new and with every new technology, there are people hoping to take advantage of it for good and bad. Fortunately, we have some of the smartest people in the world running these seemingly simple scams, defrauding people of their hard-earned money.

We often talk about how greed is the major reason people lose money in crypto but that is not always the case. There are genuine people who want to be part of this industry but fall into the wrong hands. For instance, in the documentary, there was a guy who just wanted to move his money without having to use the bank, which is one of the reasons people use cryptocurrency. Being able to transact anywhere in the world with anyone is a luxury not accessible to the average person before cryptocurrency. Unfortunately for the young man, he got caught up in a crypto scam involving an exchange.

Speaking of centralized crypto exchanges. I have never been a fan of keeping a large amount in exchanges. I have heard enough bad news of exit scams like that of Quadriga to do otherwise. But to be frank, exchanges offer certain services that are essential to the crypto space. It would be almost impossible for the crypto space to have grown this large without centralised exchanges but there is a noticeable risk.

In 2018 a group of centralised exchanges ganged up against hive’s sister chain–steem– to take over a chain and its community. It was a calculated effort using their customer’s funds to disrupt a decentralised community. No recompense was made. It took a few weeks of Twitter outrage and everything returned to normal. People lost their money and years of work, and nobody was held accountable

Crypto is the wild wide west, almost anything goes. The space is fairly regulated and there are fewer people to run to when things hit the ceiling which makes security an important part of being in this space. Part of your security checks involves doing your research and finding information about the project you are investing in, however, that did not save a lot of people from losing their money on Quadriga. The founder of the exchange was doxxed. He had a community and some track records. No one would have imagined he was a serial scammer. This is the sort of thing you are up against in this industry.

As much as crypto claims to be trustless, it is almost impossible to run a decentralised community without trust. It is a core part of social and even political structure (online and offline). So it is safe to say that there will always be a risk factor. Do we need regulators in this space? Maybe. I say this with a hint of scepticism because I do not trust them. They are part of the reasons crypto exists today.

In conclusion, There will always be bad eggs in the crypto industry as there are in other industries. I believe as the industry matures many of these scams will be avoided but before we get to that point we need to trust less and hold ourselves accountable by learning better ways to manage our crypto assets without involving a middle man. Trust No One is a great documentary and I will suggest you watch it. Cheers!

Posted Using LeoFinance Beta