Alex had always been fascinated by cryptocurrencies in general as he spent countless hours researching, reading, and learning about the market. In late 2020, he finally decided to take the plunge and invest in Bitcoin.

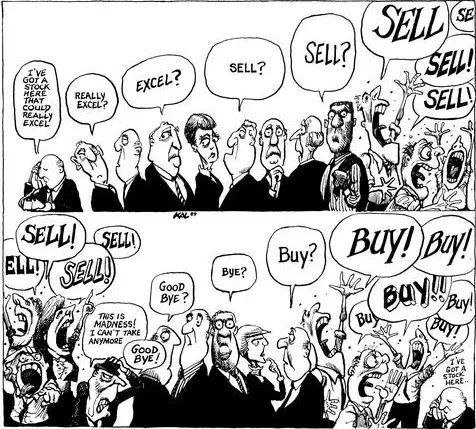

As he entered the market, Alex was caught up in the excitement. Bitcoin's price was skyrocketing, and everyone seemed to be making a fortune. Alex couldn't resist the FOMO (fear of missing out) and invested a significant portion of his savings.

As the days passed, Alex noticed some warning signs as there was Overwhelming optimism as Everyone was talking about Bitcoin's inevitable rise to $100,000 and with the Rapid price increases of Bitcoin's price, it was rising exponentially, with 10-20% gains in a single day.

Suddenly it became the news of the Mainstream media as it has caught thier attention. Bitcoin was featured on the front pages of major newspapers and magazines.

Despite these warning signs, Alex couldn't bring himself to sell. He was convinced that Bitcoin would continue to rise and that he would miss out on life-changing gains if he sold.

The Inevitable Correction

In mid-2021, the cryptocurrency market began to correct. Bitcoin's price plummeted, and Alex's investment lost significant value. He was devastated, feeling like he had made a huge mistake.

The Lesson Learned

Alex realized that he had fallen victim to the classic mistake of buying the top. He had invested at the peak of the market, driven by FOMO and greed. He vowed to be more cautious in the future, to do his own research, and to avoid getting caught up in the hype.

The Moral of the Story

The story of Alex serves as a cautionary tale for investors in this bull market as It highlights the importance of:

- Doing your own research: Don't rely on others' opinions or FOMO.

- Being cautious: Avoid investing at the peak of the market.

- Diversifying: Spread your investments to minimize risk.

- Having a long-term perspective: Avoid making impulsive decisions based on short-term market fluctuations.

By following these principles, you can avoid the pitfalls of buying the top and make more informed investment decisions.