Sometimes ago I posted Know your Fundametals. This is a continuation of that post. In order to have a deeper knowledge of Trading the financial market, one has to learn the fundamental Analysis. Just the technical analysis won't make one a good trader

Retail Sales- -> GDP: Retail sales and GDP are positively correlated so if retail sales for a specific quarter is very good we could expect a good gap for that quarter (Higher GDP means better economy)

Retail sales makes up about 70% of the market for most countries and the data is released month on month, so we can get an idea of what to expect for GDP from earl out.

While Retail Sales is monthly GDP is quarterly

Unemployment, Jobless claims, Unemployment rate — Retail Sales- If people are losing jobs they will not have money to spend at the retail level, subsequently affecting GDP on the whole. If less people have jobs then there will be less people buying things, this will result in less retail sales thereby affecting the GDP and if we have less GDP it will lead to Central Banks decreasing Interest Rate: This will make the currency of that Central bank lose value.

Housing Data & Durable goods: This is because more people buying new house will result in more people buying appliances.

PMI (Purchasing Managers Index- This tend to affect GDP); We can use the PMI for a specific quarter for what to expect for the quarter's GDP.

PMI is the indicator of the economy health manufacturing sector: It is based on 5 components:

- New orders

- Inventory Levels

- Production

- Suppliers deliveries

- Employment environment: The employment component is very important because this can be used to predict the Nonfarm payroll

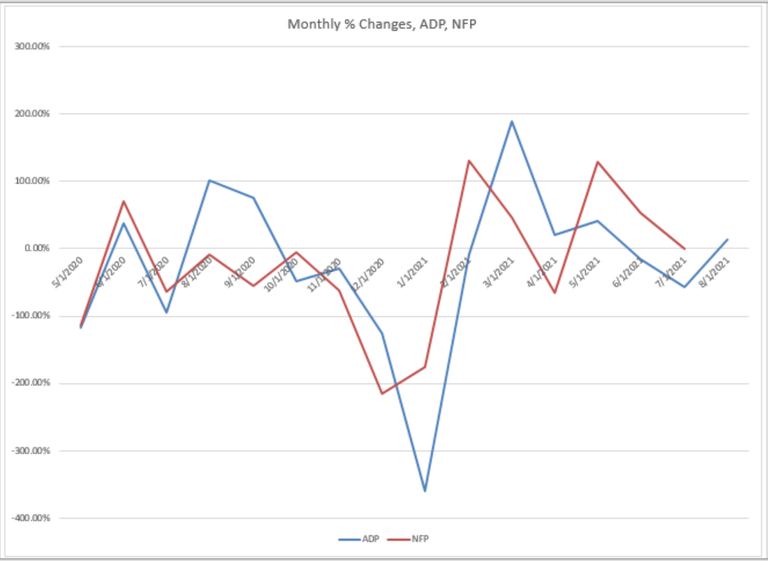

ADP - NFP: US ADP employment report has an impact on the expectation of the Nonfarm Payrolls(NFP). The PMI also affects the expectation of Nonfarm payrolls

The ADP measures the number of confirm private sector it focuses on nonfarm and private sector employment

In Forex the anticipation of the news has a greater impact than the actual news. This is because the market is largely driven by speculation. The actual news outcome is not as important as the anticipation of the news. One thing is to pay attention to the Central Banks.

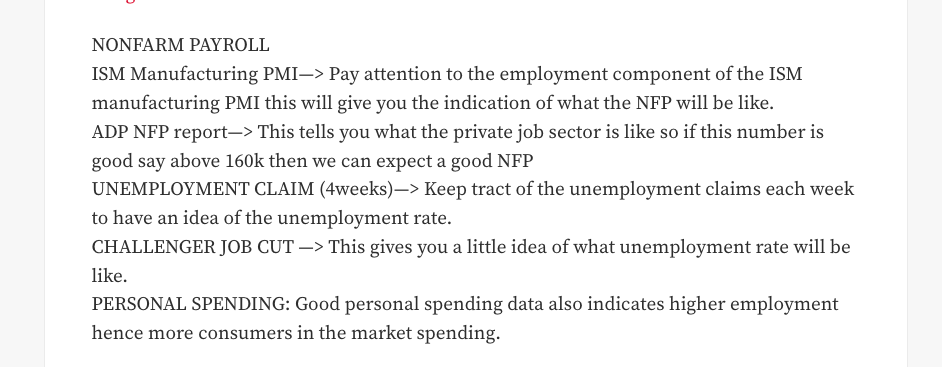

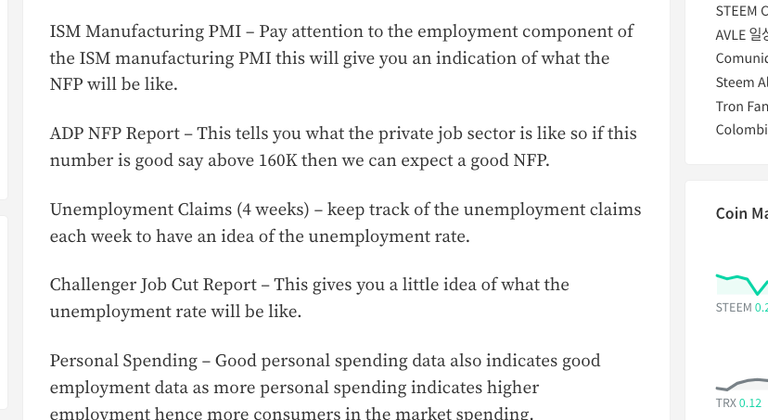

NONFARM PAYROLL

ISM Manufacturing PMI—> Pay attention to the employment component of the ISM manufacturing PMI this will give you the indication of what the NFP will be like.

ADP NFP report—> This tells you what the private job sector is like so if this number is good say above 160k then we can expect a good NFP

UNEMPLOYMENT CLAIM (4weeks)—> Keep tract of the unemployment claims each week to have an idea of the unemployment rate.

CHALLENGER JOB CUT —> This gives you a little idea of what unemployment rate will be like.

PERSONAL SPENDING: Good personal spending data also indicates higher employment hence more consumers in the market spending.

There’s no way of knowing 100% where a currency pair will go because of some new fundamental data.

Also, since most fundamental data are reported only for a single currency, fundamental data for the other currency in the pair would also be needed and would then have to be compared to get an accurate picture. As we mentioned from the get-go, it’s all about pairing a strong currency with a weak one. We like to be a little crazy by saying you should use BOTH!

(Although don’t forget about sentiment analysis, psychology, and risk management as well!). Technically focused strategies are blown to bits when a key fundamental event occurs.

In the same respect, pure fundamental traders miss out on the short-term opportunities that pattern formations and technical levels bring.