Harvest Finance is the decentralized finance platform that allows users to optimize their yield farming strategies by automatically moving their funds between various liquidity pools and protocols to maximize returns. It was the first DeFi protocol I used, and my introduction into yield farming.

The protocol focuses on automating the process of yield farming, where users provide liquidity to decentralized exchanges and earn rewards in the form of tokens. Once a farmer ... always a farmer!

Harvest Finance has evolved from a simple app into a yield powerhouse, offering a broad range of yield strategies and valuable insights into portfolio performance. Since 2020 to date.... the core mission remains intact.

The platform utilizes smart contracts to handle transactions and provide users with a seamless experience, often featuring strategies that can adjust based on market conditions. Users typically deposit their assets, and Harvest Finance takes care of the rest, aiming to maximize yields while minimizing gas fees and other costs.

Why I am bullish on $FARM? Because the emissions ended. There are now 690,420 FARM in circulation, and no more will be created. I still have those $FARM I earned in 2020, staked since the ... haydays! True Chads will know what I'm talking about!

Autumn came with the biggest-ever $ARB distribution campaign, as many Harvest Finance farms were boosted with enhanced yield opportunities. The event has 250,000 $ARB allocated, and farmers are already earning extra tokens. Farmers were able to further enhance ding vaults on top of the highly popular Camelot V3.

You reap what you sow anon! The crops I've got were bags or $ARB, along the auto-compounding yield! Staked my bag of idle $ARB when the Arbitrum farm was launched, and enjoyed an APY above 150% in the first days. The yield was consistent, and helped me farm over 50 $ARB in two weeks.

