Wow…I think everyone would agree that it has been the craziest fortnight that crypto has ever seen since the infamous Terra’s collapse. All episodes of turmoil in crypto’s 13-year history actually pale in comparison with what happened to FTX, a US exchange that was (just a month ago) one of the largest and most trusted in the world and then went all way down to bankruptcy. I’m still in shock and I’m sure I’m not the only one.

And although there were multiple precedents where centralized exchanges go south due to opaque and reckless financial practices, I must admit here that I never imagined FTX would join the list of defunct exchanges that went down due to the very same shady practices. The thing that may make you laugh (or maybe cry) is that just a month ago, the CEO and founder Sam Bankman-Fried appeared on the cover of Forbes as one of the most successful personalities in the world!

With the passage of time and events, we always find ourselves obligated to recall the six little words of wisdom; NOT YOUR KEYS, NOT YOUR CRYPTO!

There is no such thing as a safe centralized exchange even if it looks like the “poster child” of goodwill in crypto or whatever!

But having said that, there is actually a reason centralized exchanges (CEXs) have continued to grow and thrive over the years no matter how many of them went awry in the past or will do in the future. They are simply the easiest on-board for people new to the ecosystem and are providing advanced services that decentralized exchanges (DEXs) haven't yet. We can't deny the blindingly obvious fact that Binance and other CEXs have the credit of paving an easy way to bring millions of newcomers into crypto. That’s why I think CEXs are probably not going away. At least for the foreseeable future. And that is why many in the crypto community are calling for building back trust and ensuring that crypto exchanges worldwide are following safer practices. Ones that spare us from future FTX-like scenarios. The first in line is “proof of reserves” (POR)…

It is not sufficient, more is needed

“proof of reserves” is, in simplest terms, a way for centralized exchanges to provide everyone that they still have users' funds in their wallets. Put differently, it’s the practice of creating public-facing attestations (provided by a third party) as to their reserves, matched up with proof of user balances (liabilities). The idea is to create verifiable evidence that users' funds are still there safe and intangible…

So far Binance, OKX, Kucoin, Huobi, Poloniex, and others announced they're working on their versions of “proof of reserves”, while Crypto.com released its proof of reserves last week, revealing that 20% of their reserves are in "the meme coin" Shiba Inu token (Yikes!). If you like to watch the list of exchanges that have released "proof of reserves", I’d recommend you to check out Nic Carter’s site. The list is ever-growing.

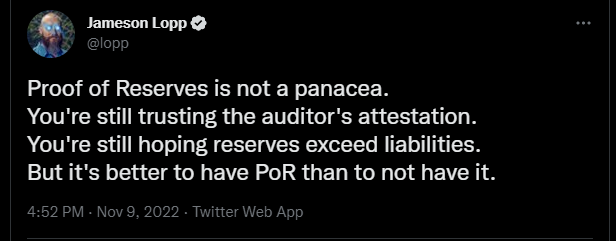

Now from what I’ve read, true POR is much easier said than done, as exchanges could simply hide or manipulate liabilities figures or they could borrow funds to cheat POR or display reserves that they don’t actually own.

Vitalik Buterin proposed "Merkle tree proof of reserve" which makes it harder for exchanges to omit, manipulate, or fake reserves/liabilities. Doubts among the crypto community haven't been suppressed nonetheless.

Proof of reserves is not perfect, self-custody is…

Well, everything in life has its positives and negatives, and one of the negatives that can POR brings is that it can create a false sense of security and safety. As mentioned earlier, POR cannot categorically ensure whether or not an exchange is solvent/insolvent. Not to mention, the POR can't stop hacks that can occur at any moment on any exchange. Let's not forget that even Binance itself was hacked in 2019 and over $40 million were gone in the accident. Fortunately, the size of the hack was within Binance's ability to compensate users in full, but no one knows what would have happened if it wasn't. (Bankruptcy file?)

So, it's a mistake to assume that POR can protect your money from being lost. However, let’s also agree that having POR in crypto is better than not having one. After all, exchanges continuing to operate the way they’ve been is no more accepted by anyone with half a brain. POR is not an alternative to self-custody by any stretch of the imagination, but it is a good step toward more transparency in the crypto world. Nic Carter, who happens to be a prominent advocate of proof of reserve, has put it nicely, which I quote:

To those who reject POR because it’s not perfectly trustless in its current implementation, I would respond that the perfect is the enemy of the good. At present, the industry standard is virtually no transparency

While the FTX saga has been the blackest ever swan for us, it is great to see the crypto community get up from the ashes again with a stronger narrative to prevent similar scenarios. Who knows, maybe this will turn into a trend of self-regulation for exchanges so that politicians/regulators can do little about it. And if that really happens, then the black swan might ultimately turn into a bright white one in the medium to long term future. But once again, self-custody is the only way to go.

What do you guys think about POR?

I’m keen to read your opinions and thoughts…