Let's dive into UmamiFinance Vaults! Deposits are made easy by Across, with intents working behind the scenes for a smooth experience! Across+ enhanced interoperability! You can now use crypto from many chains and don't worry about bridging! Just added USDC to farm at 30% APY!

Intent-based systems have become the solution for end-user cross-chain interaction by abstracting away the complexity and time constraints of traditional bridges. State-of-the-art interoperability! Basically users will use Dapps and Across will sort out the bridging under the bonnet, without extra clicks or swapping windows.

Across is the first intents-driven interoperability protocol and it will deliver a level of cross-chain UX that developers and their users demand as crypto enters a complex multichain economy. The future is intents!

Umami Finance offers top-tier "Set and Forget" yield vaults on Arbitrum, and with the Across integration... deposits are made easy! Select assets from other chains and deposit straight into vaults. Intents and interoperability simplified decentralized finance!

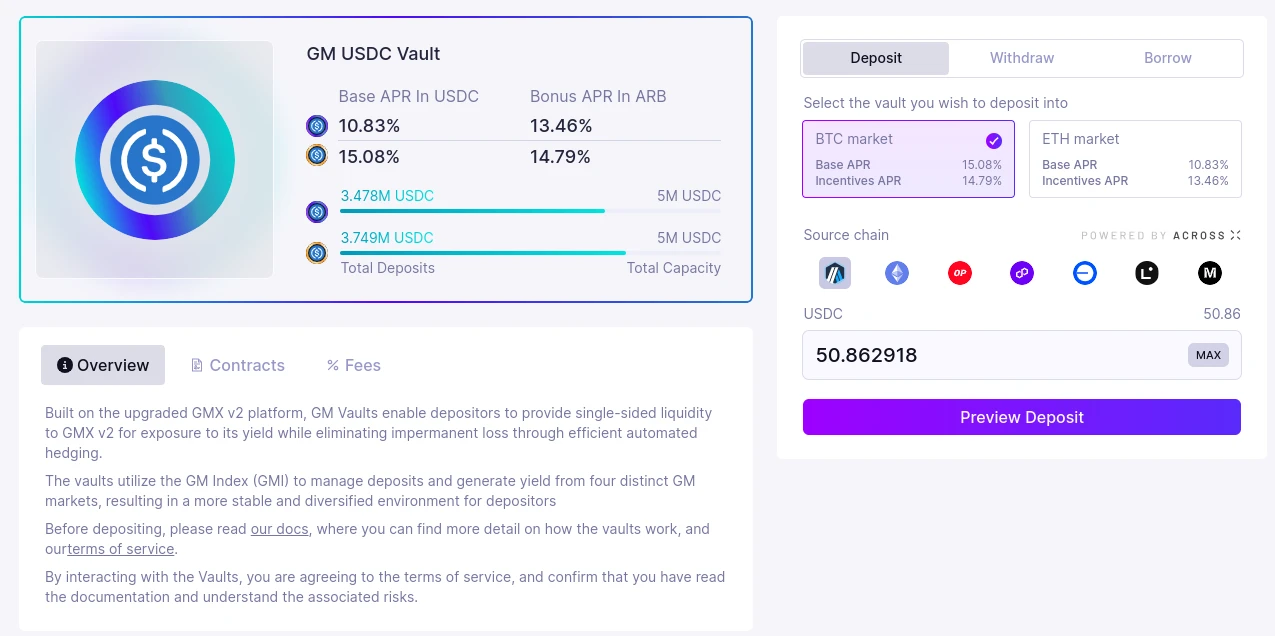

The first iteration of Umami's GM Vaults has been live for 3 months, and there are some impressive results to share. Since launch, the USDC Vault has been offering an incredible and steady 21% APR in real yield! How?

The new to Umami GM Vaults offer single-sided exposure to top assets like $USDC, $ETH, $BTC and $ARB, providing liquidity in GM pools, and farming fees on GMX v2.

GMX v2 has collected $46M in fees and realized $11M in PnL, showing an impressive net positive collection, underscoring the robustness and stability of the GMX v2 platform as a source of yield. This helped Umami with a solid 3-month sample size, and making the USDC GM Vaults a great choice for long-term investments.

I wanted to see how Across enhanced the deposits on Umami, and deposited 50.86 USDC into the GM Vault. It took only few seconds and my crypto started farming close to 25% APR. The rewards will be in compounded USDC and $ARB rewards, and this makes it extra efficient.

I know that this top-tier "Set and Forget" yield vaults are created for long-term investments, and this was why I checked the results after two weeks. In this short time I had 1.4 ARB waiting to be claimed, and the stablecoin stash grew to 52.1 USDC. It feels a lot for only $50 deposited... because it's a lot!

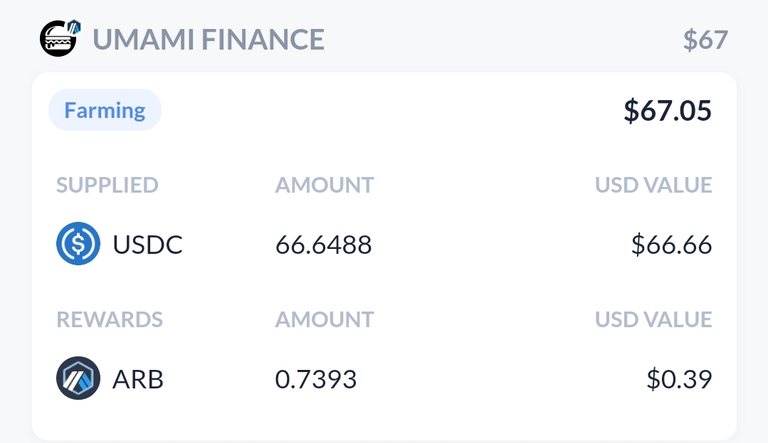

Had some spare assets on various chains and I deposited them on Umami, and must say Across made it look simple. Rounded up my staked USDC to $65 and let the GM yield vault do the job behind the scenes!

I didn't left it brew for longer, as the Harvest Finance ARB-USDC farm brought an incredible 250% APY to my attention. The USDC grew into a malefic 66.66, and 0.73 ARB was farmed until withdrawal day. The Umami yield vaults will be the alternative when no insane APY will be around!

Residual Income:

Airdrop Hunting: Layer3 / Mode / blast.io/HJEUV / Linea

50% discount on Scroll Canvas: use code TFNWC

Content: Publish0x/ Hive / GrillApp

Play2Earn: Upland / Splinterlands / ++Doctor Who++

Cashback Cards: Plutus Card / Crypto.com

$ZEC: PipeFlare / GlobalHive

PVM The Author - My Amazon Books

)

)