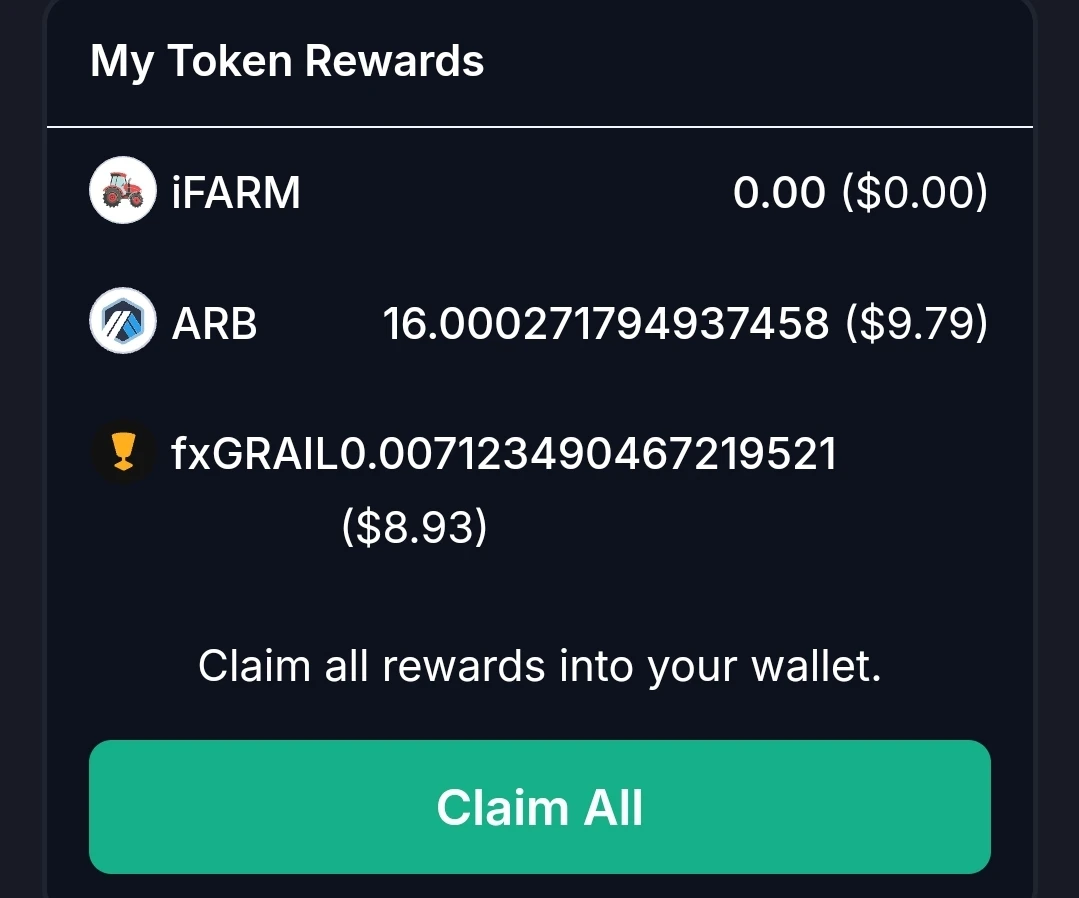

The xGrail farm was also farming extra $ARB, and claimed the rewards from there as well... and staked them as well! I've acted as a true Chad! I converted 67 $ARB into flodestar_ARB and topped up the staked crypto.

The APY fluctuated during October, and went crazy with the November's bull run! The Donald Trump spark fueled higher rewards and the xGrail farm done exceptionally well, with $10 worth of ARB and $9 worth of GRAIL farmed at accelerate speed!

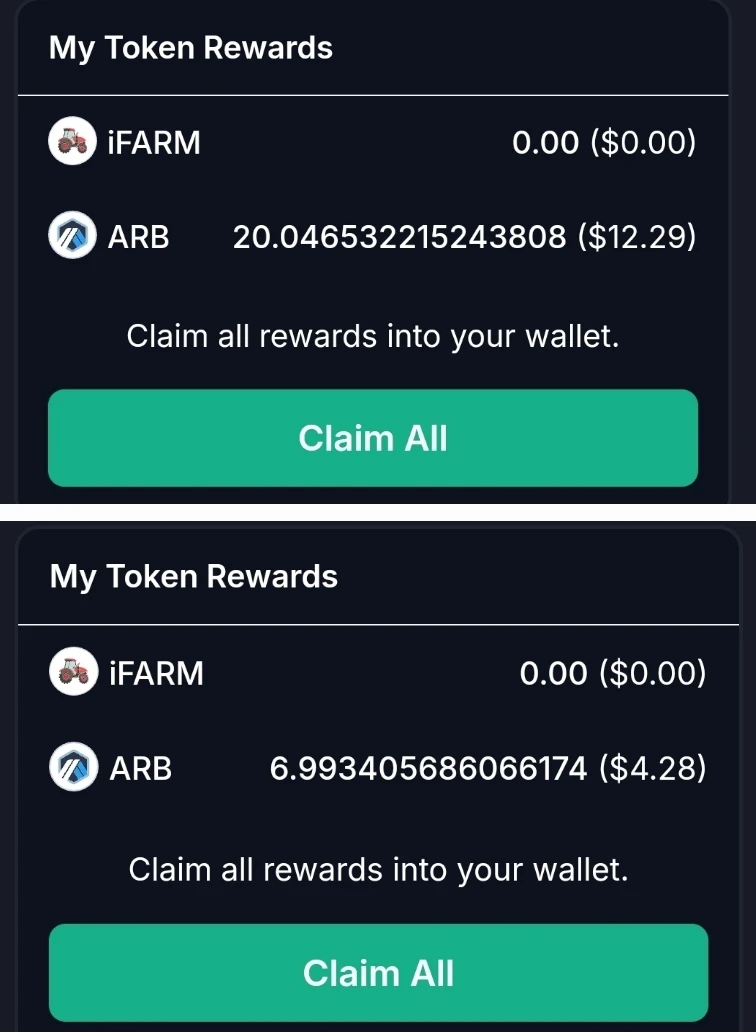

The ARB-USDC pool was launched when the $ARB boost was still ongoing, but this one didn't enjoyed the high APY for long! Once those stopped, the normal yield fluctuated between 20 and 30%. I farmed 20 ARB since I added the pair, and will keep it staked until the APY will drop to a low value.

The rewards in the $ARB pool lowered as well after the distribution campaign ended, and claimed 7 $ARB as a top-up gift. I am a strong believer that the product offering and platform are regaining the spotlight! TWelcome to the DeFI Renaissance!

What's the plan now? What should I do with the $ARB stash I have? I will probably delegate them until a new opportunity arise! Remember to always DYOR!

Residual Income:

Airdrop Hunting: Layer3 / Mode / Linea / Zerion

Lisk: https://portal.lisk.com/airdrop with code : OHbgua

Play2Earn: Splinterlands & Holozing

Cashback Cards: GnosisPay & Plutus

PVM The Author - My Amazon Books

)

)